It’s safe to say that Singapore miles and points collectors are spoiled for choice these days, with dozens of credit cards and 18 different hotel and airline partners at their disposal.

Need a short-haul award? Use a Citibank card and earn those Avios. Want to dabble with United’s excursionist perk? Get a Standard Chartered card and rack up miles with MileagePlus. Just want plain vanilla KrisFlyer? Throw a stone and you’re bound to hit something.

It’s a time of abundance, but getting here wasn’t straightforward. In fact, as inconceivable as it may seem today, credit card tie-ups with frequent flyer programmes were at one point banned in Singapore!

This Prohibition-style era almost put an early end to the nascent miles game, but for the intervention of everyone’s favourite politician…

The beginning of the miles game

To understand what happened, we need to first go back to the start of the 1990s. Credit cards had existed in Singapore for nearly three decades now, and mass adoption had turned them from cherished invitation to common commodity.

The ubiquity meant that the vast majority of card perks were underwhelming. Banks touted complimentary travel insurance, quick card replacement and a maximum liability of S$100 for lost or stolen cards as selling points- hardly things to get the pulse racing.

That all changed when American Express shook up the market with the launch of Premier Tribute in November 1991, which I regard as the first “proper” rewards programme in Singapore. Cardholders whose 3-month average spending fell above a certain threshold could choose from gifts like musical and concert tickets, wine classes and F&B experiences.

Premier Tribute was so popular that American Express ran subsequent editions in 1992 and 1993, upping the stakes each time with more and more sensational prizes like a Porsche sports car and an S$800,000 freehold luxury condominium (La Meyer, if you’re curious).

Citibank eventually entered the rewards fray in 1993 with its Miles Ahead campaign, where customers accumulated points from credit card spending to redeem discounted airfares on Qantas Airways. Their tagline — life is about guarantees, not lucky draws — was a not-so-subtle dig at American Express and their promotion mechanics.

Despite its name, Miles Ahead wasn’t about airline miles per se. But these weren’t far behind, because 1993 was also the year that Singapore Airlines, Cathay Pacific and Malaysia Airlines banded together to launch Passages, a frequent flyer programme jointly financed and marketed by all three carriers.

Make no mistake- they didn’t do so willingly. For years, Asian carriers had shunned frequent flyer programmes as an American gimmick, believing that a high quality product would engender more loyalty than any number of airline miles.

But with the early 90s recession starting to hit hard and surveys showing that customers did indeed favour airlines with “gimmicky” programmes, their hand was forced. Passages debuted on 1 July 1993.

Singapore Airlines may have gone in kicking and screaming, but the banks were delighted. Data from the US showed that frequent flyer miles were the way to drive card spending, with cardholders charging more than 4X as much once they joined a mileage scheme. The Passages contract became the single most important deal in a decade, and a hotly-contested battle ensued.

American Express was always seen as a frontrunner, thanks to its tie-ups with Qantas, Air France and Air Mexico. Visa and Mastercard made their presence felt through member banks, with Citibank, Standard Chartered and HongkongBank (HSBC’s predecessor) leading the charge.

Eventually, American Express, Diners Club and Citibank emerged as the victors. American Express and Diners Club would be Passages’ charge card partners, while Citibank would have exclusive rights as credit card partner.

| 🥊 Oh Behave |

| This led to a fun little squabble between American Express and Citibank, with the former taking exception to the latter’s advertisements claiming to be Passages’ “exclusive” card partner. AMEX complained that Citibank was basing this claim on a technicality (since they issued credit cards while American Express issued charge cards), which was liable to confuse consumers. |

So by the mid-90s, rewards were already an established facet of credit card spending. Airlines and banks batted their eyelashes at each other, multi-million dollar ad campaigns touted the allure of free travel, and customers raked in the miles (or kilometres, in the case of Passages). All was well with the world.

And then MAS stepped in.

