American Express has launched a new flash deal for the American Express Singapore Airlines Business Credit Card (also known as the AMEX HighFlyer Card), which runs from now till 16 October 2023.

|

| Apply Here |

| Note: The landing page will not reflect the S$200 eCapitaVouchers, but you can refer to the official T&Cs here |

New cardholders who spend S$1,000 in the first 30 days of approval will receive S$200 eCapitaVouchers, on top of the regular sign-up offer of:

- 60,000 bonus HighFlyer points with S$8,000 spend in the first 180 days, or

- Samsonite Choca Spinner 68/25 with S$5,000 spend in the first 90 days

As always, cardholders will receive a complimentary Accor Plus Explorer membership (one free hotel night and up to 50% off dining), plus two free lounge visits each year.

AMEX HighFlyer Card Flash Deal

|

| Apply |

| T&Cs |

| 💳 Key Info: AMEX HighFlyer Card |

|

| 👍 No minimum business size required |

|

The AMEX HighFlyer Card is meant for businesses, but there’s no minimum turnover or number of employees required to apply. If you’re running a home business, giving tuition or engaged in some other side hustle, setting up a sole proprietorship or LLC would qualify you to apply. Do note that you must be earning at least S$30,000 per annum to qualify for a card, as per MAS regulations. This need not come from the business itself; for example, I could earn S$30,000 from my day job with Company A, and have a separate side hustle with my own Company B. I can then apply for a HighFlyer Card by virtue of Company B, using Company A’s payslips. |

New AMEX HighFlyer Cardholders who submit their applications between 18 September to 16 October 2023 and receive approval before 30 November 2023 will receive S$200 eCapitaVouchers when they:

- Pay the first year’s S$301.80 annual fee

- Spend at least S$1,000 within 30 days of approval

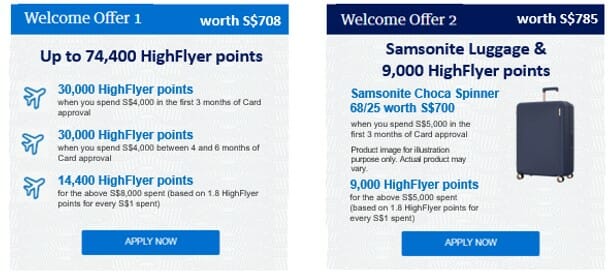

On top of this, they will be eligible to choose from one of the following two offers:

|

||

| Offer 1 | Offer 2 | |

| Spend (Day 1-90) |

S$4,000 | S$5,000 |

| Bonus | 30,000 points | Samsonite Choca Spinner 68/25 |

| Spend (Day 91-180) |

S$4,000 | – |

| Bonus | 30,000 points | – |

| For avoidance of doubt, the S$1,000 spend to earn the S$200 eCapitaVouchers also counts towards the minimum spend required for Offer 1 & 2 |

||

These bonuses are on top of the regular HighFlyer points, awarded at a rate of 1.8 HighFlyer points per S$1 (i.e. 14,400 HighFlyer points for Offer 1; 9,000 HighFlyer points for Offer 2).

There is no requirement that you be new-to-AMEX, and the offer applies even if you hold an existing AMEX consumer card. Applicants who have cancelled the AMEX HighFlyer Card previously for the same company are not eligible.

What counts towards qualifying spending?

All online and offline retail transactions will count towards the qualifying spend required for these offers, with the exception of the following:

| ❌ AMEX HighFlyer Card Exclusions |

|

Note in particular that insurance premiums, SPC transactions, GrabPay top-ups, utilities and public hospitals no longer earn points, nor count towards the minimum spend for sign-up bonuses. Education and charitable donations will count, but only until 1 October 2023.

Spending at private hospitals and CardUp transactions will count towards the minimum spend.

When will the bonus points be credited?

- S$200 eCapitaVouchers will be credited within 12 weeks from meeting the spend threshold

- All bonus HighFlyer points will be credited “6 weeks or more” from the date of meeting the spend threshold

- If you opt for the Samsonite Choca Spinner 68/25, you will receive a redemption letter within 12 weeks from meeting the spend threshold

Terms and Conditions

The T&Cs for this offer can be found below. As always, I recommend saving a copy for your personal reference because the links may be subsequently updated for future campaigns.

