So, this is rather unexpected.

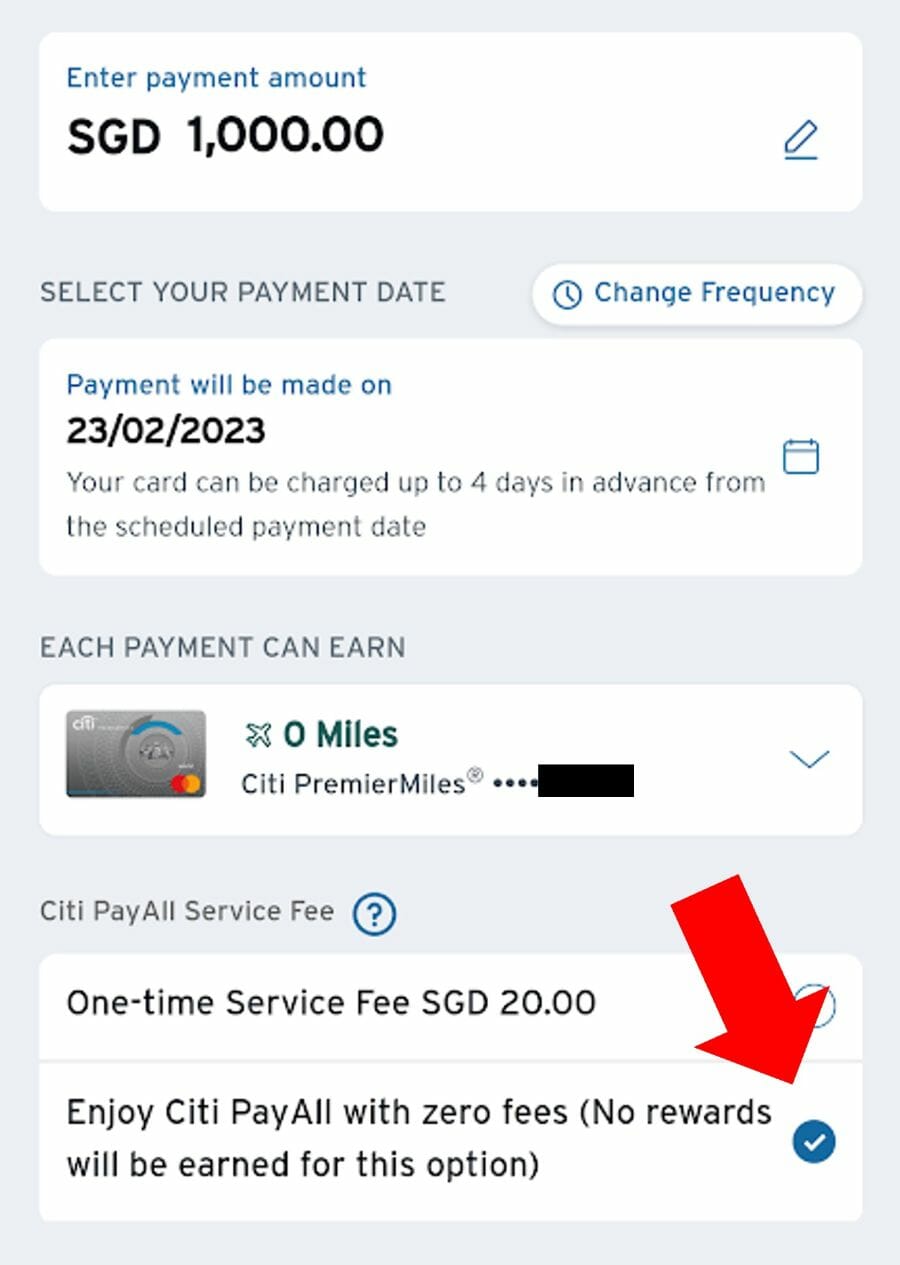

Earlier this week, I wrote about Citi PayAll’s new “no fee, no rewards” option. As the name suggests, you won’t earn any credit card rewards when choosing this option. However, you’ll still get the benefit of deferring payments and conserving cashflow, with up to 50 interest-free days on bill payments. With interest rates as high as they are now, that cash could be put to good use elsewhere!

Now, it seemed a no-brainer to me that no-fee payments would not count towards the minimum spend required for perks like Citi Prestige limo rides, or sign-up bonuses. Indeed, an email to Citi’s PR team confirmed as much.

But then a couple days later, I received an updated email which changes the dynamics completely…

No-fee Citi PayAll payments count towards minimum spend

A Citi spokesperson has provided me with the following statement, which supersedes the previous one (emphasis mine):

|

All Citi PayAll transactions can be included in the minimum spend required to qualify for card-related benefits, such as Citi Prestige’s complimentary airport limousine rides and welcome offers on other Citi cards. This includes Citi PayAll transactions, with or without service fees included. Citi PayAll transactions made with zero service fees paid, however, will not qualify for any other rewards, such as base points, bonus points or miles. In line with industry practices, we reserve the rights to review and modify the relevant terms and conditions related to Citi cards as required. |

Wow. This changes everything, and quite frankly, almost seems too good to be true.

