| ⚠️ Story update: HeyMax has reverted to the old process for cash-for-miles, i.e. the single-use virtual Visa debit card. |

HeyMax, the fintech startup better known for its MCC lookup tool, also has a rewards currency known as Max Miles.

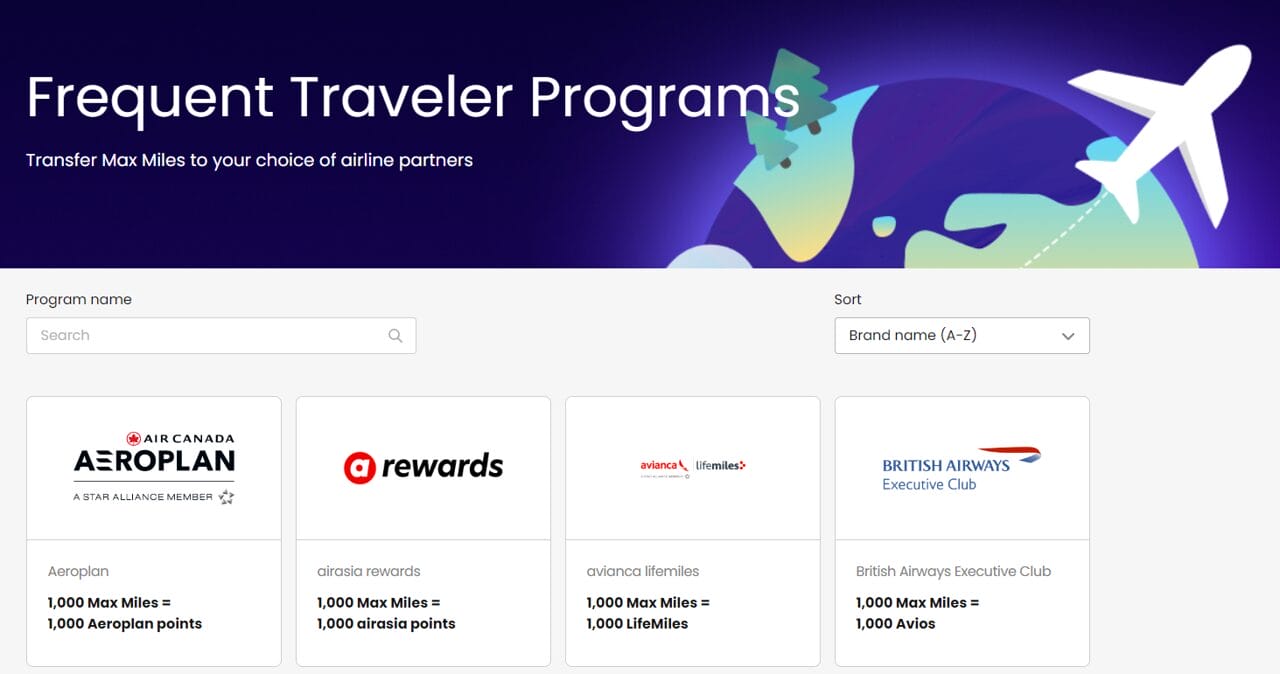

Max Miles can be earned at 150+ merchants via the Max Shopping Portal, and are transferrable to 25 airline and hotel loyalty programmes at a 1:1 ratio, without any fees.

|

| 👍 700 Max Miles joining bonus |

| Sign up for a HeyMax account and get up to 700 Max Miles as a welcome bonus after adding a card, purchasing a voucher and viewing the redemption page |

| 700 bonus Max Miles |

HeyMax is now making some changes to its transfer process, and while it’s generally positive, there’s still some important things to take note of.

HeyMax changes to Cash-for-Miles

As a reminder, HeyMax’s 25 transfer partners are currently split into two types: direct points transfer partners, and cash-for-miles.

| Direct Points Transfer Partners | Cash-For-Miles | |

| Minimum Conversion | 1,000 Max Miles | 10,000 Max Miles |

| Conversion Blocks | 100 Max Miles = 100 partner points or miles | 1,000 Max Miles = 1,000 partner points or miles |

| Number of Partners | 14 | 11 |

| Transfer Fees | None | None |

Direct points transfers work just like regular credit card points transfers: you visit a portal, select the partner you want, and transfer the points over.

