| The following is a sponsored post by Citi. The opinions remain those of The MileLion. |

This year marks the 10th anniversary of the Citi Prestige Card in Singapore, and thanks to its wide range of lifestyle, travel and dining perks, it’s become a staple in the wallets of many affluent individuals.

That’s especially so now that travel has made a roaring comeback. If you’re planning to hit the road in the near future, here’s how a Citi Prestige Card can help enhance your trip from start to finish.

Citi Prestige Card Citi Prestige Card |

|||

| Apply | |||

| Benefit T&Cs |

|||

| Income Req. | S$120,000 p.a. | Annual Fee | S$540 (inclusive of 8% GST) |

| Local Earn | 3.25 Points per S$1 (1.3 mpd) |

Points Validity | No expiry |

| Overseas Earn | 5 Points per S$1 (2 mpd) | Miles Conversion Fee | S$27 |

Read on to the end for more details on a 120,000 Points sign-up bonus for new Citi Prestige cardholders, available with a minimum spend of just $800, plus the opportunity to win a S$10,000 Trip.com voucher and save up to 50% off travel deals.

Book flights with 10 different frequent flyer programmes

Once you’ve decided where you want to go, the first step in your trip will probably be booking airplane tickets.

Citi Prestige Cardholders can transfer their Citi Points to 10 frequent flyer programmes (plus one hotel loyalty programme).

| Airline/Hotel Loyalty Programme | Transfer Ratio (Citi Points: Partner) |

| Singapore Airlines KrisFlyer | 25,000: 10,000 |

| Cathay Pacific Asia Miles | 25,000: 10,000 |

| British Airways Executive Club | 25,000: 10,000 |

| Etihad Guest | 25,000: 10,000 |

| EVA Air | 25,000: 10,000 |

| FlyingBlue | 25,000: 10,000 |

| IHG Rewards Club | 25,000: 10,000 |

| Qantas Frequent Flyer | 25,000: 10,000 |

| Qatar Privilege Club | 25,000: 10,000 |

| THAI Royal Orchid Plus | 25,000: 10,000 |

| Turkish Airlines Miles&Smiles | 25,000: 10,000 |

In addition to Singapore Airlines KrisFlyer and Cathay Pacific Asia Miles, Citi Points can also be converted to British Airways Executive Club, Air France-KLM FlyingBlue, Qatar Privilege Club and more. This provides additional flexibility when searching for award seats, since all three major airline alliances (Star Alliance, oneworld, SkyTeam) are represented.

| ❓ Still short of miles? |

|

Citi Prestige Cardholders receive 25,000 miles (in the form of 62,500 Points) each year in return for paying the S$540 annual fee. They can also earn additional miles by paying bills such as rent, income taxes, MCST fees, season parking, utilities and insurance premiums via Citi PayAll with service fee option.

From 20 April to 20 August 2023, Citi PayAll is running a campaign which allows customers to earn 2.2 miles or 5.5 Points per S$1 spent. Those new to Citi PayAll service will also receive S$50 of GrabGifts vouchers. A minimum spend of S$8,000 on Citi PayAll transactions applies, and the Citi PayAll service fee (2.2%) must be paid in order to earn miles or enjoy the above mentioned promotions. |

Enjoy complimentary travel insurance

It’s never a good idea to travel without insurance, and Citi Prestige Cardholders receive complimentary travel insurance when they charge their round-trip air ticket to their card.

For avoidance of doubt, this includes situations where tickets are redeemed with miles, and the taxes/surcharges paid with the Citi Prestige Card.

For the eligibility criteria and full policy terms, definitions and conditions of coverage, do refer to the terms and conditions of the policy.

Get the 4th night free on hotel bookings

With flights and travel insurance settled, the next step is looking for hotels.

One of the key perks of the Citi Prestige Card is the 4th Night Free benefit, which as the name suggests, gives you a free night on stays of four or more nights, with no black-out dates.

All 4th Night Free stays must be booked via the Citi Prestige Concierge, and need to be entirely prepaid at the time of booking. While this usually refers to non-refundable rates, refundable rates that require full prepayment can also be booked.

