Ever since the SCB X Card sign up bonuses came in and people started trying to cash out their points, I’ve been receiving a steady stream of questions from those who believe the bank has pulled a fast one on them.

Three common themes have emerged:

- “SCB no longer allows you to transfer points to KrisFlyer”

- “SCB has devalued the rate for KrisFlyer transfers”

- “SCB makes you pay multiple fees when converting points to miles” (sort of true, but completely avoidable)

Now, some of you may shake your head at these questions, but it’s easy to forget that what seems obvious to experienced miles chasers may be confusing to newcomers. Moreover, SCB’s convoluted rewards platform has only exacerbated the problem, as you’ll see below.

So in case you have friends who are panic texting you these questions, please point them to this article where I’ll do my best POFMA impression.

“SCB no longer lets you transfer points to KrisFlyer”

Has SCB removed KrisFlyer from their transfer partners? I understand why people are asking this, but really, it’s more a product of strange system design than anything nefarious.

If you go to the SCB mobile banking app and try to transfer your points, you’ll see 11 different rewards programs, but no KrisFlyer:

Did SCB kill the partnership? Did they run out of KrisFlyer miles? Is Singapore Airlines on the verge of bankruptcy?

Like most things in life, the answer is a lot more prosaic.

If you want to redeem KrisFlyer miles, you’ll need to go to the SCB rewards portal on your desktop. Click the login button on the right…

…enter your ibanking credentials…

…and you’ll be shown your points balance.

You’ll then be able to browse the rest of the catalogue and redeem KrisFlyer miles.

Why is the system so weird? Based on what I know, SCB engaged a third party loyalty company to bring 11 new transfer partners onboard for the X Card. Prior to this, they only had KrisFlyer.

What this means is that SCB is operating two different rewards platforms at the moment:

- their legacy platform, which only has KrisFlyer

- their new platform, which has the 11 new partners

If you go via desktop, you’ll see the legacy portal. If you go via the mobile app, you’ll see the new portal. I don’t know if they have plans to harmonize the two, but hopefully they will, because it’s really confusing a lot of first-time SCB customers.

“SCB has devalued the rate for KrisFlyer transfers”

Even when people do find the correct rewards portal, some get confused by what they think is a “stealth devaluation”.

This arises because SCB has two different conversion rates for KrisFlyer miles, depending on what card you’re holding. Hover your mouse over the “View Rewards” tab- notice how there’s an Air Miles (Visa Infinite) and an Air Miles (Other Credit Cards) option?

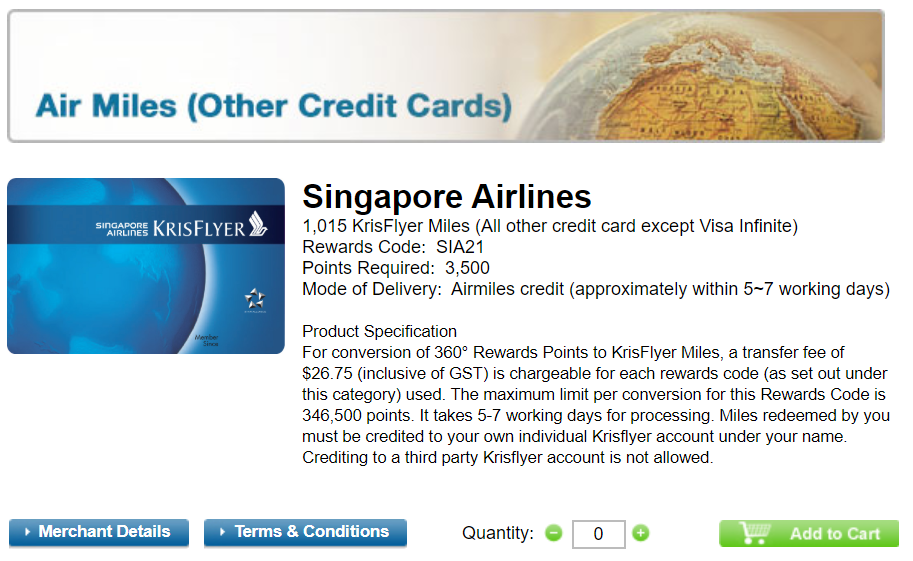

Some people make the mistake of clicking on Air Miles (Other Credit Cards). They then see a ratio of 3,500 points: 1,015 miles, do some sums in their head, and start panicking.

