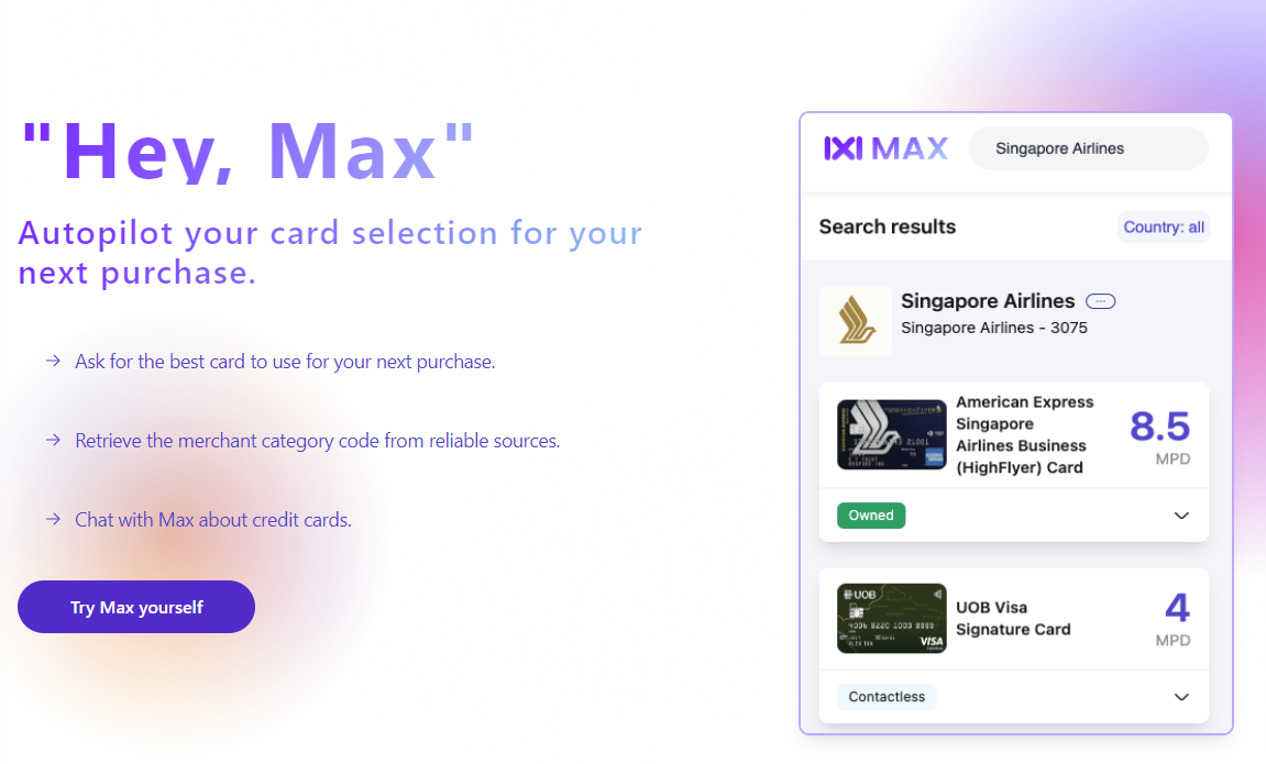

I recently wrote about Max, a new website that allows you to look up the MCC of any merchant before swiping your card.

|

| Max MCC Lookup |

Needless to say, this is an awesome tool to have. After all, getting the MCC right can be the difference between earning a ton of miles on a big ticket purchase, or walking away empty-handed.

It seems like Max has plans beyond just MCC lookups, however, with the recent announcement of the Max Card.

Now, I wasn’t originally intending to write about this until it’d developed into something more substantial- in fact, I turned down the opportunity to do a sponsored post. It’s not that I don’t like the idea of the Max Card; quite the contrary. I just didn’t feel comfortable writing a sponsored post about something I’ve not so much as seen an MVP for.

But since the Max Card has been receiving coverage (paid and unpaid) from other financial blogs, it’s probably only a matter of time before you cross paths with it. I figured I might as well give you my two cents on what could either be a complete game-changer, or the latest in a long line of fintech vapourware.

