While Amaze continues to be my go-to solution for overseas spending, I still keep a Revolut handy for ATM withdrawals, as well as foreign currency transactions where points can’t be earned.

It’s currently possible to use a card to top-up a Revolut account without fees (except for Visa Credit Cards), but that will change from June 2023 when Revolut introduces card fees across the board.

Revolut’s revised top-up fees

From 1 June 2023, Revolut’s fees for card top-ups will increase as follows:

| 💳 Fees for SG-issued cards (non-commercial) | ||

| Current | From 1 June | |

| Mastercard Debit | Free | 0.51% |

| Mastercard Credit | Free | 0.62% |

| Visa Debit | Free | 0.3% |

| Visa Credit | 1.97% | 1.97% |

Mastercard Debit & Credit and Visa Debit top-ups, which are currently free, will all be chargeable. Visa Credit top-ups will continue to attract the same 1.97% fee as they do now (in a way, these fees closely mirror the MDR that Revolut is paying).

The first top-up of your Revolut account from all cards will continue to be free. You can also top-up your Revolut account for free via a Singapore bank account.

Frankly speaking, there isn’t much reason to top-up Revolut with a card in the first place, since it won’t earn rewards nor count towards minimum spend for any sign-up offers.

However, if you use Revolut as a means of cashing out Amaze wallet balances (Amaze > Revolut > Bank account), then you’ll want to take note that a 0.51% fee will apply from 1 June 2023. I recommend switching over to GrabPay instead (Amaze > GrabPay > Bank account).

Other Revolut changes

In addition to card top-up fees, Revolut is also modifying its fair usage fees for currency conversions and outbound local bank account transfers

| Weekday currency exchanges remain fee-free across all currencies up to a fair usage limit of S$5k. For transactions beyond the limit, the fair usage fee will be increasing from 0.5% to 1.0% of the transaction value. Additional weekend exchange fees won’t be affected by this change. |

| We’ll be introducing a fair usage limit of five times per month for transfers to local bank accounts. This means you’ll still be able to enjoy up to five free local outbound transfers per month, but will be charged $2.99 per transfer beyond the fair usage limit. Peer-to-peer transfers to other Revolut customers will remain fee-free and will not count towards the fair usage limit. |

Revolut Metal cardholders can enjoy fee-free weekday currency exchanges and local outbound transfers without any fair usage limits.

What’s the best cards to use for overseas spending?

There’s one question you need to ask before using your card overseas: am I willing to pay for miles?

If the answer is no, then your objective should be to minimise the cost of the transaction as much as possible, in which case Revolut and YouTrip offer the best options (unless you need to spend more than S$5,000, the current e-wallet limit).

If the answer is yes, the next question becomes “how much?” Because of foreign currency transaction fees, you’re effectively buying miles when you swipe your card overseas.