The rebate of one complimentary night will be made in the form of a statement credit up to 90 days from completion of full payment.

Here’s a simple illustration, based on a hotel where taxes & fees that add up to 10% of the nightly room rate. The cardholder receives a rebate of S$320 on his/her stay, which is the average room rate for nights 1-4, before taxes & fees.

| 🏨 4th Night Free Illustration |

|||

| Room Rate | Taxes & Fees (assume 10%) |

Total | |

| Night 1 | S$300 | S$30 | S$330 |

| Night 2 | S$350 | S$35 | S$385 |

| Night 3 | S$330 | S$33 | S$363 |

| Night 4 | S$300 | S$30 | S$330 |

| 4th Night Free (average of Night 1-4 room rates, before taxes & fees) |

(S$320) | ||

| Nett Cost | S$1,088 | ||

Used judiciously, the 4th Night Free benefit alone can more than cover the annual fee, and so long as you instruct the Concierge to book via the hotel’s official website, you’ll still be eligible for elite night credit and hotel points with the relevant loyalty programme (based on the full four nights!).

Book overseas dining reservations and activities

Instead of stressing out over planning overseas dining and activities, why not let someone else do that for you? Citi Prestige Cardholders can seek the assistance of the Citi Prestige Concierge to:

- Plan customised itineraries based on your interests and hobbies

- Make dining reservations at Michelin-starred and other highly-rated restaurants

- Procure hard-to-find items

- Find a last-minute gift for a special celebration

This can be a lifesaver when navigating a city where you don’t speak the language, or where few restaurants accept online bookings (for example Tokyo).

Enjoy complimentary airport limo rides

Heading to the airport? Don’t waste money on a cab- Citi Prestige Cardholders can enjoy two complimentary airport limo rides when they spend at least S$12,000 in qualifying spend in a calendar quarter, defined as:

- Q1: 1 January to 31 March

- Q2: 1 April to 30 June

- Q3: 1 July to 30 September

- Q4: 1 October to 31 December

All limo rides must be booked within the quarter they are earned although you can book the limo ride prior to meeting the qualifying spend, and take the ride whenever you wish (even outside that calendar quarter).

For example, a cardholder could book a limo ride on 15 April 2023 for any future date, and will get reimbursed for the expense provided he/she spends at least S$12,000 in qualifying spend from 1 April to 30 June 2023.

Unlimited airport lounge access (+1 guest)

Regardless of what airline or cabin they choose to fly, Citi Prestige Cardholders can enjoy unlimited complimentary lounge access to more than 1,300 lounges in 600 cities worldwide, courtesy of Priority Pass. They can even invite a guest to join them in the lounge, at no additional charge.

For example, at Changi Airport, Priority Pass members can access the following lounges:

| Terminal 1 |

|

| Terminal 2 |

|

| Terminal 3 |

|

| Terminal 4 |

|

Priority Pass is much more than just lounges, however. Depending on airport, members can enjoy other perks such as:

- dining credits

- sleep pods

- spa treatments

- video game lounges

This helps make the airport experience as stress-free as possible.

Overseas golf games

|

| Golf Bookings |

For those of you who never miss an opportunity to play golf, even when on the road, Citi Prestige Cardholders enjoy complimentary golf games at the following overseas clubs:

| Club | Details |

|

|

When in Singapore, they can also enjoy free golf games at Sentosa Golf Club, Sembawang Country Club, and Marina Bay Golf Course.

Cardholders enjoy complimentary green fees at three local and three regional golf clubs per calendar year.

Get up to 120,000 Points with a new Citi Prestige Card

|

| Apply |

| T&Cs |

From now till 30 June 2023, new Citi Prestige Cardholders can enjoy a welcome gift of 120,000 Points when they spend at least S$800 within two months of card approval, and pay the first year’s S$540 annual fee.

This offer is open to anyone who does not currently hold a Citi Prestige Card, and has not cancelled one in the past 12 months. For avoidance of doubt, existing Citi cardholders will also be eligible.

Qualifying spend

New cardholders must spend S$800 within the first 2 months of approval, otherwise known as the qualifying period.

