In an unexpected move, HSBC has announced that it will devalue points transfers to Singapore Airlines KrisFlyer from 16 January 2025, hiking the points requirement by 20%.

This makes it the first bank in Singapore to price KrisFlyer miles higher than other airline partners, and makes its already-complicated system of transfers (the bank uses five different transfer ratios!) that much more confusing.

On the bright side, HSBC has also announced that the redemption fee waiver for points conversions, which was set to end on 31 January 2025, will now be continued indefinitely. I’ve covered that in a separate article, so let’s look at the KrisFlyer nerf.

HSBC nerfing transfers to Singapore Airlines KrisFlyer

Per an announcement on its website, HSBC will be increasing the number of points required to redeem KrisFlyer miles from 16 January 2025:

Effective from 16 January 2025, the number of HSBC reward points required to redeem for 10,000 KrisFlyer miles will be revised from 25,000 to 30,000 HSBC points. Alternatively, you may redeem miles from other airline partners at the rate of 25,000 HSBC points for 10,000 miles.

-HSBC

To redeem 10,000 KrisFlyer miles, cardholders will have to redeem 30,000 HSBC points, instead of the current 25,000 HSBC points, a 20% increase.

| Frequent Flyer Programme | Transfer Ratio (HSBC Points : Partner) |

| 30,000 : 10,000 |

You can still convert HSBC rewards points to KrisFlyer miles at the current ratio up till 15 January 2025, so if that’s your intention, mark your calendars accordingly. For the avoidance of doubt, the deadline refers to when you must initiate your conversion, not when the miles must be credited (and in any case, HSBC points transfers to KrisFlyer are instant).

This change in transfer ratio will require a mental adjustment, as we’re so accustomed to thinking of the HSBC TravelOne Card as a 1.2/2.4 mpd card, and the HSBC Revolution as a 4 mpd card.

Those figures are true, if you choose a partner with a 25,000 points : 10,000 miles transfer ratio. When the ratio increases to 30,000 points : 10,000 miles, the earn rates change as well.

| Transfer Ratio (Points : Miles) |

HSBC T1 (Local)* |

HSBC T1 (FCY)^ |

HSBC Revo (Bonus)# |

| 25,000 : 10,000 | 1.2 mpd | 2.4 mpd | 4 mpd |

| 30,000 : 10,000 | 1 mpd | 2 mpd | 3.33 mpd |

| 35,000 : 10,000 | 0.86 mpd | 1.71 mpd | 2.86 mpd |

| 40,000 : 10,000 | 0.75 mpd | 1.5 mpd | 2.5 mpd |

| 50,000 : 10,000 | 0.6 mpd | 1.2 mpd | 2 mpd |

| *3 points per S$1 on local spend ^6 points per S$1 on FCY spend #10 points per S$1 on bonus categories |

|||

So if you use HSBC cards to earn KrisFlyer miles, the HSBC TravelOne Card now becomes a 1/2 mpd card, and the HSBC Revolution a 3.33 mpd card. This represents a 16.7% reduction from the current earn rates.

Does it really matter?

HSBC’s decision to devalue KrisFlyer transfers certainly comes as a shock, but does it really matter?

It depends who you ask. The way I see it, there are two lines of thinking here.

(1) You shouldn’t be transferring HSBC rewards points to KrisFlyer in the first place

The first says that you shouldn’t be converting HSBC rewards points into KrisFlyer miles in the first place, as KrisFlyer miles are relatively easy to earn in Singapore through other credit cards, Kris+, Pelago, and numerous on-ground partners.

Instead, the real value of HSBC rewards points lies in their flexibility, offering access to 19 other airlines and hotel transfer partners, all of which will continue to maintain their existing transfer ratios.

| ✈️ HSBC TravelOne Airline Partners | |

| Frequent Flyer Programme | Conversion Ratio (HSBC Points : Partner) |

| 50,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

|

30,000 : 10,000 |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 |

|

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 Till 15 Jan 25 30,000 : 10,000 From 16 Jan 25 |

|

|

25,000 : 10,000 |

| 🏨 HSBC TravelOne Hotel Partners | |

| Hotel Programme | Conversion Ratio (HSBC Points : Partner) |

|

30,000 : 10,000 |

| 25,000 : 5,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

So this group might react to the devaluation with nothing more than a shrug, and even point to the indefinite extension of redemption fee waivers as a cause for celebration.

(2) But KrisFlyer miles are still the primary option for most people

The second says that even if converting HSBC rewards points to KrisFlyer miles is a waste of their potential, this is still the primary option for most cardholders.

