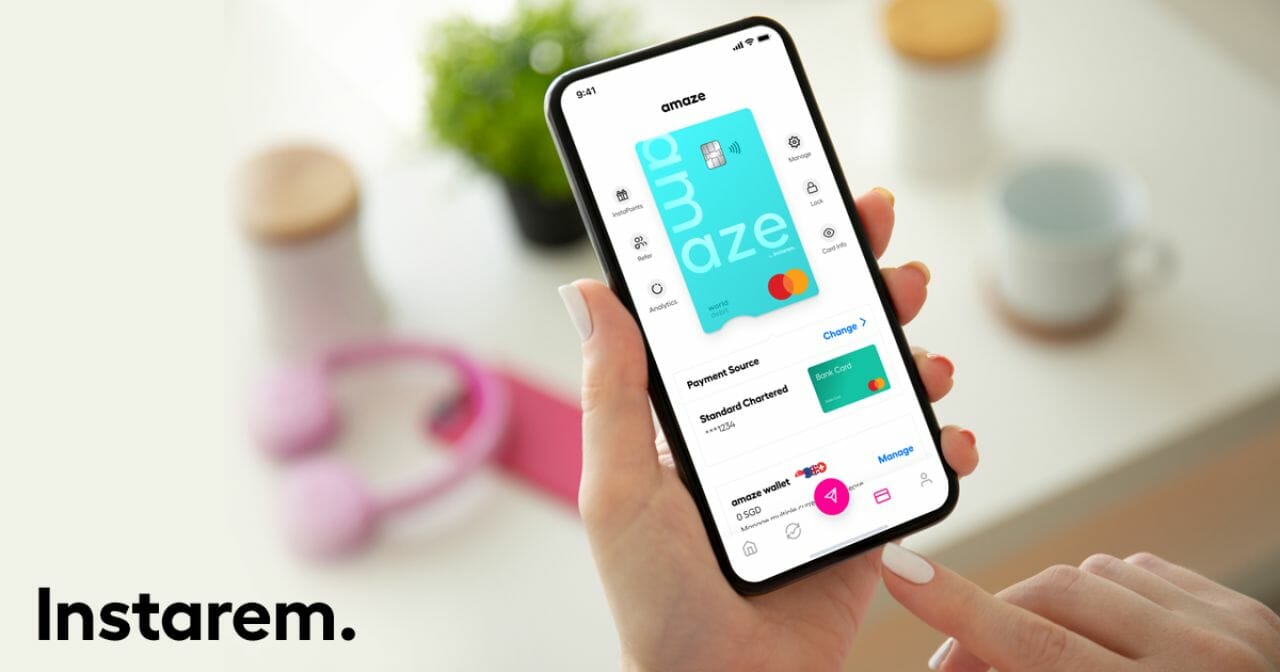

Amaze’s big selling point is that it allows users to earn credit card rewards on overseas spending, without foreign currency (FCY) transaction fees.

That’s a succinct summary, but not entirely accurate. Amaze still has to earn money, after all, and while it’s true that there’s no explicit FCY transaction fee, the rates that it uses are different from the Mastercard/Visa network.

Once upon a time, Amaze’s rates were equal to or very close to Mastercard’s rates, but at some point in 2022, those started diverging noticeably. This means that even though it doesn’t call it as such, Amaze really does have an implicit FCY transaction fee of its own.

How much exactly is that, and does it negate the benefits of using Amaze over credit cards?

|

| Apply here |

| Use code 7HK2A2 for 225 bonus InstaPoints |

| 💳 tl;dr: Amaze Card |

|

How is using Amaze different from using a bank credit card?

| Credit Card | Amaze + Credit Card | |

| Conversion Rate | Mastercard/Visa | Amaze |

| FCY Fee | 3.25% | 0% |

With a credit card, FCY transactions are converted into SGD (technically it’s converted into USD first, then SGD) based on the Mastercard or Visa rates. The bank then adds a further FCY fee on the transaction, which is usually 3.25%.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

With Amaze, FCY transactions are converted into SGD based on the Amaze rate. There is no further FCY fee, but the Amaze rate is higher than the Mastercard rate (we won’t refer to Visa here, as Amaze is only issued on the Mastercard network and can only be paired with Mastercards).

