The Maldives doesn’t exactly have a reputation for being a budget-friendly destination, even if you plan to book your vacation with miles and points. Once you add up the costs of the seaplane, food, alcohol, spa treatments and activities, you could be looking at a very expensive “free trip”.

Unfortunately, that’s going to get even more expensive from December 2024, when airport taxes get increased by up to 167%. This will impact you regardless of whether you redeem miles or purchase commercial tickets, though there is a small window of opportunity to lock in the current rates.

Maldives hiking airport charges from December 2024

From 1 December 2024, the Maldives will hike both its airport fee and airport development fee, resulting in a 67-167% increase in total airport charges

| 🏝️ Maldives Airport Charges (Airport Fee + Airport Development Fee) |

||

| Current | From 1 Dec 24 | |

| Economy Class | US$60 | US$100 +67% |

| Business Class | US$120 | US$240 +100% |

| First Class | US$180 | US$480 +167% |

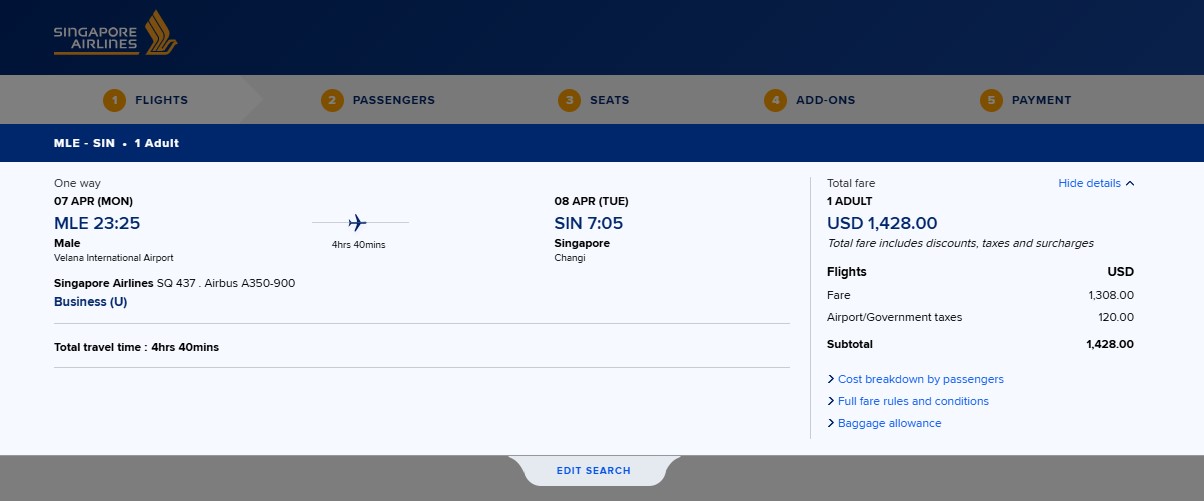

The authorities haven’t provided much notification of this change, but if it’s any consolation, the increase is based on ticketing date, not travel date. If your tickets are issued before 1 December 2024, you’ll pay the current rates, notwithstanding the fact your actual travel dates come after.

| ❓ What if I’m waitlisted? |

| If you’re waitlisted for an award ticket from the Maldives and the waitlist clears from 1 December 2024, you’ll pay the higher airport taxes. Remember, all that matters is ticketing date, when your flight is actually confirmed. |

These fees affect all passengers, excluding Maldivian nationals and diplomats. However, airline websites can’t automatically apply discounts based on citizenship, so you’ll have to pay the full taxes initially, then apply for a refund.

Children under two and transit passengers are also exempt (though Male is not exactly a natural transit point!).

The Maldives last hiked its airport taxes in January 2022, before which they were a flat US$50 regardless of cabin.

Following the fee increase, passengers on a round-trip itinerary from Singapore can now expect to pay S$200 in taxes and fees in Economy Class, and S$388 in Business Class, once Singapore’s airport taxes are factored in.

| 🇸🇬 🇲🇻 Singapore – Maldives Total Taxes (Round-trip itinerary) |

||

| Current | From 1 Dec 24 | |

| Economy Class | S$146 | S$200 +40% |

| Business Class | S$227 | S$388 +71% |

| First Class* | S$307 | S$712 +132% |

| *There is currently no First Class service between Singapore and the Maldives |

||

Hotels are getting more expensive too

Airfares from the Maldives aren’t the only thing getting more expensive; tourists can expect to pay more for hotels too.

