If you’re looking to earn miles while paying bills, CardUp has extended its ongoing promos on rental, recurring payments and one-off payments for 2023, enabling cardholders to buy miles from 1.1 cents each.

While most of the promotions are for Mastercard or Visa cardholders, American Express members aren’t forgotten either, with a code that brings the cost per mile down to 1.43 cents each.

In addition to this, first-time CardUp users can use the promo code MILELION to save S$30 off their first payment, with no minimum payment required. This means free miles on a payment of up to S$1,154, none too shabby indeed.

| ❓ What is CardUp? |

|

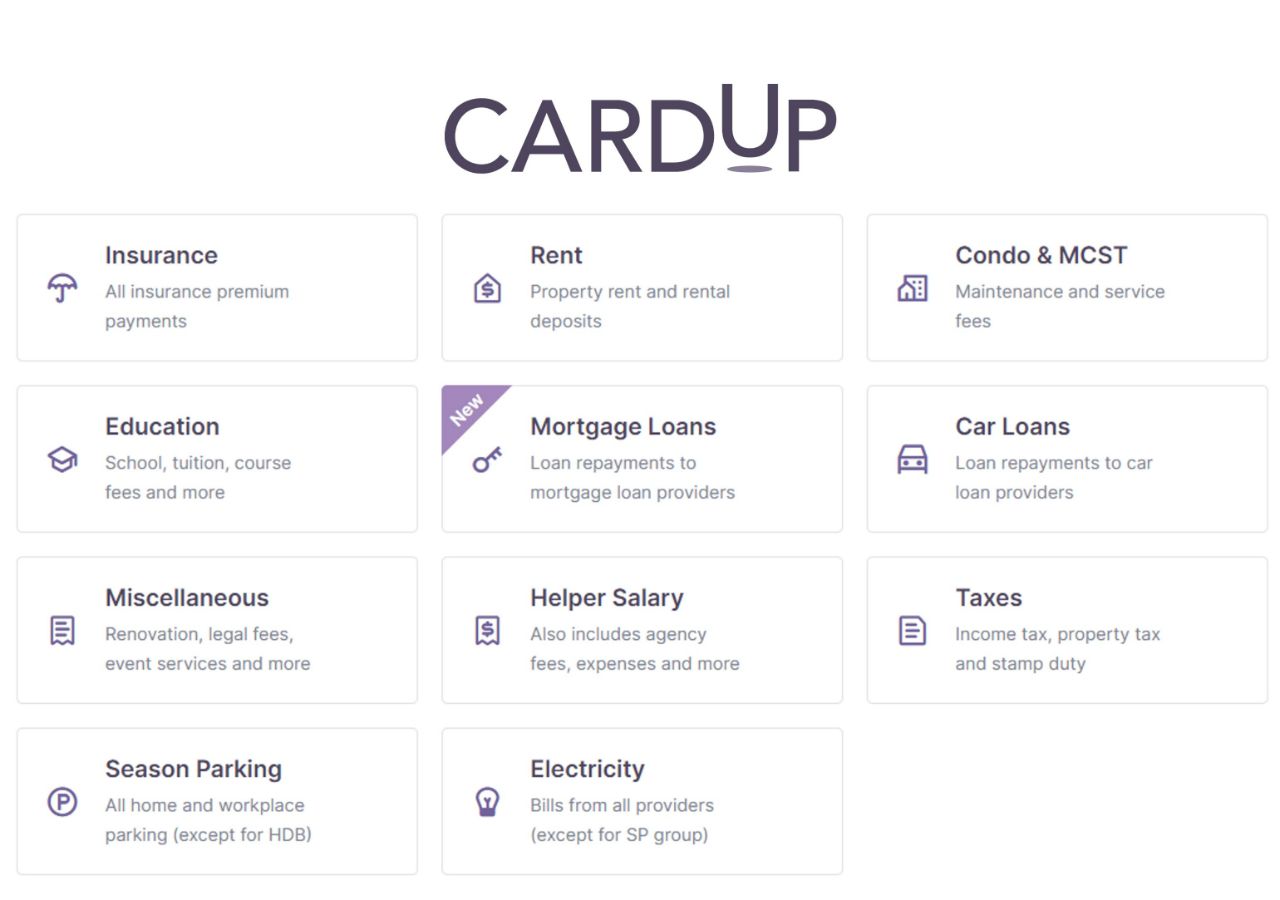

CardUp is a bill payment platform that allows users to pay rent, income tax, insurance premiums, MCST fees, season parking, mortgage installments and more with their credit card, earning miles in exchange for a small fee. The standard CardUp fee is 2.6%, but is frequently lowered through various promotions. |