Therefore, the implicit FCY fee that Amaze charges is basically its spread over Mastercard.

What rates does Amaze use?

It’s important to remember that Amaze never actually promises to give spot rates, or even Mastercard rates for that matter. In the FAQs, Amaze promises to give “competitive FX rates”.

Amaze offers competitive FX rates, unlike banks which typically add a substantial markup and FX admin fee. Thus, you get the best possible value for your FX transactions.

| ❓ FYI |

| Once upon a time, this same FAQ used to say that “Amaze offers competitive exchange rates which are very close to the published rates you can see on Google or other financial site”. That wording was later removed, as Amaze started increasing the spread as it pivoted towards profitability. |

But before we look at the actual rates Amaze charges, here’s a PSA:

Stop comparing Amaze rates to Google/XE.com rates (aka mid-market rates)

Seriously, just stop. I get far too many messages complaining that Amaze is a rip-off because “it’s more expensive than the Google rate”. That’s fundamentally the wrong basis of comparison.

| ⚠️ Don’t compare to the UOB app (at least not immediately) |

|

Another common message I get is from people complaining that the rate UOB offers is even better than Amaze + UOB. That’s also not true. What’s happening here is that the UOB app initially displays a pending SGD amount that does not yet factor in the 3.25% FCY fee. When the transaction eventually posts a few days later, the final SGD amount will increase. You can then use that figure as your basis of comparison, and I guarantee Amaze will be cheaper. |

The only time when mid-market rates become relevant is if your goal is to minimise the total cost of the transaction, in which case you’d compare Revolut/YouTrip or money changer rates to the mid-market rate and see which one is the closest.

With Amaze, the goal is to earn rewards while still paying less than a traditional credit card, and since no credit card offers mid-market rates, our basis of comparison should be the Visa/Mastercard rates.

Do I want mid-market rates and credit card rewards? Sure, in the same way I want birds to poop on the heads of people who watch videos in public without headphones. Sadly, what I want and what I get are two very different things.

| ❓ What about cost per mile calculations? |

|

It’s a valid question to ask how much we’re implicitly paying for those rewards, since an Amaze transaction will always cost more than alternatives like multi-currency cards, money changers or the Trust Card. But even then, you wouldn’t bring in the mid-market rate. Instead, your cost per mile would be the incremental cost from using Amaze over the alternative, divided by number of miles earned. For example, if a US$100 transaction would cost S$137.16 with Amaze and S$134.87 with YouTrip, and if I earn 400 miles, then my cost per mile is (S$137.16-S$134.87)/400 miles= 0.57 cents per mile. |

Amaze’s current FCY fee

When updating this article, I went to look at the rates Amaze has been charging for my FCY transactions over the past four months. In my sample set are AUD, EUR, MYR, THB and USD transactions.

I then compared these to what I would have paid if I were using a Mastercard credit card (via Mastercard’s online currency converter) with zero FCY fees. The difference between the rates is then my implicit FCY fee:

| Date | FCY Amount | Amaze | Spread vs MC (FCY Fee) |

| 13 Jul 24 | US$25 | S$34.29 | 2.0% |

| 10 Jul 24 | US$25 | S$34.49 | 2.0% |

| 27 Jun 24 | US$4 | S$5.55 | 2.0% |

| 21 Jun 24 | US$679.4 | S$626.32 | 2.0% |

| 9 Jun 24 | MYR97 | S$28.54 | 2.0% |

| 8 Jun 24 | MYR38.15 | S$11.22 | 2.0% |

| 8 Jun 24 | MYR29.7 | S$8.74 | 2.0% |

| 7 Jun 24 | MYR15.9 | S$4.67 | 1.7% |

| 22 May 24 | €52.86 | S$79.14 | 2.0% |

| 21 May 24 | €123 | S$184.1 | 2.0% |

| 19 May 24 | €53.5 | S$80.08 | 2.0% |

| 18 May 24 | €158.24 | S$236.84 | 2.0% |

| 17 May 24 | €40.5 | S$60.66 | 2.1% |

| 16 May 24 | €30.1 | S$45.19 | 2.2% |

| 15 May 24 | €15.3 | S$22.92 | 1.8% |

| 11 May 24 | €9.98 | S$14.89 | 2.0% |

| 29 Apr 24 | €60.88 | S$90.99 | 2.1% |

| 24 Apr 24 | THB577 | S$21.78 | 1.9% |

| 23 Apr 24 | THB4720 | S$178.39 | 2.1% |

Based on my sample set, the fee is now around 2% mark.

