While Amaze has been on the receiving end of several nerfs and devaluations over the past year, it remains my first choice for foreign currency (FCY) transactions.

The implicit FCY transaction fee (i.e. the spread between the Amaze rate and Mastercard rate) is still lower than the usual 3.25% that banks charge, and so long as I can earn my 4-6 mpd plus InstaPoints, I’m happy.

|

||

| Apply here | ||

| Review | ||

| Use code 7HK2A2 for 225 bonus InstaPoints | ||

| 💳 tl;dr: Amaze Card | ||

|

However, there’s certain situations where you shouldn’t use the Amaze overseas, because it leads to unnecessary complications and potential losses on FX spreads.

I’m thinking in particular of scenarios where a hold is required, such as hotel rooms and car rentals.

Amaze’s problem with holds

When you check into a hotel or pick up a rental car, it’s standard practice for the merchant to request a credit or debit card as security against damage or to cover incidentals.

Using a hotel as an example, what typically happens is that the front desk puts a hold on your card, say US$200. When you check-out, assuming you haven’t spent anything at the hotel restaurants or otherwise wrecked the room, the hold will be automatically released.

If you provide a credit card, there’s no real issue here. That US$200 was never actually charged to your account. It was deducted from your available credit balance, but when the hold is released, it’s like nothing ever happened. You won’t see anything on your credit card statement, nor do FCY transaction fees come into the picture.

If you provide a debit card, that US$200 is deducted immediately from your bank account because authorisation with debit cards works differently (there’s no credit line to draw on). When the hold is lifted, the US$200 is refunded. You’ll see one line item on your debit card statement for the charge, and another line item for the refund.

Now here’s the kicker: Amaze is a debit card, not a credit card. This is quite easy to forget, since most people will be pairing Amaze with a credit card, and Amaze charges appear on their credit card statement at the end of the month, not as an instant deduction from their bank account. Maybe the best way to think of it is Amaze is a debit card funded by a credit card.

So what happens when you provide an Amaze card at check-in is that US$200 is charged to your linked credit card immediately. That’s an actual transaction which will be converted into SGD at the Amaze rate and appear on your credit card statement.

When you check-out, US$200 will be refunded to your linked credit card. That’s another transaction which will be converted into SGD at the Amaze rate and appear on your credit card statement.

However, the amount that’s refunded may not be the same as the amount that’s charged.

| ⚠️ Not just Amaze |

|

By the way, this isn’t an Amaze-specific problem. You’d encounter the same issue if you provided a Revolut or YouTrip card at the time of check-in, since both are debit cards. The main difference is that you’d probably notice the hold straight away, since those funds would be immediately deducted from your wallet and you wouldn’t be able to use them on your trip. |

