It is a truth, universally acknowledged, that while banks don’t show much love to existing customers, they trip over themselves to roll out the red carpet for new ones.

Put it another way: if you’re an existing customer, you’ll be lucky to get an annual fee waiver. But if you’re a new customer, you could be on the receiving end of some very generous welcome gifts when signing up for a credit card. This year alone we’ve seen some insane deals, like the recent one that offered a choice of a Dyson Airwrap, PlayStation 5 or S$500 eCapitaVoucher.

This then begs the question: who exactly counts as a new customer?

How do banks define new customers?

Here’s a rundown of how each bank defines a new customer.

Do note that definitions can change over time. Always refer to the relevant promotion’s T&Cs for the most up-to-date information!

| Bank | Definition |

| AMEX (see footnote) |

*Does not include AMEX cards issued by DBS or UOB, nor the AMEX HighFlyer Card |

| CIMB |

|

| Citibank |

|

| DBS (see footnote) |

|

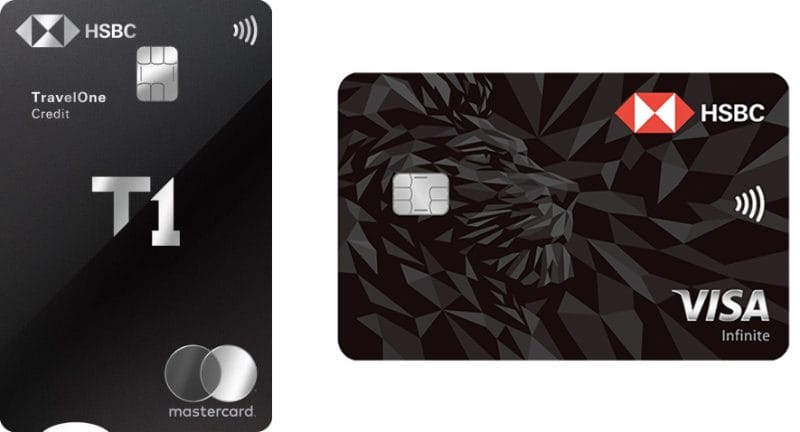

| HSBC |

*Except the HSBC TravelOne Card or HSBC Visa Infinite |

| Maybank |

|

| OCBC |

|

| StanChart |

|

| UOB |

|

| Note for AMEX and DBS: The above definitions have been expanded from the T&Cs to add further clarity regarding the timeout period. The additional details are based on my discussions with the relevant product teams | |

A few important points worth highlighting.

Timeout periods

Banks need to enforce a timeout period for an applicant with a recently-cancelled card to be considered new once again. Otherwise, people would just cancel their cards today and reapply tomorrow for a new customer gift.

In general, this period is 12 months, though UOB (6 months) and Maybank (9 months) are noticeable outliers. OCBC used to be 6 months as well until 1 November 2023, after which they extended it to 12 months.

Here’s one exception to the timeout rule: American Express. If you hold AMEX Card A today, cancel it and apply for AMEX Card B tomorrow, you meet the definition of a new customer for the purpose of welcome offers for AMEX Card B. In practice, however, I would wait about a week in case the system needs to be updated internally to process your cancellation and reflect the fact you’re no longer a cardholder.

When does the timeout period start from?

Another point of confusion is when the timeout period is counted from. There’s three possibilities:

- Date the promotion period starts

- Date of application for the new card

- Date of approval for the new card

Here’s an illustration. Suppose:

- Bank A has a timeout period of 12 months

- Bank A runs a promotion valid for applications from 1-31 March 2024

- John applies for a credit card on 5 March 2024

- John gets approval on 11 March 2024

| If Bank A uses 12 months from… | John’s last card with Bank A must be cancelled no later than… |

| Date the promotion period starts | 1 March 2023 |

| Date of application | 5 March 2023 |

| Date of approval | 11 March 2023 |

What complicates things is that some banks are not internally consistent! For example, the current KrisFlyer UOB Credit Card sign-up offer says:

…you have not cancelled your principal UOB credit card(s) six (6) months prior to the commencement of the Promotion Period

However, the current UOB PRVI Miles Card sign-up offer says:

…you have not cancelled your principal UOB credit card(s) six (6) months prior to card(s) approval date

Likewise, the current StanChart Journey Card sign-up offer says:

In other words, you must not have any existing or previously cancelled Standard Chartered credit cards which you are the principal cardholder of, in the last 12 months from the date that the Bank receives your Journey Card application pursuant to this Promotion

However, the current SingSaver offers for StanChart cards (including the Journey) says:

“Existing SCB Cardholder” refers to a Standard Chartered Bank (Singapore) Limited principal cardholder with at least one (1) existing principal credit card with SCB at the point approval of your Eligible Card application or a previously cancelled credit card(s) with SCB in the last 12 months from the date the Eligible Card is approved. Must not have applied for the same credit card within the last 12 months from the date of application.