Bank executives I’ve spoken to often tell me that they don’t see the value in adding more transfer partners because 90% of redemptions are still for KrisFlyer, and let’s be honest: how many people you know even use a second frequent flyer programme, let alone know about its sweet spots?

So even though experienced miles chasers might be indifferent to this devaluation, they still constitute a minority of users. For many people, it’s KrisFlyer or bust, and this could very well make them quit HSBC cards altogether.

I personally take the first viewpoint- most of my HSBC rewards points have been going to Air France-KLM Flying Blue and British Airways Executive Club anyway.

At the same time, I’m also certain there’s going to be plenty of blowback on HSBC for this decision, given the popularity of KrisFlyer. Quite frankly, I’m already expecting to get a few angry emails down the road from people who didn’t follow the news, screaming that HSBC “cheated” them by quietly devaluing their stash of points.

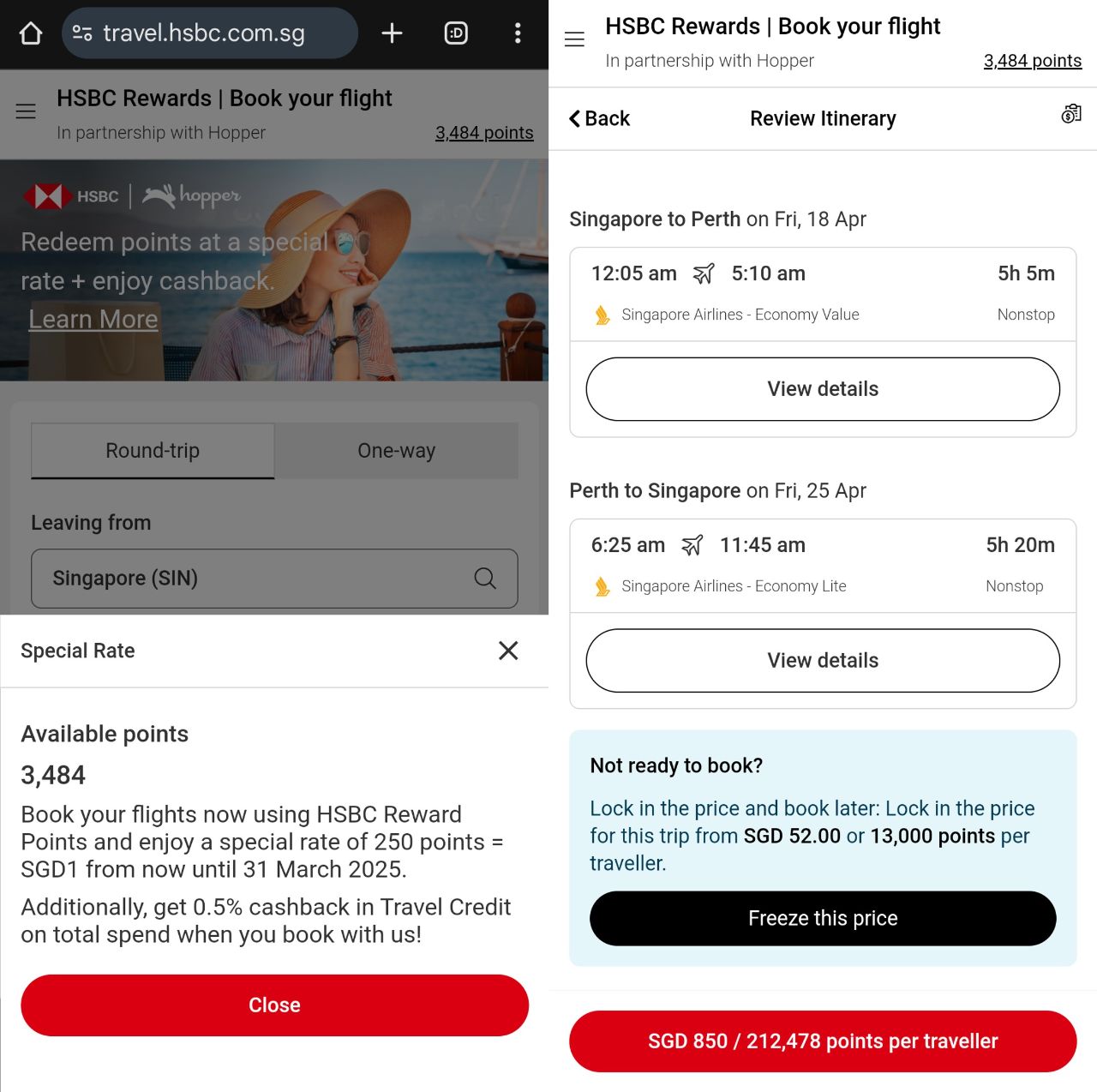

You can book Singapore Airlines flights with HSBC rewards points

HSBC has also introduced a new feature that allows cardholders to book Singapore Airlines (or other airlines) flights directly from the Rewards Marketplace portal, using rewards points.

