Back in April 2024, HSBC announced that it would be phasing out the step-up earn rates on the HSBC Visa Infinite Card, which enabled cardholders to earn 1.25 mpd/2.25 mpd on local/overseas spend instead of the regular 1/2 mpd, subject to a minimum spend of S$50,000 in the previous membership year.

The sunsetting process began the following month, but won’t be fully completed until 31 May 2025. And that’s created a strange transitionary period, where some cardholders enjoy the step-up earn rates and others don’t.

Since there’s been a lot of confusion as to who’s in and who’s out, I’ve written this guide to provide additional clarity (and not because the title made me giggle like an adolescent schoolboy; seriously, how immature do you think I am?).

How the HSBC Visa Infinite is phasing out step-up rates

First, let me try to save you some reading.

If your HSBC Visa Infinite Card was approved after 20 May 2023, this entire article is irrelevant to you.

I know. It’s unfair, and HSBC hasn’t done right by its customers here. HSBC only announced the termination of the step-up earn rates in April 2024, so a more equitable way of implementing the change would have been to remove this feature for cardholders approved from May 2024 onwards, since this group would have been fully aware of the situation going in.

As it stands, there could very well be cardholders who were approved between May 2023 and April 2024, and started clocking transactions towards the S$50,000 mark in anticipation of enjoying the step-up earn rate from their second membership year onwards.

Mind you, that’s not a particularly astute strategy, since much of that S$50,000 could probably have been put on higher-earning cards, but I’d nonetheless be annoyed to find that the rug’s been suddenly pulled.

But that aside, if your HSBC Visa Infinite was:

- approved before 20 May 2023, and

- you spent at least S$50,000 in qualifying transactions in your previous membership year

you will be eligible for the step-up earn rate of 1.25/2.25 mpd on local/overseas spend till the last day of the month in which your next card anniversary falls.

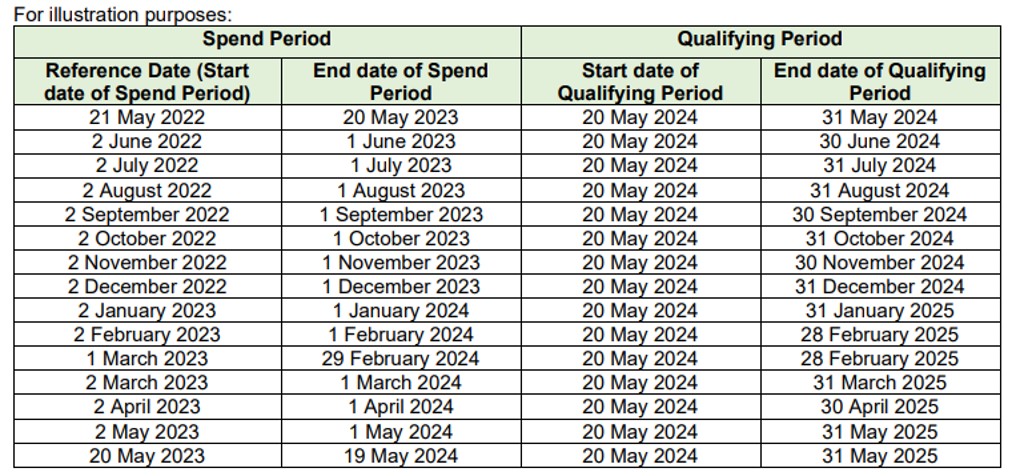

HSBC has provided some illustrations in the T&Cs for its step-up phase out, which I’ve adjusted slightly for clarity:

| If you spent at least S$50K in the membership year running… | You’ll enjoy step-up earn rates from… | ||

| Start | End | Start | End |

| 21-May-22 | 20-May-23 | 21-May-23 | 31-May-24 |

| 2-Jun-22 | 1-Jun-23 | 2-Jun-23 | 30-Jun-24 |

| 2-Jul-22 | 1-Jul-23 | 2-Jul-23 | 31-Jul-24 |

| 2-Aug-22 | 1-Aug-23 | 2-Aug-23 | 31-Aug-24 |

| 2-Sep-22 | 1-Sep-23 | 2-Sep-23 | 30-Sep-24 |

| 2-Oct-22 | 1-Oct-23 | 2-Oct-23 | 31-Oct-24 |

| 2-Nov-22 | 1-Nov-23 | 2-Nov-23 | 30-Nov-24 |

| 2-Dec-22 | 1-Dec-23 | 2-Dec-23 | 31-Dec-24 |

| 2-Jan-23 | 1-Jan-24 | 2-Jan-24 | 31-Jan-25 |

| 2-Feb-23 | 1-Feb-24 | 2-Feb-24 | 28-Feb-25 |

| 1-Mar-23 | 29-Feb-24 | 1-Mar-24 | 28-Feb-25 |

| 2-Mar-23 | 1-Mar-24 | 2-Mar-24 | 31-Mar-25 |

| 2-Apr-23 | 1-Apr-24 | 2-Apr-24 | 30-Apr-25 |

| 2-May-23 | 1-May-24 | 2-May-24 | 31-May-25 |

| 20-May-23 | 19-May-24 | 20-May-24 | 31-May-25 |

For example, if your card issuance date or anniversary date of card issuance falls on 2 February 2023, and you spent at least S$50,000 from 2 February 2023 to 1 February 2024, you will enjoy the step-up earn rate on all transactions from 2 February 2024 till 28 February 2025.