Prohibition hits

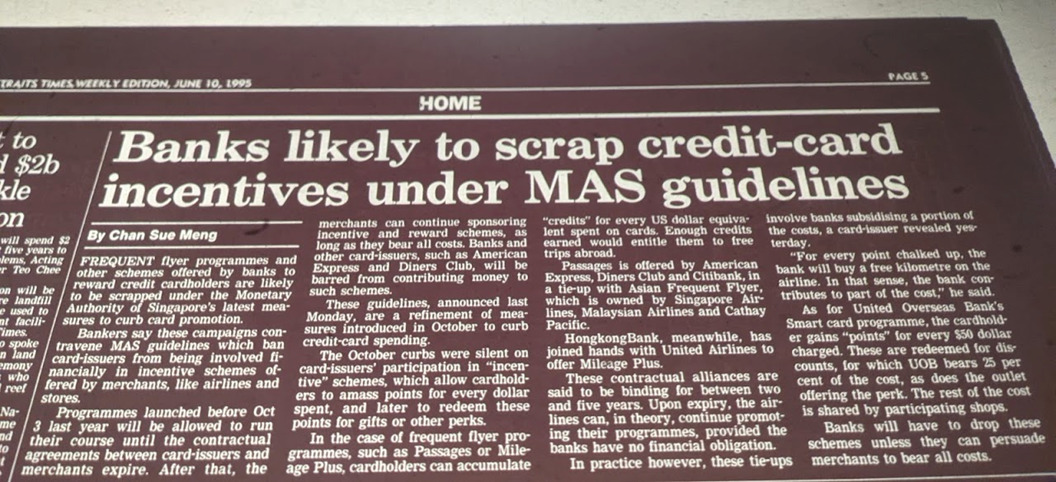

In June 1995, the MAS dropped a bombshell on the industry with a circular stating that frequent flyer tie-ups ran afoul of guidelines prohibiting card issuers from financial involvement in merchant incentive schemes.

What that meant, in simple terms, is that banks weren’t allowed to purchase miles from airlines and give them to customers, because this created a financial obligation between banks and the airlines.

Merchants (in this case the airlines) had to be responsible for all the costs of the rewards scheme, effectively a de facto ban on earning miles through credit cards (unless perhaps an airline fancied applying for a banking license, or a bank an Air Operator Certificate).

The impact would be particularly acute for Passages. Just shy of its second year of operations, Passages was counting on banks to be the all-important link to customers on the ground. Take away credit cards, and how many people would stay in hotels or rent enough cars to be meaningfully involved?

If there was any silver lining, it was that tie-ups launched prior to October 1994 (e.g. Passages) would be allowed to see out their contractual agreements, after which airlines had to bear the costs of any rewards scheme alone.

But perhaps the banks should have seen this coming. Just the year before, DBS had been on the receiving end of an almighty telling off by regulators, consumer watchdogs, and even then-finance minister Richard Hu (though he declined to mention them by name) for sending out unsolicited, pre-approved credit cards to 25% of its cardholders. “This makes nonsense of the government’s efforts to encourage the virtues of frugality,” said CASE in a statement.

With credit card debt hitting all-time highs, MAS was also concerned about the aggressive marketing campaigns banks were undertaking to promote card spending. Freebies and promotions tied to spending were de rigueur, with American Express’ Premier Tribute programme rapidly copied across the market. Singaporeans held an average of three cards per eligible person, one of the highest rates in the region.

The regulator also wasn’t happy about the tone that banks were striking in their advertisements, with OUB whimsically inviting consumers to “double your spending power”, and OCBC talking about “taking your spending power to the max”. In August 1994, MAS issued a circular to banks telling them to knock it off, leading to a 30-day moratorium on all credit card advertisements.

In that sense, one could see the ban on frequent flyer tie-ups as MAS’ way of sending a message to the free-wheeling credit card market. Indeed, it went one step further in February 1996 and capped credit limits at 2X cardholders’ monthly salary, to the chagrin of charge card issuers American Express and Diners Club (whose entire value proposition was based on no credit limits, no rollover balances).

These rules weren’t just paper tigers either. HongkongBank, which had been the exclusive card partner for United Mileage Plus in Singapore since its launch in 1993, had to terminate its tie-up in August 1996 once the contract lapsed.

In a textbook example of misery loving company, a spokesperson for HongkongBank noted that other card issuers would soon be in the same boat. And he was right. It’s unclear just how long Passages’ contracts with American Express, Diners Club and Citibank were, but sooner or later the partnerships would have to be sunset.

As Bonnie Tyler once crooned, “I need a hero”.

Happy (sp)ending

While Passages enabled its three founders to check off the frequent flyer programme box, it was always made up of allies of convenience.

As time went by, it became increasingly apparent that by operating a combined scheme, Singapore Airlines, Cathay Pacific and Malaysia Airlines were missing out on opportunities to brand and market themselves uniquely. Malaysia Airlines, for example, wanted to start rewarding passengers who flew domestically, but couldn’t because the other two partners did not operate domestic routes.

