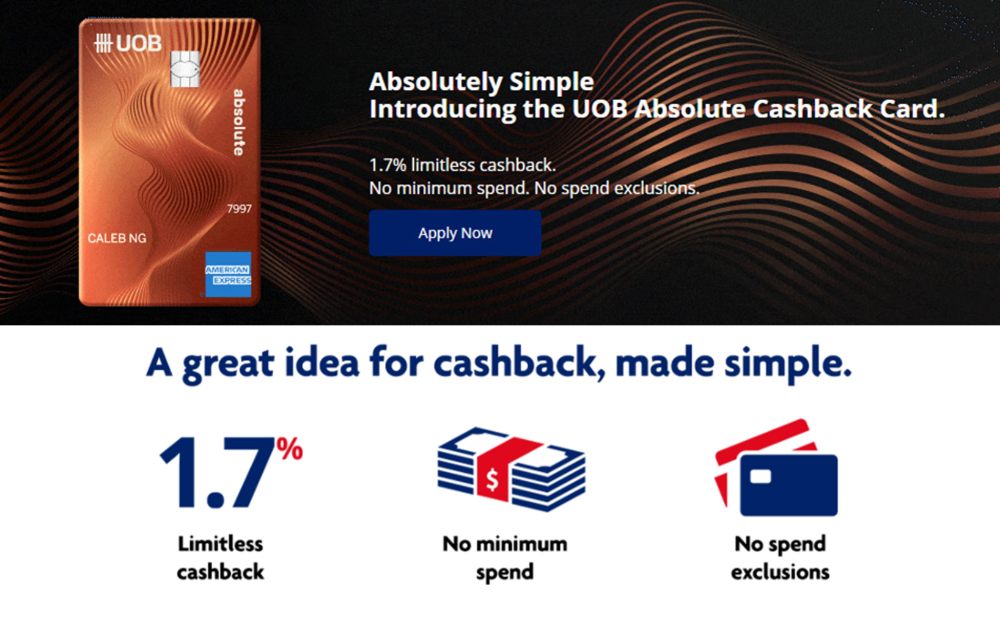

Back in May 2021, UOB introduced the UOB Absolute Cashback Card, a product that made everyone sit up and take notice.

UOB Absolute Cashback Cardholders earned a market-leading 1.7% cashback with no minimum spend or caps, and while unlimited cashback cards weren’t anything new, what was unique was that UOB was promising no spend exclusions. In a market where T&Cs were getting littered with more and more exclusions, this was a welcome development indeed.

I was skeptical at first, but UOB kept their word. Insurance premiums, school fees, e-wallet top-ups, hospital charges, utilities bills- all the things that other banks considered taboo, UOB awarded cashback without so much as a shrug.

Yes, they eventually cut the rate for GrabPay top-ups to 0.3%, but that was always somewhat inevitable. In fact, the only catch I could think of was that the card was an American Express, so merchant acceptance could be limited.

Unfortunately, UOB is now testing the limits of how far they can go and still claim “no spend exclusions”, with a nerf to numerous categories that reduces the cashback to almost nothing- but technically not zero.

UOB Absolute Cashback Card cutting cashback rates

The UOB Absolute Cashback Card currently earns 1.7% on all local and overseas transactions, with the exception of Grab wallet top-ups, which earn 0.3% cashback.

However, from 6 May 2024, the cashback awarded on charity, education, government, healthcare, utilities and other professional services will be cut from 1.7% to 0.3%.

| 👎 0.3% cashback from 6 May 2024 | |

| MCC | Description |

| 0742 | Pet stores and Veterinary Services |

| 4900 | Utilities |

| 5047 | Medical Equipment and Supplies |

| 5122 | Drug Stores |

| 5912 | Drug Store and Pharmacies |

| 5975 | Medical Equipment, Hearing Aid |

| 6513 | Real Estate Agents & Managers – Rentals |

| 7261 | Funeral Services and Crematories |

| 7278 | Shopping Services |

| 7311 | Advertising Services |

| 7361 | Employment Services and Agency |

| 7392 | Consulting and Public Relation Services |

| 7911 | Schools, Dance Halls and Studios |

| 8011 | Medical Services, Doctors |

| 8021 | Medical Services, Dentist and Orthodontist |

| 8041 | Medical Services, Chiropractors |

| 8042 | Medical Services, Optometrists and Ophthalmologist |

| 8043 | Medical Services, Opticians |

| 8049 | Medical Services, Chiropractors and Podiatrists |

| 8062 | Hospitals |

| 8071 | Medical Services, Dental Laboratories |

| 8099 | Medical and Health Services |

| 8211 | Schools, Elementary and Secondary |

| 8220 | Colleges, Universities, Professional Schools and Junior Colleges |

| 8241 | Schools, Correspondence |

| 8244 | Schools, Business and Secretarial |

| 8249 | Schools, Trade and Vocational |

| 8299 | Schools and Educational Services–Not Elsewhere Classified |

| 8398 | Organizations, Charitable and Social Service |

| 8999 | Professional Services |

| 9311 | Tax Payment |

| 9399 | Government Services—not elsewhere classified |

| 9402 | Postal Services—Government Only |

On first glance, this looks like UOB’s general exclusions list, but in fact it goes even further. I’ve listed below the MCCs which are not on UOB’s general exclusions list, but feature on the UOB Absolute Card’s exclusions list.