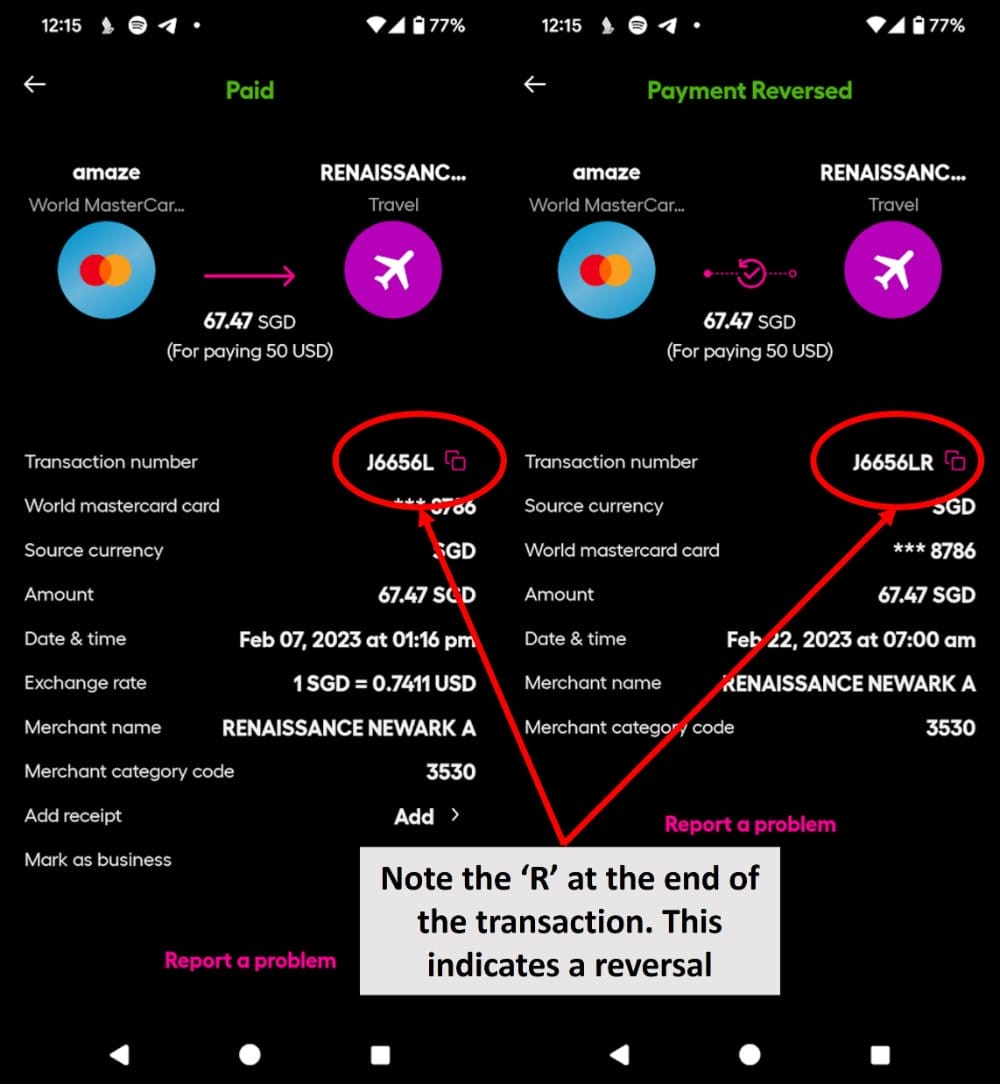

It all boils down to how the merchant processes the refund. Sometimes, they do a reversal, in which case you could get back exactly what you were charged.

For example, I stayed at the Renaissance Newark, which put a US$50 hold on my Amaze. This hold was converted into S$67.47 and charged to my credit card. I had no further charges at the hotel, so about two weeks after I checked out, the transaction was reversed and I was credited back the same S$67.47.