- From January 2025, the Green Tax (a daily fee levied on each tourist) will double from US$6 to US$12 (for resorts >50 rooms) or US$3 to US$6 (for resorts <50 rooms)

- From January 2025, resorts with an average daily rate above US$800 will be required to exchange US$500 per tourist into local currency. While this is a requirement for businesses rather than individuals, it will ultimately result in increased costs, and therefore increased room rates

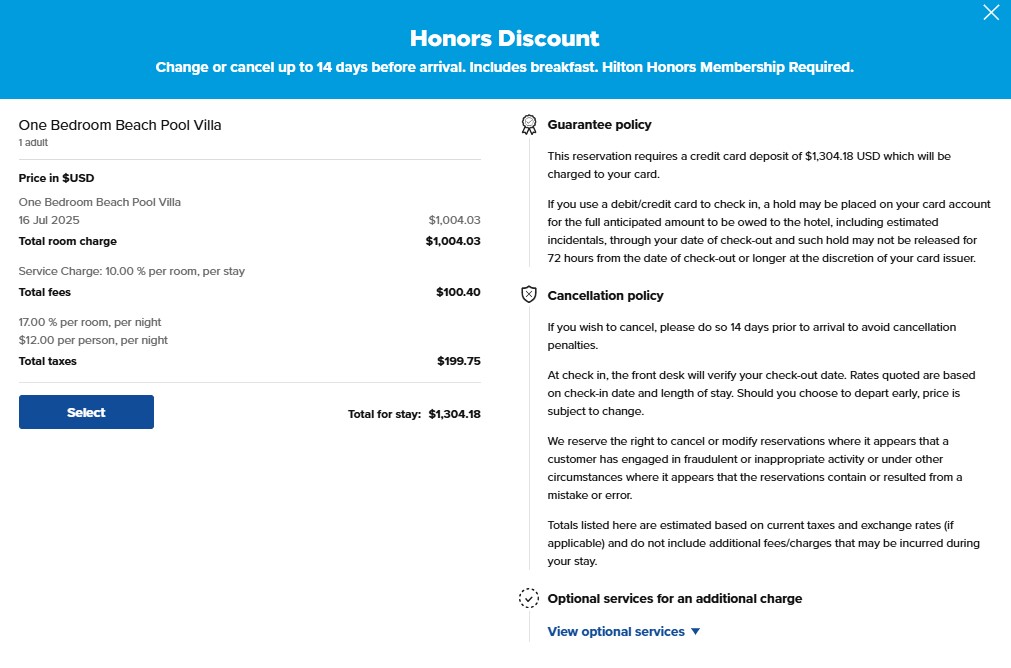

- From July 2025, the Tourism Goods and Services Tax (T-GST) will increase from 16% to 17%. You might remember the T-GST was only just increased in January 2023 from 12% to 16%, so this will be the second hike in two years

Unlike the hike in airport taxes, these increases are based on actual travel dates, so if you’re staying in July 2025, for instance, you can expect to pay the higher green tax and T-GST.

I don’t need to tell you that this makes already expensive hotel rates even more frightening, once the mandatory 10% service charge is factored in. For example, at the Hilton Maldives Amingiri, a nightly rate of US$1,004 becomes US$1,304 after all the additional charges are factored in.

T-GST doesn’t apply to award nights as such (though you’ll pay it on all your incidental spending, like dining and spa treatments), but you’ll still need to pay the Green Tax in cash.

Don’t forget that you’ll also need to budget for other costs like the seaplane, F&B, and activities in your resort. With most of the high-end resorts situated on their own island, it’s not like you have a lot of choice where these are concerned, so expect to pay captive prices!

Conclusion

From December 2024, the Maldives will be hiking its airport taxes significantly for passengers across all cabins. If you’re flying in Business Class, for example, you’ll pay double what you do now, resulting in a total cash payment of S$388 on your “free” ticket, or close to S$800 per couple.

Hotels are also going to get more expensive in 2025, with another hike to the T-GST rate, Green Tax, and a new foreign exchange requirement that will increase the cost of operations and almost certainly room rates.

Granted, the Maldives was always an expensive destination to begin with, and I’m sure there will be some for whom the increases will barely register. But this could certainly deter the more price-sensitive tourists who, come to think of it, might not be the target market in the first place.

I really enjoyed my trips in 2019 (W Maldives) and 2023 (JW Marriott Maldives), but would find it hard to return for a third time given the hefty costs involved in a trip.

over-tourism = govt taking advantage

What a disgusting money grab. There are equally if not more beautiful places on earth you can visit without being fleeced.

Like?