DBS has launched a new campaign which offers DBS/POSB cardholders an extra S$100 cashback on shopping, dining and travel expenses, on top of the usual credit card rewards.

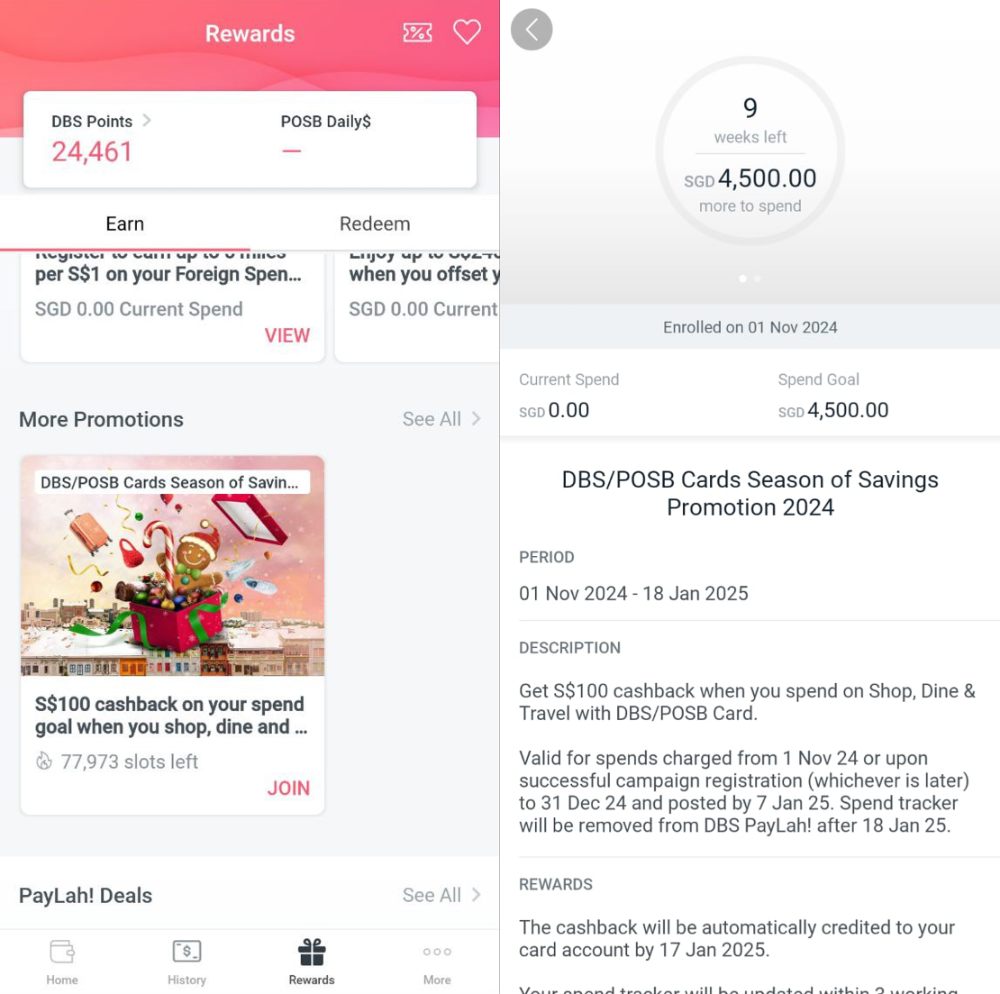

Cardholders will need to register via the DBS PayLah! app and meet their personalised spend goal by 31 December 2024, upon which the cashback will be automatically credited.

How attractive this offer is boils down to your personalised spend goal, but what sweetens the deal is that it’s stackable with other ongoing DBS campaigns such as 5 mpd with the DBS Altitude Cards, and S$500 cash for salary credit and card spend.

DBS Season of Savings 2024

|

| Campaign Details |

From 1 November to 31 December 2024, DBS cardholders can earn a bonus S$100 cashback upon meeting their personalised spend goal on dining, shopping and travel.

Registration is required, and can be done via the DBS PayLah! app. Tap on the ‘Rewards’ tab and look for the ‘DBS/POSB Cards Season of Savings 2024’ banner.

Registration is capped at 80,000 cardholders, and while that’s a sizeable number, why not register sooner rather than later all the same?

Upon registration, you’ll receive your personalised spend goal. For me, this was S$4,500, significantly higher than the S$1,500 I had during the previous offer. DBS doesnt list all the possible spend goals, but other figures reported so far include S$3,500 and S$5,000.