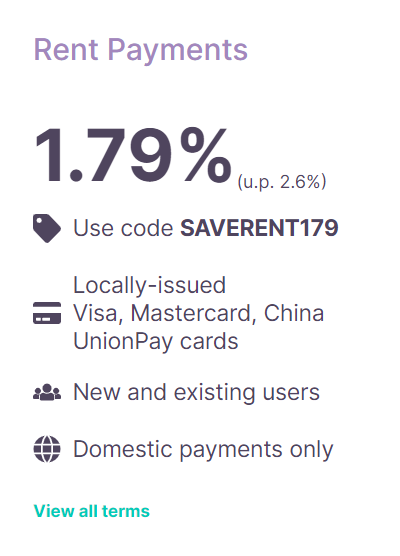

Rental (1.79%)

|

| SAVERENT179 T&Cs |

CardUp users paying rent can use the promo code SAVERENT179 to enjoy a 1.79% fee, for payments scheduled by 31 January 2024 with due dates on or before 5 February 2024.

This code is valid for all locally-issued Visa, Mastercard and UnionPay cards.

With a 1.79% fee, you’ll be paying between 1.1 to 1.76 cents per mile, depending on card. Remember, both the payment and the CardUp fee are eligible to earn miles.

| Earn Rate | Cost Per Mile (1.79% fee) |

| 1.6 mpd | 1.1 cents |

| 1.5 mpd | 1.17 cents |

| 1.4 mpd | 1.26 cents |

| 1.3 mpd | 1.35 cents |

| 1.2 mpd | 1.47 cents |

| 1.1 mpd | 1.60 cents |

| 1.0 mpd | 1.76 cents |

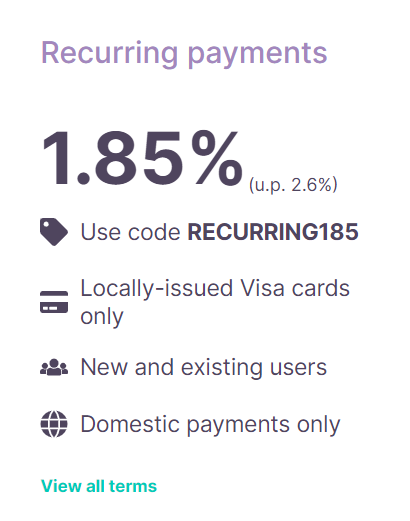

Recurring Payments

|

| RECURRING185 T&Cs |

CardUp users making recurring payments can use the promo code RECURRING185 to enjoy a 1.85% fee, for payments scheduled by 31 January 2024 with due dates on or before 5 February 2024.

The code is only valid for locally-issued Visa cards, and applies to the first six payments in a weekly, monthly or quarterly recurring series, where each payment is a maximum of S$10,000. You can always cancel your 7th payment onwards, or edit it to add a new promo code depending on what’s available at the time.

As a reminder, CardUp now supports mortgage payments too (both bank and HDB), so this could be useful for anyone looking to repay a housing loan.

With a 1.85% fee, you’ll be paying between 1.14 to 1.82 cents per mile, depending on card. Remember, both the payment and the CardUp fee are eligible to earn miles.

| Earn Rate | Cost Per Mile (1.85% fee) |

| 1.6 mpd | 1.14 cents |

| 1.5 mpd | 1.21 cents |

| 1.4 mpd | 1.30 cents |

| 1.3 mpd | 1.40 cents |

| 1.2 mpd | 1.51 cents |

| 1.1 mpd | 1.65 cents |

| 1.0 mpd | 1.82 cents |

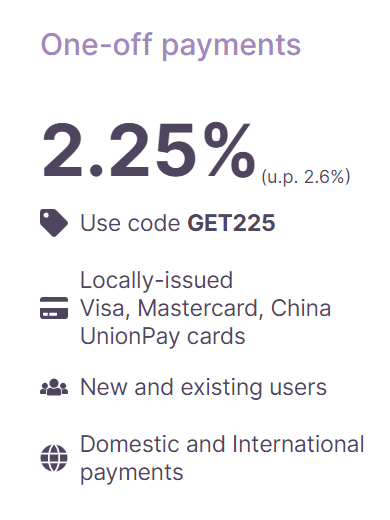

All other payments

|

| GET225 T&Cs |

For all other payments, CardUp users can use the promo code GET225 to enjoy a 2.25% fee, for payments scheduled by 31 January 2024 with due dates on or before 5 February 2024.

