Back in November 2023, the Maybank Horizon Visa Signature Card received a major revamp, which added 2.8 mpd on all foreign currency (FCY) transactions (uncapped) and air tickets (capped at S$10,000 per month) as an evergreen benefit.

This was temporarily upsized to 3.2 mpd for a limited time, making this card a highly attractive option for these categories, especially after the loss of the DBS Altitude’s 3 mpd on airline bookings.

Maybank has now brought back the 3.2 mpd earn rate for May and June 2024, and remember: it even applies to overseas charitable donations, education, insurance premiums, private hospitals and utilities!

This is fast becoming one of my favourite cards to use for overseas spending, once the caps on my Amaze pairings have been exhausted.

Maybank Horizon Visa Signature 3.2 mpd promo

From 1 May to 30 June 2024, Maybank Horizon Visa Signature Cardholders will earn:

- 3.2 mpd on FCY spend (no cap)

- 3.2 mpd on air tickets (capped at S$10,000 per calendar month).

| 💳 Maybank Horizon 3.2 mpd Promotion | ||

|

||

| Apply | ||

| Min. Spend | S$800 per calendar month | |

| FCY Spend (no cap) |

3.2 mpd |

|

| Air Tickets (capped at S$10K per calendar month) |

3.2 mpd |

|

This offer is available to both existing cardholders, and cardholders who sign up subsequently. No registration is needed, but a minimum spend of S$800 per calendar month is required.

FCY spend

FCY spend is defined as card retail transactions posted in foreign currencies, regardless of whether they’re online or in-person.

A Maybank spokesperson has confirmed that you will earn the 3.2 mpd rate on charitable donations, education, insurance, private hospitals and utilities, so long as it’s charged in FCY! This would be fantastic for anyone who has overseas university fees to pay.

Air tickets

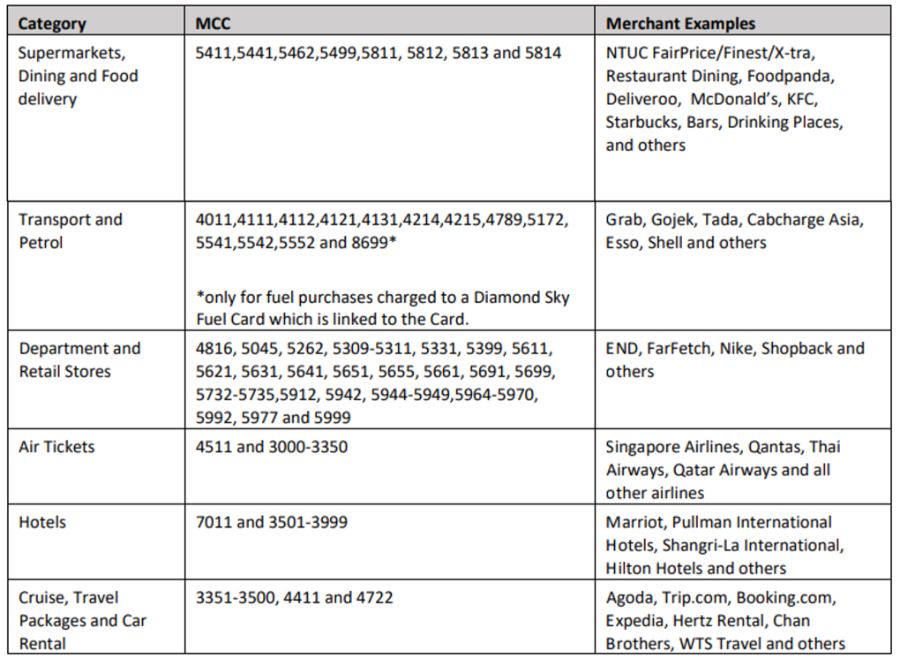

Air ticket spend is classified as transactions posted in Singapore dollars (if you have air tickets in FCY, they fall under the previous section, with no cap) under MCCs 4511 and 3000-3350.

This includes Singapore Airlines, Scoot, British Airways, Cathay Pacific, Qatar Airways and pretty much every major airline out there.

If you’re kiasu and want to check the MCC of a particular airline transaction before spending, here’s three ways of doing so:

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

What counts towards the S$800 min. spend?

The minimum S$800 spend required to trigger the 3.2 mpd rate includes all retail transactions, both online and offline, in local and FCY.

Maybank keeps a list of transactions that will not count towards the minimum spend or TREATS points issuance in its T&Cs, from the bottom of page 1 onwards (Maybank, annoyingly, does not number its bullet points).