So it was little surprise when rumours started circulating in mid-1998 that Passages would be dissolved. High value PPS members (remember, the PPS Club predates both Passages and KrisFlyer, having started in October 1984) were invited to clandestine focus groups at Airline House, where management was hatching plans for Singapore Airlines’ first-ever frequent flyer programme.

KrisFlyer was announced in October 1998, with a launch date set for 1 February 1999. But what good would it be without any card partners in its home market?

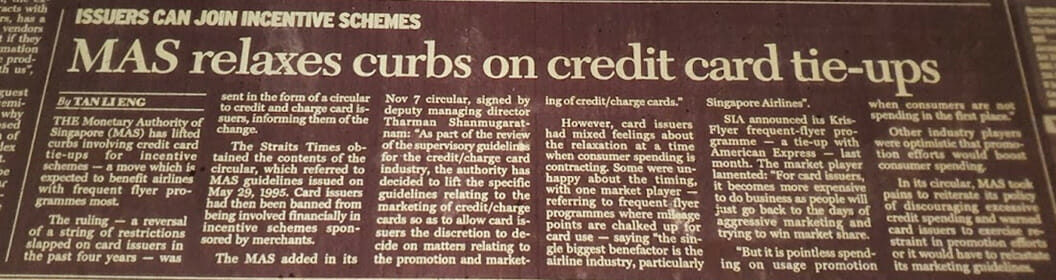

We’ll never know the answer, because the very next month, MAS announced that it would lift the curbs it imposed back in 1995. Card issuers could once again participate in incentive schemes sponsored by airlines, at their own discretion.

Went the circular:

“As part of the review of the supervisory guidelines for the credit/charge card industry, the authority has decided to lift the specific guidelines relating to the marketing of credit/charge cards so as to allow card issuers the discretion to decide on matters relating to the promotion and marketing of credit/charge cards”

Who signed off on it? None other than deputy managing director Tharman Shanmugaratnam.

We’ll never know for sure what went on behind the scenes, but I like to imagine that Tharman was a miles bro at heart, and fought a valiant battle to get rid of these draconian restrictions. A less romantic explanation would simply be that SIA’s lobbying efforts bore fruit, or that regulators decided the rules had run their course.

Either way, the proximity of the two events was hard to ignore. One unnamed market player lamented the changes, saying that they unfairly favoured the airline industry at the expense of banks, who would have “go back to the days of aggressive marketing and trying to win market share.”

Boo hoo hoo.

Love it or hate it, it was full steam ahead for credit card tie-ups after this announcement as banks chased the lucrative KrisFlyer contract. UOB became the first of the big four Singapore banks to tie up with KrisFlyer in January 1999, American Express launched the first cobrand KrisFlyer card in September 2000, and by the mid-2000s, there were so many options out there it’s like the miles game never took a break.

Conclusion

The ease with which you can get a miles card today belies the turbulent early years, where at one point it looked like Singaporeans might lose the ability to earn miles from day-to-day spending altogether.

Fortunately that never happened, and frequent flyer tie-ups are so common you can earn miles from food delivery, mall shopping, hotel stays, magazine subscriptions, activity bookings, even taking a cruise.

And if you’ve always had a soft spot for Tharman you could never quite place your finger on, perhaps now you know why.

| ✈️ The Nostalgia Series | |

| P.S: If you liked this post, here’s a few more you might find interesting- courtesy of my digging in the NLB archives! | |