| 💳 FCY Fees by Issuer and Card Network | ||

| Issuer | ↓ Visa & Mastercard | AMEX |

| Standard Chartered | 3.5% | N/A |

| Citibank | 3.25% | 3.3% |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

| American Express | N/A | 2.95% |

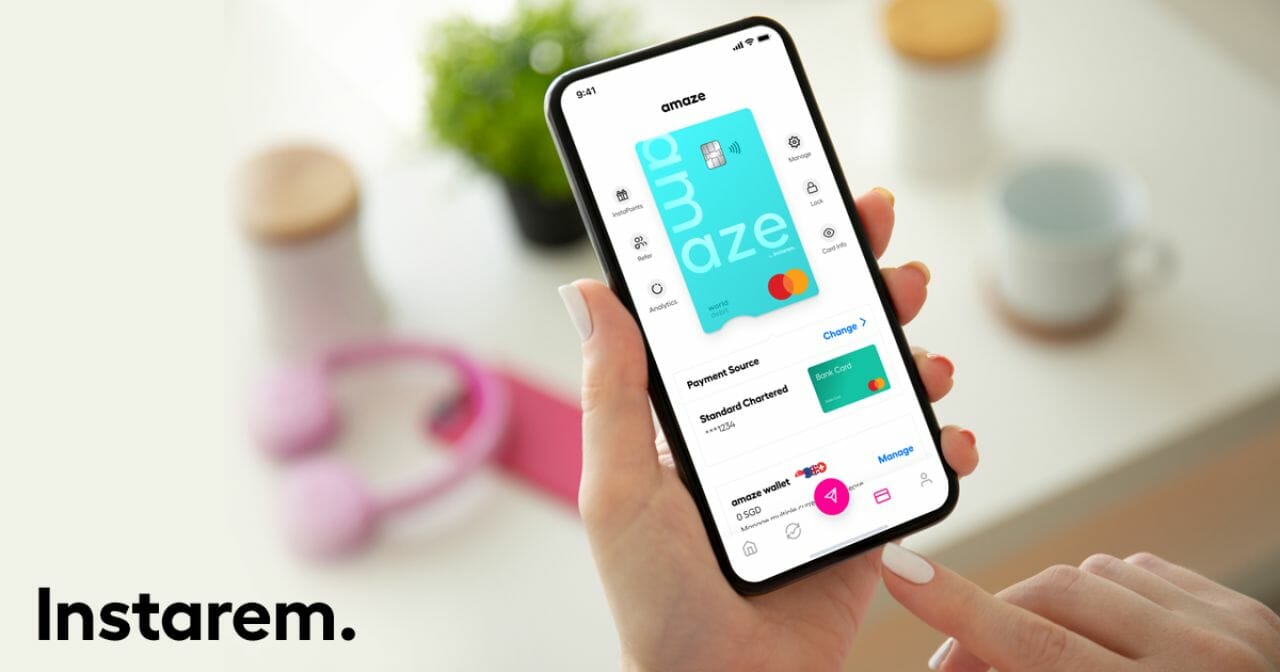

You could also use Amaze, which charges an implicit FCY fee of about 1.5-1.8% through its spreads while offering up to 1% cashback via InstaPoints. While Amaze rates are higher than Revolut or YouTrip, they’re still lower than what banks charge, and you can still earn credit card rewards on your spending.

|

| Apply here |

| Use code 7HK2A2 for 225 bonus InstaPoints |

| 💳 tl;dr: Amaze Card |

|

For the full rundown of cards to use, as well as applicable fees, refer to the post below.

Conclusion

Revolut will be adding card top-up fees across the board from 1 June 2023 ranging from 0.3 to 1.97%.

It’s simple enough to avoid these fees by using a bank account to top-up your balance, however, so I wouldn’t get too worked up about it. The main attraction of Revolut is rates, not rewards.

Are there typos in the following?

“Other Amaze changes”“In addition to card top-up fees, Amaze is also …”

You’ve mixed up amaze and revolut in the fee for FX conversions and bank transfers section

thanks. forgot my coffee.

4pm coffee?!

“Frankly speaking, there isn’t much reason to top-up Revolut with a card in the first place, since it won’t earn rewards nor count towards minimum spend for any sign-up offers.”

There is actually (assuming no fee). Topping up with credit card essentially allows you to delay actual cash outflow.

Though the benefit is not great, but there can be good use cases.

Interesting- never thought of this before. Thanks for sharing!

The other is to charge to a credit card that is paid using giro from a HSBC EGA, effectively earning 1% rebate from your top ups. You could still do that, but it’s 0.38%…

Is there any option left to transfer money abroad that can be topped up with credit or debit card at no cost?

I tried YouTrip but it doesn’t look like I can se it to transfer money to a bank.

You missed out Trust card which doesn’t charge any foreign transaction fees and their conversion rate is pretty good. Initially, I was using Amaze card, but the limited amount of cash back and restrictions you can claim from each transaction doesn’t make it attractive, plus their conversion rate is not really that great as you have pointed out.

Revolut’s e-giro setup ends in an error message for each bank I tried. Time to move to something new, revolut is throwing up too many barriers..

Things may not be looking up for Revolut. See Reuters’s report: https://www.reuters.com/technology/revolut-cfo-departs-after-two-years-role-2023-05-11/ and https://www.reuters.com/business/finance/revoluts-2022-revenues-grew-by-33-despite-crypto-winter-2023-03-01/

For myself, I will keep my amount in Revolut small…just in case.

PSA – Revolut SG top up’s with credit cards failing 1 20 Sept 2024z pls be careful..