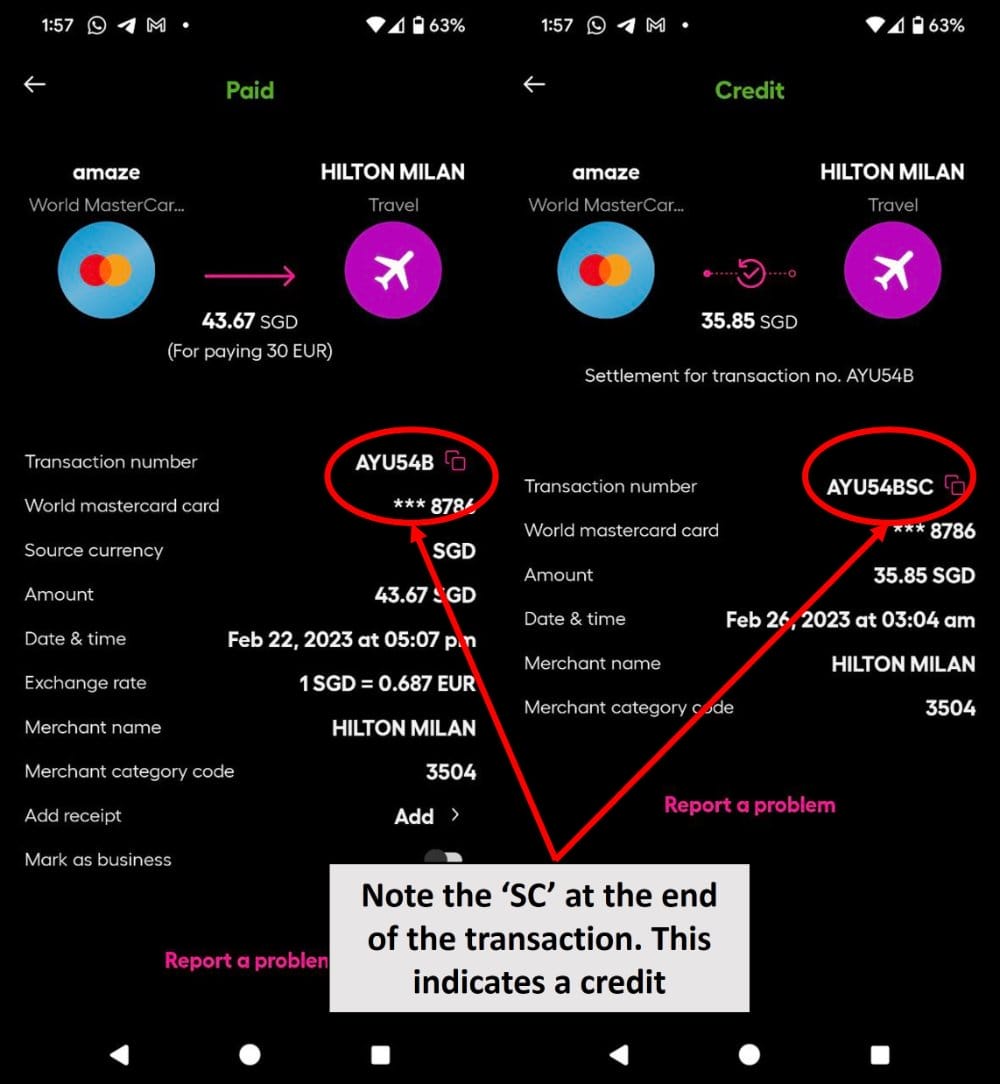

Other times, the merchant may do a credit or original credit, in which case the money you get back may be different.

For example, I stayed at the Hilton Milan, which put a €30 hold on my Amaze. This hold was converted to S$43.67 and charged to my credit card. My only charge at the hotel was a €5 city tax, so €25 was refunded to my Amaze.

Let’s do some quick math: based on the rate Amaze charged at the time of the €30 authorisation (€1= S$1.4557), my €25 refund should have become S$36.39. Instead, I was credited S$35.85(€1= S$1.434), which means I ate a spread of about 1.5%.

How merchants process refunds is a whole other rabbit hole that I don’t want to dive into (not to mention it’s quite technical and I’m liable to explain it incorrectly), but the tl;dr is that there’s no reason to put yourself in this situation in the first place.

| 🌎 Only a problem for FCY transactions |

|

At the risk of stating the obvious, this is only a problem for FCY transactions. You can go ahead and present your Amaze at check-in when you’re staying at a hotel in Singapore, though there’s really no reason to do so- you won’t earn InstaPoints, and the “offline to online” benefit doesn’t apply for the Citi Rewards, since hotel transactions are excluded from 4 mpd. |

You can still use Amaze for hotels and rental cars!

Just so I’m not misunderstood, there’s no problem using Amaze to pay for hotels or rental cars. In fact, in the case of hotels, it’s a great opportunity to earn 6 mpd from the UOB Lady’s Card with Travel selected as your quarterly bonus category.

To avoid the issue with authorisation holds, provide a credit card at the initial check-in or pick up. When you check-out or drop off the car, let them know you want to use a different card to pay, then pass them the Amaze. This means some added inconvenience, insofar as you can’t use express check-out or drop-off, but hey, the things we do for miles, right?

Conclusion

Because Amaze is a debit card, using it for an authorisation hold may result in FX losses, depending on how the merchant processes transactions. I’ve used the example of hotels and rental cars, but there could be other scenarios as well.

To avoid this hassle altogether, make sure you’re using your Amaze card to pay for something, not to secure it. In other words, only give your Amaze when the final bill is being settled.

It’s even more prominent when u pump in Malaysia and use your Amaze card to pay at the pump because every transaction is a RM200 hold and the refund is always lower..

ah yes automated terminals at petrol kiosks would be another good example. i guess in this case the solution is to pay inside before pumping?

As for hotel bookings for example Hilton Hotel, I do not use Amaze for the booking even if they state that it is for Advance and prepayment required as I noticed different hotels have different policies when to encash the payment. Some deduct it straightaway while others will encash it at checkout. I use another credit card for confirmation with no forex fee or low forex fee just in case and Amaze card if there is still payment at check out.

yes, i’ve noticed that with hilton, even prepaid/advance pay rates are not actually billed at the time of booking.

Just to add another complication – when the merchant does a credit, it goes to the credit card that is paired to Amaze at the time of credit, NOT the original card used at the time of hold. Most of the time this won’t be a problem, but something to take note nonetheless.

Some people have actually found that this works very nicely for them…hint hint.

How? I don’t get it.

Because it allows you to get bonus points / miles for the full hold sum. Since the refund doesn’t hit the original card, the bank doesn’t realize that you got part of that transaction refunded.

So it has finally been leaked. I wonder how long now until it is nerfed?

Why would you leak this?

Good article. Have always suspected the YouTrip card works like a debit card instead of credit card since not issued by a bank.

I have tried credit card and it has fx differences too

you are referring to an entirely different scenario where a transaction is made on your credit card and later refunded. there will be fx differences in that case.

this is talking about pre-authorisation, which is not the same as a transaction.

Can i get suggestions for which card to use for overseas car rental services?

Works the other way too. if the rate moves in your favour, you get a bonus