OCBC has launched a new credit card sign-up offer which runs from now till 30 June 2023.

New-to-bank customers can enjoy either S$250 cashback or a Samsonite Polygon Spinner 28″ luggage, subject to meeting a certain minimum spend.

Even though the absolute amount of cashback has been hiked from the previous offer (S$228), the minimum spend has also increased significantly, making this a much weaker offer overall. In addition, OCBC has pulled a fast one by sneaking in a term that excludes supplementary cardholder spend from counting towards qualifying spend!

| ⚠️ Update: OCBC has now modified Clause 10 which excluded supplementary cardholder spend, replacing it with the following: “For principal cardmembers with supplementary Cards, Qualifying Spend charged to the supplementary Card will be aggregated under the Qualifying Spend for the principal Card.” |

Get S$250 cashback or Samsonite luggage with a new OCBC card

OCBC’s latest acquisition offer runs from 16 May to 30 June 2023, and is valid for new-to-bank applicants approved by 31 July 2023 for the following cards:

| Card | Annual Fee |

Features |

OCBC 365 Card OCBC 365 CardApply |

S$194.40 |

Up to 6% cashback |

OCBC NXT Card OCBC NXT CardApply |

S$162 |

0% interest instalments for up to 6 months |

OCBC Titanium Rewards OCBC Titanium RewardsApply |

S$194.40 |

4 mpd on online shopping |

| ❓ New-to-bank | ||

|

New-to-bank customers are defined as those who:

|

||

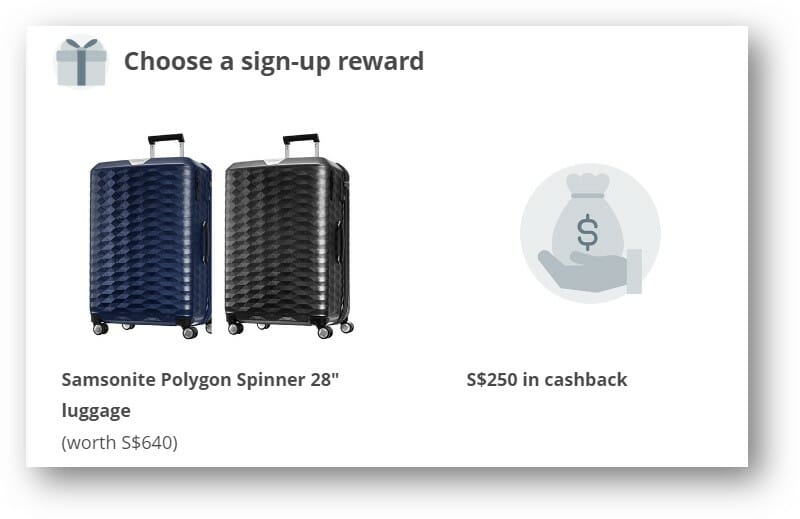

Cardholders will be prompted to select from one of the following gifts at the time of application:

| Gift | Min. Spend |

| Samsonite Polygon Spinner 28″ luggage | S$500 within 30 days of approval |

| S$250 cashback | S$2,000 within 60 days of approval, split into S$1,000 per 30 days |

For avoidance of doubt, applicants will only qualify for one gift in total, regardless of how many cards they apply for.

While the minimum spend for the Samsonite luggage is relatively straightforward, the S$250 cashback needs a little explaining.

Cardholders are required to incur S$1,000 of qualifying spend for every 30 days within the qualifying spend period. For example, if their card is approved on 1 June 2023, they will need to spend S$1,000 by 30 June 2023, and a further S$1,000 by 30 July 2023. Excess spending during the first 30 day period will not count towards qualifying spend for the second 30 days period.

That’s much more onerous than the previous offer of S$228 cashback:

| Gift | Min. Spend | |

| Previous Offer | S$228 | S$500 in 30 days |

| Current Offer | S$250 | S$2,000 in 60 days, split into S$1,000 per 30 days |

As you can see, the gift might be bigger this time, but the minimum spend much higher. Expressed as a percentage, the rebate has actually declined from 46% to 13%!

Spending exclusions

Qualifying spend refers to any retail transaction, whether face to face or online, but excludes OCBC’s standard exclusions list:

- Charitable donations

- Education expenses

- Government payments

- GrabPay top-ups

- Hospitals

- Insurance premiums

- Real estate agents

- Utilities bills

While this is all business-as-usual, I want to draw your attention to something that isn’t. Referring to Clause 10 in the T&Cs:

For principal cardmembers with supplementary Cards, only transactions by the Primary Cardholder on the principal Card will be considered Qualifying Spend.

Seriously, guys? I thought that such shenanigans were the exclusive domain of UOB, but apparently not. OCBC is taking pages out of the UOB playbook, and not the right ones; in recent times we’ve seen them adopt S$5 earning blocks and double down on “first X” sign-up offers (this offer is uncapped, to be fair).

I’ve said it before and I’ll say it again: there is no good reason to exclude supplementary cardholder spending from qualifying spend. If the bank is perfectly content to hold principal cardholders responsible for the spending of their supplementary cardholders, why should the principal cardholder bear all the risks and none of the rewards?

| ⚠️ Update: OCBC has now modified Clause 10 which excluded supplementary cardholder spend, replacing it with the following: “For principal cardmembers with supplementary Cards, Qualifying Spend charged to the supplementary Card will be aggregated under the Qualifying Spend for the principal Card.” |

Gift crediting

All sign-up gifts will be credited within four months from the end of the qualifying spend period.

Terms & Conditions

The T&Cs for the acquisition offer can be found here.

Conclusion

OCBC is offering new-to-bank cardholders S$250 cashback or a Samsonite Polygon Spinner 28″ luggage with its latest sign-up offer, but if you’re considering the cashback, I’d hold my fire until another offer comes round.

Do also note that OCBC has snuck in a term that excludes supplementary cardholder spending from counting towards qualifying spend. There’s really no reason for doing that, so I sincerely hope this is just a once-off and not the start of a broader policy.

I applied for ocbc 365 card in on 26 Dec 2023 to get free luggage. Completed the $500 min spending within 1st mth by 8 Jan 2024. Basically I booked an air ticket for April 2024 and fulfilled the spending requirement. However when I called the customer service to ask when I can collect my luggage, they informed that luggage collection will only be available end May 2024. By then I would have already completed my vacation. This experience is quite disappointing. So if you are looking to get the redemption soon, don’t get this card. I manage to redeem… Read more »