For comparison, when I last did this analysis in March 2023 (based on rates from December 2022 to March 2023), the fee was about 1.5-1.8%.

Historical Amaze Rates, December 2022 to March 2023

| Date | FCY Amount | Amaze | Spread vs MC (FCY Fee) |

| 18 Mar 23 | GBP 404.51 | S$675.45 | 1.7% |

| 15 Mar 23 | THB 450 | S$17.97 | 1.6% |

| 14 Mar 23 | THB 1,477 | S$59.01 | 1.9% |

| 14 Mar 23 | THB 9,700 | S$387.57 | 1.9% |

| 14 Mar 23 | THB 195 | S$7.79 | 1.9% |

| 9 Mar 23 | US$439 | S$605.84 | 1.8% |

| 4 Mar 23 | US$11.99 | S$16.47 | 1.8% |

| 1 Mar 23 | US$5.87 | S$8.07 | 1.8% |

| 27 Feb 23 | US$132 | S$180.72 | 1.3% |

| 23 Feb 23 | US$10 | S$13.61 | 1.2% |

| 23 Feb 23 | €7.50 | S$10.89 | 1.5% |

| 22 Feb 23 | €15 | S$21.83 | 1.7% |

| 22 Feb 23 | €7.60 | S$11.06 | 1.7% |

| 20 Feb 23 | CHF 40 | S$58.95 | 1.6% |

| 15 Feb 23 | CHF 28.37 | S$41.98 | 1.7% |

| 7 Feb 23 | US$14.92 | S$20.13 | 1.5% |

| 5 Feb 23 | US$87.40 | S$117.15 | 1.4% |

| 4 Feb 23 | US$25.66 | S$34.24 | 1.0% |

| 1 Feb 23 | US$4.03 | S$5.38 | 1.5% |

| 31 Dec 22 | A$14.95 | S$13.85 | 1.5% |

| 30 Dec 22 | A$111 | S$102.78 | 1.4% |

| 27 Dec 22 | A$150 | S$138.41 | 1.2% |

| 26 Dec 22 | A$38.22 | S$35.18 | 1.1% |

| 22 Dec 22 | US$138.60 | S$190.29 | 1.4% |

| 👛 Using Amaze Wallet? |

|

If you choose the Amaze Wallet as your funding source (as opposed to a credit card), you’ll enjoy rates that are very close to mid-market. This option is similar to using Amaze like a Revolut/YouTrip type solution: enjoying better rates at the expense of credit card rewards. |

While it’s obviously not a good thing that the spread has increased, the fact of the matter is that Amaze still makes sense so long as the following holds:

- Amaze transactions earn credit card rewards

- Amaze’s implicit FCY fee < bank FCY fee (3.25%)

2% is less than 3.25%, so there’s no reason to switch.

What about InstaPoints?

Foreign currency transactions on the Amaze earn 0.5 InstaPoints per S$1, subject to the following conditions:

- Transactions must be at least S$10

- No InstaPoints are earned on exclusion categories such as education, hospitals and charitable donations

InstaPoints can be redeemed for cash rebates at a rate of 2,000 points= S$20, so this is equivalent to a rebate of 0.5%. That brings the nett fee down to 1.5%, but keep in mind that you can only earn a maximum of 500 InstaPoints per month. Therefore, the more you spend above S$1,000, the more your average fee approaches 2%.

What card should you use with Amaze?

