The Merchant Category Code (MCC) is the all-important four-digit number that determines whether you earn big bonuses on a transaction, or walk away empty-handed.

In the past, checking MCCs was an arduous task, and only possible after the fact. But in recent times, consumers have benefitted from tools like the DBS digibot and HeyMax, which allow them to verify an MCC before spending a single cent.

Now there’s an additional resource available: the Instarem app.

Checking MCCs with Instarem app

In order to check MCCs via the Instarem app, you’ll need to update it to the latest version.

Once that’s done, login to the app, tap on Activity (at the bottom right corner), then pick a transaction. The MCC will be listed towards the bottom; you can cross reference it against this list to get the full description.

MCCs are available for any transaction up to one year ago, which is the maximum historical data that the Instarem app displays.

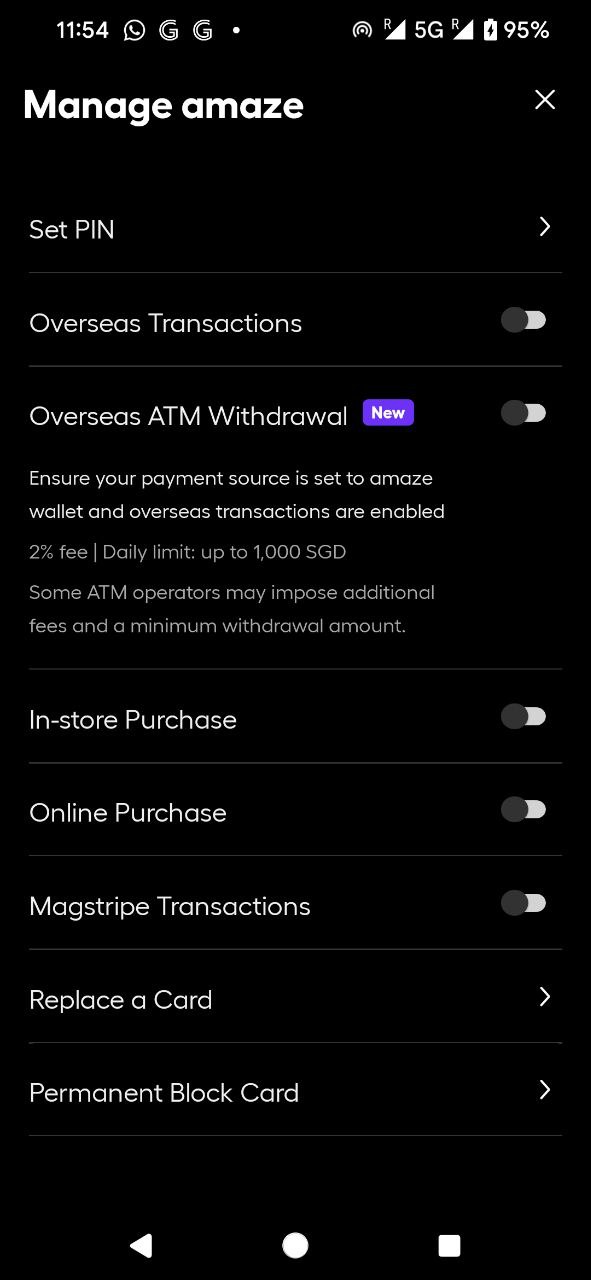

As useful as it is to check past transactions, you can also use this feature to check MCCS before spending. All you need to do is put a temporary block on your Amaze Card, which can be done by opening the Instarem app > Card > Manage > Disable in-store purchase, online-purchase, overseas transactions, magstripe transactions.