Key exclusions to note are:

- Government services

- Betting or gambling transactions

- Brokerage or securities transactions

- Stored value top-ups like GrabPay or YouTrip

Education, insurance, medical bills and utilities will count towards the minimum spend, whether in SGD or FCY.

Maybank also has an unusual policy when it comes towards transaction versus posting dates, but it’s one that works in your favour.

- Retail transactions charged to a Card made within a calendar month that are successfully posted to a Card Account prior to the 6th day of the following calendar month, will be counted towards the minimum spend of the month that the retail transactions are made.

- Retail transactions charged to the Card which made within a calendar month but are only posted to a Card Account after the 6th day of the following month will be counted towards the following month’s minimum spend

Basically, so long as your transaction posts by the 6th day of the following calendar month, that transaction will count towards the minimum spend and bonus cap for the month it was made.

How does this compare to other cards?

For the period of the promotion, the Maybank Horizon Visa Signature becomes the highest-earning uncapped general spending card for FCY spending.

| 💳 FCY Earn Rates by Card (For general spending cards with uncapped earn rates only) |

||

| Card | Earn Rate | Remarks |

Maybank Horizon Maybank HorizonApply |

3.2 mpd | Min. S$800 spend per c. month Review |

StanChart Visa Infinite StanChart Visa InfiniteApply |

3 mpd | Min. S$2K spend per s. month Review |

UOB PRVI Miles UOB PRVI MilesApply |

2.4 mpd | Review |

HSBC TravelOne HSBC TravelOneApply |

2.4 mpd | Review |

OCBC VOYAGE (Premier, PPC, BOS) OCBC VOYAGE (Premier, PPC, BOS)Apply |

2.3 mpd | Review |

HSBC Visa Infinite HSBC Visa InfiniteApply |

2.25 mpd | With min. S$50K spend in previous m. year Review |

OCBC Premier Visa Infinite OCBC Premier Visa InfiniteApply |

2.24 mpd | |

DBS Vantage DBS VantageApply |

2.2 mpd | Review |

OCBC VOYAGE OCBC VOYAGEApply |

2.2 mpd | Review |

OCBC 90°N Card OCBC 90°N CardApply |

2.1 mpd | Review |

| All other options earn 2 mpd or less | ||

Its closest competitor is the StanChart Visa Infinite with 3 mpd on FCY spend, but this:

- Has a higher FCY fee of 3.5% (compared to 3.25% for Maybank)

- Requires a higher minimum spend of S$2,000 per statement month (compared to S$800 for Maybank)

- Has an income requirement of S$150,000 (compared to Maybank’s S$30,000)

- Has a non-waivable annual fee of S$594 (compared to Maybank with the first three years free)

That said, we need to keep in mind that there are a lot of ways to earn 4-6 mpd on FCY spend, albeit with a cap. Top-of-mind options include the UOB Visa Signature Card, the Citi Rewards Card (paired with Amaze), and the UOB Lady’s Cards.

Refer to the article below for a rundown of the options.

Therefore, you should ensure you’ve maxed out those other cards first, before using the Maybank Horizon Visa Signature to soak up what’s leftover.

Welcome gift

Maybank is currently offering a welcome gift to new-to-bank customers, defined as those who:

- do not have an existing principal Maybank credit card or CreditAble account at the time of application, and

- did not cancel a principal Maybank credit card or CreditAble account within 9 months prior to application

New-to-bank customers who apply for a Maybank Horizon Visa Signature Card and CreditAble account will have a choice of one of the following gifts:*

- Samsonite ENOW SPINNER 69/25 EXP (worth S$570)

- Apple AirPods (3rd Gen) with Lightning Charging Case (worth S$261.40)

- S$200 cash credit

- 10,000 KrisFlyer miles (in the form of 25,000 TREATS points)

*You need not select your gift at the time of application; rather, you’ll select it at the time of fulfillment.

Cardholders must spend a minimum of S$600 per month for the first two consecutive months after approval. For example, if your card is approved on 15 April 2024, your spend periods are:

- Spend Period 1: 15 April 2024 to 14 May 2024

- Spend Period 2: 15 May 2024 to 14 June 2024

There is no need to charge anything to the CreditAble account.

If you do not want to apply for a CreditAble account, you can still receive the welcome gift provided you spend at least S$650 per month for the first two consecutive months after approval. All other terms remain the same.

It may sound almost blasphemous, but my recommendation is not to take the miles. 10,000 KrisFlyer miles are worth around S$150 (based on my valuation of 1.5 cents per mile), so the S$200 cash credit feels more enticing to me. Of course, if you fancy a pair of AirPods or luggage, those two would be much better deals than the miles as well.

Gifts will be fulfilled within five business days after meeting the minimum spend requirement. Yes, that’s not a typo. Unlike other banks, which take months to award your gifts, Maybank does it in just five days- I personally tested this last year and was amazed at how fast it was.