Now, why this transition is confusing so many people is because the official table which HSBC published shows the following:

Notice how the third column shows 20 May 2024 as the uniform starting date? That’s led some cardholders to think they won’t enjoy the step-up earn rate outside the period between the third and fourth columns.

Going back to our previous example of someone whose card issuance date or anniversary date of card issuance falls on 2 February 2023, reading the official table could make me believe that my step-up earn rate would only be valid from 20 May 2024 to 28 February 2025. What happens to my spending from 2 February 2024 to 19 May 2024?

Relax. It still earns the step-up earn rates. This transitionary T&Cs is meant to be read in conjunction with the original T&Cs, which cover the period up till 19 May 2024.

In other words:

- your spending from 2 February 2024 to 19 May 2024 earns step-up earn rates in accordance with the original HSBC Visa Infinite T&Cs

- on 20 May 2024, HSBC terminated the step-up earn rates for new customers, but simultaneously launched a transitionary provision for existing cardholders which is govererened by the revised T&Cs

Either way, your spending from 2 February 2024 to 28 February 2025 is covered.

Basically, HSBC is allowing HSBC Visa Infinite Cardholders who were approved before 20 May 2023 to see out the rest of their year of step-up earn rates, but that’s not really something to pat yourself on the back about because it’s the bare minimum I’d expect.

What counts as qualifying spend?

The S$50,000 spend to trigger the step-up earn rates must consist of qualifying transactions, which excludes:

- CardUp

- Charitable donations

- Education

- Government transactions

- Hospitals (new exclusion from 20 May 2024 that shouldn’t count retroactively, but hopefully they’ve coded the system properly)

- ipaymy

- Insurance premiums

- Points.com

- Utilities

The full list of non-qualifying spend can be found in the T&Cs.

When will bonus points be credited?

HSBC Visa Infinite Cardholders will earn the regular rate of 1/2 mpd on local/overseas spend initially, when the transaction posts.

The bonus 0.25 mpd for the step-up earn rate will be credited by the last day of the following calendar month.

A relaunch is coming!

HSBC put a temporary freeze on new HSBC Visa Infinite applications back in September 2024, a likely sign that a relaunch is planned.

I say that because the last time HSBC paused applications for a card, it was the HSBC Premier Mastercard, which relaunched on 1 October 2024 earning miles instead of cashback.

I’m very interested to see what HSBC has in store because, contrary to what you may think, I actually have a pretty good opinion of the HSBC Visa Infinite. It has solid travel benefits, like unlimited lounge visits for the principal cardholder and up to five supplementary cardholders, 24 airport limo rides a year, comprehensive complimentary travel insurance, and 20 transfer partners with instant transfers, free points conversions (till 31 January 2025) and conversion blocks as small as two miles.

The main gripe I have is that its earn rates are so pathetic, especially for a card that commands the highest annual fee in the $120K segment (S$662.15 if you’re not a HSBC Premier customer). If they managed to address that, the HSBC Visa Infinite would be a much more compelling offering.

For a detailed review of the HSBC Visa Infinite, refer to the article below.

Conclusion

The HSBC Visa Infinite is in the process of sunsetting its step-up earn rates, and at the time of writing, the only cardholders who could still be enjoying this feature are those whose previous membership year ended from November 2023 to May 2024.

I don’t think HSBC has covered itself in glory with the way it’s handling the transition, however. Cardholders who were approved after 20 May 2023 but before the announcement was made in April 2024 will feel hard done, particularly if they’d been regularly clocking spend on the card in anticipation of enjoying step-up earn rates the following year. And even if you did qualify for the transitionary provision, the way HSBC presents the information in its T&Cs has led to a lot of confusion.

With any luck, the relaunched HSBC Visa Infinite won’t be nearly as convoluted!

This card was very good when HSBC had a tax payment facility. However, even now for a premier customer, the 35,000 miles make up for the first year annual fee, and the 4 limo rides are a bonus. Just apply for that reason and no need to use the card at all. My wife has a premier account from her HSBC mortgage, and the good thing is the whole family are qualified to become premier customers too. So we just take turns by applying for the card in alternative years.

This card is junk. Why even bother?

This card has been suspended from new app for months. Any intel? Otherwise I guess not worth to cover this card as I doubt anyone actually renews it given it is quite lame