| 💡 Alternative method |

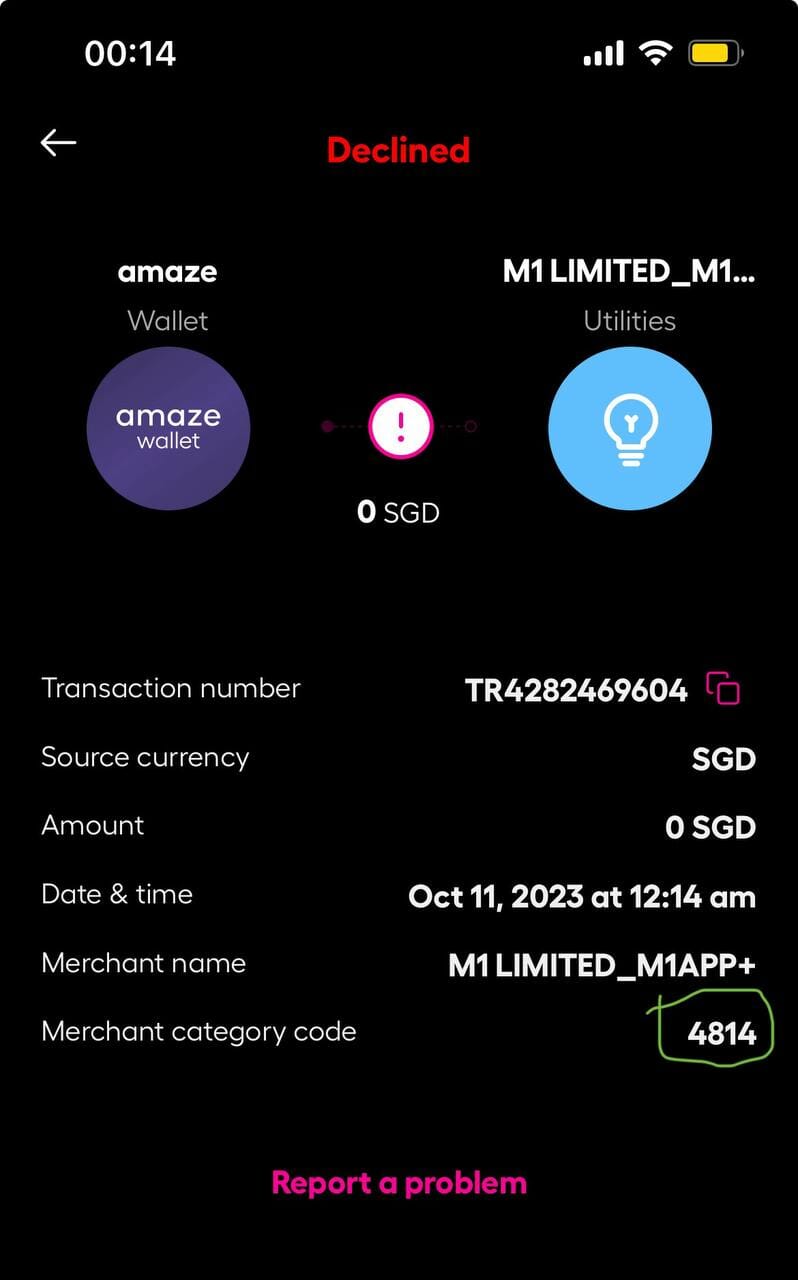

| If you prefer not to block your card, you can also choose the Amaze Wallet as your funding source, provided it has an insufficient balance to carry through with the transaction. |

After this, attempt to pay the merchant. The transaction will fail, of course, but you can then go back to the Instarem app, tap on Activity, and see the failed transaction’s details- including MCC.

Now, a brief caveat here. The above is based on reports from the MileLion community. I personally have not been able to replicate this, because declined transactions do not appear in my Activity tab. That said, it could just be a me-problem, because I’ve seen successful reports from both Android and iOS users.

Other ways of checking MCCs

In addition to the Instarem app, there are two other ways of checking MCCs before spending:

The DBS digibot method can potentially be more reliable, because Visa and Mastercard may use different MCCs. Therefore, if you test a Visa/Mastercard card with the DBS digibot method, you can be assured that if you use a Visa/Mastercard to carry out the actual transaction, the results will be the same.

In contrast, Amaze only supports Mastercards, so if you use a Visa to carry out the actual transaction, there is a (very) small chance the results will be different. Keep in mind that 99% of the time you’ll be fine though.

