Back in June 2024, the HSBC Travel One Card enhanced its welcome offer by bumping it up to 30,000 bonus miles (previously: 20,000), which given the minimum spend of just S$500, represents one of the best sign-up offers in Singapore on a spend-to-miles ratio.

This offer was originally set to lapse on 31 August 2024, but has now been extended for applications submitted by 30 September 2024.

While I have concerns about the longevity of the TravelOne Card, there’s nothing objectionable at all about the first year’s value proposition: 30,000 miles, eight lounge visits, fee-free conversions with small enough blocks to avoid orphan miles, and the widest range of transfer partners in Singapore.

There should be more than enough in there to recover the first year’s annual fee, and then some.

HSBC TravelOne Card 30,000 miles welcome offer

|

|||

| Apply |

HSBC TravelOne Cardholders who apply between 21 June to 30 September 2024 will receive 30,000 bonus miles (in the form of 75,000 HSBC points) when they:

- Pay the annual fee of S$196.20

- Spend at least S$500 by the end of the month following approval

- Provide marketing consent during application (an important step that people sometimes forget!)

There used to be a first year fee waiver option, without the bonus miles, but that has been discontinued.

This offer is open to all applicants, regardless of whether or not they currently hold a HSBC credit card. However, if they have cancelled a HSBC TravelOne Card in the past 12 months, they will not be eligible to receive the welcome offer again.

Bonus miles are on top of the base miles that TravelOne Cardholders normally earn, namely:

- 1.2 mpd for local currency spend

- 2.4 mpd for foreign currency spend

For example, if you spend the full S$500 in local currency, you’ll receive a total of 30,600 miles (30,000 bonus, 600 base).

Since the S$196.20 annual fee must be paid, you’re basically paying 0.65 cents per mile, which is an extremely compelling price.

| 🎁 Alternative SingSaver offer |

|

Do note that gifts rotate frequently, and the abovementioned ones are valid till 5 September 2024. The S$196.20 annual fee must be paid, and a minimum spend of S$1,000 is required (full T&Cs here). If you’re interested in this offer, apply via the link below |

| SingSaver offer |

What counts as qualifying spend?

Cardholders must make a minimum qualifying spend of S$500 by the end of the month following card approval.

| Card Account Opening Date | Qualifying Spend Period |

| 21-30 Jun 2024 | 21 Jun to 31 Jul 2024 |

| 1-31 Jul 2024 | 1 Jul to 31 Aug 2024 |

| 1-31 Aug 2024 | 1 Aug to 30 Sep 2024 |

| 1-30 Sep 2024 | 1 Sep to 31 Oct 2024 |

| 1-14 Oct 2024 | 1 Oct to 30 Nov 2024 |

You basically have anywhere between 1-2 months to meet the minimum spend, depending on when your card is approved. Try to get approved early in the month so you have more time to make the minimum spend.

Qualifying spend includes all online and offline retail transactions, excluding the following:

|

The key exclusions to note here are insurance, utilities, education, government transactions as well as CardUp/ipaymy. These were all excluded from 1 July 2020 onwards as part of HSBC’s revised rewards terms and conditions.

When will bonus miles be credited?

The 30,000 bonus miles will be credited (in the form of 75,000 HSBC points) within 90 days from the card opening date, provided the eligibility criteria is met.

In my personal experience, I applied in early May and received the bonus points on 20 July 2023.

Terms & Conditions

The terms & conditions of this welcome offer can be found here.

What can you do with HSBC points?

HSBC points earned on the TravelOne Card can be transferred to 21 airline and hotel partners, as shown below.

Airlines

| ✈️ HSBC TravelOne Airline Partners | |

| Frequent Flyer Programme | Conversion Ratio (HSBC Points : Partner) |

| 50,000 : 10,000 | |

| 40,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

|

30,000 : 10,000 |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 |

|

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

|

25,000 : 10,000 |

Hotels

| 🏨 HSBC TravelOne Hotel Partners | |

| Hotel Programme | Conversion Ratio (HSBC Points : Partner) |

|

30,000 : 10,000 |

| 25,000 : 5,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

Do remember that not all partners share the same ratio, so your effective mpd and size of the welcome offer depends on which partner you choose.

