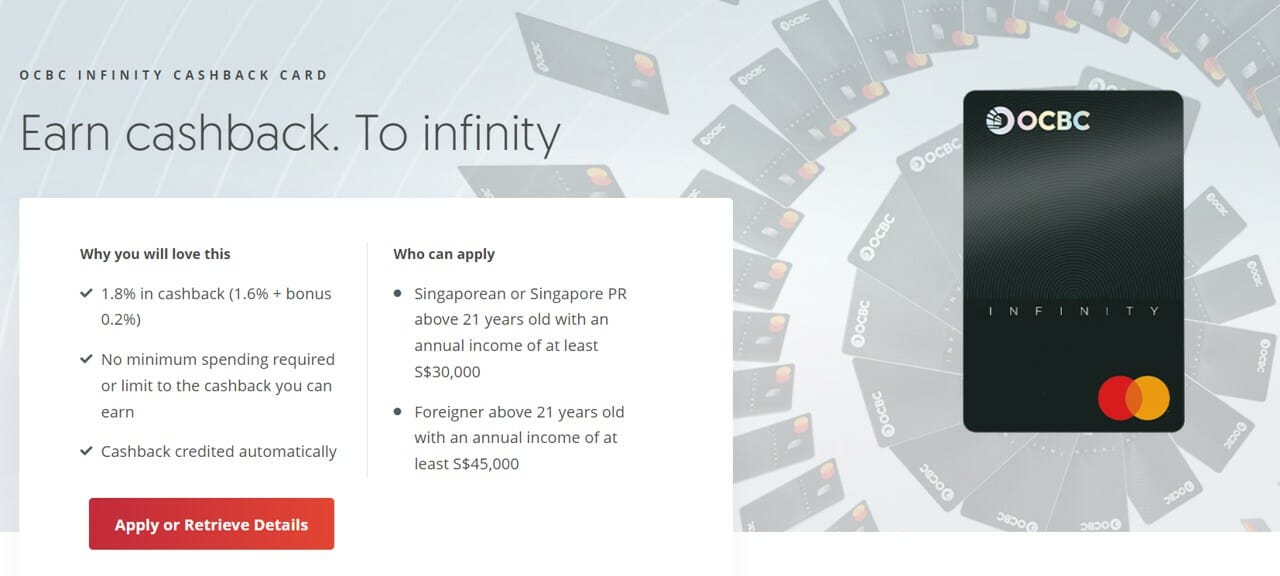

OCBC has become the latest bank to launch an unlimited cashback card, with the OCBC INFINITY Cashback Card offering 1.6% cashback with no minimum spend or caps.

“Earn cashback. To infinity” goes the tagline, and I suppose we should all admire the restraint shown by the marketing team not to tack on “and beyond”.

While I think the card design is nice — even if the concentric circle pattern is a dead ringer for American Tourister luggage— the problem is that I simply don’t see anything that separates the INFINITY from an already-crowded field.

Put it another way: if you already have an unlimited cashback card, there’s no compelling reason to switch over to OCBC’s.

Details: OCBC INFINITY Cashback Card

OCBC INFINITY Cashback Card OCBC INFINITY Cashback Card |

|||

| Apply | |||

| Card T&Cs | |||

| Income Req. | S$30,000 p.a. | Earn Rate | 1.6% cashback |

| Annual Fee |

S$194.40 (FYF) |

FCY Fee | 3.25% |

The OCBC INFINITY Cashback Card has a minimum income requirement of S$30,000, and its S$194.40 annual fee is waived in the first year. Subsequent fee waivers are available with a minimum spend of S$10,000 per membership year.

Cardholders earn a flat rate of 1.6% cashback on all SGD and FCY transactions, with no minimum spend or cap. Spending on the INFINITY also counts towards the S$500 minimum card spend required to earn a bonus 0.6% p.a. on the first S$100,000 in an OCBC 360 Account.

That’s it, really. After all, the selling point of unlimited cashback cards is simplicity.

Bonus 0.2% cashback

|

| Bonus 0.2% Cashback T&Cs |

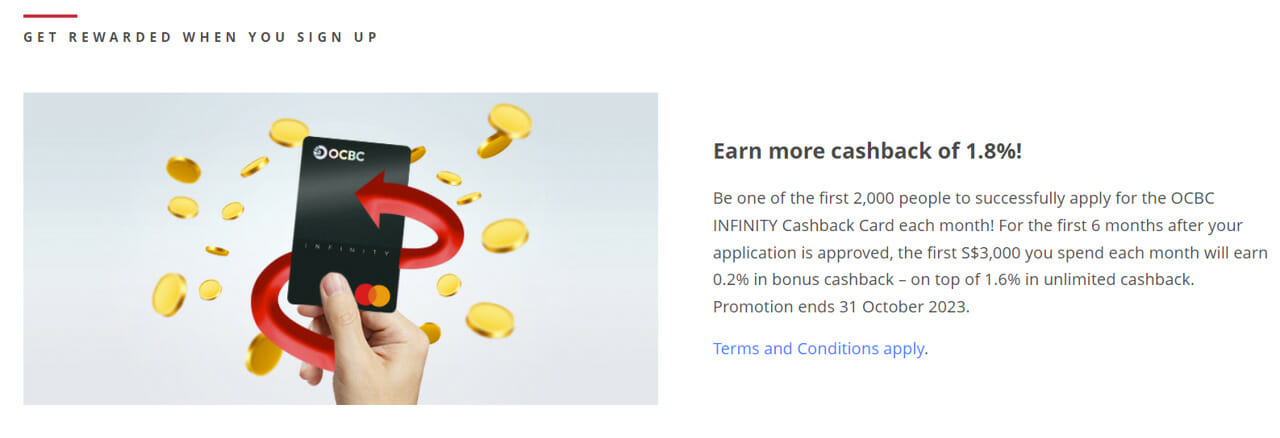

From 18 August to 31 October 2023, the first 2,000 new-to-OCBC cardholders approved for an OCBC INFINITY Cashback Card will earn an extra 0.2% cashback (i.e. 1.8% cashback total) for the first six months of approval.

