While the Trust Card isn’t exactly part of my day-to-day lineup, it does have one big thing in its favour: zero foreign currency (FCY) transaction fees.

When using other credit cards overseas, you can typically expect to pay an FCY fee of 3.25%, which can really add up on big ticket purchases. With the Trust Card, you simply pay the Visa rate, and nothing more.

|

| Sign up for Trust with code 2GQEAM81 and get bonus S$10 FairPrice e-voucher |

That’s led many to ask whether they should be using the Trust Card for overseas spend instead of other credit cards or multi-currency debit cards, and the answer is that it really boils down to two things:

- Whether you’re interested in earning rewards on a transaction, or simply minimising costs

- If you’re interested in minimising costs, how you view the trade-offs between credit and multi-currency debit cards

But first, how do FCY transactions work with the Trust Card?

How FCY transactions work with the Trust Card?

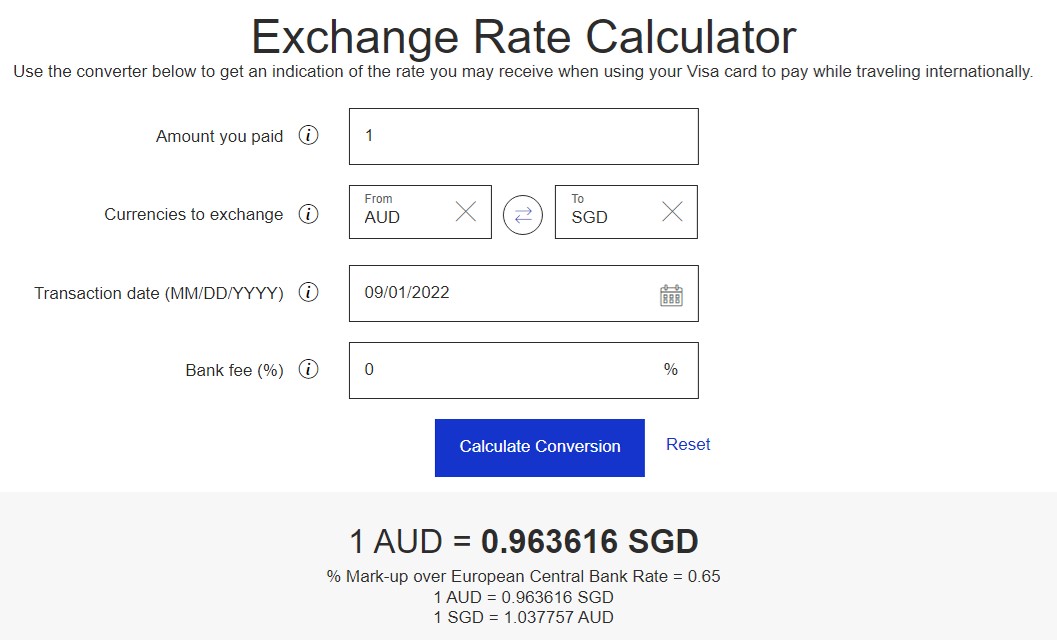

Whenever you charge an FCY transaction to the Trust Card, all that happens is the FCY amount is converted to SGD at the prevailing Visa rate. No further mark-up is applied by the bank nor the card network.

For example, I made a transaction of A$1 on my Trust Card which came to S$0.96; exactly what the Visa Currency Converter says I should be paying on a card with zero FCY fees.

The natural instinct is to compare this with the mid-market rate (e.g. what you find on XE.com), but keep in mind that the mid-market rate may not be a realistic point of comparison, since you won’t get it at ATMs, money transfer services or moneychangers (multi-currency debit cards can come close though, assuming it’s not the weekend).

For the sake of comparison, here’s the XE.com and Visa rates for several currencies, as of the date of writing.

| Amount | XE.com | Visa | Spread |

| US$100 | S$135.23 | S$135.26 | ~0% |

| A$100 | S$89.20 | S$89.77 | 0.6% |

| ¥10,000 | S$86.08 | S$86.42 | 0.4% |

| €100 | S$146.18 | S$146.95 | 0.5% |

| £100 | S$171.66 | S$172.46 | 0.5% |

Leaving aside the USD amount, which appears to be an outlier, you’re looking at a ~0.5% spread.

Rewards or minimising cost?

When you use your credit cards overseas, you can earn as much as 4 mpd on your spend.

In contrast, the Trust Card earns a miserly 0.22% rebate on non-FairPrice Group spend, which is so small it might as well be negligible.

So does it make sense to earn those miles? It depends on how much you value them. I personally value a mile at 1.5 cents each, so the way I see it, I’m earning a 6% rebate, minus a 3.25% FCY fee and some additional Visa spread.