The quoted figures of 1.2/2.4 mpd and 30,000 miles only apply if you choose a partner with a 25,000 points = 10,000 miles transfer ratio. Otherwise, it can go as low as 0.6/1.2 mpd and 15,000 miles on the other end of the spectrum if you pick a partner with a 50,000 points = 10,000 miles transfer ratio.

| Transfer Ratio (Points : Miles) |

HSBC T1 (Local)* |

HSBC T1 (FCY)^ |

| 25,000 : 10,000 | 1.2 mpd | 2.4 mpd |

| 30,000 : 10,000 | 1 mpd | 2 mpd |

| 35,000 : 10,000 | 0.86 mpd | 1.71 mpd |

| 40,000 : 10,000 | 0.75 mpd | 1.5 mpd |

| 50,000 : 10,000 | 0.6 mpd | 1.2 mpd |

| *3 points per S$1 on local spend ^6 points per S$1 on FCY spend |

||

Conversions must be done via the HSBC Singapore app (Android | iOS) and are processed instantly, with the exception of the following:

- Club Vistara: Within 5 business days

- Hainan Fortune Wings Club: Within 5 business days

- Japan Airlines Mileage Bank: Within 10 business days

Transfers are free of charge till 31 January 2025.

While the minimum transfer block is 10,000 miles/points (Accor: 5,000 points), the subsequent block is just 2 miles (Accor: 1 point). In other words, you could choose to transfer 10,002 miles or 20,958 miles, which helps you avoid orphan points.

HSBC points are now pooled across all cards, ever since May 2024.

