Back in September 2024, the DBS yuu Cards took the miles game by storm when yuu Rewards Club added KrisFlyer as a transfer partner.

With a conversion rate of 3.6 points to 1 mile, cardholders could earn an incredible 10 mpd (or 18% rebates) at Cold Storage, Giant, Guardian, foodpanda, Gojek, and the rest of the yuu ecosystem.

How long will this last? No one knows. A 10 mpd earn rate is clearly unsustainable in the long run—but that’s a problem for another day. For now, it’s a question of how much hay you can make.

If you haven’t signed up for a DBS yuu Card yet but want to join the party, here’s an extra incentive: for the next few months, the welcome offer has been doubled from S$150 to S$300 cashback.

DBS yuu Card offering S$300 welcome bonus

The following welcome offer is valid for new-to-bank customers, defined as those who:

- do not currently have a principal DBS/POSB credit card, and

- have not cancelled one in the past 12 months prior to application

Customers who apply for a DBS yuu Card from 1 February to 31 July 2025 (with approval by 14 August 2025) will receive S$300 cashback when they spend at least S$800 within the first 60 days of approval.

| Card | New | Existing |

DBS yuu AMEX DBS yuu AMEXApply |

S$300 Code: CASH300 |

N/A |

DBS yuu Visa DBS yuu VisaApply |

S$300 Code: CASH300 |

N/A |

| After you’ve received your yuu Card, link it to the yuu app with the code TMCYRWM5 for 2,000 bonus yuu points! | ||

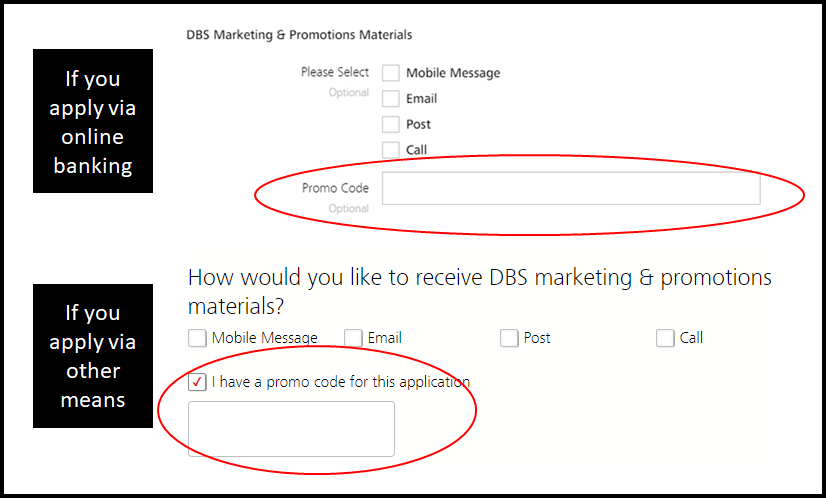

Customers must enter the code CASH300 when applying. Don’t forget to enter your code! No code = no reward.

Unfortunately, there’s no offer for existing DBS cardholders this time round. Previously, they were able to get a smaller reward of S$60 cashback when they signed up for the DBS yuu AMEX.

What counts as qualifying spend?

After receiving your card, you must make a minimum qualifying spend of at least S$800 within 60 days of approval.

If I were you, I’d be clocking the entire minimum spend at yuu merchants in order to maximise my rewards. Remember, the 10 mpd/18% cashback rates are capped at S$600 per calendar month, so it’s best to spread your spending out over two months.

The usual exclusions apply, such as charitable donations, education, insurance premiums, prepaid account top-ups, and utilities bills. The full list of exclusions can be found at point 6 of the T&Cs.

Terms & Conditions

You can read the full T&Cs of this sign-up offer here.

