Grab has unveiled a further nerf to the GrabRewards programme, which takes place from 1 August 2022.

In a move that’s clearly aimed at nudging people to use their GrabPay wallet, GrabRewards points will no longer be awarded for credit or debit card transactions on the Grab app.

The world is changing. From the way we shop, to the way we pay our bills and get our meals. In the past year alone, we’ve seen more Grab users opting for safer and more convenient cashless payments. The way you spend has shifted, so must the way we reward you. That’s why GrabPay Wallet or PayLater users will be able to get more points, while still enjoying the same tier benefits.

-Grab

This effectively forces most consumers to choose between credit card rewards and GrabRewards, and there’ll only be one winner in that contest…

No more GrabRewards points for card payments

From 1 August 2022, Grab will no longer award GrabRewards points for credit or debit card payments made in the Grab app.

The only way to earn GrabRewards points will be to pay with your GrabPay wallet, GrabPay card or PayLater by Grab (all of which are funded by your GrabPay balance).

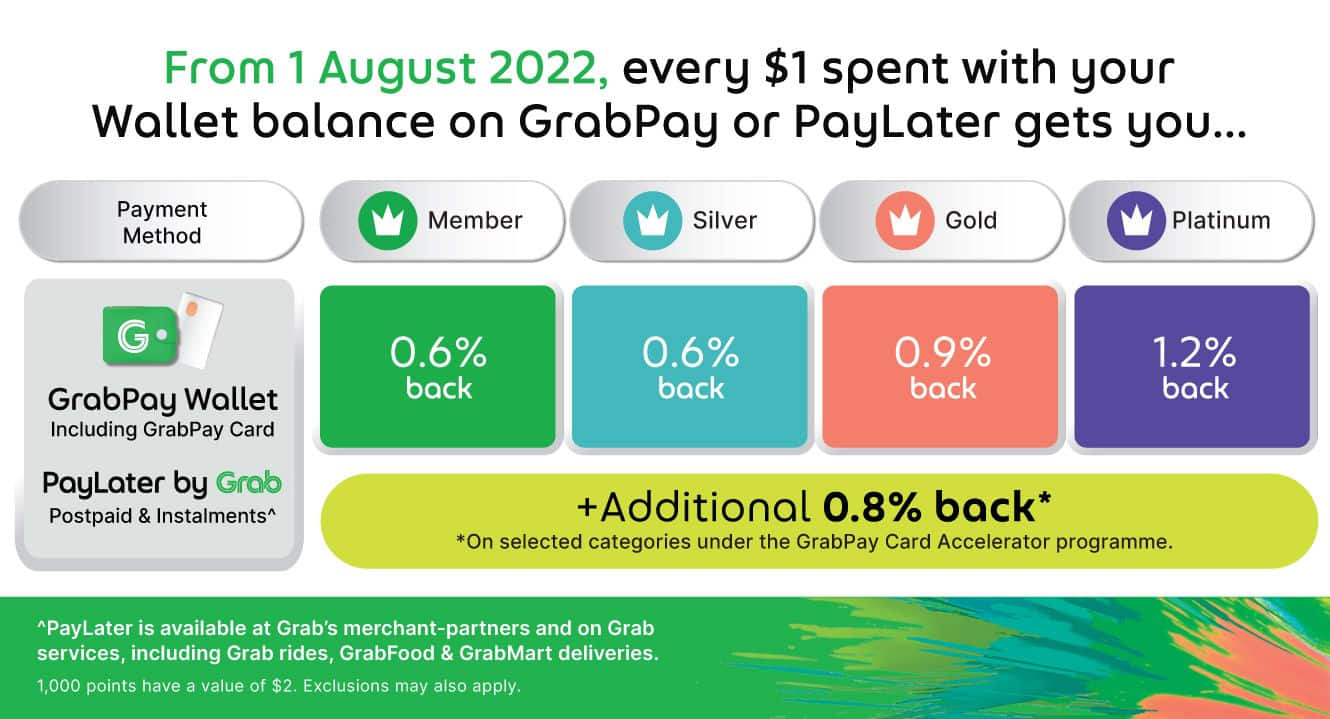

| GrabRewards Earning Structure (From 1 Aug 2022) |

||

| Tier | Credit/Debit Card | GrabPay Wallet/Card |

| Member | 3 | |

| Silver | 3 | |

| Gold | N/A |

4.5 |

| Platinum | N/A |

6 |

It effectively means the Grab ecosystem will stop rewarding you after you’ve hit the S$30,000 annual limit on GrabPay (since you can’t use the Grab wallet, nor earn points with debit/credit cards).