Overview: AMEX HighFlyer Card

|

|||

| Apply Here | |||

| Income Req. | S$30,000 p.a. | Points Validity | 3 years |

| Annual Fee | S$301.80 |

Min. Transfer | N/A |

| Miles with Annual Fee |

None | Transfer Partners | HighFlyer |

| FCY Fee | 2.95% | Transfer Fee | None |

| Local Earn | 1.8 mpd | Points Pool? | N/A |

| FCY Earn | 1.8 mpd | Lounge Access? | Yes |

| Special Earn | Up to 8.5 mpd on SIA tickets | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

AMEX HighFlyer Cardmembers earn 1.8 HighFlyer points per S$1 on all local and overseas transactions, and up to 8.5 HighFlyer points per S$1 on Singapore Airlines and Scoot revenue tickets.

This consists of 2.5 HighFlyer points per S$1 from the AMEX HighFlyer Card itself, and a further 6 HighFlyer points per S$1 broken down into:

- The usual 5 HighFlyer points per S$1 awarded to all HighFlyer members

- A bonus 1 HighFlyer point per S$1 awarded to HighFlyer members with the AMEX HighFlyer Card

Note that these 6 HighFlyer points per S$1 are not awarded on tickets issued in the V or K booking classes (Economy Lite). Tickets issued in the Q or N booking classes (Economy Value) will only be eligible for 50% accrual of HighFlyer points.

Using the AMEX HighFlyer Card to pay for taxes and surcharges on award tickets will earn a flat 2.5 HighFlyer points per S$1.

| ✈️ What is HighFlyer? |

|

HighFlyer is Singapore Airlines’ loyalty program for SMEs. The program is free to join and does not require any minimum spend commitment; all you need to sign up is an ACRA business registration number. Companies can redeem HighFlyer points at a rate of 1,050 HighFlyer points= S$10, or convert them to KrisFlyer miles for nominated employees at a rate of 1 HighFlyer point= 1 KrisFlyer mile. HighFlyer points are valid for 3 years. |

Do note the following restrictions when converting HighFlyer points to miles:

- Each HighFlyer account can only be linked to a maximum of five selected KrisFlyer accounts for the purpose of converting HighFlyer points to KrisFlyer miles

- Each HighFlyer account is only allowed to convert HighFlyer points to a maximum of 150,000 KrisFlyer miles per calendar year

- Each selected KrisFlyer account may receive a maximum of 30,000 KrisFlyer miles converted from HighFlyer points per calendar year, regardless of which HighFlyer accounts the points are converted from

Purchases of Singapore Airlines tickets will enjoy 0% interest for six months, and other purchases get 51 days of interest-free credit. Employees who purchase tickets with the card will still be entitled to accrue miles for personal use, based on the fare class purchased.

In terms of personal benefits, cardholders enjoy:

- Two complimentary visits to Priority Pass lounges per year

- A complimentary Accor Plus Explorer membership, which includes one free stay every year and up to 50% off dining

- Hertz Gold status with 10% off best available rates and one class upgrades

- A fast track to KrisFlyer Elite Gold status with S$15,000 or more spent on Singapore Airlines group transactions in the first year of card membership

- Complimentary travel insurance when travel tickets are bought with the card

AMEX HighFlyer Card members will also enjoy the following spending bonuses:

- First year only: 5,000 HighFlyer points for S$500 SIA Group spending

- Every year: 15,000 HighFlyer points for S$10,000 SIA Group spending

Complimentary Accor Plus Explorer Membership

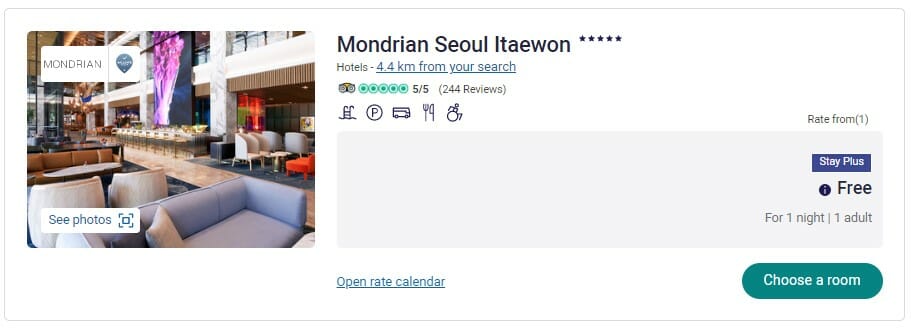

One of the highlights of the AMEX HighFlyer Card is the free Accor Plus Explorer membership, which includes:

