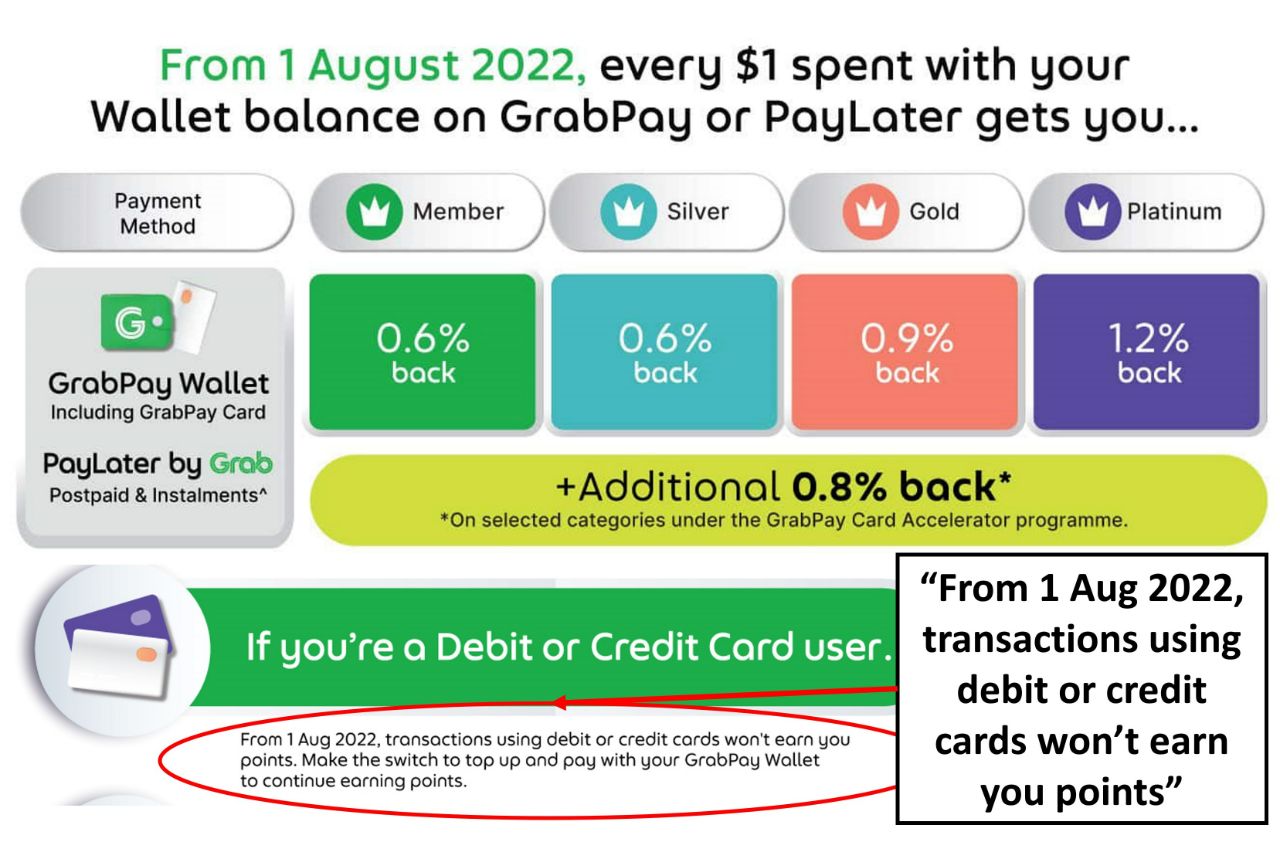

On 1 August, GrabRewards implemented the latest in a series of seemingly endless devaluations by eliminating the ability to earn points when paying by credit or debit card.

Under the revised system, GrabRewards Points can only be earned from GrabPay or PayLater transactions, ending double dipping with credit card points and effectively forcing consumers to choose sides- a contest it seems destined to lose.

| GrabRewards Points per S$1 (From 1 Aug 2022) |

|||

| Tier | Cash | Credit & Debit Card | GrabPay & Pay Later |

| Member | 0 | 3 | |

| Silver | 0 | 3 | |

| Gold | 0 | 0 |

4.5 |

| Platinum | 0 | 0 |

6 |

I’ve covered the changes in a separate article, but one thing I haven’t looked at yet are the implications for GrabRewards elite qualification.

