Trust Bank, better known for its free rice giveaways, has launched its second-ever credit card: the Trust Cashback Card.

Unlike the inaugural Trust Link Card which awards LinkPoints, the Trust Cashback card awards…wait for it…cashback.

Even though cashback isn’t really my area of speciality, I figured I’d take a look, just in case there was more free rice to be harvested.

But the more I analysed it, the more I felt compelled to write something. That’s because the Trust Cashback Card’s claims of 15% cashback are extremely misleading, making me wonder what on earth they were thinking.

And since it’s apparent that Trust’s love language is emoji — its T&Cs are saturated with them — I am going to try and communicate in a language they understand 😘.

💳 Overview: Trust Cashback Card

Trust Cashback Card Trust Cashback Card |

|||

| Card T&Cs | |||

| Income Req. | S$30,000 p.a. | Annual Fee |

None |

| Regular Earn Rate |

1% cashback | Bonus Earn Rate | Up to 15% cashback (not really) |

| FCY Fee | None | Emoji Level | 🤯🤯🤯 |

The Trust Cashback Card has a minimum income requirement of S$30,000 per annum 💰, and no annual fee. You’ll receive a digital card in the app immediately upon approval, with a numberless physical card later sent to your mailing address.

If you already have a Trust Link Card, your credit limit will be shared among both cards.

Where perks are concerned, the Trust Cashback Card has three main selling points. I’d group these into the good, the bad and the (really) ugly.