Cash-for-miles works very differently, and involves purchasing the miles directly from the airline or hotel via their official website.

Previous process

Here’s how the cash-for-miles process previously worked:

- Customer fills out an online form

- HeyMax customer service issues a single-use virtual Visa debit card

- Customer uses this card to buy the miles or points themselves (back-end controls ensured the card would only work for points purchases).

This was a serviceable, if clunky solution. In my experience, the cards didn’t always work the first time round, and some back and forth with customer service was sometimes needed.

Also, Points.com (which powers most if not all of the cash-for-miles partners) has a policy where purchases made with a new card number are automatically held for 24-48 hours as an anti-fraud measure. And since every virtual Visa is a new card number, you’ll encounter this wait every time.

New process

Here’s how the cash-for-miles process now works:

- Customer purchases the miles or points himself, using his own credit card

- Customer submits an online form with the number of points purchased, as well as proof of purchase

- HeyMax reimburses him in cash via PayNow within five business days

The obvious advantage here is that you can now earn additional miles from your credit card for the purchase, versus previously where you had to use HeyMax’s virtual Visa.

The downside is that there is some credit risk, however brief, in the period between when you’ve paid and when HeyMax reimburses you. Also, HeyMax’s reimbursements will be based on the mid-market rate, and since all cash-for-miles purchases are in USD, you’ll have to eat the ~3.25% FCY fee charged by your card.

As always, all purchases are subject to the individual programme’s rules and regulations, including annual purchase caps (for example, World of Hyatt only allows members to buy a maximum of 55,000 points pre-bonus each calendar year).

HeyMax transfer partners

Here’s a recap of HeyMax’s 25 airline and hotel transfer partners, split into direct versus cash-for-miles.

| ✈️ HeyMax Direct Points Transfers | |

|

|

| ✈️ HeyMax Cash-for-Miles | |

|

|

All direct points transfers are processed instantly, with the exception of Hainan Airlines Fortune Wings Club (5 business days) and JAL Mileage Bank (21 business days).

Cash-for-miles fulfilment can be instant if you’ve made a previous purchase with the airline or hotel programme using the same credit card before, but otherwise you’ll usually need to wait at least 24 hours.

For a full rundown of the Max Miles ecosystem, refer to the post below.

What card to use for cash-for-miles?

Cash-for-miles purchases are processed by Points.com in USD and code as MCC 7399, so you can use the following cards to maximise the miles on your purchase.

| Card | Earn Rate | Remarks |

Citi Rewards Card Citi Rewards CardApply |

4 mpd | Cap of S$1K per s. month |

UOB Visa Signature UOB Visa SignatureApply |

4 mpd | Min S$1K, max S$2K FCY spend per s. month |

Maybank Visa Infinite Maybank Visa InfiniteApply |

3.2 mpd (till 31 Aug 24) |

No cap |

SCB Visa Infinite SCB Visa InfiniteApply |

3 mpd | Min S$2K per s. month |

UOB PRVI Miles UOB PRVI MilesApply |

2.4 mpd | No cap |

| S. Month= Statement Month | C. Month= Calendar Month | ||

You should not use the DBS Woman’s World Card nor the HSBC TravelOne Card for these purchases as MCC 7399 does not qualify for points.

Conclusion

|

| 👍 1,000 Max Miles joining bonus |

| Sign up for a HeyMax account and get up to 1,000 Max Miles as a welcome bonus |

| 1,000 bonus Max Miles |

HeyMax has revamped its cash-for-miles redemption process, which now requires customers to purchase miles first and then seek reimbursement.

This has the added benefit of letting you earn miles on your personal card, though there is some credit risk involved, and the reimbursed amount will be slightly lower than the actual outlay because of the FCY fees.

All things considered, HeyMax has some very useful transfer partners that aren’t available through cards in Singapore, so it’s worth exploring if you need to top-off an account for a redemption.

If anyone working at HeyMax reads this: Is there progress with SQ?