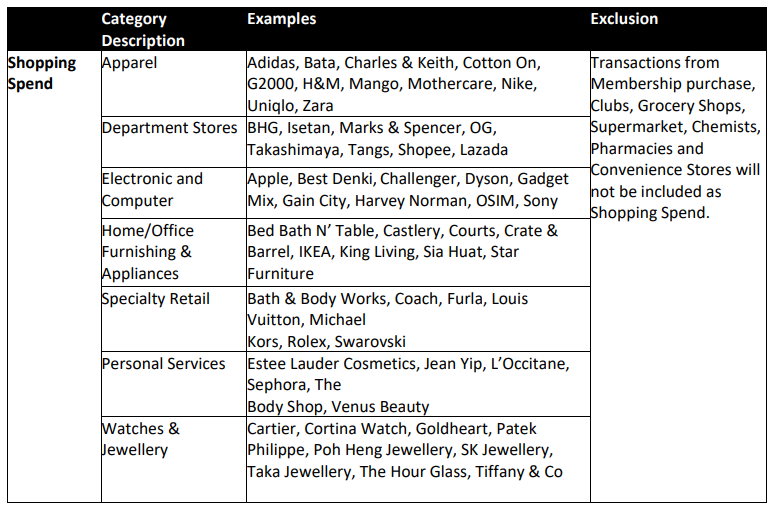

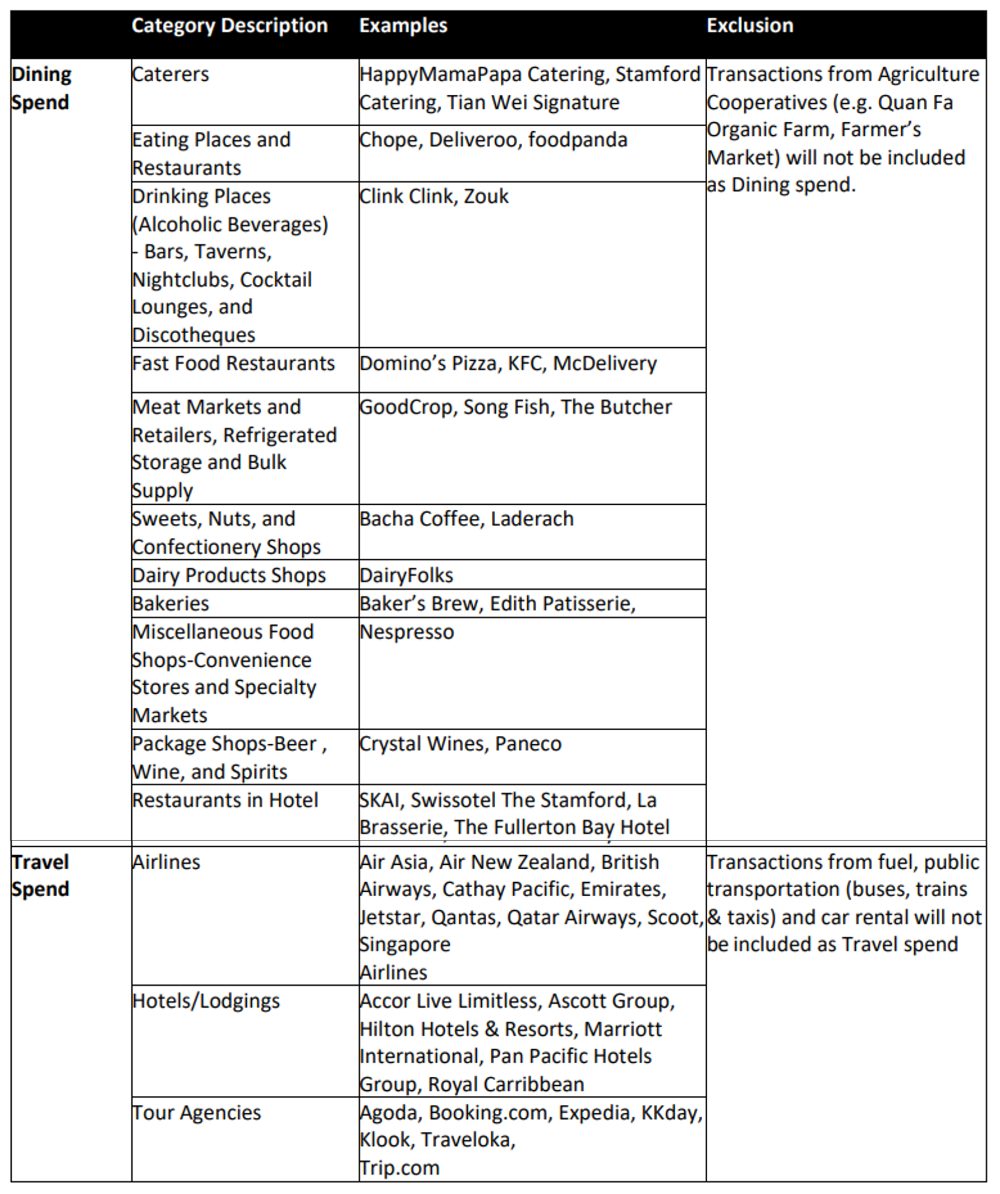

What counts as qualifying spend?

Your personalised spend goal must consist entirely of qualifying spend, defined as online and offline transactions in SGD or FCY on shopping, dining and/or travel.