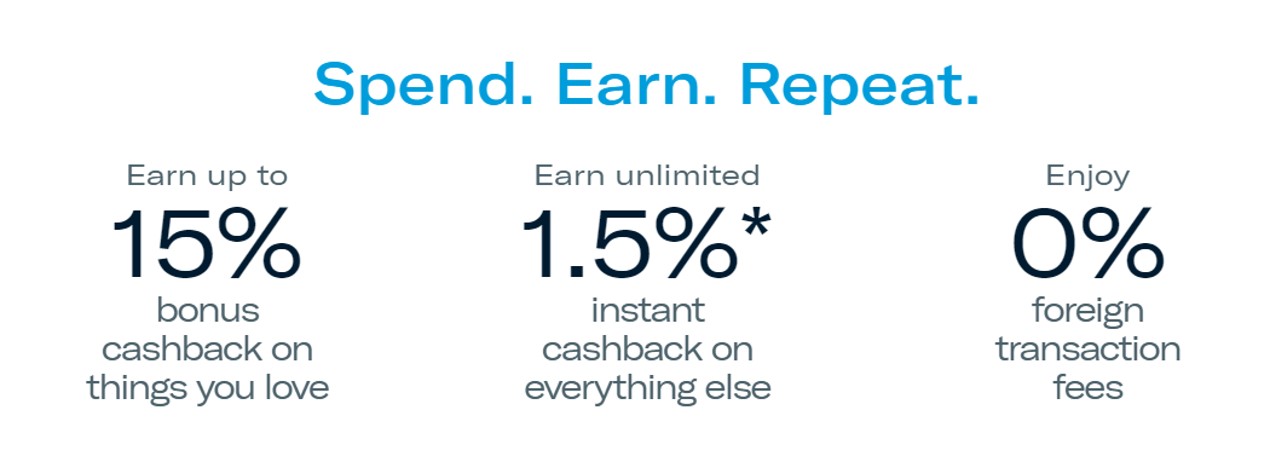

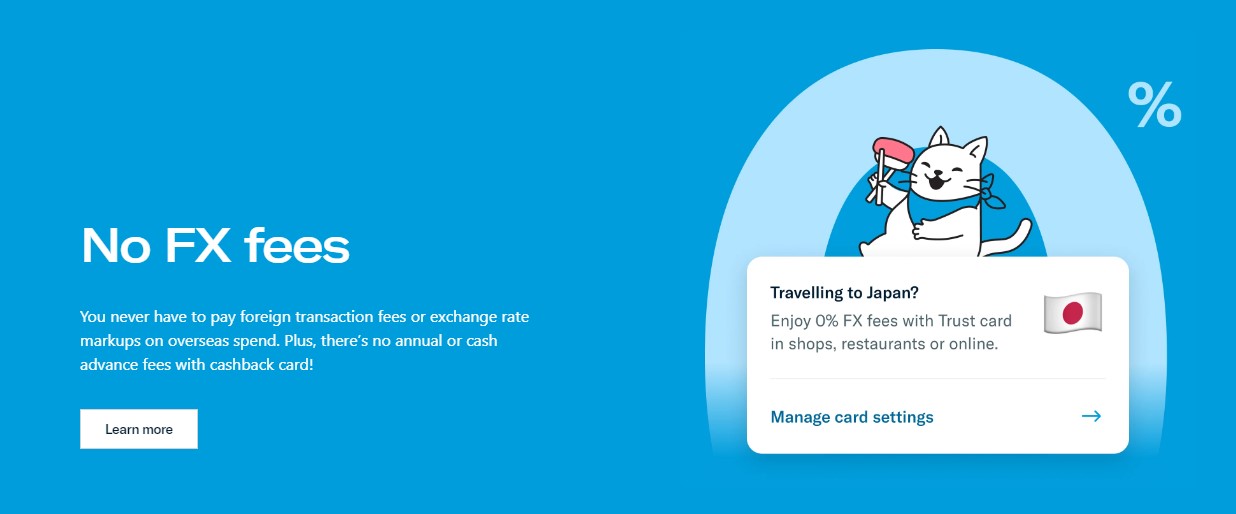

👍 The good: 0% FCY fees, instant base cashback

Just like the Trust Link Card, the Trust Cashback Card has zero FCY transaction fees, not even the usual 1% fee charged by Visa. In other words, you’ll pay whatever the Visa rate happens to be for the day (usually a ~0.3% spread over interbank rates), with no further markup.

This makes it a good option for overseas spending, especially in scenarios where you can’t earn rewards such as charitable donations, education, government organisations and insurance premiums. In these situations, it’s simply a question of minimising the total transaction cost, and a card with zero FCY transaction fees will let you do that.

I suppose the other good thing is that the base cashback (see next section) is credited as soon as the transaction posts, which is better than other banks which credit it at the end of the month, or offset the following month’s bill.

👎 The bad: 1% cashback

Contrary to what the banner above says, the Trust Cashback Card earns a very underwhelming 1% cashback on general spending. The 1.5% cashback rate is only available for new-to-Trust customers, and only on a promotional basis till 31 December 2024.

| ❓ Definition: New-to-Trust |

|

New-to-Trust customers are defined as those for whom the Trust Cashback Card is the first product they have successfully signed up for with Trust Bank. So if you already have a Trust Bank account but no Trust credit card, you won’t count as a new-to-Trust customer when you sign up for the Trust Cashback Card. |

Given that the market is offering up to an uncapped 1.7% cashback (or 2% cashback with a S$200 monthly cap, which you wouldn’t trigger unless you spent more than S$10,000), the Trust Cashback Card ranks lowest in this segment.

| 💳 General Spending Cashback Cards (without minimum spends) |

||

| Annual Fee | Cashback | |

DCS Ultimate Platinum Card DCS Ultimate Platinum CardApply |

S$196.20 (FYF) |

2% (capped at S$200 per month) |

Mari Credit Card Mari Credit CardApply |

N/A | 1.7% |

UOB Absolute Cashback UOB Absolute CashbackApply |

S$196.20 (FYF) |

1.7% |

BOC Visa Infinite BOC Visa InfiniteApply |

S$381.50 (FYF) |

1.6% |

Citi Cash Back+ Card Citi Cash Back+ CardApply |

S$196.20 (FYF) |

1.6% |

OCBC Infinity Cashback OCBC Infinity CashbackApply |

S$196.20 (FYF) |

1.6% |

ICBC Chinese Zodiac Card ICBC Chinese Zodiac CardApply |

S$150 (F3YF) |

1.6% |

Maybank FC Barcelona Card Maybank FC Barcelona CardApply |

S$130.80 (F2YF) |

1.6% |

AMEX True Cashback Card AMEX True Cashback CardApply |

S$174.40 (FYF) |

1.5% |

SC Simply Cash Card SC Simply Cash CardApply |

S$196.20 (FYF) |

1.5% |

Trust Cashback Card Trust Cashback CardApply |

Free | 1%^ |

| FYF= First Year Free, F2YF= First 2 Years Free, F3YF= First 3 Years Free ^1.5% for new-to-Trust customers until 31 December 2024 |

||

So there’s absolutely no reason why you should be using the Trust Cashback Card for general spending (at least in SGD, maybe there’s a case for FCY), as you’d be missing out on incremental cashback easily earned with any other card on the market.

