After an extended hiatus, SingSaver has brought back its welcome offers for DBS & POSB credit cards, which are valid from now till 30 September 2024.

New-to-bank customers who spend at least S$500 within 30 days of approval can choose from one of the following gifts:

- Apple iPad 9th Gen 10.9 WiFi 64GB (worth S$508.30)

- Nintendo Switch OLED (worth S$508.30)

- Bose QuietComfort Ultra Wireless Noise Cancelling Headphones (worth S$599)

- S$350 eCapitaVoucher

For context, the previous DBS acquisition offers I can recall maxed out at S$300 cashback, so if you don’t have a DBS/POSB credit card yet, or cancelled yours more than 12 months ago and have yet to reapply, this would be a great opportunity to pick up an extra gift in the process.

SingSaver x DBS welcome offers

|

| Details |

This offer is valid for new-to-bank customers, defined as those who:

- do not currently have a principal DBS/POSB credit card, and

- have not cancelled one in the past 12 months prior to application

Applications must be submitted between 30 August to 30 September 2024 via the links in this article, for one of the following credit cards.

| Card | Min. Income | Annual Fee |

DBS Altitude Visa DBS Altitude VisaApply Review |

S$30,000 | S$196.20 (FYF) |

DBS Altitude AMEX DBS Altitude AMEXApply Review |

S$30,000 | S$196.20 (FYF) |

DBS Live Fresh DBS Live FreshApply |

S$30,000 | S$196.20 (FYF) |

POSB Everyday Card POSB Everyday CardApply |

S$30,000 | S$196.20 (FYF) |

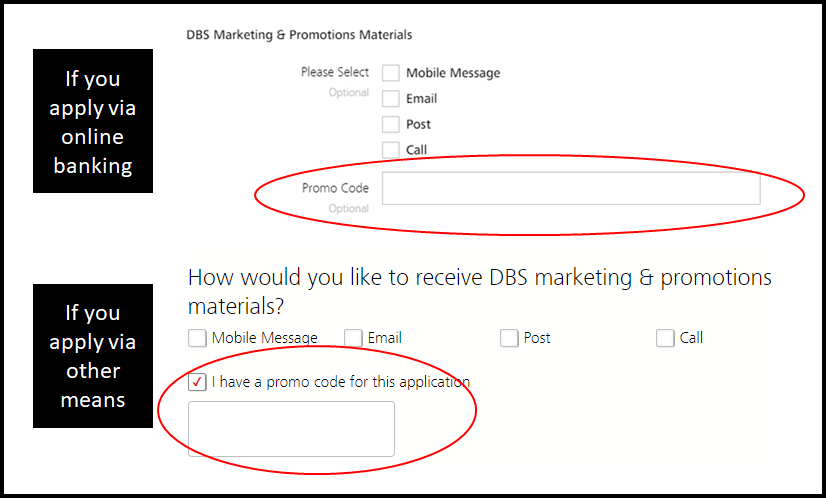

At the time of application, you must enter one of the following promo codes, depending on which gift you prefer:

- SSAUG1: Apple iPad 9th Gen 10.9 WiFi 64GB (worth S$508.30)

- SSAUG2: Nintendo Switch OLED (worth S$508.30)

- SSAUG3: Bose QuietComfort Ultra Wireless Noise Cancelling Headphones (worth S$599)

- SSAUG4: S$350 eCapitaVoucher

Don’t forget to enter your code! No code = no reward.

What counts as qualifying spend?

After receiving your card, you must make a minimum qualifying spend of at least S$500 within 30 days of approval.

Qualifying spend is based on posted local and foreign retail sales and posted recurring bill payments, excluding charitable donations, education, hospitals, insurance premiums, utilities bills and other standard exclusions.

The full list of exclusions can be found in the T&Cs at point 7(b).

Terms & Conditions

You can read the full T&Cs of this sign-up offer here.

Alternative offer for DBS cards

If you’re considering the DBS cards in particular, do remember that there’s an alternative welcome offer of up to 25,000 miles for cardholders who spend at least S$800 within 60 days of approval.

Whether this offer is better or worse boils down to how much you value a mile, and how much you value the SingSaver gifts (keeping in mind that retail price may not always be a good proxy of value). Based on my personal valuation of 1.5 cents per mile, I think most people would be better off with one of the SingSaver gifts, though you’ll need to do the sums yourself and decide.

Conclusion

DBS/POSB credit cards are back on SingSaver, and from now till 30 September 2024, new-to-bank customers can enjoy a welcome gift worth up to S$599 with a minimum spend of S$500 within 30 days of approval.

Be sure to enter the appropriate promo code when submitting your application, and remember that rewards will take up to four months for fulfillment.

Since the qualifying period is 30 days, wouldn’t DBS still be better since the minimum spend is only $300 higher? Which means you can get double dip the 5mpd on FCY spend for your qualifying spend in Nov as well as the 25k miles signup if you apply towards the end of this month. The singsaver bonus made more sense when they offered min spend of $500 vs the Alt’s $2000.

keep in mind that the 5 mpd on fcy spend is independent of sign up offers, so there’s nothing stopping you from enjoying that even if you sign up via singsaver.