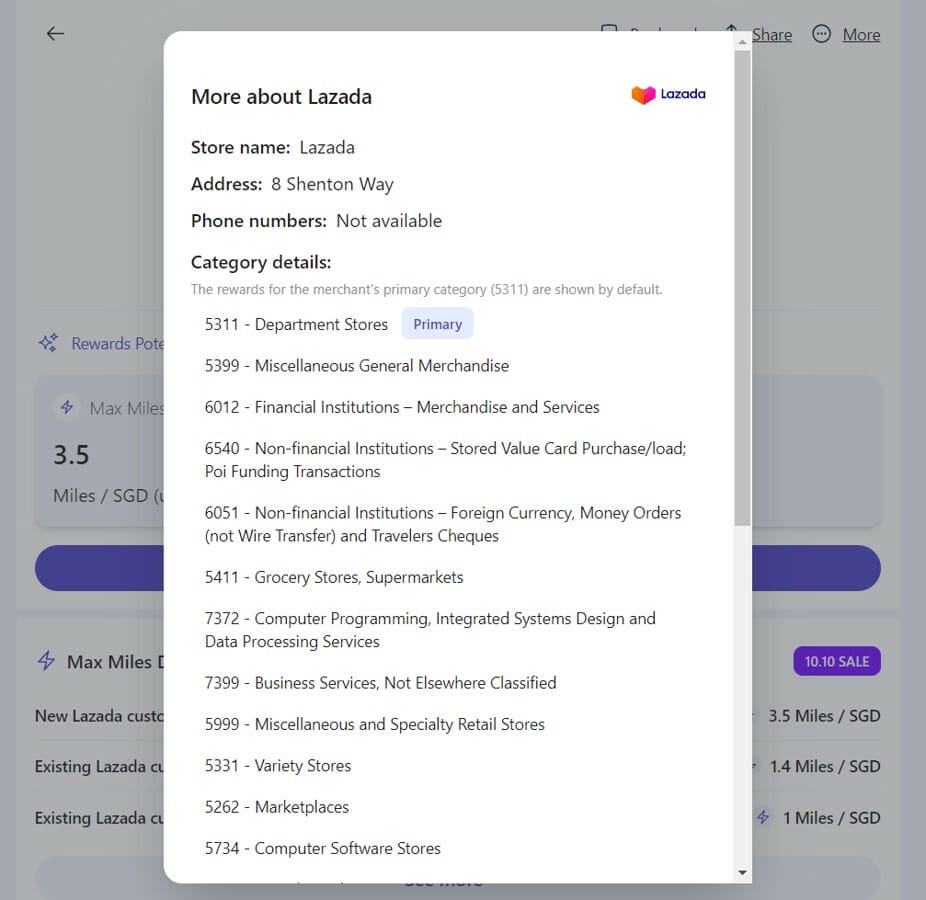

HeyMax is a portal that lets you look up MCCs just by typing in the merchant name, and while it’s generally reliable, it’s less useful in situations where a merchant processes transactions under a range of MCCs (e.g. e-commerce sites like Amazon, Lazada, Qoo10, Shopee). It can list you all the potential MCCs, but can’t tell you exactly which one will be used.

That’s why I’d consider the Instarem app to be the gold standard for checking MCCs, because you can be assured that whatever appears there is how the actual transaction will code.

Conclusion

Verifying MCCs before or after spending just got a whole lot easier with Instarem’s latest app update, so be sure to update your version and check it out.

Who needs the Visa Supplier Locator, eh?

There is still a problem that even for the same merchant, MCC for Mastercard and VISA can be different. It is really rare but I have seen one previously. DBS digibot is still useful in this case

If MC n VISA have the same issue, then digibot will still have the same issue right

What do you mean “same issue”?

Yeah but that’s pretty rare and I’m guessing most mile chasers have enough MC and Visa cards to just use a MC when there is a chance they’ll lose the MCC lottery using a Visa.

Just checked, in my past transactions, there’s no MCC Code in the transaction details.

I’ve checked, my Instarem app has no new update also.

App version v3.10.10 on Android

latest app version is 3.11.0. i suspect they are rolling out in batches

Me too!

I had to delete and reinstall the app to get the MCC to show. Updating alone didn’t work.

My issue is the same as Aaron’s, I can’t get the declined transactions to show up in the activity tab. I tried locking the card and also linking it to my wallet with insufficient balance. Neither way works.

I’m on version 3.11.0 of the app. Running iOS 16.6.1.

i could see my past decline transactions, but not able to see the MCC under the declined ones.

those that could pass thru, past transactions, the mcc are showing

i think the value of seeing mcc before paying/spending is greater than seeing mcc after..

I think it’s just inconsiderate to jam the queue to check MCC. Imagine having to block card, decline transaction, check MCC, unblock card, swipe card again. And if every other person in the queue is doing that… Next please…

psst! hey you! yeah you! there’s something known as….step aside and let others go first while you check. you might want to try it.

Thanks K D for making my point, ie, ppl who are inconsiderate often do not realise that they cause inconvenience to others. Assuming 5 ppl behind you in the queue. You make a pseudo payment once, steps aside, next 1-2 customers make payment, then you cut back into the queue. Yes, you did not inconvenience the person immediately behind you but as the person further down in the queue, your second bite of the cherry has increased his/her wait time. Now, multiply this by the number of mile chasers in the queue. Of course, I bet you meant you will… Read more »

More transparency please! Love this move by Amaze, great direction towards customer obsession.

I see it in my app. Surprised to see that Shopee MCC is actually 5331 and not 5262!

FSMone debit card, which is issued under Nium also shows MCCs. Probably they just brought that feature to Instarem app.

Just a data point. Locking card, processing a declined transaction, but declined transaction didn’t appear in Past Transactions list. Previous declined transactions (due to bank), did show up, but from the past.

I just tried… I temp block my uob card in TMRW app and put in a transaction then it will appear in activity. Time to update ur blog! then after checking the mcc, can unblock card from TMRW.