💩 The ugly: 15% bonus cashback

“Well,” says Trust. “1% cashback may be mediocre, but this is really gonna knock your socks off: 15% cashback!”

Um, no. Here’s where the Trust Cashback Card becomes straight out misleading 😠.

Trust advertises that cardholders can earn 5%, 10% or 15% bonus cashback on their preferred bonus category, subject to the following minimum monthly spends and quarterly caps.

| Bonus Cashback | Min. Monthly Spend (for 3 consecutive months)* |

Quarterly Cap |

| 5% | S$500 | S$30 |

| 10% | S$1,000 | S$100 |

| 15% | S$2,000 | S$250 |

| *Waived in the first calendar month of approval. For example, if your card is approved on 20 Sep 2024, you can earn bonus cashback without meeting the min. spend for September | ||

Where bonus categories are concerned, Trust is taking a leaf out of the UOB Lady’s Card playbook by allowing cardholders to select their preferred bonus category from six options, changeable every quarter.

| Category | Description | MCCs |

|

Dining |

|

5462, 5499, 5811, 5812, 5814 |

|

Shopping |

|

5262, 5309, 5310, 5311, 5331, 5399, 5611, 5621, 5631, 5641, 5651, 5655, 5661, 5681, 5691, 5699, 5940, 5941, 5944, 5946, 5947, 5948 |

|

Travel |

|

3000 – 3308, 3501 – 3839, 4411, 4511, 4582, 4722, 4723, 5962, 7011, 7012, 7033 |

|

Wellness |

|

5912, 5977, 5997, 7230, 7297, 7298, 7997, 8031, 8041, 8049 |

|

Transport |

|

3351 – 3441, 4111, 4112, 4121, 4131, 4457, 4784, 4789, 5521, 5541, 5542, 5552, 5983, 7512, 7513, 7519, 7523 |

|

Entertainment |

|

4899, 5733, 5735, 5813, 5815, 5816, 5945, 7832, 7841, 7922 |

| Bonuses apply to online and offline spending, whether in SGD or FCY | ||

| 📅 How is quarter defined? |

| Unlike the UOB Lady’s Card, where bonus categories follow the calendar quarter, Trust Bank defines a quarter as 3 consecutive months starting from the month your Trust Cashback Card is approved. |

Unlike base cashback, which is credited upon transaction posting, bonus cashback will be credited on the first day after your quarter ends.

Now, here’s my beef: 15% cashback would be amazing, but it’s not actually possible 😡.

