Citi PayAll has launched a new flash deal with up to S$120 eCapitaVouchers on offer for bill payments set up from 23-28 February 2023.

While this flash deal doesn’t coincide with any promotional earn rate for PayAll transactions, it still lets you offset a significant amount of the regular 2% admin fee, reducing the cost per mile to as little as 0.31 cents depending on card.

Citi PayAll offering up to S$120 eCapitaVouchers

|

| Citi PayAll Flash Deal |

Here’s the key details of the new Citi PayAll flash deal:

- Registration is not required

- Payments must be set up between 23 February 2023, 12 a.m to 28 February 2023, 11.59 p.m. If you have any existing payments scheduled before this date, you must cancel and set them up again to qualify

- Charge date for payments must fall on or before 6 March 2023

- For any recurring payments, only the first payment of the series will count towards the minimum spend

- Citi PayAll’s new “no fee, no rewards” option will not qualify for this offer. You’ll need to select the one-time service fee (2%) option to qualify

Citi PayAll customers who set up at least S$4,000 of payments will receive up to S$120 eCapitaVouchers, according to the following table:

| Total Citi PayAll Payments | eCapitaVouchers |

| S$4,000 to S$7,999 | S$60 |

| S$8,000 and above | S$120 |

Customers are entitled to a maximum of one gift, i.e. either a S$60 or S$120 eCapitaVoucher.

All Citi PayAll transactions will count towards this promotion:

| 💰 Citi PayAll: Supported Payments | |

|

|

The “misc. payments” category is very broad, and almost serves as a catch-all: you could use it to pay for wedding expenses, donations, renovations, even the nebulously defined “travel expenses” and “payment for retail good and services”. Most of these don’t even require supporting documentation; you can simply transfer funds to someone else’s bank account.

Do remember, however, that Citi PayAll T&Cs explicitly prohibit you from sending money to yourself, or using it as a cash advance facility. In other words, whatever payment you make must have some underlying economic substance.

|

|

10.1 When accessing and using the Service, you must comply with any prescribed verification procedures, or other procedures, directions and instructions communicated by us to you. Further, you hereby represent and warrant that you shall not, in connection with your use of the Service: (b) send money to yourself or recipients who have not provided you with goods or services (unless expressly allowed by us); (c) provide yourself or any other party a cash advance from your card (or help other parties to do so); |

Which Citi cards are eligible?

This Citi PayAll flash deal is valid for the following Citi credit cards:

- Citi ULTIMA Card

- Citi Prestige Card

- Citi PremierMiles Card

- Citi Rewards Card

- Citi Lazada Card

- Citi Cash Back+ Card

- Citi Cash Back Card

Stick to one card!