The qualifying period for meeting the minimum spend runs from the approval date and two full calendar months following that. For example, those approved on 14 May 2023 will have until 31 July 2023 to meet the minimum spend. In other words, you actually have 2-3 months to hit the minimum spend, and should apply as early in the month as possible to maximise your time.

Qualifying spend excludes the following:

| ❌ Qualifying Spend Exclusions |

| (i) any Equal Payment Plan (EPP) purchases, (ii) refunded/disputed/unauthorised/fraudulent retail purchases, (iii) Quick Cash and other instalment loans, (iv) Citi PayLite/Citi Flexibill/cash advance/quasi-cash transactions/balance transfers/annual card membership fees/interest/goods and services taxes, (v) bill payments made using the Eligible Card as a source of funds, (vi) late payment fees and (vii) any other form of service/ miscellaneous fees (vii) Citi PayAll transactions where the customer is not charged the Citi PayAll service fee |

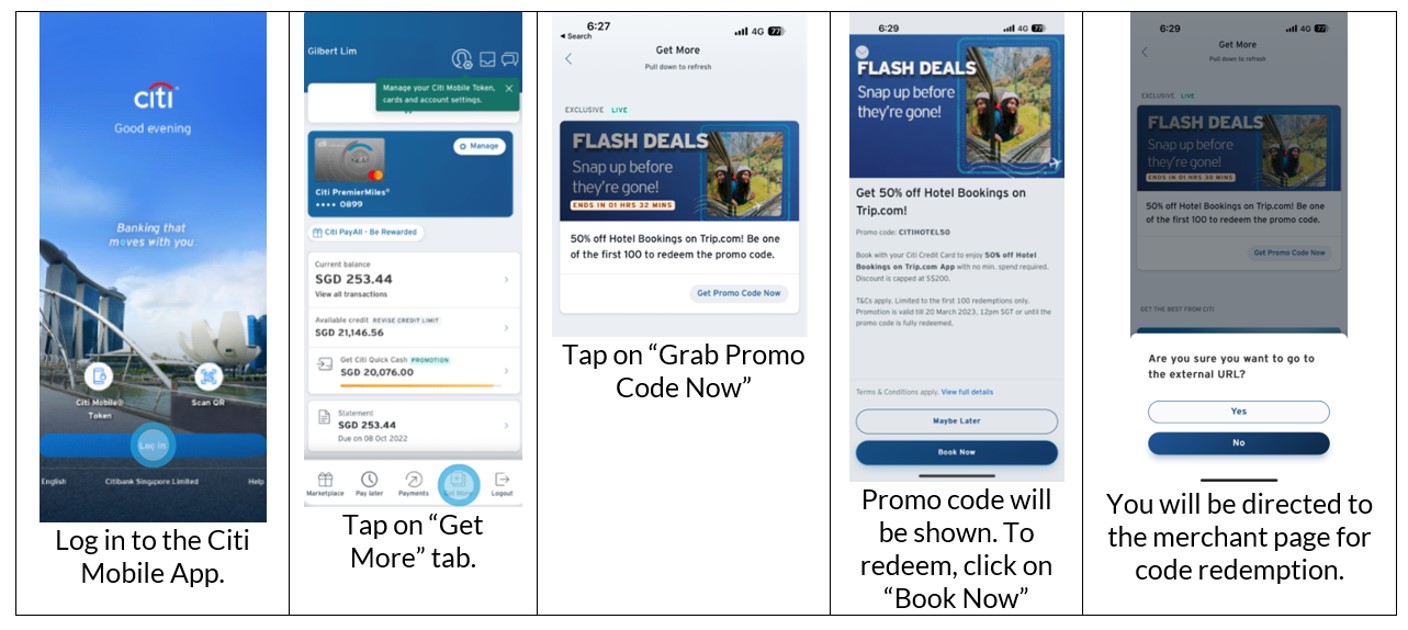

Enjoy up to 50% off travel flash deals with Citi Credit Cards

Flights and hotel prices have recovered from their COVID-era slumps, and in some cases, can be even more expensive than before!