Other card benefits

Four complimentary lounge visits

|

|

| Lounge Benefit T&Cs |

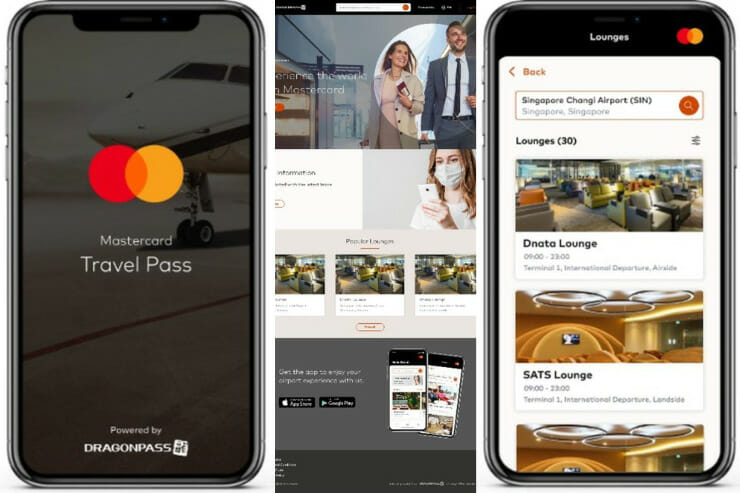

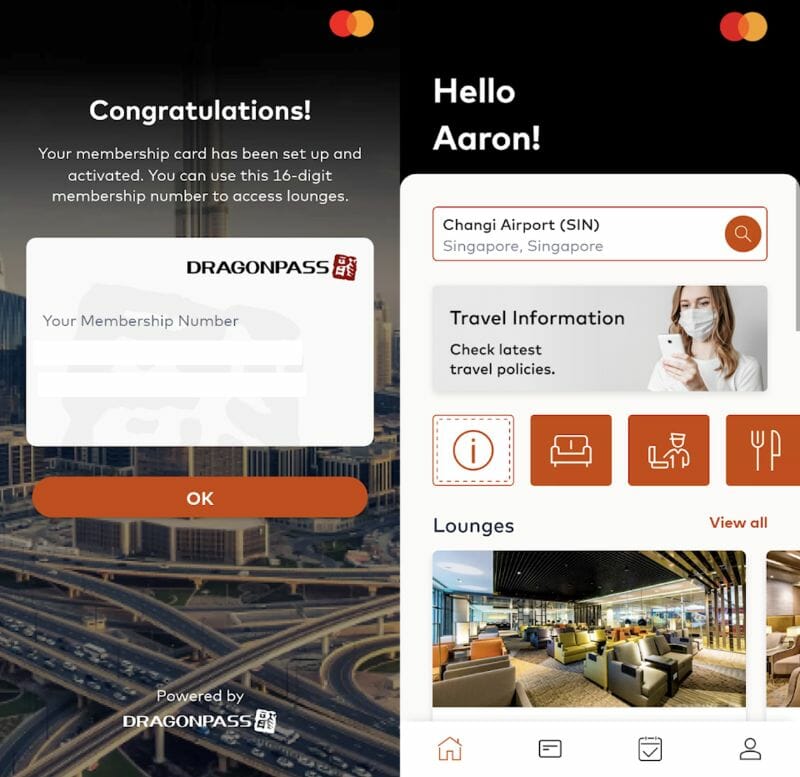

Principal HSBC TravelOne Cardholders enjoy four complimentary lounge visits per year, provided via DragonPass.

Allowances are awarded by calendar year, which means you basically enjoy eight visits in your first membership year. For example, if your card is approved in June 2024, you will be awarded:

- On date of approval: 4x visits (expires 31 December 2024)

- On 1 January 2025: 4x visits (expires 31 December 2025)

Allowances cannot be rolled over to the following year, so be sure to fully utilise your visits by the end of the calendar year. For avoidance of doubt, using the second calendar year’s allotment does not preclude you from cancelling the card at the end of the first membership year, if that’s what you wish to do.

Here’s how to start enjoying the benefit:

- Step 1: Download Mastercard Travel Pass app (Android | iOS)

- Step 2: Select ‘Sign up’ to register for the programme, or log on to your account if you’re already a member

- Step 3: Enter your HSBC TravelOne Card details for a one-time verification

- Step 4: Complete your personal details for Mastercard Travel Pass account registration (enter your name as shown in your passport)

- Step 5: Set your account password

The main catch is that these visits cannot be shared with a guest.

Entertainer with HSBC

|

| ENTERTAINER with HSBC |

Principal HSBC TravelOne Cardholders receive a complimentary ENTERTAINER with HSBC app membership, which includes:

- 1-for-1 dine-in offers at more than 150 merchants across Singapore, including Sushi Jiro @ PARKROYAL COLLECTION, Bangkok Jam, Paul Bakery and more

- 1-for-1 takeaway offers at more than 50 merchants including Canadian 2 For 1 Pizza, Andersen’s of Denmark and more

- Up to 50% off leisure, attraction and wellness offers at BOUNCE Singapore, Spa Infinity, Virtual Room and more

- 1-for-1 stays in rooms at over 175 hotels around the world

You’ll need an activation key to start using your ENTERTAINER membership. This should have been emailed to you; if not you’ll need to call 1800 4722 669 to get it from customer service.

Complimentary travel insurance

| Accidental Death | S$75,000 |

| Medical Expenses | S$150,000 |

| Travel Inconvenience | Flight Delay: S$150 Baggage Delay: S$1,500 Lost Baggage: S$1,500 |

| Policy Wording | |

HSBC TravelOne Cardholders receive complimentary travel insurance when they:

- Use their TravelOne Card to purchase air tickets, or

- Use their TravelOne Card to pay for the taxes and surcharges on a ticket redeemed with airline miles

This provides coverage of S$75,000 for accidental death, S$150,000 for overseas medical expenses, S$1 million for emergency medical evacuation, as well as coverage for travel inconveniences like flight delays and lost luggage.

Do note that there is no coverage for personal liability or rental vehicle excess, so you may need to purchase supplementary coverage if this is important to you.