How much spending is required to earn GrabRewards elite status?

GrabRewards has a four-tier elite system, starting at Member and maxing out at Platinum. Tier qualification is based on the number of points earned within a calendar half:

- 1 Jan to 30 Jun

- 1 Jul to 31 Dec

| Tier | Points Req. | Spend Req.* Qualify | Requalify |

| Member | N/A | N/A |

| Silver | 300 | S$100 | S$100 |

| Gold | 1,200 | S$400 | S$267 |

| Platinum | 4,500 | S$1,133 | S$750 |

| *Spending required for qualification and requalification is different because earn rates are different between tiers. For example, a Silver member (3 pts/S$1) would need to spend S$400 to earn Gold (4.5 pts/S$1), but only S$267 to maintain it. |

||

Status earned is valid for the rest of the calendar half, plus the following calendar half.

For example, if I accrued 1,200 points on 3 March 2022, I’ll enjoy Gold status till 31 December 2022. To requalify for Gold, I’ll need to earn a further 1,200 points between 1 July to 31 December 2022.

What are the perks of GrabRewards elite status?

I’ve been a GrabRewards Platinum for a long time now, though it was always more of a by-product than a concerted effort since I’m a heavy Grab user, taking rides perhaps 2-3X daily and ordering food about 3-4X weekly.

While I didn’t earn a lot of points paying with my credit card (4 pts/S$1 before 22 March 2021, then 2 pts/S$1 until the recent devaluation), the sheer volume of spending over a six month period was enough to get me over the line.

Frankly speaking though, the benefits are nothing to get excited about.

| Silver | Gold | Platinum | |

| Points per S$1 | 3 pts | 4.5 pts | 6 pts |

| Lounge Access | 20% off | 40% off | 55% off |

| Airport F&B | ✖ | 10% off | 10-20% off |

| Priority Allocation | ✖ | ✖ | ✔ |

| Priority Support | ✖ | ✖ | ✔ |

Platinum members enjoy larger discounts on walk-up lounge access (which I have no use for, thanks to credit cards), discounts on airport F&B, as well as some vaguely-defined “priority ride allocation and customer support”.

Maybe priority ride allocation meant something a few years ago, but I can honestly say I don’t notice any difference in how fast I get a ride versus The MileLioness (Silver member). With so many Platinums out there anyway, priority becomes a misnomer.

Platinum members used to enjoy preferential rates for KrisFlyer miles redemptions and selected rewards, but that has long been nerfed, and the main distinguishing factor now is simply the higher earn rate.

Therefore, I wouldn’t be too upset if I lost Platinum status. In fact, I probably will, given the new earning structure. By eliminating GrabRewards points for credit card transactions, Grab is basically asking consumers to choose between:

- 4 mpd with credit cards

- 3-6 GrabRewards points per S$1 (effective rebate of 0.6-1.2%)

It’s quite simply no contest at all; even if you prefer cashback, you’d be much better off earning 8% cashback with the Maybank Family & Friends Card.

Now, it’s true that we don’t have an either/or decision on our hands just yet, because there’s still three cards on the market awarding points or cashback for GrabPay top-ups…

| 💳 Cards for GrabPay Top-Ups | ||

| Card | Earn Rate | Remarks |

AMEX SIA Business Card AMEX SIA Business CardApply |

1.8 mpd | Only for owners of SMEs |

AMEX True Cashback Card AMEX True Cashback CardApply |

1.5% cashback | No cap |

UOB Absolute Cashback Card UOB Absolute Cashback CardApply |

1.7% cashback | No cap |

…but even so, this only marginally changes the equation. The choice is now:

- 4 mpd from credit cards

- 3-6 GrabRewards points per S$1 (0.6-1.2% rebate) + 1.8 mpd or 1.5/1.7% cashback

I’d still pick credit cards, which means bye bye GrabRewards points, and bye bye Platinum.

Possible exception: Paying utilities bills

While I wouldn’t advocate actively earning GrabRewards status (i.e. diverting spend that could have otherwise gone on your credit card), there is one way you could conceivably retain your status with minimal opportunity cost.

I’m thinking of utilities bills. This category has been excluded by most (though not all) banks, but you can still earn GrabRewards points. In an ideal scenario, you’d top-up your GrabPay account with one of the three cards I mentioned earlier, then use the GrabPay Mastercard to pay the utilities bill and earn up to 6 points/S$1.