- 1x Stay Plus complimentary night certificate

- Up to 50% off member exclusive room rates with with Red Hot Room offers

- 10% off best available public rate

- Up to 50% off dining across 1,400 restaurants in Asia Pacific

- 15% off drinks bill in Asia

- Member exclusive More Escapes stay packages

- Early access to global Accor hotel sales

- Members’ exclusive experiences

- 20 status nights each year

The Stay Plus certificate can be redeemed for one complimentary hotel night each year at participating hotels in Singapore and across Asia Pacific.

Members also get access to the periodic Red Hot Rooms sale, which can be a good opportunity to book cheap staycation or overseas hotel rates.

The other big draw of an Accor Plus membership are the dining discounts. The discount structure works like this:

- 25% off dining: 1 member only

- 50% off dining: 1 member and 1 guest

- 33% off dining: 1 member and 2 guests

- 25% off dining: 1 member and 3 guests

- 15% off drinks in Asia

Some examples of participating Accor Plus restaurants in Singapore include Prego, Mikuni and Asian Market Cafe at the Fairmont, SKAI, The Stamford Brasserie, CLOVE, at Swissotel and The Cliff and Kwee Zeen at the Sofitel Sentosa Resort.

Don’t forget that your dining benefits apply overseas too- even on breakfast. You’ll often find that it makes more sense to book a non-breakfast rate and then purchase breakfast at 50% off at the hotel itself.

For those who have already received their AMEX HighFlyer Card, here’s how to go about activating your Accor Plus membership.

Conclusion

|

| Apply Here |

Customers who apply for an AMEX HighFlyer Card via The MileLion will receive an additional gift of S$200 eCapitaVouchers, in addition to the usual 60,000 bonus HighFlyer points/ Samsonite luggage offer. That, together with the complimentary Accor Plus Explorer membership, should more than help to cover the first year’s S$301.80 annual fee.

If you’re interested in this offer, don’t forget to submit your application by 16 October 2023.

For a full review of the AMEX HighFlyer Card, refer to the post below.

Hey Aaron, thanks for the sharing! the additional 200sgd voucher is really attractive.

am curious if my business is not longer existing later on, will my AMEX Highflyer credit gets cancelled?

context is that i am trying to register a sole proprietorship to get an UEN in order to apply.

1 year cost is 115 and 3 year cost is 175…i am a bit hesitating. If I go with 1 year option, after 1 year , I assume my business entity will expire. will this affect my AMEX highflyer credit card’s status? (my gut feeling is no?)

thanks!

that’s an interesting question, and the frank answer is i don’t know. obviously AMEX will do checks at the start when opening your highflyer account, but ever since then i’ve not been asked for any further documentation as to the continued operation of my company. that said, it doesn’t rule out the possibility of them doing checks in the background- they could very well have without me knowing, it’s not too hard to look up a UEN on ACRA and see if the entity is still active.

oh i just checked. the business renewal fee is 30 dollars per year. so should just go with the 1 year option for more flexibility. 🙂

Application was not as straight forward as expected. Received a phone call from AMEX that they need a director’s resolution form to be completed. Can imagine if you are not the boss of a business – how inconvenient it is.

Hi I would like to share a frustrating conversation with Amex on the above offers. First – I was told that since my sign up with via milelion, they have no record of the sign up offer of $200 ecapita vouchers for first $1k spent. This must be true as I was told twice by online/mobile team to wait for 4 days, and then another 4 days and finally for the phone/CSO team to wait for another week. Finally they found information that I am eligible and FORTUNATELY for me, I have managed to spend $1k during the first 30… Read more »