This code is valid for all locally-issued Visa, Mastercard and UnionPay cards.

With a 2.25% fee, you’ll be paying between 1.38 to 2.2 cents per mile, depending on card. Remember, both the payment and the CardUp fee are eligible to earn miles.

| Earn Rate | Cost Per Mile (2.25% fee) |

| 1.6 mpd | 1.38 cents |

| 1.5 mpd | 1.47 cents |

| 1.4 mpd | 1.57 cents |

| 1.3 mpd | 1.69 cents |

| 1.2 mpd | 1.83 cents |

| 1.1 mpd | 2 cents |

| 1.0 mpd | 2.2 cents |

What about American Express?

|

| AMEX19X T&Cs |

While all of the abovementioned promo codes above are for Visa or Mastercard cardholders, there’s an offer for American Express too. Using the code AMEX19X will get you a 1.9% fee for the next payment of at least S$500 and no more than S$7,000.

Payments must be scheduled by 14 April 2023, with due dates on or before 19 April 2023. This code can be redeemed a maximum of once per user, and is capped at the first 100 redemptions.

With a 1.9% fee, you’ll be paying between 1.33 to 1.7 cents per mile, depending on card. Remember, both the payment and the CardUp fee are eligible to earn miles.

| Card | Cost Per Mile |

UOB PRVI Miles AMEX UOB PRVI Miles AMEX |

1.33 cents |

AMEX PPS Solitaire Card AMEX PPS Solitaire Card |

1.43 cents |

AMEX PPS Card AMEX PPS Card |

1.43 cents |

DBS Altitude AMEX DBS Altitude AMEX |

1.55 cents |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

1.55 cents |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.7 cents |

New users

If you have not made a CardUp payment before, you can use the code MILELION to save S$30 off your first payment, with no minimum spend required.

Based on the regular CardUp fee of 2.6%, that’s equivalent to free miles on a payment of up to S$1,154.

Alternatively, you can use the promo code SGNEW13 to enjoy a fee of 1.3% on the first S$10,000 scheduled as a one-off payment or within the first 2 payments of a recurring series.

Basically, if your payment is more than S$2,300, the SGNEW13 code will save you more money. If your payment is less than S$2,300, the MILELION code will save you more money.

Both codes are only applicable for locally-issued Visa or Mastercards.

The Citi PayAll alternative

While CardUp’s offers aren’t bad, in and of themselves, it’s hard to compete with the juggernaut that is Citi PayAll.

From now till 31 January 2023, Citi cardholders will earn 1.8 mpd on all Citi PayAll transactions with a fee of 2%, which works out to 1.1 cents per mile. This covers rental, income tax, insurance, education, utilities, you name it.

Citi PayAll offering 1.8 mpd on all payments; buy miles at 1.1 cents

The only catch for this promotion is that a minimum charge of S$5,000 is required to qualify, so if you’re planning to make smaller payments then CardUp can still come into play.

CardUp FAQ

I’m attaching the usual CardUp FAQ below. Be sure to have a read, because it answers commonly asked questions like whether CardUp payments count towards sign up bonuses (they mostly do) and whether there are any 10X opportunities (there aren’t).

| ❓ CardUp FAQ |

|

Q: What cards earn miles with CardUp?

Q: Do any cards earn 10X with CardUp? Q: Does CardUp spending count towards sign up bonuses/promotional bonuses? Q: Do I earn miles on the CardUp fee too? |

Conclusion

CardUp has extended its offers for rental, recurring and all other payments till the end of 2023, allowing cardholders to buy miles from as little as 1.1 cents each.