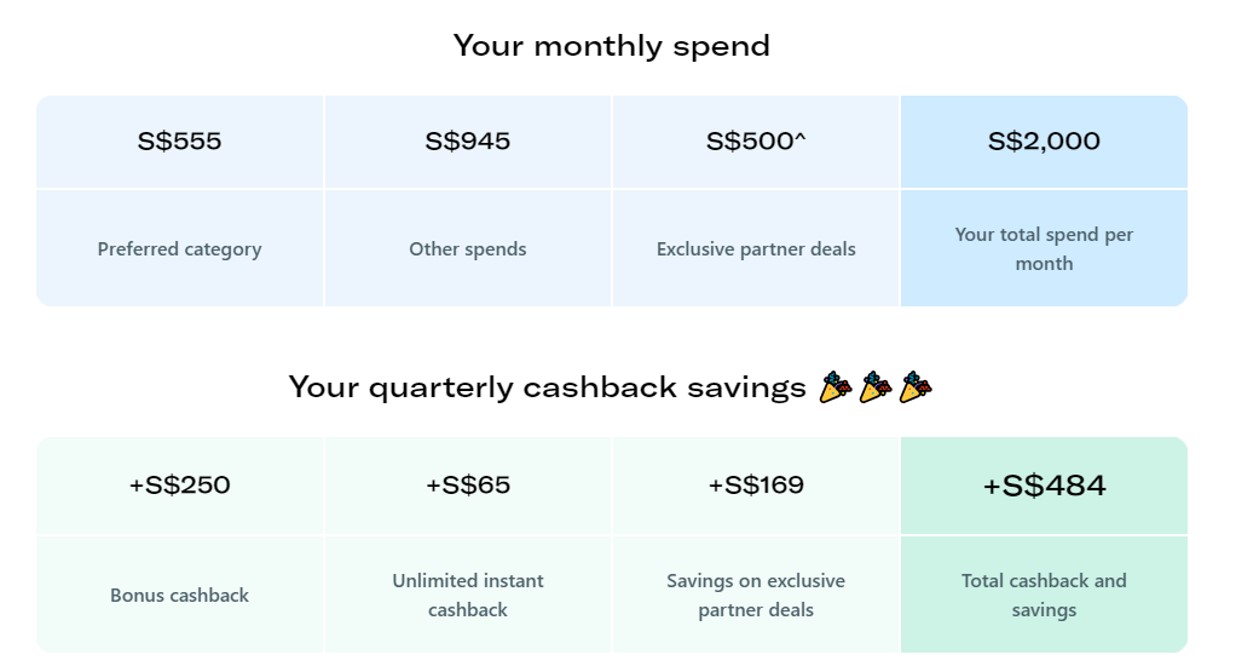

Let’s look at these figures more closely. To earn 15% cashback, I would need to spend at least S$2,000 per month for three consecutive months, with a quarterly cap of S$250.

The first hint that something is wrong is the fact that 15% of S$6,000 (S$2,000 x 3 months) is $900 per quarter. Where did the S$650 difference go🤷?

Into Trust’s pocket, apparently. Out of the S$6,000 spend you need each quarter to trigger the 15% cashback, only the first S$1,667 is rewarded at 15%. The remaining S$4,333 earns just 1% cashback!

| S$1,667 | S$4,333 |

| 15% cashback | 1% cashback |

Remember, you can’t just spend till S$1,667 and call it a day. You must meet the S$6,000 minimum spend each quarter for the 15% cashback on the first S$1,667 to become a reality.

Once you factor in the 1% base cashback on the remaining S$4,333, your total cashback is S$293.33, which means the real world best-possible cashback outcome is 4.9% (S$293.33/S$6,000). That is still a good figure, but it is not 15%.

| ⚠️ No 1% cashback on bonus category! |

|

There’s another gotcha here. The 1% base cashback is not awarded on your choice of bonus category. This means that in our example above, if I spent the entire S$6,000 on the bonus category, I would only earn S$250 cashback, an effective return of 4.17%. For you to attain 4.9%, you must spend S$1,667 on the bonus category, and S$4,333 on non-bonus categories. This also means that if you just intend to use the Trust Cashback Card as a 1% cashback card, you’d better pick a bonus category you DON’T regularly spend on, because if you fail to meet the minimum spend, you will earn zero cashback! |

It’s a similar story for the 10% and 5% tiers, as summarised in the table below.

| Advertised Cashback | Real World Cashback | Difference |

| 5% | 2.6% | -2.4% |

| 10% | 4.0% | -6% |

| 15% | 4.9% | -10.1% |

Why am I so worked up about this? Because it’s dishonest. If we stretch this logic further, there is nothing stopping me from advertising an 80% cashback rate, and in the fine print saying “min. spend S$1,000 per month, capped at S$10, 1% afterwards”.

Then when people call me out, I say “I’m not lying! For the first S$12.50, you really do earn 80% cashback!”, conveniently omitting the fact that the remaining S$987.50 you need to spend is rewarded at just 1%.

Or let me put it in more familiar miles terms. Suppose I launched a new credit card and advertised a 100 mpd earn rate. But in the fine print, I say “min. spend S$1,000 per month, capped at 500 miles, 1 mpd afterwards”.

When people start complaining, I give my best kawaii eyes and say “For the first S$5 you really do earn 100 mpd!” You’d get the pitchforks out, and rightly so. In what universe is that the “transparency and simplicity” that Trust likes to harp about?