What they should have done is click on the Air Miles (Visa Infinite) option, where they’ll see the ratio of 2,500 points: 1,000 miles.

The 3,500 points: 1,015 miles ratio applies to cards like the SCB Rewards+, and isn’t relevant to SCB X Card holders. Remember: the SCB X Card is a Visa Infinite. Come on, it even says so on the cardface!

All things considered though, I don’t understand why SCB felt the need to have two different burn structures. If the idea is to reward Visa Infinite cardholders more, couldn’t they just have built that into the earn rate?

I mean, it’s obvious to me to click on the Visa Infinite option, but the number of questions suggests not everyone sees it that way. It probably doesn’t help that SCB has another card called the SCB Visa Infinite, so when people see the Air Miles (Visa Infinite) option, they may wonder if it means the tier, or that particular card.

“SCB makes you pay multiple fees when converting points to miles”

Some people are getting their feathers ruffled by the following term in the SCB rewards catalogue:

| For conversion of 360° Rewards Points to KrisFlyer Miles, a transfer fee of $26.75 (inclusive of GST) is chargeable for each rewards code (as set out under this category) used. |

They interpret this as having to pay S$26.75 for each rewards code redeemed, which would add up to a hefty fee if you were trying to cash out 100,000 miles.

Not quite. SCB charges S$26.75 per unique rewards code redeemed. There are a total of 5 different reward codes, and a maximum of 99 can be redeemed in a single transaction.

- Rewards Code SIA 11: 2,500 points (1,000 miles)

- Rewards Code SIA 12: 25,000 points (10,000 miles)

- Rewards Code SIA 13: 75,000 points (30,000 miles)

- Rewards Code SIA 14:125,000 points (50,000 miles)

- Rewards Code SIA 15: 250,000 points (100,000 miles)

For example:

- if you transfer 20 x SIA 11, you’ll pay S$26.75

- if you transfer 10 x SIA 11 and 1 x SIA 12, you’ll pay S$26.75 x 2= S$53.50.

So the simplest way to avoid paying multiple fees is to hit 275,000 points on your SCB X card and cash out 11 x SIA 12. You can do this by either spending an additional S$2,334 in local currency, or simply buying the balance in points.

For the record, I completely agree that it’s a very clunky system, and not what you’d expect in this day and age. But you don’t have to pay multiple conversion fees; you just need to think a little strategically about conversions.

Conclusion

One thing that struck me as interesting was how ready people were to believe the worst in the situations above. That can’t bode well for the bank can it?

That said, I think SCB is at least partly to blame for some of the confusion- having two different rewards portals, two different reward rates, and charging multiple fees for rewards redemptions is a surefire recipe for confusion.

But tl;dr, none of these claims are true. So please point your panicking friends here. There are genuine concerns about the X Card (2 free lounge visits for a $695.50 annual fee?), but these aren’t some of them.

I can imagine why people think the worst, automatically. For example, Citibank (to be honest, I don’t know when) devalued the conversion rates of their ThankYou rewards to all FFPs that now require bigger “blocks” – without a pipsqueak of notice to cardholders.

“So the simplest way to avoid paying multiple fees is to hit 275,000 points on your SCB X card and cash out 11 x SIA 11.”

I think you meant 11 x SIA 12.

Fixed, thanks!

Oh….Aaron thanks for this article.

I spent more than the required on the X Card and then recent weeks I don’t see Krsflyer option. Told myself SCB ran out of KF miles and to wait till 2020 b4 complaining.

So…..I have to log in to site on PC. Surely they can make it less hassle for their customers.

so… i was not aware that i should have clicked the visa infinite option and redeemed my miles through other cards… ugh. i only learned about it when i asked scb why i only had 80,000ish miles……. UGH KILL ME

i didnt even know the system would let you do that if you had an scb vi card. can they reverse?