Whether that’s worth it depends on how much you value a mile, but on the whole I’d say there’s certainly situations where it can make sense. The higher your mpd, the lower your cost per mile, so try and use a higher-earning general spending card as much as possible.

Don’t forget about the Citi PayAll promotion either, because assuming you can meet the minimum spend, it’s the cheapest way of buying miles in Singapore at the moment.

Cardup is dead already. Citibank Payall does exactly the same thing, for less cost. Why would anyone use Card up?

1. because citi payall offers don’t run year round, whereas there’s always bills to pay

2. because citi payall has min spend and caps

3. because competition is fundamentally a good thing. would you want citi payall to be the only bill payment solution on the market?

citi payall regular price is 1.67 cents per mile for citi premiermiles. not necessarily cheaper.

and the current promo has a $5k minimum to unlock the bonus.

Citi regular price without hitting the $5k required for the promo is 1.5 cents per mile (not 1.67. Cost is 2%. Receive 1.3 miles per $1 on Prestige card. $20/1300 = 1.5 cent). Cardup with it’s promo is 1.6 cents per mile. When I went to school, which admittedly was a while ago, 1.5 was less than 1.6, and you would be better off using Citi at the regular price, than Payall at the promo price.

@Mark, you can’t use Citi PayAll to pay for your mortgage loans. Enuf said.

You certainly can ! Enuf said.

Because I cannot use Citi Payall to hit the spending requirement for sign up bonuses & other promotions of non-Citi cards.

Doe

sn’t matter. Citi Payall is cheaper than Cardup even at the standard Citi Payall rates – admittedly only slightly cheaper, but nevertheless still cheaper.So how do I use Citi Payall to fulfill the sign up bonus for say, my Krisflyer Ascend Amex card?

dont think its worth the hassle to sign up for Ascend Amex card and then using card up. just use citipay as the alternative.

Then you’re probably not looking hard enough.

(Hint: https://milelion.com/2022/12/30/amex-krisflyer-ascend-sign-up-offer-spend-1000-get-35800-miles/)

Citipay offers 30,000 miles for a lower sign-up fee… you’re probably just relying on the writer’s article

not fair to compare sign up fee alone, since ascend also comes with free hilton night stay + 2 more lounge passes.

both offers are good lah, depends whether or not you’re new to bank. and nothing stopping you from taking both. hell, i would.

No it doesn’t. I can get 37,000 miles at a cost of $340.20 if I am a first time KF Amex applicant & new CardUp user using a referral code. The same 37,000 miles will cost $411.11 using Citi Payall. Citi Payall is only ‘cheaper’ if you are a previous KF Amex applicant & existing CardUp user using the AMEX19X promo code. Then you get 32,000 miles at a cost of $358.84, whereas it cost $355.56 with Citi Payall. However, at $3+ more, you get a free night at a Hilton, & 4 lounge passes, so I’m still going to… Read more »

That is a slightly distorted calculation. If you are going to compare Citi Payall with a first-time applicant for Amex and a first-time user of Card-up, shouldn’t you compare it with a first time user of Citi Payall too? Afterall a first time user of Citi Payall gets an extra cash back too. Anyway, I think the point has been lost here. Yes, it makes sense to avail yourself of the Amex bonus miles if you can. To achieve that you need to spend $1000 on the card. If the only way you can get the $1000 on the card… Read more »

You made this statement.

“Cardup is dead already. Citibank Payall does exactly the same thing, for less cost. Why would anyone use Card up?”

So, I gave you a specific example why someone would use CardUp.

To be clear, I agree completely 100% that all things being equal, Citi Payall is a superior product. I was just pointing out that there are specific use cases (such as the Amex Krisflyer Ascend sign up bonus) for CardUp.

With a 2.25% fee, you’ll be paying between 1.1 to 1.6 cents per mile, depending on card.

i think it’s typo.

fixed that! thank you.

Does this cardup work for AMEX Highflyer card as well?

Maybe read the article again?

It does not mention that. But I take your reply as a yes.

Is ‘MILELION’ a referral code? If it is, it will work with Amex as well.

Hey Aaron I think the ‘SGNEW13’ is only for CardUp business users and not personal, unfortunately

https://www.cardup.co/personal/terms/amex16n-amex19x

Cardup’s T&C states AMEX cards issued by DBS and UOB are not eligible for the AMEX19 promo.