For greater convenience, you may also book Singapore Airlines flights directly from our travel portal on Rewards Marketplace using your reward points. You can visit Credit Cards Rewards for the step-by-step guide to redeem from our travel portal.

-HSBC

Ignore this.

This is not a “convenience”; it is a terrible use of points. Instead of redeeming an award ticket, you’re basically paying for a commercial ticket using your rewards points, and getting a poor rate in return.

The current rate on offer is equivalent to 1 cent per mile, which is far below what you should be accepting. Keep in mind, the rate is set to get worse from April 2025 onwards, as the 1 cent per mile value is a promotional one!

Conclusion

For as long as I can remember, it’s been taken for granted that whatever transfer ratio is offered to KrisFlyer, other partners will be equivalent or worse.

That will soon no longer be the case for HSBC cardholders, and it’s a puzzling decision to say the least. Maybe HSBC couldn’t secure a competitive enough rate with Singapore Airlines for the upcoming year?

HSBC is giving one month’s notice of this change, and if you want to convert your HSBC rewards points to KrisFlyer, you’ll need to do so by 15 January 2025 to take advantage of the current rate.

The waiver on redemption fees for points conversions has also been made indefinite, which is a positive development if nothing else.

What do you make of this HSBC devaluation?

I’m done with HSBC now !

same

Well…..since the Revo nerf, the only HSBC card I use regularly is Advance and that’s not a miles card. The 2 HSBC miles card are hardly used. Great job, HSBC Card team

HSBC has an avalanche of offers to sign up and new cards. Then selective choose who they issued the cards to. Next thing is an avalanche of downgrades as if they got “lao sai”. They lack consistency of other banks.

In the UK Krisflyer has always been a “premium” redemption rate with HSBC and Amex so maybe they charge more…

Woo now can cancel hsbc for good

You’ve summed up my reaction perfectly, Aaron. HSBC cards’ value to me is for transfers to Flying Blue, because there’s no shortage of other banks to make transfers to KrisFlyer. The indefinite fee waiver is fantastic news.

HSBC card spend will plummet for sure, given how huge the miles market is … i guess they’ve done their sums and made their bed

Just hope other Banks not follow HSBC

Luckily minimal pts inside HSBC already… all pulled out liao

Luckily I already cancelled my 1 and only HSBC revo card after their previous nerfs

Dosent impact me, nerf it more

Hi, maybe you can write an article sharing some sweet spots for Flying Blue and BA? I think I will take too long on HSBC and Heymax to reach critical mass for these FF programs though, as I usually redeem in pairs.

But still keen to find out more about options other than KF

SECONDED!

I’ve cancelled Revolution 2 months ago for obvious reasons.

Now, my only fear is that other banks will look to follow the same – nerf devalue SQ points. x_x

Cashback.

only using the revo card for shopee and lazada purchases nowadays

These are the banks which have plenty of miles-earning cards but NOTHING beyond KrisFlyer and Cathay Asia Miles (not counting AirAsia Rewards): * DBS (though it has Qantas Frequent Flyer but not very useful) * UOB (as many as 3 cards that earn 4 mpd, but just 2 transfer partners) * Maybank (don’t count MH Enrich) * Standard Chartered So to those who are thinking of cancelling their HSBC cards, pause for a moment and understand if you’re cool with giving up QR/BA Avios, AF/KL Flying Blue, Etihad Guest, EVA Infinity MileageLands, Turkish Miles&Smiles, etc. If that’s okay with you… Read more »

I already cancelled all HSBC cards middle of this year. What are you guys waiting for?

I use HSBC card to buy GV promo tickets. 🙂 no rush for me to cancel yet, can use it on EVA and other airlines.

still useful (with multiple Frequent flyer options). and no annual charges …

anyone knows when you do transfer/convert from points to sq krisflyer miles. can the transfer be a different name in the krisflyer account?

Strangely as of this morning, Kris flyer isn’t in the list of redemption

Damn I missed this change! But the weird thing is I go to the app and I can’t even see Kris miles for redemption under miles!