|

|

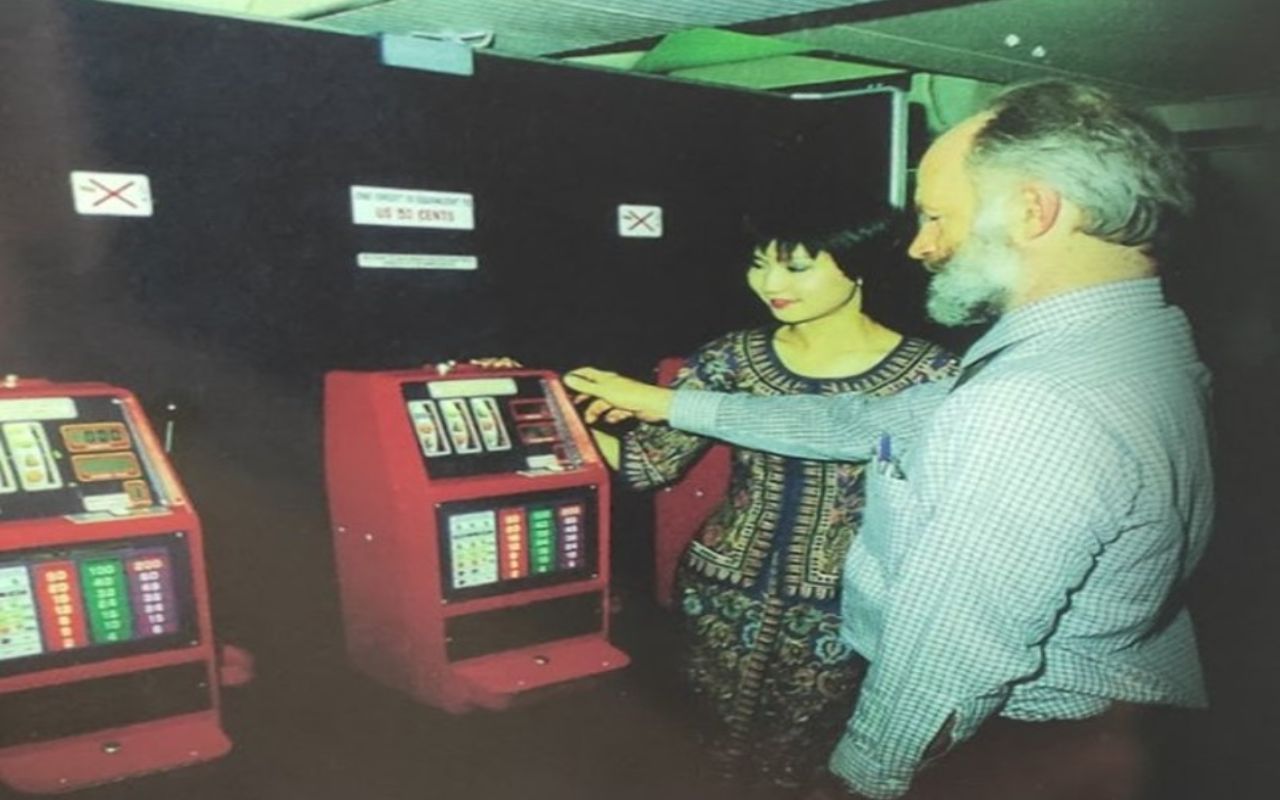

| SIA’s Boeing 747 Slumberettes: So good that other airlines complained | Orchard Rows: The story of SIA’s ill-fated jackpot machines |

| Read It! | Read It! |

|

|

| Cigarettes, jackpots and live bands: SIA’s IFE through the years | The Young Explorer Club: SIA’s FFP for kids |

| Read It! | Read It! |

|

|

| Hugo’s in the Sky: SIA’s gastronomic partnership with Hyatt | MSA: Mercury Singapore Airlines, or Malaysia Says Alamak |

| Read It! | Read It! |

|

|

| Before KrisFlyer: Singapore Airlines’ other frequent flyer programs | |

| Read It! | |

Thanks for sharing Aaron! Very fun to read, this keeps the blog interesting and fun for all, not just 100% miles maths.

Glad you enjoyed it! And yes, tharman for pm

We are not ready for a non-Chinese PM.

But its cool if you want a pseudo-Malay President. Same same, but different, ok?

We had non-Chinese presidents for quite a while already, dumb ass.

Tharman’s my first pick too. But the trade off might be that it would be harder for us to pander to lucrative China. Not that they’re going to say that out loud.

Also, great read! You have a very engaging style.

Love it! Learnt another reason to support Tharman for pM

Haha indeed. Anyone who likes miles can’t be that bad

Not

Going

To

Happen

Ha ha

Great article Aaron! Applaud you for the effort taken to research the history of the miles “game” in Singapore!

Excellent, excellent read

I wish it was expanded more on how it happened instead of just who

Thanks Aaron for the informative post! Did you personally head down to NLB’s microfilm room to view the June 1995 MAS Bombshell/Prohibition article?

for the previous nostalgia posts I did, but since it’s so time consuming I now pay someone to do the heavy lifting research work.

There are a lot of donkeys rules and regulations in MAS still despite one brilliant change. While modern, they can be slow or “unwilling” to step in when they ought to.

Banks collectively dropping the income requirement for miles cards circa 2016 (?) sure was a big help.

Nowadays most uni grads can get their hands on an Altitude/PRVI Miles when in the past you would have required a 4k/mth kind of starting job.

oh yes, very much so. altitude, citi premiermiles and uob prvi miles were all $80k income cards at one point. i thought i’d have to work for 5 years before i could get into the miles game.