You’d need to pay an average bill of S$125 a month over a 6-month period to earn the 4,500 points necessary to requalify for Platinum, but since you wouldn’t earn any rewards on those bills with most credit cards anyway, it’s not the worst option imaginable.

Of course, there are those who argue that you should conserve the GrabPay’s S$30,000 calendar year limit for transactions that can’t earn credit card points at all (e.g. income tax bills, MCST fees), and since utilities doesn’t fall into that category yet, doing this is a waste.

| ❓ What’s the point of GrabPay? |

|

GrabPay is a very useful conduit to earn rewards/rebates on commonly excluded transactions, such as MCST fees, insurance premiums, income tax, utilities bills, town council charges etc. Simply top-up your GrabPay account and make a payment via AXS using the GrabPay Mastercard. You won’t earn GrabRewards points for AXS transactions, but the purpose is really to earn credit card rewards. See the full details here. |

It’s a fair point, so to each their own.

Conclusion

With GrabRewards’ new earning structure, the Platinum (and Gold/Silver for that matter) ranks are likely to be culled as customers pick their credit cards over GrabPay. That’s my choice, at least, and the only situation where I’d pick the Grab wallet is when I’m forced to in order to use vouchers from my GrabUnlimited subscription.

To put it another way, GrabRewards Platinum benefits are not worth the opportunity cost you’ll incur to earn it. Unless Grab comes up with some killer new perks (like a surge protector), there’s very little reason to be loyal.

Are you planning to retain GrabRewards elite status?

Amex is giving cashback for utilities payments, a much better option.

Amex is giving cashback for grabpay too which is giving points for utility payments. How is Amex standalone a “much better option”?

i think he may be referring to the AMEX offer for utilities. i can’t remember offhand what that is, though you’d need to compare cashback + GR points versus value of the amex offer alone (since amex cards don’t offer rewards for utilities, amex highflyer/true cb aside).

Trure CB – save offer to eligible Card and spend S$50 or more, in one or more transactions, in-app or online at participating Utility businesses by 31 Dec 2022 to receive one S$5 credit per month up to 5 months. Limited to 60,000 Cards.

10% assuming you can only pay $50 per txn.

I pay 100+ with my two cards, 50+ each and get 10 back

spend $50 on utility and get $5 off, ~10%

Amex Ascend gives 3.2mpd for first $200/month lol.

Even that is better

Income tax bills cant earn credit card points?

IRAS doesn’t accept direct credit card payments. Need workaround – see https://milelion.com/2022/04/11/2022-edition-earning-miles-when-paying-iras-income-tax-with-a-credit-card/

This loyalty programme has been pretty much trash for the last 2 years or so. I don’t even remember the last time I redeemed a ride/food voucher as the earn rates got nerfed so damn hard!

same thoughts, Aaron. Grab now gives a free two month membership to award you with 20% vouchers, then force you to use GrabPay to get that 20% discount. If i insist on using my credit card, there is no discount. Come the end of two months, when the membership ain’t free anymore, its silly to do GrabFood from their platform because foodpanda is cheaper than Grab when you want to use credit card only… for me, it’s bye bye Grab soon. likewise for transport, its almost entirely back to Comfort’s Zig for me now. Grab is not competitive with prices.… Read more »

I’ve relied quite a bit on Grab for the past two years for transportation and food delivery and had been Platinum tier since 2019. However, I am very comfortable “losing” the status and not break a sweat. For one, my 30k/yr wallet limit will be dedicated to AXS for IRAS entirely and will continue to be this way until it is no longer an option. I’m happy with its return (30000*1.7%) with UOB Absolute. Secondly, the Platinum tier yielded ZERO benefit for me. Well, ZERO is a bit of a stretch…I did redeem points for 1-2 dollar voucher every month… Read more »

What about using the GrabPay card to pay public hospital bills?

https://help.grab.com/passenger/en-sg/360038831171-What-are-the-transactions-that-DO-NOT-qualify-for-GrabRewards-points

Check out the link above for exclusions: MCC 8062 – Hospitals.

Grab shot itself in the foot when it stopped offering 10% off rides and food to some GrabUnlimited plan users. I used to spend heftily on Grab points so I could be eligible for those discounts.

Now, no discounts, plus Plat is nerfed, zero appeal to Grab loyalists. I’ve started using Foodpanda, deliveroo and ryde gojek alot more in place of grab. Share price going down further it seems.