As a reminder, only Mastercard credit or debit cards can be paired with Amaze. You can therefore consider the following pairings to maximise the miles you earn (DBS excluded Amaze in June 2022, and UOB in October 2024).

| 💳 Recommended Amaze Pairings |

||

| Card | Earn Rate | Cap |

Citi Rewards Citi RewardsApply |

4 mpd1 | S$1K per s. month |

OCBC Rewards OCBC RewardsApply |

4 mpd2 | S$1.1K per c. month |

| 1. 1. All online transactions except travel (airlines, hotels, rental cars, tour agency, cruises etc.) and in-app mobile wallet (T&Cs) 2. Clothes, bags, shoes and shopping (T&Cs) |

||

For a detailed guide to the best cards to use with Amaze, refer to the post below.

Conclusion

While Amaze does not have an explicit FCY transaction fee, it does have an implicit spread of ~2% over Mastercard rates. This is offset by a 0.5% rebate in the form of InstaPoints, but remember that you’re capped at 500 InstaPoints per month, so any spending beyond S$1,000 will not earn rebates.

It’s undeniable that the spread is gradually increasing, but so long as Amaze offers the same rewards you’d get from using your credit card directly, plus lower FCY fees than the bank, then using it over a credit card is a no-brainer. The fact that it used to be even better is lamentable, but you shouldn’t skip a good deal just because it used to be a great deal.

What kind of spreads are you seeing for Amaze vs Mastercard?

How about Trust card? Seems to indicate that they use the Google rates. Would it not be a better option?

No rewards…ok technically some linkpoints, but so few to the point of irrelevancy

If 1. you don’t have a good general spending card for Amaze (e.g. Citi rewards), 2. you maxed out your credit card rewards, or 3. don’t have a credit card, then Trust card is probably a good alternative. Good rates + 0.22% back in Linkpoints.

With amaze, while the rate is slightly poorer, as mentioned in the article, you get back 1% in points + earn credit card rewards. If you use a 4mpd card, it’s probably much more worth it than trust.

Trustbank specifically says it uses the Visa exchange rate, not the spot rate. Also, for non-USD amounts, you’ll get double-conversion, first to USD, then to SGD.

If you are considering Trust (for instance, when you’ve maxed out your 4mpd rewards), you may also want to consider ICBC’s Global Travel Mastercard. 2.5% FCY fees (above the MC rates), but 3% cashback, earning you a net 0.5%.

I checked the Trust Card rate for CNY to SGD, I find the rate as 5.379 versus MC Exchange rate of 5.386. Difference is about 0.14%. With Trust card giving you back 0.22% linkpoints, I guess it is about slightly superior to Revolut or Youtrip on its own. In addition, it is not a wallet so potential you get up to 45 days leaving money in an account that pays you up to 3.5% so it is about 0.43% additional interest back. But if you use Amaze you are potentially get up to 4 miles per dollar or 6.8% based… Read more »

Can confirm that trust rates are pretty good

Not to mention they don’t have any overseas ATM withdrawal

and

They also don’t have a limit on how much you can withdraw before charging fees

Realised the amaze rates were exceptionally low when I used it on Friday, not sure if it was because paired with my amaze wallet (left-overs from Insta Points)?

It was 1 SGD : 3.24MYR compared to Youtrip with 1SGD : 3.34MYR.

this is an interesting hypothesis- testing amaze rates with wallet versus card. will add it to the to-do list

The rates using a wallet currency (of which there are a few now) are way better than using a card (e.g a EUR transaction last week cost SGD460 on the card, but would have been SGD448 using the wallet). The ONLY time you would use a paried card for a wallet currency is if the card is going to earn 4mpd. And given there is a hack that I am sure you would be aware of that does allow you to earn miles on a top-up of the wallet, you are much better off topping up the wallet, earning miles… Read more »

I don’t think you earn miles for topping up the wallet because of the quasi cash MCC?

if there’s a way of doing this, i’m certainly in the dark about it!

Keen to know about that too….

The prev transactions (end Feb) using the Citi rewards paired with Amaze card got me a fairly similar rate to Youtrip. The difference in SGD/MYR rate was like 0.05-0.07. so really not sure if the rates just went bad with amaze or was it cuz I used the wallet balance!

How about UOB PRVI Master card? Is this card now excluded from

pairing?

Why would you pair Amaze with a card offering anything less than 4mpd?

Because the only 4mpd possibility has a cap of $1k per month

I always thought the ~3.5% FCY bank fee was including the 1% Visa/MasterCard fee. Are we paying 4.5% on foreign currency charges?