| 💳 Exclusions unique to the UOB Absolute Card | |

| MCC | Description |

| 0742 | Pet stores and Veterinary Services |

| 5047 | Medical Equipment and Supplies |

| 5122 | Drug Stores |

| 5912 | Drug Store and Pharmacies |

| 5975 | Medical Equipment, Hearing Aid |

| 7261 | Funeral Services and Crematories |

| 7278 | Shopping Services |

| 7311 | Advertising Services |

| 7361 | Employment Services and Agency |

| 7392 | Consulting and Public Relation Services |

| 7911 | Schools, Dance Halls and Studios |

| 8011 | Medical Services, Doctors* |

| 8021 | Medical Services, Dentist and Orthodontist |

| 8041 | Medical Services, Chiropractors |

| 8042 | Medical Services, Optometrists and Ophthalmologist |

| 8043 | Medical Services, Opticians |

| 8049 | Medical Services, Chiropractors and Podiatrists |

| 8071 | Medical Services, Dental Laboratories |

| 8099 | Medical and Health Services* |

| 8999 | Professional Services |

| *Also excluded for the KrisFlyer UOB Credit Card |

|

“Exclusions list?” UOB will no doubt take issue with this characterisation, saying that these transactions aren’t excluded; they just earn a lower cashback rate. Look, play with semantics all you want, but the way I see it these are basically exclusions. You don’t nerf the reward to close to zero unless you really want to discourage people from spending on these categories.

I also wonder whether UOB will continue to market this card as “no spend exclusions” from 6 May, because logically speaking there must come a point where this claim is just straight up misleading. I mean, you could technically offer 0.00001% cashback on these categories and still be factually accurate. It’s not excluded! It’s just earning close to nothing!

That said, there are also transactions on UOB’s general exclusions list which don’t feature on the UOB Absolute Card’s exclusions list, such as MCC 6300 Insurance and MCC 7995 Gambling and Casinos. My assumption is that you’ll continue to earn cashback on these merchants.

And please don’t go away thinking that cashback is your only option. While it’s true that most banks and cards have excluded rewards for charity, education, healthcare and utilities, there’s still a handful of options or workarounds available for earning miles- which will surely be worth more than 0.3% cashback!

If you need to know the MCC of a merchant before transacting, here’s three ways of looking it up:

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

What alternatives are there?

The space for unlimited cashback cards is a crowded one, so the UOB Absolute Cashback Card certainly has its competitors.

| 💳 General Spending Cashback Cards |

||

| Card | Annual Fee | Cashback (for SGD spend) |

DCS Ultimate Cashback DCS Ultimate CashbackApply |

S$196.20 (FYF) |

2% (capped at S$200 per month) |

UOB Absolute Cashback UOB Absolute CashbackApply |

S$196.20 (FYF) |

1.7% |

BOC Visa Infinite BOC Visa InfiniteApply |

S$381.50 (FYF) |

1.6% |

Citi Cash Back+ Card Citi Cash Back+ CardApply |

S$196.20 (FYF) |

1.6% |

Maybank FC Barcelona Card Maybank FC Barcelona CardApply |

S$120 (F2YF) |

1.6% |

OCBC Infinity OCBC InfinityApply |

S$196.20 (FYF) |

1.6% |

AMEX True Cashback Card AMEX True Cashback CardApply |

S$174.40 (FYF) |

1.5% |

HSBC Advance Card HSBC Advance CardApply |

S$196.20 (FYF) |

1.5%^ (capped at S$70 per month) |

SC Simply Cash Card SC Simply Cash CardApply |

S$196.20 (FYF) |

1.5% |

| FYF= First Year Free, F2YF= First 2 Years Free ^2.5% when you spend above S$2,000 |

||

Of course, the key thing to note here is that almost all its competitors completely exclude the categories that UOB is nerfing to 0.3%, so you could still argue that 0.3% cashback is better than nothing (but like I said in the previous section: you might still be able to earn miles!).

On the other hand, the fact that the UOB Absolute Card is an AMEX means that merchant acceptance will be far from universal, and that’s something you need to factor into your consideration too.

Conclusion

From 6 May 2024, the UOB Absolute Cashback Card is adding a long list of “not-quite-exclusions” such as donations, healthcare, education, utilities and government, which will earn a mere 0.3% cashback instead of the regular 1.7%.

It still remains the highest uncapped cashback card on the market though, and my guess is that people will continue to use it for that reason alone.

UOB Absolute Cashback Card: No exclusions. Just several categories that earn almost nothing.

Seems nerfing is becoming a very common word. Aiyoh.

Everything is getting nerfed now. With FED rate cuts. UOB One , HSBC and now their absolute.

Don’t know whether worth keeping the card.

How is this UOB Amex now compared to Amex True Cashback?

I use this card mainly for hospitalization, doctors, dental, medical services (like X-ray). Now it’s nerfed, there’s no reason to use this card anymore.

another card to cancel

DCS Ultimate Cashback is not eligible, written in T&C.

“Of course, the key thing to note here is that almost all its competitors completely exclude the categories that UOB is nerfing to 0.3%, so you could still argue that 0.3% cashback is better than nothing (but like I said in the previous section: you might still be able to earn miles!).”