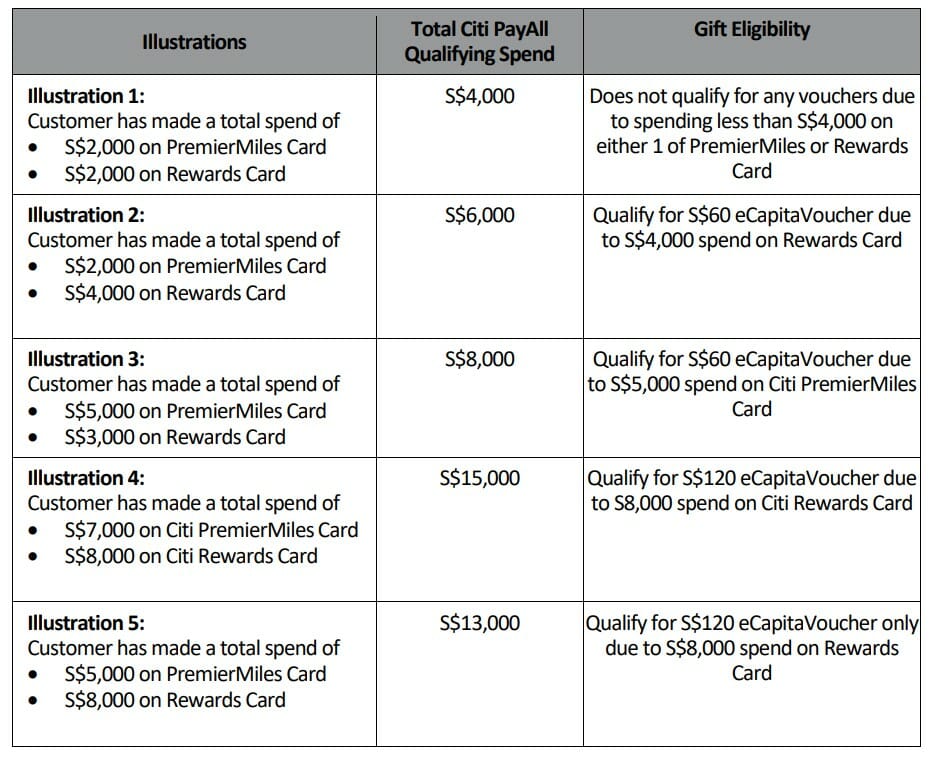

Citi has introduced a new policy for this particular PayAll promotion, which requires that the minimum spend be made on only one eligible card.

The following illustrations are provided:

tl;dr: you can’t combine minimum spend across multiple cards; pick one card and stick with it.

When will I get my gift?

Eligible customers will receive a notification via SMS/email with gift redemption details within 16 weeks from the end of the promotion period, i.e. 20 June 2023.

That’s four weeks longer than previous flash deals. Based on data points I’ve seen, Citi was regularly missing the 12-week fulfilment window, so presumably they’ve decided to give themselves more breathing room.

Terms and Conditions

The full T&Cs of this offer can be found here.

Is it worth it?

Unfortunately, this flash deal does not coincide with one of Citi PayAll’s upsized miles offers- the most recent one (1.8 mpd) ended on 31 January 2023.

However, eCapitaVouchers are as good as cash to many people, and reduce the effective cost per mile significantly. A S$60 eCapitaVoucher on a S$4,000 payment or S$120 eCapitaVoucher on a S$8,000 payment is effectively a 1.5% rebate off a 2% admin fee.

Given a 0.5% fee, your effective cost per mile drops as follows:

| Assuming S$4,000 or S$8,000 Citi PayAll payment |

||

| Card | Earn Rate | Cost Per Mile @ 0.5% |

Citi ULTIMA Citi ULTIMA |

1.6 mpd | 0.31 cents |

Citi Prestige Citi Prestige |

1.3 mpd |

0.38 cents |

Citi PremierMiles Citi PremierMiles |

1.2 mpd |

0.42 cents |

Citi Rewards Citi Rewards |

0.4 mpd |

1.25 cents |

To illustrate, suppose you made a PayAll payment of S$4,000 on your Citi PremierMiles Card:

- You pay an admin fee of S$80 (2% of S$4,000)

- You receive S$60 eCapitaVouchers + 4,800 miles (1.2 mpd x S$4,000)

- The cost of 4,800 miles is therefore S$20, or 0.42 cents per mile

Don’t forget, we’re not just talking about KrisFlyer miles. Citibank points can be transferred to 10 different frequent flyer programmes, including some with great sweet spots like British Airways Executive Club, Etihad Guest, Qatar Privilege Club and Turkish Miles&Smiles.

| 💳 Citibank Transfer Partners | |

|

|

|

|

|

|

|

|

|

|

|

|

| For a full list of transfer partners, refer to this article | |

Conclusion

For the next six days, Citi PayAll is offering a flash deal with S$60/S$120 eCapitaVouchers up for grabs to customers scheduling at least S$4,000/S$8,000 of payments, on top of the regular miles.

Don’t forget to set up your payments by 28 February 2023 (with a charge date by 6 March 2023) to be eligible, and to charge your payments to a single Citi card. And don’t try to pull a fast one by choosing the no-fee-no-rewards option; when Citi says no rewards, they mean it!

I wonder how many people have used Payall in breach of clause 10.1 mentioned above?

It really is stupid policy. Either, like Cardup, request for supporting documentation when the transaction is setup, or, like UOB Pay Anything, state up front that you can use it for any purpose you like.

To not check documentation and have a clause like that which I was not even aware of until I saw the above article really is bizzaire. A bet most people were not even aware of the clause.

They need to avoid it being seen as a cash advance. Is all.

Can I pay the town council fees thru PayAll?

Cannot find in their payment categories.

The stick-to-one-card policy seems to be in place since Apr’22 campaign (https://milelion.com/2022/04/08/great-deal-citi-payall-offering-2-5-mpd-on-all-payments-including-tax-buy-miles-at-0-8-cents/) . I used CitiRewards & Citi Premiermiles cards, but they only give me bonus miles on my CitiRewards Payall transaction. I’m still arguing about my CitiPM bonus miles with the CSO until now. Sigh. Does anyone have the same experience?

thx for the information. prepaid some income tax