To take some of the sting out of this, from now to 1 June 2023 Citi is offering special flash deals with up to 50% off flights, hotels and attractions with Klook, Trip.com and Expedia.

Promo codes are in very limited quantity (first 100 redemptions), and go live at 12 p.m on the 1st and 15th of every month.

Be sure to login to your Citi Mobile App and camp out in advance to secure your codes.

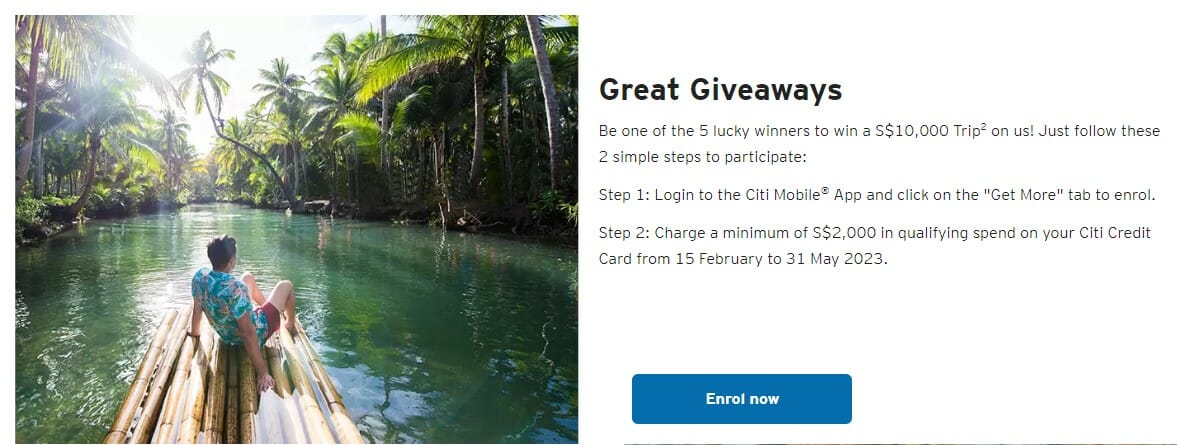

Citi Great Giveaways

|

| T&Cs |

In addition to earning Citi Points, your spending on the Citi Prestige Card (or any other Citi Credit Card for that matter) can turn out to be doubly rewarding.

From 15 February to 31 May 2023, Citi is running a Great Giveaways contest with S$10,000 worth of travel vouchers up for grabs to five lucky winners.

To participate, all you need to do is register and spend clock at least S$2,000 qualifying spend on your Citi Credit Cards during the campaign period. Your spending can be combined across multiple Citi Credit Cards if you so wish.

To register, login to the Citi Mobile App and tap on “Get More” at the bottom. Scroll until you see the Great Giveaways banner, and tap to enrol.

The Trip.com travel vouchers is valid for one year from date of issuance. Winners will be announced within seven days of the draw date, which is set for 28 June 2023.

Qualifying spend

Qualifying spend refers to any retail transactions (including online purchases) which

do not arise from:

- any Equal Payment Plan (EPP) purchases;

- refunded/disputed/unauthorised/fraudulent retail purchases;

- Quick Cash and other instalment loans;

- Citi PayLite/Citi Flexibill/cash advance/quasi-cash transactions/balance transfers/annual card membership fees/interest/goods and services taxes

- bill payments made using the Eligible Card as a source of funds;

- late payment fees; or

- any other form of service/ miscellaneous fees

Conclusion

Citi Prestige Card Citi Prestige Card |

|||

| Apply |

With complimentary lounge access, airport limo rides, travel insurance and the 4th Night Free benefit, the Citi Prestige Card can be an excellent companion for any globetrotter.

Don’t forget to apply by 30 June 2023 to take advantage of the 120,000 Points sign-up offer, and register for Citi Great Giveaways to stand a chance of winning a S$10,000 travel voucher.