How does the DBS yuu Card work?

|

|||

| Apply (AMEX) | |||

| Apply (Visa) | |||

| After you’ve received your yuu Card, link it to the yuu app with the code TMCYRWM5 for 2,000 bonus yuu points! | |||

| Income Req. | S$30,000 p.a. | Points Validity | 2 years |

| Annual Fee | S$196.20 (First Year Free) |

Min. Transfer |

200 yuu points (56 miles) |

| Miles with Annual Fee |

N/A | Transfer Partners |

1 |

| FCY Fee | 3% (AMEX) 3.25% (Visa) |

Transfer Fee | Free |

| Local Earn | 0.27 mpd | Points Pool? | Yes |

| FCY Earn | 0.27 mpd | Lounge Access? | No |

| Special Earn | 10 mpd at yuu merchants | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

As the name suggests, the DBS yuu Card is best used for spending at yuu merchants, which currently consist of the following.

| 🛍️ yuu Merchants | |

| Group | Merchants |

| 🛒 DFI Retail Group (DFI) |

|

| 🍞 BreadTalk Group (BTG) |

|

| 🐘 Mandai Wildlife Group |

|

| 📱 Singtel |

|

| 🚕 Gojek |

|

| 🍽️ foodpanda |

|

Transactions at yuu merchants earn a total of 36 yuu Points per S$1.

| Component | Rate | Remarks |

| Base Reward | 10 pts per S$1 5% rebate 2.78 mpd |

No min. spend or cap |

| Bonus Reward | 26 pts per S$1 13% rebate 7.22 mpd |

Min. S$600 spend per c. month, cap at 15,600 points per c. month |

The base reward consists of 10 yuu Points per S$1, comprising:

- 1 yuu Point per S$1 for scanning the yuu app at the cashier

- 9 yuu Points per S$1 for paying with the DBS yuu Card

The base reward has no minimum spend requirement nor cap.

The bonus reward consists of 26 yuu Points per S$1. This requires a minimum spend of S$600 per calendar month, and is capped at 15,600 bonus yuu Points per calendar month. This also happens to be S$600, so the minimum spend is the cap.

| 👍 Each card has its own cap |

| Both the DBS yuu AMEX and DBS yuu Visa have their own bonus cap, so if you get both, you can earn 10 mpd or 18% rebates on up to S$1,200 of spend per calendar month (subject to meeting the minimum spend on both cards). |

Put the two together, and you have a total of 36 yuu points per S$1, equivalent to an overall rebate of 18%, or 10 mpd.

Regardless of whether you prefer rebates or miles, a reward of this magnitude is almost too good to be true, so my advice would be to enjoy it while it lasts.

For more information on the DBS yuu Card, refer to my detailed review below.

Conclusion

DBS has doubled the welcome offer for the yuu Card to S$300 cashback, for applications submitted by 31 July 2025.

I’d like to believe that most miles chasers would already have one of these, but if you’re new here, this would be an excellent opportunity to hop onboard.

Be sure to enter the correct promo code during your application, and spend at least S$800 within 60 days of approval – all at yuu merchants, preferably!

If I’m existing DBS customer can I get the $300?

This is how you tell who had read and who havent read the article cos its already mentioned early in the article

The following welcome offer is valid for new-to-bank customers, defined as those who:

Read the article, or use Cltr+F to find the info within.

The best credit card in Singapore. Almost everyone needs to spend at supermarket, pharmacy, rides or food delivery. 18% rebate or 10mpd. I always clear this $1200 spend before touching any 4mpd for the month. The only entry-level card in Singapore I’d keep even if I had to pay the annual fee since $196 is a fraction compared to an easy $1296 discount. No need to go out of my way to change my spending habits.

Do you have any updated referal code for linking to yuu app? The current code states it’s only applicable if sign up in Jan.

Might you know if purchase of shopback’s zalora e-gift card qualify for the $800 spending? The MCC should be 7299. Thanks

Does paying for the new phone when recontracting Singtel CIS plan online/offline count towards the bonus spend? The T&C state that corporate plan/sign-up are excluded.