Standard Chartered has launched a new promotion for the 2025 income tax season, which offers a 100% rebate of the admin fees for its Income Tax Payment Facility to StanChart Beyond and Visa Infinite Cardholders, capped at S$300 per cardholder.

This is similar to the offer we saw in 2024, but the game-changer this year is the Beyond Card. With an attractive earn rate of up to 2 mpd on tax payments, the possibility of extra cashback is just the icing on the cake.

The catch is that there’s a cap of 50 applications per calendar month, so you’ll need to be quick in order to be in with a chance.

StanChart Income Tax Payment Facility promotion

From 1 April to 30 June 2025, Standard Chartered will offer a 100% rebate of the processing fee for its Income Tax Payment Facility.

This promotion is available to the first 50 applicants per calendar month, and you must designate a current or savings account under Standard Chartered Bank to receive the funds (last year’s promotion had no such requirement). This effectively forces you to open a Standard Chartered account if you don’t already have one, though that should be simple enough for most people.

The rebate is capped at S$300 per eligible cardholder for the entire promotion period, so based on a 1.9% processing fee, you would max out the rebate with a tax payment of ~S$15,790.

| ❓ Don’t the T&Cs suggest you can enjoy the offer multiple times? |

|

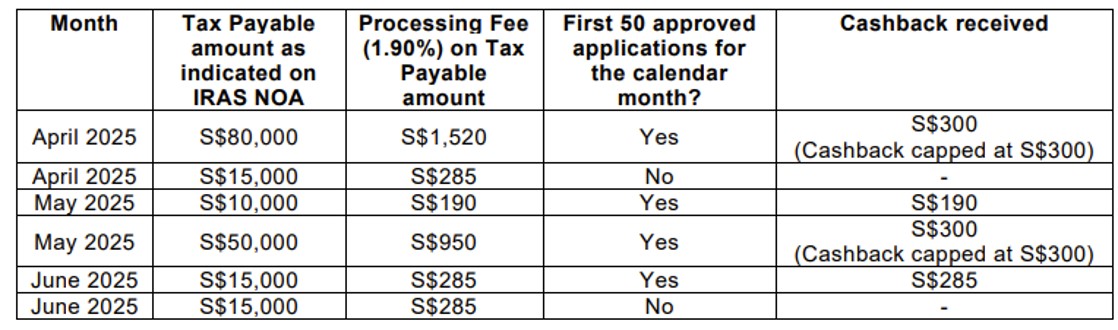

The illustration provided at point 4 of the T&Cs may appear to suggest that cardholders can enjoy the S$300 cashback multiple times, provided they’re within the first 50 applications each month.

However, the last two rows of the table would not make sense if they were intending to show a single cardholder (he/she can’t both be and not be part of the first 50), so I’m interpreting this as separate cases for separate cardholders. |

Which cards are eligible?

As a reminder, the Income Tax Payment Facility is open to principal and supplementary cardholders of the:

- StanChart Beyond Card

- StanChart Visa Infinite Card

For the avoidance of doubt, the StanChart Priority Visa Infinite Card (the blue-coloured one) is not eligible for this facility.

Here’s what the usual cost per mile looks like, in the absence of any processing fee rebate.

| 💳 Income Tax Payment Facility (1.9% Fee) | ||

| Card | Earn Rate | Cost Per Mile |

StanChart Beyond Card StanChart Beyond Card(PB/PP) |

2 mpd | 0.95¢ |

StanChart Beyond Card StanChart Beyond Card(Regular) |

1.5 mpd | 1.27¢ |

StanChart Visa Infinite StanChart Visa Infinite(Step Up Rate)* |

1.4 mpd | 1.36¢ |

StanChart Visa Infinite StanChart Visa Infinite(Regular Rate) |

1 mpd | 1.9¢ |

| *Requires a minimum spend of S$2,000 per statement month. Payments made to the Income Tax Payment Facility will count towards the S$2,000 spend | ||

If you manage to get the S$300 cash rebate, then it’s basically free miles on a tax payment of up to S$15,790, or 31,580 miles, assuming you have a StanChart Beyond Card with Priority Banking or Priority Private status.

When will the cashback be credited?

Cashback earned under this promotion will be credited by 31 August 2025.

Terms & Conditions

The T&Cs of this offer can be found here.

Is it worth it?

While the monthly cap of 50 applicants throws some uncertainty into the picture, a StanChart Beyond Cardholder should be using the Income Tax Payment Facility regardless. Whether you’re a regular or Priority Banking/Priority Private customer, you won’t find a lower cost per mile with any other platform on the market.

If you’re a StanChart Visa Infinite Cardholder, however, then unless you fancy rolling the dice, you might prefer to go with CardUp instead.

CardUp is currently offering a 1.75% admin fee for income tax payments made with a Visa card and the promo code MLTAX25R, which reduces the cost per mile to as low as 1.23 cents each.

| Spend Amount | StanChart (1.9% fee) |

CardUp (1.75% fee) |

| Charge ≥ S$2,000 per statement month 1.4 mpd |

1.36 cents | 1.23 cents |

| Charge < S$2,000 per statement month 1 mpd |

1.9 cents | 1.72 cents |

Of course, the two are not mutually exclusive. Since the Income Tax Payment Facility does not pay IRAS directly (see next section), there’s nothing stopping you from using your NOA to buy miles from StanChart, then making the actual payment via CardUp to buy additional miles.

How does the income tax payment facility work?

Here’s a brief refresher on how the income tax payment facility works, using the example of a StanChart Beyond Cardholder with Priority Banking status and a S$10,000 tax bill:

- Cardholder completes an online application form and uploads a copy of their IRAS NOA

- S$10,190 is charged to their StanChart Beyond Card (S$10,000 tax due + S$190 admin fee @ 1.9%), for which they earn 20,000 miles (S$10,000 @ 2 mpd)

- S$10,000 will be deposited into their designated bank account (which need not be with Standard Chartered- but has to be for the purposes of the aforementioned promotion)

- They use the funds to pay IRAS

Step (4) is optional. Whether or not you pay IRAS with the funds credited in step (3) is your own business. You’re perfectly at liberty to keep your current GIRO payment plan, or even use another bill payment platform like Citi PayAll or CardUp to buy more miles while paying IRAS.

The number of miles you can buy is only limited by the amount stated on your NOA (and of course, your credit limit).

You are only permitted to pay your own tax bill through this facility. However, supplementary cardholders can also use the facility to pay their personal taxes.

Conclusion

Standard Chartered is now offering a full rebate of the processing fees for its Income Tax Payment Facility, to the first 50 StanChart Beyond or Visa Infinite Cardholders who apply each month.

Given that the cost per mile for this facility is already attractive (especially if you’re a StanChart Beyond Cardholder), this should provide some added incentive to set up a payment and open a Standard Chartered bank account, if needed. You’ll ideally want to apply as early in the month as possible, preferably just after midnight on the 1st of each month.

Remember, there’s nothing stopping you from using this facility in addition to other platforms like CardUp or Citi PayAll, since Standard Chartered does not pay IRAS on your behalf.