What is the Max Card?

|

| Max Card Waitlist |

| Joining via the link above gives both of us 1,000 bonus Max Miles |

In so many words, the Max Card is the ultimate answer to the “what card do I use” question.

Like Amaze, you’ll pair your existing credit cards with the Max Card (Max plans to support all major card issuers). When you charge a transaction to the Max Card, it will automatically be routed to the best card for that particular expense. For example, if you’re dining at a restaurant, the Max Card would automatically bill the transaction to your HSBC Revolution.

How does Max know which card to charge the transaction to? The exact process eludes me, but if Max already has all the MCCs mapped to the best card on the back end, then it’s certainly theoretically possible.

What if Max gets it wrong, or if you’d prefer to use something else instead (e.g. a transaction may have multiple “right” cards, or you may have busted the bonus cap on the card that Max chooses)?

Max says it will allow cardholders to set custom rules on card selection, and if all else fails, there’s a Time Machine feature which lets you switch cards even after you’ve paid. It’s not as far-fetched as it sounds actually; Curve in the UK offers pretty much the same thing.

Max is promising more than just credit card rewards optimisation, however. It claims it will:

- keep track of T&C updates

- handle credit card fee waivers

- offer one-time virtual card numbers for every single transaction

- alert cardholders of fraud in real-time using AI (yes, I suppose they have to mention “AI” in order to attract that sweet VC money)

In addition to your credit card rewards, the Max Card will offer its own rewards programme featuring Max Miles. These will be convertible at an “approximate” 1:1 ratio into air miles, or redeemed for cashback at a rate of S$1 per 100 Max Miles.

The plan is to offer both a free and paid tier of service, though it’s not clear at the moment what features will be offered for each tier.

Max Card Waitlist

Max plans to launch its public beta in Q4 2023 (though with all things fintech, I’d take this date with a liberal pinch of salt).

In the meantime, it’s opened a waitlist for those who wish to participate. In addition to early access:

- Signing up via a referral link will get you an extra 1,000 Max Miles

- The first 1,000 signups will earn a 10,000 Max Miles bonus when the card launches.

- The first 10,000 signups will earn a 2,000 Max Miles bonus (presumably when the card launches, this part was omitted)

- Early adopters will also enjoy increased reward levels and complimentary premium services for a limited period

I should emphasise that being on the waitlist is no guarantee of receiving an invitation to join, if/when Max launches a beta. At the same time, I guess it’d help the team gauge the interest out there, and if nothing else it’s always better to show investors a full waitlist than an empty one.

My thoughts on the Max Card

In many ways, the Max Card is something I’ve always hoped that someone would invent. The idea of a universal “one card” solution that handles everything automatically would really change the miles game forever.

At the same time, I’ve got a lot of questions:

- How will the Max Card know how much of my bonus cap I’ve already utilised?

- How will the Max Card deal with “trigger criteria” like minimum spend?

- How will the Max Card deal with merchants that process under different MCCs e.g. Amazon and Lazada (presumably this isn’t that big an issue if all Max Card transactions simply code as online)?

- How will the Max Card consolidate cards from different networks, when presumably Visa won’t be happy with payments rerouted via Mastercard and vice versa?

- The Max Card presumably won’t be able to give rewards in situations where rewards are tagged to specific merchant names, right?

- In the same way that some banks have blocked Amaze transactions, will the same fate eventually befall Max?

- Which features is Max going to reserve for its paid tier, and which will be offered free of charge?

The Max Card is an exciting concept for sure, but make no mistake, there’s a lot of work still to be done. I have no idea how far along the team are with this, whether they’ve got the funding secured, whether they’ve got the infrastructure in place, whether what they’re proposing is even doable. So until we see a beta, I think it’d be wise to keep your expectations in check.

Conclusion

The team behind the Max MCC lookup tool is working to launch the Max Card, which will automatically route all transactions to the best card. The waitlist is currently taking names, so if you’d like to be part of the beta you can register and see where this goes.

Please, please don’t be vapourware.