This promotion does not currently have an end date. The T&Cs for this offer can be found here.

Overview: Maybank Horizon Visa Signature

|

|||

| Apply | |||

| Income Req. | S$30,000 p.a. | Points Validity | 12-15 mo. |

| Annual Fee | S$180 |

Fee Waiver | First 3 years free |

Here’s a recap of the new-and-improved Maybank Horizon Visa Signature, where the key factor determining the earn rates is whether you spend less than S$800 or S$800 and more per calendar month.

Cardholders who spend <S$800 per calendar month

| Currency | Category | Earn Rate |

| Local | Education Insurance Medical Utilities |

0.24 mpd |

| Dining Food Delivery Supermarkets Transport Petrol Department and Retail Stores Air Tickets Hotels Cruises Travel Packages Car Rental |

1.2 mpd | |

| All other local spend | 0.4 mpd | |

| FCY | All FCY spend | 1.2 mpd |

Cardholders who spend less than S$800 per calendar month will earn at one of three different tiers:

- 0.24 mpd

- 0.4 mpd

- 1.2 mpd

Maybank has carved out a separate tier for education, insurance, medical and utilities. These will earn just 0.24 mpd, which is better than the nothing that most other banks offer.

Maybank has also added an extensive list of local transactions that will earn 1.2 mpd.

Any local transaction that does not fall into the MCCs above will earn 0.4 mpd, while all FCY transactions will earn 1.2 mpd.

Cardholders who spend ≥S$800 per calendar month

| Currency | Category | Earn Rate |

| Local | Education Insurance Medical Utilities |

0.24 mpd |

| Dining Food Delivery Supermarkets Transport Petrol Department and Retail Stores Hotels Cruises Travel Packages Car Rental |

1.2 mpd | |

| All other local spend | 0.4 mpd | |

| Local or FCY | Air Tickets | 3.2 mpd* |

| FCY | All FCY spend | 3.2 mpd |

| *Capped at S$10,000 per calendar month |

||

Cardholders who spend at least S$800 per calendar month will earn at one of four different tiers:

- 0.24 mpd

- 0.4 mpd

- 1.2 mpd

- 2.8 mpd

What’s changed between this and the previous section is that cardholders will earn 3.2 mpd on air tickets (temporarily upsized from the usual 2.8 mpd), capped at S$10,000 per calendar month. Any spending beyond this will earn 1.2 mpd.

They will also earn an uncapped 3.2 mpd on FCY spend (temporarily upsized from the usual 2.8 mpd for the May and June 2024 period), regardless of whether it’s online or offline.

For a detailed review of the card, refer to the following article.

Conclusion

The Maybank Horizon Visa Signature has brought back its 3.2 mpd earn rate for the May and June 2024 peak travel season, and if you’ve already exhausted the cap on your Amaze pairings, then this would be an excellent backup option.

Moreover, if you’re buying air tickets and haven’t chosen the Travel category for your UOB Lady’s Cards, then a 3.2 mpd earn rate on up to S$10,000 per month is likewise fantastic (I suppose you could also use the DBS Woman’s World Card for 4 mpd on air tickets, but it feels a bit wasteful given how you could utilise that cap for other things).

I never thought I’d be using a Maybank card so much, but the Horizon is really growing on me.

Looks interesting. However, depending on the minimum or transfer block, may end up with orphaned miles?

A Maybank spokesperson has confirmed that you will earn the 3.2 mpd rate on charitable donations, education, insurance, private hospitals and utilities, so long as it’s charged in FCY! This would be fantastic for anyone who has overseas university fees to pay.

I am trying to understand how this was confirmed… haha – Hi MB, can you confirm that the bank will still dish out the full bonus for spending on those foreign merchants with supposedly low MDR?

Hi Aaron, was checking thru the TnC and it states that you must apply for both to be eligible for the gifts. Only when yr CreditAble account is rejected, then u will be subjected to the other condition of $650. So there is an inaccuracy in yr post if this is true… 4. To be eligible to receive a S$200 cashback, or AirPods (3rd generation) with Lightning Charging Case, or Samsonite ENOW Spinner 69/25 Luggage, or 10,000 KrisFlyer miles * (each an “Activation Gift”). Applicants must during the Promotion Period: (a) apply for at least one new Eligible Card as… Read more »

nope. maybank has confirmed you dont need to apply.

Thanks for the confirmation!

Hey there! Maybanks website’s T&Cs say that bonus “treats points” (8x) awarded for air tickets are capped at 50,000 TP, which is equivalent to a $6250 cap, rather than $10k.

Am I interpreting it correctly?