Category descriptions and examples have been provided below.

The full list of eligible MCCs can be found here.

Qualifying spend is cumulative across all DBS/POSB credit cards, so you could split your spending across multiple cards if you wish. Also note that qualifying spend is only counted from the date of registration; any spending prior to that will be disregarded, even though it falls within the promotion period.

Qualifying spend must be charged within November or December 2024, and posted by 7 January 2025. This means that you should be able to safely spend towards the end of December as well, because seven days is more than enough time for transactions to post.

When will the cashback be credited?

Eligible cardholders will receive S$100 cashback credited to the card that was last transacted on within five working days of receiving a push notification from the DBS PayLah! app that 100% of the spend goal has been met.

Terms & Conditions/FAQs

T&Cs for this campaign can be found here.

FAQs are available here.

Which card should you use to spend?

Those interested in earning miles and points will probably default to the following DBS cards.

| Card | Local Spend | FCY Spend |

DBS Altitude AMEX DBS Altitude AMEXApply |

1.3 mpd | 2.2 mpd |

DBS Altitude Visa DBS Altitude VisaApply |

1.3 mpd | 2.2 mpd |

DBS Treasures Black Elite DBS Treasures Black EliteApply |

1.2 mpd | 2.4 mpd |

DBS Vantage DBS VantageApply |

1.5 mpd | 2.2 mpd |

DBS WWMC DBS WWMCApply |

0.4 mpd Offline 4 mpd* Online |

1.2 mpd Offline 4 mpd* Online |

DBS yuu AMEX DBS yuu AMEXApply |

10 mpd^ yuu Merchants |

0.27 mpd |

DBS yuu Visa DBS yuu VisaApply |

10 mpd^ yuu Merchants |

0.27 mpd |

| *Capped at S$1,500 per calendar month ^Subject to minimum spend of S$600 per calendar month and capped at S$600 per calendar month |

||

Since this campaign spans over two calendar months, those with a spending goal of S$3,000 or less could meet it entirely with the DBS Woman’s World Card, earning 4 mpd on the whole amount.

With regards to the DBS yuu Card, do note that MCC 5411 is not on the list of qualifying spend, so transactions at Cold Storage or Giant won’t count. However, foodpanda transactions are included, as are BreadTalk and Toast Box.

Stack with DBS Altitude 5 mpd campaign

|

| Campaign Details |

The Season of Savings promotion stacks with the ongoing 5 mpd offer for DBS Altitude Cards.

By way of recap, from 1 September to 31 December 2024, DBS Altitude AMEX and DBS Altitude Visa Cardholders can enjoy:

- 5 mpd on online travel for September and October 2024

- 5 mpd on FCY spend for November and December 2024

This is subject to meeting a minimum retail spend of S$1,000 within each calendar month, and is capped at S$2,000 per calendar month.

For the full details of this offer and how to register, refer to the post below.

DBS Altitude offering 5 mpd on online travel and foreign currency spend

DBS Salary & Spend campaign

|

| Campaign Details |

The Season of Savings promotion also stacks with the ongoing Salary & Spend campaign for all DBS cards.

By way of recap, DBS/POSB customers can get S$500 cash by completing the following activities:

- S$300 cash: Crediting a minimum salary of S$1,600 per month for three consecutive months to a DBS/POSB SGD-denominated account

- S$200 cash: Spending at least S$500 per month on their DBS/POSB cards for three consecutive months

For avoidance of doubt, you cannot have just the card spending component without the salary crediting. The salary crediting is a pre-requisite for the card spending component.

The first salary credit must take place by 31 October 2024, so hopefully you’ve already acted on this last month. The spend period for cards begins from the month after your first salary credit.

| First Salary Credit | Card Spend Period |

| Aug 24 | Sep, Oct, Nov 24 |

| Sep 24 | Oct, Nov, Dec 24 |

| Oct 24 | Nov, Dec 24 and Jan 25 |

The offer is valid for anyone who did not have a salary crediting arrangement linked to any DBS/POSB account from 1 February to 31 July 2024.

For the full details of this offer and how to register, refer to the post below.

DBS offering easy S$500 cash for salary credit and card spend

Conclusion

DBS/POSB cardholders can now register to earn an extra S$100 cashback on top of their usual credit card rewards, by meeting their personalised spend goal by 31 December 2024.

If you’re a DBS Altitude Cardholder, there’s an opportunity to triple stack by combining it with the ongoing 5 mpd offer for FCY spend and S$500 cash offer for salary crediting and card spend.

What other spend goals have you been targeted for?

My target is 3k

Under participating cards, there is an indicative list by DBS and WWMC is not included. Not sure if this varies user to user.

I registered for both mine and my wife’s account. Don’t see WWMC as one of the participating card.

I got 4.5k. That’s unfair…

Basically, the 100 Dollars is used to help cover for the majority of the forex fee charged by the bank when you used the Altitude card to max out the spending of 2K for Nov and Dec.