This certainly reads like a VERY sponsored post – tone is so different from ‘normal’ ML posts. Admittedly this is declared at the top, but have to say it really sticks out like a sore thumb amongst the usual excellent writing. Guess Aaron has to make a living….:\

https://www.charities.gov.sg/Pages/AdvanceSearch.aspx

If you look at the above link you will see that this website is in fact NOT a charity. Of course the guy still has to make a living, particularly after over two years of practically non-existent travel as a travel website! I still found the post to be helpful and informative.

“The opinions remain those of The MileLion.”

Where are those opinions exactly?

Omg asking the CP concierge to help you with any of the things listed is a TOTAL disaster. They are colossally useless like all Citi CSO I wouldn’t even trust them to tell me the time. Please assure me you didn’t write that bit with a straight face!!

Citi must have had a gun to your head with this one

If you have some specific examples can you send me (via contact us). It’s a rare opportunity to have a direct line to the product team so I want to make sure they get all this feedback on board. I’m also soliciting feedback from the telegram group- hopefully this will be a chance to get them to seriously consider areas of improvement too

Isn’t it the incompetence of the product team for not having trained their CSOs properly?

The pre-paid on booking requirement is very annoying. In the city I am going, most of the properties only have pay later option.

I have a feedback . The prepayment requirement for 4th night free is annoying . I don’t like the idea of locking in my hotel stay

Oh another feedback but unrelated to prestige . Why does Citi pay all restrict payment limit on a monthly basis ? It’s annoying . My tax bill is 100k and my card limit is 10k . Transferring excess credit to my card so my card now has 50k of excess credit doesn’t get registered in the pay all limit check . Only way for me advised by cso is to apply for a perm credit increase

Dude if you have a 100k tax bill how on earth is your credit limit only 10k? I have a tax bill nearly five times lower and a credit limit five times higher! This should be very easy for you to fix (I believe you can even apply for the limit increase online!).

The CSO’s are certainly not up-to-par with other organisations. I had a case recently where I had 2 non-refundable bookings. One through Agoda and one through Citi Prestige. Same hotel. Same dates. Due to exceptional circumstances, the Agoda CSO negotiated with the hotel and was able to cancel the booking with a full refund. But not so Citi Prestige. OK, I have no grounds to take issue – the bookings were non-refundable. But Agoda negotiated an exception whereas Citi Prestige could/would not.

thanks for sharing- will add this pointer in as well. There were some issues with Citi CSOs providing customers with the wrong information regarding eligibility for the Prestige sign-up offer. That’s been flagged too for remedial action.

I agree this paints too good a picture of this card. I have it and I want to cancel it. The free 4 night is almost impossible to use now. Restrictions include: Room has a kitchen does not apply Cannot pre pay does not apply The word Suite is in the room description does not apply even though its a room for 2. Half board implies food is included (which only includes Breakfast) does not apply In short you will never be able to use this at any location in Maldives or Ski Resort. Tried using it to book a… Read more »

thanks for sharing this, will add it to the consolidated feedback

Just to share this datapoint – hopefully it helps others, or if it is something Aaron could feedback as well. I just called the AIG hotline, the travel insurance provider for the card, and while they said that redemption tickets do qualify, they have to be redeemed round-trip as per the strict interpretation of the T&Cs. So in other words, you can’t book one-way redemption tickets on SQ into Amsterdam and out of Paris, as an example, even though it’s part of the same trip (and the SQ website does not allow multi-city redemption bookings as far as I’m aware).

What’s all this about flash deals and great giveaways? I have had Prestige and other Citi cards forever and spend heavily on them, yet the “get more” section of the app remains resolutely empty. Don’t remember ever having seen anything in the ever. 🙁

I don’t think great giveaways is targeted, but will check

I thought that the prestige card would come in handy for an upcoming trip. applied for the card around mid March. Application for the card was not straightforward for existing customers. You have to apply as a new customer even though there is a separate button for existing customers. instead of instant approval, received a rejection email a couple of days later. Seeing that I won’t be getting the card, I booked a 4 night hotel stay using another card, prepaid. On 1 or 2 April, I received a weird SMS on contact info update. On checking the app, saw… Read more »

Will check on this with the citi tean

Priority Pass – How about Jewel lounge? I just entered using PP from Prestige as well