| ❓ New-to-OCBC | ||

|

New-to-OCBC customers are defined as those who:

|

To illustrate:

| Card approval | Earn bonus 0.2% cashback |

| Aug 2023 | Approval date to 31 Jan 2024 |

| Sep 2023 | Approval date to 28 Feb 2024 |

| Oct 2023 | Approval date to 31 Mar 2024 |

But don’t hold your breath, because the extra 0.2% cashback is capped at S$3,000 per month. This means we’re talking about an incremental S$6 per month (0.2% of S$3,000).

At least this is on top of the standard OCBC acquisition gifts for new-to-OCBC customers, namely:

- De’Longhi Icona Vintage Breakfast set with S$500 spend in 30 days, or

- Samsonite Polygon Spinner 28″ luggage with S$500 spend in 30 days, or

- S$200 cashback with S$2,000 spent in 60 days (S$1,000 spend in each 30 day period)

However, if you’re a new-to-OCBC customer, might I suggest applying through SingSaver instead, because for the month of August, applicants who spend S$500 in 30 days can choose from:

- Apple iPad 9th Gen 10.2 Wi-Fi 64GB

- Apple AirPods Pro (Gen 2) + MagSafe Charger

- S$350 eCapitaVoucher

- S$250 cash

These are way superior gifts if you ask me, and even though you can’t apply for the INFINITY via SingSaver yet, I’d say that losing the chance to earn an extra 0.2% cashback is not something to lose sleep over.

What transactions don’t earn cashback?

The OCBC INFINITY Cashback Card follows OCBC’s standard exclusions list, which means that cashback will not be earned on:

- Charitable donations

- Education

- Government entities

- Prepaid account top-ups (e.g. GrabPay, YouTrip)

- Hospitals

- Insurance premiums

- Utilities

The full list of exclusions can be found in the T&Cs, at point 1.4 & 1.5.

Do we need another unlimited cashback card?

If there’s one thing we’re not short of in Singapore, it’s unlimited cashback cards. By my count, the OCBC INFINITY would be the 10th such option on the market.

| 💳 General Spending Cashback Cards (without minimum spends) |

||

| Annual Fee | Cashback* | |

DCS Ultimate Cashback DCS Ultimate CashbackApply |

S$194.40 (FYF) |

2% (capped at S$200 per month) |

UOB Absolute Cashback UOB Absolute CashbackApply |

S$194.40 (FYF) |

1.7% |

BOC Visa Infinite BOC Visa InfiniteApply |

S$378 (FYF) |

1.6% |

Citi Cash Back+ Card Citi Cash Back+ CardApply |

S$194.40 (FYF) |

1.6% |

ICBC Chinese Zodiac Card ICBC Chinese Zodiac CardApply |

S$150 (F3YF) |

1.6% |

Maybank FC Barcelona Card Maybank FC Barcelona CardApply |

S$120 (F2YF) |

1.6% |

AMEX True Cashback Card AMEX True Cashback CardApply |

S$172.80 (FYF) |

1.5% |

HSBC Advance Card HSBC Advance CardApply |

S$194.40 (FYF) |

1.5% |

SC Simply Cash Card SC Simply Cash CardApply |

S$194.40 (FYF) |

1.5% |

| FYF= First Year Free, F2YF= First 2 Years Free, F3YF= First 3 Years Free *For local SGD transactions |

||

There’s only two cards here which are trying something different:

- The DCS Ultimate Cashback Card offers a notably higher 2% cashback with no minimum spend, though it’s capped at S$200 per month

- The UOB Absolute Card offers 1.7% cashback with no rewards exclusions (although GrabPay top-ups earn a nerfed rate of 0.3% cashback)

The rest of the pack might as well be carbon copies of each other. Exclusion lists are virtually identical, and while some cards earn 0.1% more than others, it is a rather infinitesimal difference once you do the math (e.g. even if you spent S$50,000 on your cashback card over a year, you’d only be worse off by S$50).

The lack of differentiation means I’m struggling to see how the OCBC INFINITY Cashback Card will carve a niche for itself. If I already have a cashback card that earns ≥1.6% cashback, there’s no reason for me to switch. If my cashback card earns 1.5% cashback and I haven’t already switched to a higher-earning alternative (maybe I’m just lazy to do the paperwork), there’s little reason why the launch of the INFINITY will make me change my mind.

But hey, if you want a cashback card that’s kind of nice looking, and are secretly turned on by a banking app that polices your phone (I don’t kinkshame), then this might be the one for you!

Conclusion

The newly-launched OCBC INFINITY Cashback Card offers customers 1.6% unlimited cashback with no minimum spend, though with all the usual bank exclusions, there’s very little to get excited about here.

I honestly have no qualms about choosing cashback over miles when the math checks out (see the DBS yuu Card), but 1.6% cashback is not going to beat 4-6 mpd anytime soon.

Will this card prevent us from using it if it detects that we have unapproved cards from other financial institutions in our wallets?

Very meta, much funny, wow

anyways…. back to more important matters.. any intel on upcoming mastercards with great earn rate to pair with amaze?

Amex True CashBack and SC Simply Cash are the better knes.

Amex True Cash Back credits the rebate within the same statement month.

SC Simply Cash credits the rebate immediately in the next statement momth.

Not on singsaver/moneysmart?