😿 Not just Trust

Unfortunately, this kind of advertising is not limited to Trust Bank, and points to a bigger problem in the industry.

Back when the DBS yuu card first launched, I criticised its misleading claim of 15% rebates because it was not mathematically possible- some of the spending to unlock the 15% figure had to be on non-bonus spend, which would drag your overall average below the advertised threshold.

At least DBS cleaned up their act when they revamped the yuu Card in April 2023 with an actually-achievable 18% rebate. I can’t say the same about UOB, whose EVOL card similarly skirts the bounds of legality by advertising 10% cashback, when the mathematical best you can do is 6.4% (no room to explain here, but you need to spend at least S$300 at 0.3% to unlock 10% cashback on S$500 spend).

It’s disappointing that no watchdog has stepped in to challenge such misleading claims, because you can bet the average consumer is not doing these sums. DYODD, sure, but how about some truth in advertising?

To be clear: I don’t expect to earn an uncapped 15%. That would be ridiculous. However, if you advertise 15% cashback, I would expect that it’s actually attainable in practice. There is a world of difference between 15% and 4.9%.

💡 Are there any use cases?

Lest people say I’m missing the forest for the trees, I’ll wrap up with a couple of use cases for the Trust Cashback Card.

As mentioned earlier, zero FCY fees are great for situations where rewards can’t be earned. If you have an overseas tuition fee, donation or insurance premium to pay, you might as well keep the total cost as low as possible since it’s a common exclusion category (though refer to my guides for education, charitable donations and insurance– there are a very small number of cards that still earn rewards!).

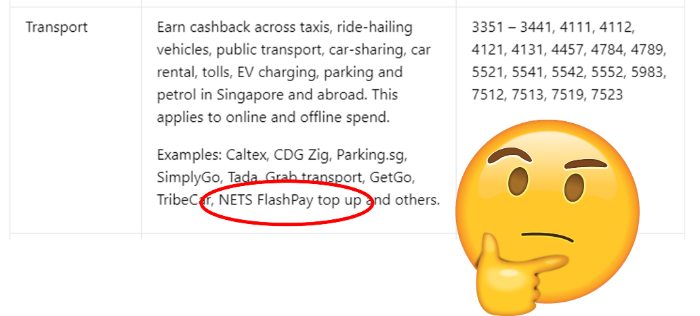

I’m also intrigued that Trust explicitly mentioned Nets FlashPay top-ups as an example of a bonus merchant, under the Transport category.

There’s a reason most banks exclude this category (hint: it rhymes with “lanufactured end”), and I would be very surprised if bonus cashback were actually awarded. After all, it appears to contradict their own T&Cs, which excludes rewards for “any top-ups or payment of funds to any accounts.” We’ll need to field test this, so stay tuned 🤫 .

And finally, misleading marketing aside, a 4.9% cashback rate on your choice of bonus category is good, especially if it’s in foreign currency. I have no criticism about that, other than a caution to be diligent about meeting the minimum spend each month for three consecutive months.

👋 Conclusion

|

|||

| Trust Cashback Card |

The new Trust Cashback Card claims to offer cashback rates of up to 15%, but if we do the math, it’s really up to 4.9% only. Good luck spotting that amidst the media blitz and usual influencer gushing when this officially launches though.

It speaks volumes that Trust feels the need to artificially inflate the quarterly cashback savings figure on its website with a nebulously-defined “savings on exclusive partner deals” (basically the coupons you find in the app, which could be used with any other Trust card anyway)- almost as if it realises the actual cashback figures aren’t nearly as incredible as they’d like people to believe.

Trust Bank? No, not really.

maybank visa platinum is 3.33% cashback , min spend 500/1000/2000 per quarter

I’m not thoroughly surprised at how they’ve gone about this though, it’s very similar to their existing credit card where to earn the bonus Linkpoints at FairPrice Group you have to hit the minimum spend “anywhere outside FairPrice Group”. Basically they give you extra here/this category, but they want you to use their card(s) for everything else *as well*.

And I guess their illustration isn’t “wrong” per se, since they indeed state only spending S$555(.55) monthly to max out the $250 quarterly cashback. Oh well.