Sorry, at the risk of sounding silly – is there a reason why “Travel” is omitted from the UOB Lady’s X Amaze suggested parings in the footnote?

Added it back, thx

After having been hit with fraudulent transactions on Amaze that only went away because of citi (Instarems reaction, I kid you not, was “sorry we can only dispute up to 20 transactions” – they charged about 40 going up from 5$ to 150) I’ve stopped using them except for big ticket items that are worth taking out the phone and unlocking the card. Granted, thanks to the wife I have access to US cards that offer MC rates and points, but even without these I’d likely just stomach the 3% fee rather than keeping an unlocked amaze card

that dispute limit is probably one of the most stupid things i’ve ever heard of. then again, can’t expect any better from instarem’s customer service.

That is one of the nice things about Amaze in my view. It is so easy to control it via the app. What is the big deal about locking/unlocking the card? I usually unlock it in the time the sales person takes to get their device ready for me to tap. And it is a 1 second job to lock it again as soon as the transaction has gone through. When not in used it is ALWAYS locked.

For real life this works. For online it’s tricky as for example Amazon for confirmed payment methods sometimes charges hours after you clicked buy. It’s of course not a major deal though absolutely not a 1 second thing – logging in takes more like 20 seconds, and you need to be online which abroad I nowadays usually buy not always am. As you said, no biggie but also not really that competitive. I won’t do this to save 20c on a McDonald’s meal, and with my wife’s US citi card which gives me 3 mp(US)d on hotels without any fee… Read more »

This is such a bad post. Of course **you compare with Google/XE.com rates**, that *is the only* rate that matters. From there you calculate that Mastercard steals x%, and that Amaze steals x+y%.

But benchmarking a thief to another thief, which is what you do in this post, is criminally ridiculous (pun intended).

Makes me seriously wonder if you’re on the take (i.e. corrupted).

But yes, let’s continue to use *real* rates as benchmarks. Amaze does steal quite a lot.

and from where are you able to exchange currency at XE.com rates may I ask? or do you consider every money changer/bank/financial institution thieves?

*steals* lol. So NTUC also steals money from you when they charge you for rice more than the wholesaler?

please call the cops then 🤣

MaStErCarD SteAlS 3% of OuR MonEy iN FoReiGn TraNsaCtiOns!!

wait till he learns the government *steals* up to 22% of our income in taxes, followed by 20% for CPF, followed by 8% on everything we consume.

This is such a stupid take, that’s why you stay in school, kids.

Good Lord Jake, so much retardation in one post. Please remember to take your medicine.

Yes I agree. LV, Hermes, Prada should sell you bags etc at the cost price too.

I see on google that an equivalent size of calf hide, threading, metal, fabric and old French man’s working wages for 40 hours (yes a birkin is up to 40 hours) is is about $950.

You definitely should go into Hermes to expect to pay only $950.35 for a birkin… yes I included the refreshment that Hermes serves you (at cost prices of course!) Not at their marked up prices. They are thieves if they charge you more.

Lol

The point is the comparison should be made between the net benefit i.e. miles/points – amaze rates – google rates. If that is more than zero then there is a net benefit. If it is less than zero, use youtrip. Google rates are relevant.

My Korea trip charges around 950 KRW per SGD while at the same time Revolut is giving 975 KRW per SGD. That is approximately 2.5%…not too far from what the banks are charging. As far as I am concerned…I try not to use Amaze card in Korea.

I have recently faced multiple decline using the Amaze Card when traveling (USA) using both chip and contactless, linked to both OCBC N90 and Citi Rewards. Contacting instarem, they stated it is the banks that are declining, despite having enabled Overseas use for both cards. Super annoying.

Wondering if anyone has faced issue of Amaze Card getting declined? It only started happening recently, maybe the banks are clamping down?

Seems the bank side has gotten stricter on overseas transactions recently. Had transactions on Amazon US rejected by OCBC through Amaze, and HSBC and DBS directly via CC. Instarem also told me it’s the bank side declining which was true. Had to call up the bank to tell them to let the transaction pass through. I think maybe it’s because of the increase in fraud cases they are extra cautious these days rather than any clampdown on Amaze.