Of course, application and approval dates are usually fairly close to each other (unless the bank is dealing with a huge backlog), so in most cases this difference won’t be material unless you’re really riding the edges of that 12 month timeout period.

tl;dr: make a point of reading the T&Cs!

HSBC quirk

HSBC’s definition of a new customer is slightly different from the rest of the banks, but it’s a difference that benefits you.

If you’re applying for a HSBC Advance, Revolution or Visa Platinum card, then the current holding or recent cancellation of a HSBC TravelOne or Visa Infinite card will not disqualify you from counting as a new customer. HSBC classifies these cards differently, for whatever reason.

And if you’re applying for a HSBC TravelOne or Visa Infinite card, it’s irrelevant whether you’re a new or existing customer; your welcome offer is the same.

For more information on how this works, refer to the post below.

PSA: HSBC’s unusual definition of new and existing customers

Other questions about new customer status

Do debit cards count?

No. Debit cards are not the same as credit cards, and holding one does not disqualify you from new customer status.

Do supplementary cards count?

No. A supplementary card will not disqualify you from new customer status, because banks only look at principal cards.

One exception: Bank of China usually excludes supplementary cardholders from their new customer definition (I sometimes wonder if it’s because their systems are so bad they can’t differentiate!)

Do corporate cards count?

No. A corporate card does not disqualify you from new customer status.

Do bank accounts count?

No. A bank account has no bearing on your new customer status where credit cards are concerned.

What if I applied for a card previously but didn’t activate it?

Suppose you applied for a card and received approval, but the approval came after the deadline stipulated in the T&Cs.

Unfortunately, you no longer count as a new customer- even if you didn’t activate the card you received. It is indeed unfair, to the extent that the approval delay was due to no error on your part (sometimes approvals are delayed because applicants forget to attach supporting documents, or the copies they send are unclear), but there’s not much you can do about it.

Should I “churn” my status?

For the uninitiated, “churning” refers to regularly opening and closing credit card accounts in order to enjoy welcome gifts and reset your new customer status. I’m not going to make a judgement on the ethics of this practice, but I will point out two things.

First, the T&Cs of the welcome offer may contain “clawback clauses”, which give the bank the right to charge you the value of the welcome gift if the card is cancelled within a certain period of account opening (usually 6-12 months).

Second, banks aren’t stupid. If you establish a pattern of repeatedly opening and closing credit card accounts, you shouldn’t be surprised if your future applications are rejected despite meeting all the eligibility criteria otherwise. Banks reserve the right to choose who they want to do business with.

What constitutes a “pattern?” It’s hard to say, and it will differ from bank to bank. Doing it once or twice probably won’t hurt. Doing it repeatedly probably will.

Conclusion

New customer status is extremely valuable when applying for credit cards, and it’s not unheard of for people to rope in their spouses, parents, siblings, and anyone who qualifies for a credit card every time a lucrative offer rolls round.

It also means that you shouldn’t waste your new customer status by signing up at a random roadshow because they’re offering a coffee mug and a sports towel!

My personal experience with SCB is like below:

2014 – get $200 sign-up bonus

2016 – cancel

2018 – apply for $250 sign-up bonus but only $50 is given. Emailed SCB & their reply is, sign-up bonus will deduct the amount “previously paid”.

I am not sure whether SCB is still doing that, and whether it is the only bank doing that (not experienced such with other banks). Perhaps you can put some insights on this?

Yes they have a “previous cashback cap” mechanism – https://www.sc.com/sg/terms-and-conditions/credit-card-sign-up-promotion/

I have not had the opportunity to try this but in theory I think next time you can still sign up via Singsaver if SS is the one who fulfills the gifts

Planning to sign up for HSBC Revo to get the sign up bonus gift. Had previously cancelled my HSBC Revo on 3 Dec 2022 because i, for some reason, did not consent to the marketing materials hence did not receive the gift back then. As per the t&c, one of the conditions is – has not cancelled any HSBC Credit Card within the last 12 months prior to the “Card Account Opening Date”. “Card Account Opening Date” means the calendar month printed on the letter sent to an Eligible Applicant enclosing his/her Card issued pursuant to this Promotion. Does it mean if… Read more »