Why does this sound like a mishmash of UOB Evol (Cachback cap), One (Min. spend per quarter), Lady’s (Bonus category) ?

( •_•)

๑(◕‿◕)๑

Ⴚტ⊙▂⊙ტჂ

⌗(́◉◞౪◟◉‵⌗)

(━┳━。 Д 。━┳━)

Sorry I had to lol

Technically it’s not false advertising as you can STILL get 15% cashback.

Just not the way they make it out to be

At this rate, what’s stopping them from saying “100% cashback (minimum spend 1000% a month, capped at $1)”?

Totally off topic but I like the new card art of the Amex true cashback card. Can we use that?

I implore you – NO kawaii eyes please

don’t knock it till you’ve tried it.

Learnt it from the Milelion CEO prob ☺️

Trust Bank’s external legal advisers (and from time to time, seconded external lawyers) are Rajah & Tann. No surprises there when you think about it.

Optimizing your stable of credit cards from various banks can be a fully time endeavor. I screwed up quite a few times already. New a spreadsheet is regularly updated to avoid the errors.

Thanks to this Aaron, i am not signing up for Trust Card when they can’t even get the simple thing, “Trust” done correctly

Thieves, conman, sleazy salesman and used car salesman are the only people I know who say Trust me. I never liked the word trust.

Btw your 4.9% is really best case scenario when you hit spend requirements on the dot which most folks won’t they’ll exceed so as the spend goes up the % drops

can we file a compliant with MAS and ASAS for this?

Agree with the article. Such complicating terms and conditions.

Please make it easier and direct. Dont have to go round the mulberry bush just to earn these discounts

This articles comes to the second google search results of “trust cashback card”. was about to apply this and luckily i bumped into this article. thank you so much. a good writing!

the T&C of all these credit card are so complicated, to the extend that most people lost track and unable to understand, giving the bank a lot of rooms to market the rates as they like with fine prints that is hard to understand.

Nets FlashPay top-ups does not earn bonus points as it is coded under MCC 6540. Tried and tested, confirmed also by CSO via in app messaging. Sigh.

Hi Yang,

Hope you are well.

Netflashpay is coded 4111 by amaze. https://www.instarem.com/help-personal/mcc-fees/ . Thus you should get bonus points provided you hit the min spend for a quarter. Could you clarify?

in your article, “4.9% cashback rate on your choice of bonus category is good” is wrong or misleading at best. The 4.9% is only achievable with a very specific combination of bonus and non bonus spend, otherwise, it’s actually 4.17% (like you said in another part of the article)

Thanks for this article. I was almost misled by the 15% cashback offer.

thanks for this!!! was so excited and realized that their terms were sooo misleading. wondering if i should just stick to youtrip

Is there a better cashback card that this one in Singapore for spend in foreign currency, after factoring the 3.25% fee? 4.25-4.75% benefit sounds very good to me.

I have a lot of transaction which are supposed under shopping but due to their mcc classification and is now fall under others instead of shopping. Like Singapore mint, foot locker, world.taobao etc.

And because I used atome to pay, it’s under others too. Trust Cashback is really misleading people.

I spent around $6388 in February 2025 on this card, guess how much cash back I get? $3.8! I contacted the trust’s customer service, they said the eligible cash back has already been given. period.

I made 2 earlier payments at supermarkets and another 3 transactions via PayPal to qualify for their spend bonus (spend $30 at least 5 times) for the higher interest on 28 April. But when there was no spend bonus credited and I checked with them, they claimed that the transactions had to go through authorization which went into May instead. What a scam. How would consumers know about these backend issues? The terms just stated spending within the month. There’s no other mention about ensuring that the transactions are cleared by whatever backend system required. How can 1 out of… Read more »

Just like car loans in Singapore. Screams out low interest rates, but with the math, it’s so untrue!

Trust restricted daily withdrawal or any bank transfers to $5K from Aug 2024. Is that allowed just to prevent them from facing a liquidity issues? If we urgently need the funds, why is Trust allowed to stop us from withdrawing our available funds from our own savings account?

How can any bank stop me from withdrawing money that’s held with them?