The real question is, are your credit card points worth the amaze spread and the mental anguish if you need to deal with Instarem’s CS (god forbid).

Youtrip gave me better rates than google/XE when I was in Japan recently.

Anything more than 5k (thank you MAS), you’re right to compare against other cards (and your 1% rebate becomes 0.1% or less here). But anything less, google/XE is absolutely relevant.

on the contrary, your well researched article confirms my suspicions and i can finally delete the app and revert back to revolut/youtrip after using it exclusively since post-covid travel!

Instarem rate seem to be really low. Just booked 2 tickets from the same airline, 1 charged via Amaze linked with UOB Lady’s, one direct from UOB Lady’s.

The one via Amaze was SGD1 = KRW 952.3336643

The one charged direct was SGD1 = 969.4726574

XE rate was SGD1 = 976.9768

Guess I won’t be using the Amaze card anymore.

What I found was that after you did a fx transaction, then you check internet banking, you saw that pending transaction with a SGD amount, that is NOT the final amount (in fact this should be pre-3.25% FCY fee amount), once the transaction is posted, you would find that UOB charged 3.25% and the actual SGD amount is higher. I guess your 969.4726574 was MA rate and Amaze rate was 952.3336643, which was 1.77% spread. This looks normal nowadays and still better than 3.25% FCY with UOB direct transactions.

Is there a reason the Citi PremierMiles / UOB PRVI Miles card are excluded from the list of pairings?

It might be useful to compare to Wise or Revolut to see if the cost per mile is worth it, as per your article of a value of a mile.

Hi Aaron

whats the earn rate using amaze linked to uob solitaire card? I’m trying to decide if im better off getting an Australian Amex card (I’m aust citizen) versus using Amaze when we move back to Australia next month. Thank you!

“I want birds to poop on the heads of people who watch videos in public without headphones”

I feel exactly the same way!

Man my eyes skipped the word ‘bird’ while reading and I became really worried about your bottled up frustrations…

I assume this article is talking about the rates when your purchase goes straight to a linked card. But the way to get a much better rate, is to convert your SGD to the currency you require in the wallet and pay from the wallet. Of course not all currencies are available as wallet currencies, but the list is pretty decent these days.

Why use Amaze? Better and easier alternatives if you don’t want credit card rewards. Amaze wallet = no rewards.

Are you sure about that?

I would never use a vendor that hides their fees this way. Historically you shown it was 2%, today could be 4% (who knows?) and when I use it it may be 6%.

It’s also an extremely unethical way of doing business.

I’m very surprised that you are almost outright recommending this sleazy product.

Did you have a chance to try with GBP? I bought a concert ticket last weekend and Amaze’s implicit fee was a whopping 4.6% over mid-market rates (so about 4% over MasterCard’s rate based on previous experience). It was only ~$100 on a 4mpd card so I’m not too upset, but for spending on my upcoming trip I may just use HSBC TravelOne without amaze linkage and save my 4mpd cap for spending back home.

Although the 2% rate is lower than most bank’s 3.25%, the miles rewarded is also reduced to local currency. 1.3/0.02*3.25 = 2.1125, it makes amaze+general spending cards giving less than 2.12 miles per dollar on local spending meaningless. Better to use cards like DBS altitudes, maybank horizon, etc with the FYC fees.

but…why would you use amaze with a general spending card? the whole point is to pair it with the 4 mpd mastercards.

edit: ah, my table says “recommended”. i would actually only go as far down as 3 mpd. the rest of the cards are only there because people keep asking “why is it uob prvi miles/hsbc travelone etc etc is not listed does it not work with amaze”

haha, that makes sense now 🙂

Thanks for this @Aaron. I’m new to the miles game but I’m wondering if using the Amaze card + Citi Premiermiles overseas gives you the FCY earn rate or the S$ earn rate since all my transactions are listed in S$. Thank you.

just adding data point based on recent experience.

used amaze x uob ladys for a transaction amounted 59.50 MYR and got charged 19.00 SGD.

checked the same day, from the visa fcy website, with 3.25% fcy, the same amount will be charged 18.66 SGD.

yes i know i’ll get that additional instapoint, but surely it seems like the music is slowing down?