To be clear, this has nothing to do with the points you earn from your credit cards. You will continue to earn 4 mpd on Grab transactions (excluding GrabPay top-ups) with the following cards:

| Card | Earn Rate | Remarks |

Citi Rewards Citi RewardsApply |

4.0 mpd | Max S$1K per s. month Review |

DBS WWMC DBS WWMCApply |

4.0 mpd | Max S$2K per c. month Review |

HSBC Revolution HSBC RevolutionApply |

4.0 mpd | Max S$1K per c. month Review |

UOB Lady’s Card UOB Lady’s CardApply |

4.0 mpd | Max S$1K per c. month. Must choose transport as 10X category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4.0 mpd | Max S$3K per c. month. Must choose transport as 10X category Review |

Look, it’s quite obvious what Grab is trying to do here. By cutting off GrabRewards points for credit and debit card transactions, the hope is that more users switch to paying with their Grab wallet balances, which provides working capital for Grab, and lowers the card fees they pay.

But that assumes GrabRewards points have any sort of motivational power in the first place. Grab has nerfed them to the point that I see them as the icing on the cake, rather than the cake itself. I’ll take GrabRewards points if they’re on top of my credit card miles, but I’m certainly not going to trade my credit card miles for them!

In other words, Grab is basically asking you to choose between:

- 4 mpd from credit cards

- Up to 6 GrabRewards points per S$1 (equivalent to a 1.2% rebate).

It’s a no-brainer, really.

What if you have a card that earns rewards for GrabPay top-ups?

There are currently only three credit cards which still earn rewards for GrabPay top-ups.

| 💳 Cards for GrabPay Top-Ups | ||

| Card | Earn Rate | Remarks |

AMEX SIA Business Card AMEX SIA Business CardApply |

1.8 mpd | Only for owners of SMEs |

AMEX True Cashback Card AMEX True Cashback CardApply |

1.5% cashback | No cap |

UOB Absolute Cashback Card UOB Absolute Cashback CardApply |

1.7% cashback | No cap |

If you have one of these, the equation changes slightly. Your choice is now:

- 4 mpd from credit cards

- Up to 6 GrabRewards points per S$1 (equivalent to a 1.2% rebate) + 1.8 mpd or 1.5/1.7% cashback

This closes the gap somewhat, but on the balance I’d still go with the credit card miles. Assuming you value a mile at 1.5 cents each, then Grab wallet + AMEX HighFlyer Card is offering a rebate of 1.2% + 1.8*1.5= 3.9%, versus 6% (4*1.5) from using a credit card.

Conclusion

Grab will no longer offer GrabRewards points on in-app transactions made through credit or debit cards, effective 1 August 2022. This forces consumers to choose between credit card rewards or GrabRewards, and that’s a battle Grab’s never going to win.

While it’s probably another nail in the coffin for GrabRewards, this hardly bothers me since my primary use case for GrabPay is AXS payments. There’s no GrabRewards points issued, but I’m still able to earn 1.8 mpd on my income tax, MCST fees and insurance premiums.

Even with this there will still be a healthy amount of unenlightened individuals happy to continue using Grabpay credits because of GrabReWArdS, lol!

How long before these fintechs follow the crypto world and withdrawals are suspended? I’m starting to get nervous. It feels like picking up pennies in front of a steamroller. I guess I can take comfort in the fact that Grab loses improved 35% YOY and they “only” lost $435,000,000 in the first quarter this year!

What about hawkers that use SGQR? Is it still viable to use Grabpay for these merchants since they don’t accept credit cards anyway (so I still earn the 1.5% Amex cashback..) or am I missing a 4mpd hack for these purchases?

There is no 4mpd for SGQR via Grab. 4mpd is when you use a credit/debit card from within the Grab app to fund a purchase. Grabpay with SGQR can only be funded with the Grab wallet balance.

You’d earn 1.8mpd topping up Grab wallet using AMEX HiFlyer, which you then use to pay via SGQR. But you’d forgo 4mpd from paying with credit cards using SGQR. So in essence top up Grab wallet using AMEX HiFlyer is only useful for stuff that credit cards won’t give you miles for – like Income Tax, MCST & Insurance (as pointed out by Aaron above).

Or if you’ve maxed out your mileage limits for other credit cards (e.g. $2k for DBS Womens World, $1k for Citi Rewards, etc) and merchant won’t accept AMEX. Then link HiFlyer to GrabPay MC to get around merchants who do accept AMEX.

Important to note that you can earn miles via Amex Pay. You can pay most (if not, all) SGQR payments using that too.

Thanks, I didn’t know this! Grab wallet is currently my catch all for merchants that don’t accept any sort of credit cards at all but allow for QR payments. Will keep a lookout for QR codes that allow for Amex pay

I only use grabpay or paylater when I need to use $4 off delivery as that translates to a close to 20% rebate 😀

First, as standalone, even a general cash back card will yield 1.5%. No fight with credit cards.

Second, when paired with Amex, the best use of the precious 30k per year limit is to pay AXS towards income tax, property tax, MSCT, etc

The only viable segment are those without credit cards.

Could you also use GrabPay topped-up via UOB Absolute to pay your rent via bank transaction from Grab Wallet?

So you would get 1.7% cash back on rent? (Given the rent is less than $5000/transaction)

Do you get credit card rewards for using Grab’s PayLater?