Citi is basically saying that no-fee PayAll transactions will be treated the same as fee-paying PayAll transactions when it comes to qualifying for card-related benefits. So that there was no ambiguity, I also got on a quick call with the team, who confirmed exactly that.

This presents two main opportunities.

(1) Citi Prestige limo rides

Citi Prestige Cardholders currently earn two free limo rides with a minimum qualifying spend of S$12,000 within a calendar quarter, defined as follows:

- Q1: 1 January to 31 March

- Q2: 1 April to 30 June

- Q3: 1 July to 30 September

- Q4: 1 October to 31 December

All limo rides must be booked within the quarter they are earned (Citi no longer allows carry forwards), although you can book the limo ride prior to meeting the qualifying spend, and take the ride whenever you wish (even outside that calendar quarter).

Citi PayAll payments have always counted towards minimum spend, but the news that no-fee payments also count is massive, to say the least. It means a Citi Prestige Cardholder has every incentive to look for things to charge to PayAll, whether it’s rent, insurance premiums, utilities bills, or any other supported payment.

(2) Sign-up bonuses

Citibank is currently running the following sign-up offers for the Citi Prestige, Citi PremierMiles and Citi Rewards Cards, available to new-to-bank customers.

| 💳 Citi Sign-Up Bonuses | |||

| Spend (AF) | Miles^ | Cost Per Mile | |

Citi Rewards Citi RewardsApply |

S$800 (FYF) |

16K | – |

Citi Premier Miles Citi Premier MilesApply |

S$800 (S$194) |

30K | 0.65 |

Citi Prestige Citi PrestigeApply |

S$800 (S$540) |

48K | 1.13 |

| ^Does not include base miles |

|||

The minimum spend was already attractively low at S$800, and the fact that no-fee Citi PayAll payments count too means you have no excuse not to qualify.

What payments are supported?

As a reminder, Citi PayAll currently supports the following payment types:

| 💰 Citi PayAll: Supported Payments | |

|

|

Some categories are rather nebulously defined, which means it really isn’t difficult to find something to pay.

Just remember, however, that Citi PayAll T&Cs explicitly prohibit you from sending money to yourself, or using it as a cash advance facility. In other words, whatever payment you make must have some underlying economic substance.

|

|

10.1 When accessing and using the Service, you must comply with any prescribed verification procedures, or other procedures, directions and instructions communicated by us to you. Further, you hereby represent and warrant that you shall not, in connection with your use of the Service: (b) send money to yourself or recipients who have not provided you with goods or services (unless expressly allowed by us); (c) provide yourself or any other party a cash advance from your card (or help other parties to do so); |

Is there a catch?

Like I said, I’m still trying to figure out how this makes sense for Citi.

Yes, it will drive adoption of Citi PayAll like crazy, and almost certainly take business away from competitors like CardUp and SC EasyBill. But all this costs money, and without the 2% admin fee, how are the numbers going to work?

That said, Citi has shown historically that it isn’t afraid of splashing the cash when it needs to. PayAll has seen some blockbuster promotions over the past couple of years (2.5 mpd earn rates, extra Grab/eCapitaVouchers), and who can forget the legendary Citi x Apple Pay 8 mpd offer?

I suppose the only caveat I’d highlight is that last bit in the spokesperson’s statement:

| In line with industry practices, we reserve the rights to review and modify the relevant terms and conditions related to Citi cards as required. |

As you know, the T&Cs that banks publish give them a very wide berth, including the right to vary or amend terms from time to time without notice. While I’m not saying this will happen, I just want to point out that Citi is not obligated to provide advance notice of any changes, so the tl;dr would be enjoy it while it lasts.

Conclusion

Citibank has confirmed that no-fee Citi PayAll payments will count towards the minimum spend requirement for all card-related benefits, such as limo rides on the Citi Prestige, and sign-up bonuses on Citi cards.

I’m just as surprised as you are, and wonder how long this will last. But in any case, now’s the time to make hay, and make hay we shall.

no matter how ppl complain about Citibank, it is still one of the best in the market (as compared with those stingy-family business kind of local banks)

If they improved their website UI + customer service, I wouldn’t reccomend any other bank

Especially sweet with EGA giro 1%!

Does this need to be paper giro? Or would doing it online be good enough?

Just to confirm, there’s a one time admin fee of S$20 for this no fee option?

As Citi Cash back Credit card is eligible for payall, also payall transaction is not excluded from the $800 monthly minimum spend to earn 8% on groceries and dining. So this would make another good use case. You are welcome 🙂

Does pay all count for the 800 minimum spendings?