But if I pair my credit card with Amaze, the picture gets even better. With Amaze, the FCY fee is cut to 2% (Amaze does not have an explicit FCY fee, but its rates are ~2% higher compared to Mastercard), and there’s a further rebate of up to 0.5% from InstaPoints, though this will soon be nerfed with the upcoming monthly InstaPoint cap.

| Trust | 4 mpd Card | 4 mpd Card + Amaze | |

| FCY Fee | 0% | 3.25% | ~2% |

| Value of rewards (based on 1.5 cpm) |

0.22% | 6% | Up to 6.5% |

| Net Benefit^ | 0.22% | 2.75% | Up to 4.5%* |

| *The InstaPoints rebate is “up to” 0.5%, because the maximum InstaPoints you can earn on a transaction is capped at 500 (or 500 per month from June 2024). Therefore, any spend above S$1,000 will not earn any rebate. InstaPoints are not awarded on transactions smaller than S$10. |

|||

| ^The net benefit here does not take into account the spread charged by Visa/Mastercard, but that will equally apply to all three options | |||

That’s why I personally wouldn’t consider using the Trust Card for my overseas spending, though it all boils down to how much you value a mile.

Assuming we ignore the InstaPoints rebate, a 4 mpd card + Amaze is a better option than Trust so long as you value a mile higher than 0.55 cents.

If you’re reading this website, I reckon you do (if your valuation is lower than 0.55 cents, you should switch to cashback immediately), so the way I see it, there’s no reason to switch to Trust right now.

Exception: When rewards can’t be earned

If you’re dealing with a category where rewards can’t be earned, such as education or charitable donations, then it’s simply a question of “damage minimisation” (i.e. minimising the total cost of the transaction).

In that case, the Trust Card would be a great option, since there’s no reason to pay an FCY transaction fee when there’s no rewards in the picture.

But don’t be so quick to conclude that a given category is “unrewardable”! For example:

- The Maybank Horizon Visa Signature will earn 2.8 mpd (temporarily upsized to 3.2 mpd) on charitable donations, education, insurance premiums or utilities bills in FCY

- The UOB Visa Infinite Metal Card and Maybank Visa Infinite will earn 2.4 mpd and 2 mpd respectively on education transactions in FCY

Credit card or multi-currency debit card?

|

|

|

| Trust Credit Card | Multi-Currency Debit Cards | |

| Pros |

|

|

| Cons |

|

|

Assuming you’ve chosen to minimise the cost of the transaction over earning rewards, the next question becomes whether you should use the Trust Card, or a multi-currency debit card like Revolut or YouTrip.

Historically speaking, multi-currency debit cards were at a disadvantage because the MAS-imposed transaction limits restricted customers to keeping S$5,000 in a wallet at any time, and spending S$30,000 per year. These restrictions meant that customers wanting to make big ticket purchases would have to use a credit card instead.

But at the start of 2024, YouTrip became the first e-wallet to increase its stock limit (the amount that can be kept in the wallet) to S$20,000, and the flow limit (the amount that can be spent per 12-month period) to S$100,000. Why Revolut hasn’t followed yet, I do not know, but this makes YouTrip a viable alternative to Trust.

The key advantages of multi-currency debit cards is that you’ll enjoy better rates than Visa, assuming it’s not the weekend (where rates can be worse).

| Amount | YouTrip | Visa | Spread |

| US$100 | S$135.24 | S$135.26 | ~0% |

| A$100 | S$89.21 | S$89.77 | 0.6% |

| ¥10,000 | S$86.13 | S$86.42 | 0.3% |

| €100 | S$146.20 | S$146.95 | 0.5% |

| £100 | S$171.67 | S$172.46 | 0.5% |

Moreover, a multi-currency debit card allows you to lock in today’s rates for future spend. For example, if you feel the JPY/SGD rate today is good, you can go ahead and buy JPY for your trip six months down the road (keep in mind there’s still the opportunity cost of funds to consider, since your YouTrip balance earns no interest).

In contrast, Trust Cardholders can only take advantage of the prevailing rate at the time the transaction is processed.

So why consider Trust? Well, if you’re making a very big transaction that would bust even the increased YouTrip limits, then you might not have a choice. As a credit card, Trust is capped only by the assigned credit limit, and in my experience they’re very generous with this.

Then there’s fraud considerations. As a debit card, any transactions charged to your Revolut or YouTrip, whether fraudulent or legitimate, are immediately deducted from your account. There was a recent feature in CNA about the pitfalls of multi-currency card fraud prevention, including the horror story of a customer who found her YouTrip wallet drained by 31 unauthorised transactions in quick succession and had to wait months to recover her funds.

