UOB cardholders now have an additional option for converting UNI$, as budget carrier AirAsia joins existing partners KrisFlyer and Asia Miles.

While more choices is always a good thing, this fixed-value rebates programme is unlikely to raise any pulses.

UOB adds AirAsia as transfer partner

UOB cardholders can now transfer UNI$ to AirAsia Rewards at a rate of 2,500 UNI$ = 4,500 points.

| Frequent Flyer Programme | Conversion Ratio (UNI$: Partner) |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

| 2,500: 4,500 |

A S$25 admin fee applies per transfer, regardless of the number of points transferred. AirAsia points expire 24 months after the date of issuance.

Cardholders will receive a redemption code via SMS upon successful conversion, which must be redeemed via the AirAsia Super App for points within 30 days. That should already be a hint that AirAsia Rewards is less of a frequent flyer programme, and more like a prepaid balance used to buy things.

AirAsia points can be used to offset the cost of flights and other purchases on the AirAsia Super App at a rate of 125 points= MYR 1. However, during its monthly Super Members Week, the value is temporarily boosted to 50 points = MYR1, which I suppose is when you should be spending points.

In its previous iteration as AirAsia BIG, there was an award chart of sorts where the number of points required for a free flight was based on flight duration. But that was scrapped in favour of a fully-dynamic system when AirAsia Rewards was born.

AirAsia also offers something called “Final Call Flight Deals” which I assume are available for fewer points, but it’s just hard to analyse the burn opportunities because they’re listed on the AirAsia Super App, and I keep getting the message “deals are not available in your region” when I check.

The 2,500 UNI$ required to redeem 4,500 AirAsia points is worth 5,000 Asia Miles or KrisFlyer miles, so if you redeem points at the regular rate of 125 points = MYR 1, you’re taking MYR 36 (S$11) of value instead of S$75 (assuming a value of 1.5 cents per mile).

If you redeem points at the enhanced rate of 50 points = MYR 1, you’re taking MYR 90 (S$28) of value instead of S$75 (assuming a value of 1.5 cents per mile), which I suppose is somewhat better, but still there’s very little to get excited about here.

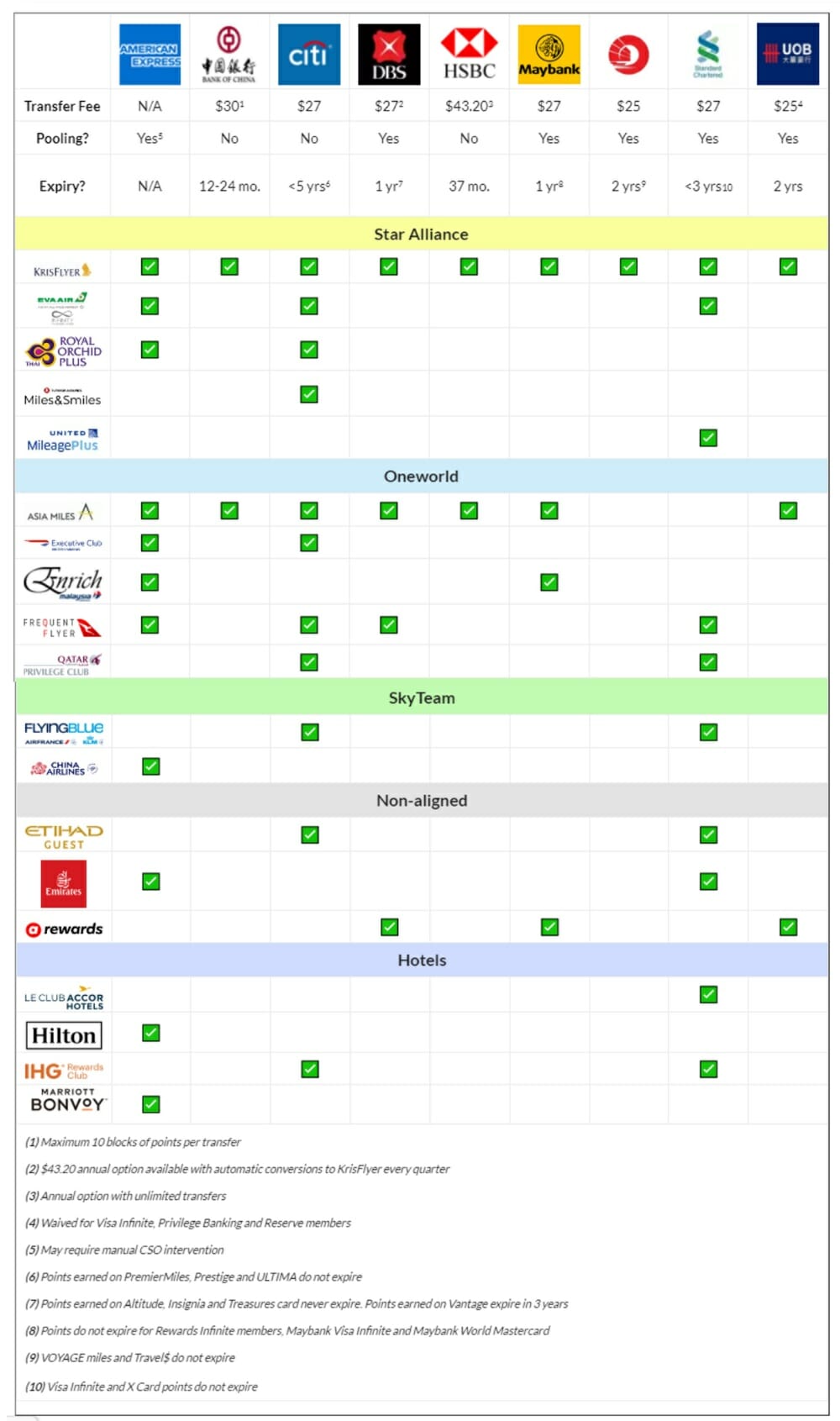

Which bank has the most transfer partners?

While the addition of AirAsia brings UOB’s transfer partner stable to three, it’s still a far cry from the big boys in the market.

The leader by far remains Citibank with its 10 airline and one hotel partner, followed by American Express with nine airline and two hotel partners, and Standard Chartered with eight airline and two hotel partners (no, they’ve not removed KrisFlyer).

Conclusion

UOB cardholders now have three airline transfer partners to convert their UNI$ to, but I just can’t see any scenario in which you’d opt for AirAsia. Even if you need airasia tickets, you’re better off buying them on sale than turning your hard-earned UNI$ into airasia points.

Any sweet spots within the AirAsia rewards programme I’m unaware of?

Goodness. What a total complete waste of time. Any new offerings can surely only improve in 2023?

So very UOB, introduce and offer rewards that has no value whatsoever to customers. I’m just surprised they didn’t offer this to the 1st 10000 who sign up or whatnot.

any possibility that we will see UOB and DBS having MORE transfer partners like for Qatar and Emirates this year? 😛