Conclusion

|

|||

| Apply |

The HSBC TravelOne Card has extended its 30,000 miles welcome offer to 30 September 2024, while keeping the minimum spend and all other eligibility criteria the same. Even though the first year’s S$196.20 annual fee must be paid, I feel there’s enough here to make it worthwhile.

What’s more, you can apply for both a TravelOne Card and a Live+/Advance Card and enjoy new-to-bank gifts for both, since HSBC sees the two as separate types of products.

For a detailed review of the HSBC TravelOne Card, refer to the post below.

Hi Aaron, can I apply for both a TravelOne Card and the HSBC Visa Infinite Credit Card to enjoy new-to-bank gifts?

yes, though there isn’t actually a new to bank gift for hsbc vi card (unless you’re referring to the 35k welcome miles which everyone gets anyway)

Ah thank you! So it’s not a new to bank gift! Thank you very much

Thinking of getting this and then cancel revolution card. Will the points be transferred over since points can pool?

no, points earned from revolution will be lost once u cancel. pooling only affects redemption in that you redeem from a common pool,with expiring points redeemed first.. but backend, points earned from each card follows that card.

Ohhh!… So can apply this card to get the bonus miles, then redeem all the points, then cancel the revolution card then?

no it doesn’t transfer over. points pool only for redemption purpose.

Out of curiosity: Is there anything DragonPass unlocks which Priority Pass doesn’t?

Railway stations in China

anyone realised that the card application via singsaver is not working? had my details filled using singpass and nothing happens after clicking continue.. and manual filling in keeps kicking me back to select card page

Does this promo stack with any singsaver sign up promo?

I would like to know too

Is the 1st bullet exclusion is spending in foreign currency not counted for a minimum of $500 spent?

Any updates on the forex spend?

Hi Aaron, can I check when do they charge the first year annual fee?

I just called in because I don’t see the annual fee in the transaction history. CS told me 90 days after card approval date. And then in the next cycle after fee is paid then the miles (as points) will be credited.

What do you mean by next cycle? So the following month?

Hi Aaron, I check with HSBC agent and they told me the annual fees cannot be waived even if I don’t want the welcome gift. So which is correct? Thanks

hmmm it looks like they’ve removed the first year free option from the website. will update, thanks!

Hi Aaron, do Amaze transactions count towards fulfilling the sign up spend requirement?

Hi guys, just to share that I had applied for this HSBC T1 credit card in May 2204 and received the 50k points (=20k miles) in Aug 2024. I wanted to accumulate more and redeem by 31 Jan 2025 to avoid charges. The curious thing is that 2 weeks later after the welcome bonus points were credited, my card got hit with fraudulent charges so I had to cancel the card & all the points earned disappeared. I was told that the missing points will be transferred to the new card which I’m waiting for a week now. The frustrating… Read more »

I applied for the card on 3rd of July and up till today the 30th of September they have yet to charge me annual fee. I have been following up with HSBC but they keep on repeating within 90 days. The customer service person confirmed that I have fulfilled all the criteria so all that’s pending is the annual fee. Usually for Credit cards from other banks, I notice the annual fee is the first thing charged but for HSBC, it isn’t? Anyone else has experienced the same? Does HSBC wait until the 90th day to charge? Or delay it… Read more »

I also waiting for the annual fee to be charged so that i can fulfill the sign up promo from singsaver.

Hi Aaron,

I’ve applied the card in Sept and spent the $500.. the statement for Sept is out but annual fees are not charged yet. When will it be charged? I’m gunning for the 30k milles.

Tks!

hello folks, just wanted to share and ask for advise. I applied for the Travelone card in August 2024. There was a long delay to the 75k points welcome bonus for the travelone card so I called them three times starting in January 2025 to ask about this and they said they would check with their product team. The customer service staff have checked and verified that I have fulfilled all the conditions that Aaron has laid out above. Pay the annual fee of S$196.20 Spend at least S$500 by the end of the month (30 Sept 2024) Provide marketing… Read more »