There are ways of protecting yourself, however, such as locking your multi-currency card whenever it’s not in use. If you’re only taking that trip a few months down the line, there’s no reason to leave your card unlocked in the interim.

In contrast, if your credit card gets hit by a fraudulent transaction, there is no immediate deduction of funds. You can spot the fraudulent transaction on your statement and open a dispute with the bank, and in the majority of cases you should receive a temporary credit to offset the disputed amount while investigations are carried out.

| 🏧 ATM withdrawals |

|

While cash-based transactions aren’t really the focus of this article, I should highlight that Trust has the upper hand when it comes to this. Trust allows you to make unlimited fee-free withdrawals from overseas ATMs, while YouTrip only offers S$400 of free withdrawals per month, after which a 2% fee applies. Revolut allows up to S$350 or five withdrawals per month on the Standard plan, after which a 2% fee applies. Do note that the overseas bank operating the ATM may impose a fee of its own, but that’d be the same whether you used Trust or Revolut/YouTrip. Also, when using Trust for ATM withdrawals, be sure to toggle it to debit card mode (on the app, switch the source to “pair with savings account”). You want to make a withdrawal from your Trust savings account (free), not a cash advance from Visa ($$$). |

On a similar note, debit cards do not support so called “authorisation holds”, the type required when you rent a car or check in to a hotel. This means that the hold amount is automatically deducted from your available funds, leaving you with less money on hand. For instance, if you have a YouTrip balance of US$1,000 and use the card to rent a car, and the rental car company puts a US$400 hold, you only have US$600 left to spend. If you used the Trust Card, there’d be no deduction of funds because it’s a credit card.

Finally, as a credit card, Trust allows you to stretch your cashflow. While multi-currency debit cards involve an immediate deduction from your account, transactions on the Trust Card are only due later when the statement amount becomes payable.

Conclusion

Trust Cardholders enjoy zero FCY transaction fees, which makes it a potentially attractive option for overseas spend. However, I personally prefer to stick with a 4 mpd card + Amaze, because this lets me earn rewards for a fee I find acceptable.

That said, in situations where you can’t earn rewards, or where minimising the total transaction cost is the primary goal, then Trust can be a good option- though you should also consider Revolut or YouTrip if you can stomach the shortcomings with regards to transaction limits and fraud protection.

I used the Trust Card regularly compared to Youtrip or Revolut card primarily as I do not need to put it in a Wallet and I do get 3 percent per annual interest with the Trust Bank deposit. So it works out to be up to 1.5 months interest or around 0.375% plus 0.22 per cent, so about 0.5 percent. On top of it, when I reached 700 dollars per month of expenditure outside of Fairprice group over 3 months, I get about 12.5% bonus linkpoints. As I do a fair bit of shopping with Fairprice, the card does makes… Read more »

Agreed.

Using overseas spend to get to the nonFPG minimum sum creates leverage.

But it’s capped at a few hundred dollars a month. An overseas trip often costs a lot more.

Yup. CCs already have fine prints. So I use multiple cards. Keeping track is getting more difficult.

The focus of this kind of article needs to be whether it’s worth using Wise, YouTrip or Revolut (or cash from money changer if you can get a rate better than Mastercard forex) instead of a general spend card in a developing country. This is the case where credit cards might charge a total of 5.0-5.5% FCY above the spot rate.

Everywhere else, it is a no brainer to use even your general spend credit card without Amaze and there is no debate.

Completely agree. As long as the FCY does not exceed 6%, I still break even with the miles, even at 2.4 mpd.

Hard disagree. It is highly dependent on how much you value your mile. The break even point is (3.25%+0.22%)/2.4 = 1.45 cts per mile, so we are getting v close between UOB Prvi Miles vs Trust vs YouTrip, and definitely not quite a no brainer.

Agree that the order ought to be:

– amaze + 4mpd

– 4mpd

– then basically your choice between uob prvi/trust/yt with some pros and cons

Trust has an additional 1.5% cash rebate which did not write into the Tnc. You need to register the card to know.

don’t see it for my card- assume it’s targeted? 1.5% would certainly close the gap, though not enough to beat amaze +4 mpd.

Trust card is good when you are making big ticket purchases in foreign currency. Amaze + Citi Rewards has a pitiful cap of $1k, which is nowhere near enough to pay for flights, hotels and foreign dining/shopping for your typical overseas trip.

I prefer to use CREDIT card than DEBBIT card as need to always top up when balance is running low or not sufficient to pay. If I am only using Citi Premier Miles Card which provide 2.2 Citi Miles# for every S$1 foreign currency spent, does it making more sense to use trustcard or otherwise?