Last month, the Standard Chartered Visa Infinite Card nerfed one of its few remaining bright spots, by hiking the admin fee on its Income Tax Payment Facility from 1.6% to 1.9%. This raised the cost per mile when paying taxes from 1.14 cents to 1.36 cents- still decent, in and of itself, but obviously not as good as before.

But this month comes a mea culpa of sorts, as the bank seeks to soothe ruffled feathers with a 100% cash rebate on the admin fee for income tax payments, capped at S$300 per card.

|

| Tax Payment Facility |

| The tax payment facility is not available to SC Priority Banking Visa Infinite, SC Journey or SC X Cardholders |

There is a catch though: it’s limited to the first 50 applications each month, and if you fall outside this threshold, you’d be better off paying taxes via CardUp instead.

StanChart Visa Infinite income tax cashback promo

StanChart Visa Infinite Cardholders currently pay a 1.9% admin fee when using the Income Tax Payment Facility. This works out to a cost per mile of 1.36 or 1.9 cents, depending on whether you’re on the 1.4 mpd or 1 mpd earn rate.

StanChart Visa Infinite StanChart Visa Infinite |

||

| Spend Amount | Earn Rate | Cost Per Mile (1.9% fee) |

| Charge ≥ S$2,000 per statement month |

1.4 mpd | 1.36 cents |

| Charge < S$2,000 per statement month |

1 mpd | 1.9 cents |

| 👍 Income tax payments count towards minimum spend |

| I’ve previously confirmed with Standard Chartered’s PR team that amounts charged to the Income Tax Payment Facility will count towards the S$2,000 minimum spend required to trigger the 1.4 mpd earn rate. |

From 5 April to 30 June 2024, StanChart Visa Infinite Cardholders will receive a 100% rebate of the processing fees for the Income Tax Payment Facility, capped at S$300 per card.

Given the current 1.9% admin fee, this works out to free miles on a tax payment of up to S$15,790. In other words, you can earn up to 22,106 free miles, assuming you’re on the 1.4 mpd earn rate.

However, this offer is capped at the first 50 successful applications per calendar month, and there is no way of knowing if you’re in the first 50. So ideally you’ll want to apply as early in the month as possible, preferably just after midnight on the 1st.

StanChart provides some illustrations in its T&Cs:

When will the cashback be credited?

Cashback earned under this promotion will be credited by 31 August 2024.

Terms & Conditions

The T&Cs of this offer can be found here.

Maybe just stick with CardUp?

Given the uncertainty created by the first 50 cap, StanChart Visa Infinite Cardholders may find themselves better off just using CardUp instead.

CardUp is currently offering a 1.75% admin fee for income tax payments using the code MLTAX24, for payments scheduled by 31 August 2024 (6 p.m) with due dates on or before 25 March 2025. Paying taxes via CardUp therefore represents a cost per mile of 1.23 to 1.72 cents, cheaper than the 1.36 to 1.9 cents via StanChart’s Income Tax Payment Facility.

StanChart Visa Infinite StanChart Visa Infinite |

||

| Spend Amount | StanChart (1.9% fee) |

CardUp (1.75% fee) |

| Charge ≥ S$2,000 per statement month 1.4 mpd |

1.36 cents | 1.23 cents |

| Charge < S$2,000 per statement month 1 mpd |

1.9 cents | 1.72 cents |

Of course, the two are not mutually exclusive. Since StanChart’s Income Tax Payment Facility does not pay IRAS directly (see next section), there’s nothing stopping you from using your NOA to buy miles from StanChart at 1.36 cents (or less, if you earn the cashback for the first 50 applicants), then making the actual payment via CardUp to buy additional miles at 1.23 cents.

To learn more about this offer, refer to the post below.

CardUp offering 1.75% fee for income tax payments with Visa, buy miles from 1.07 cents

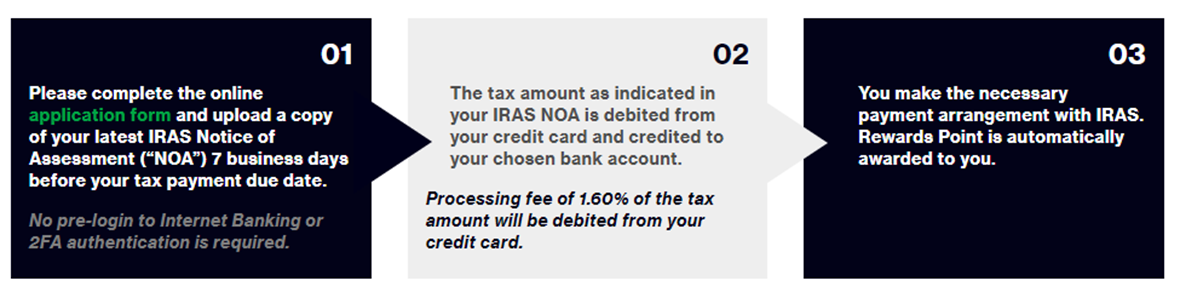

How does the Income Tax Payment Facility work?

Here’s a quick refresher of how the StanChart Visa Infinite Income Tax Payment Facility works, using the example of a cardholder with a S$10,000 tax bill:

- Cardholder completes an online application form and uploads a copy of their IRAS NOA

- S$10,190 is charged to his StanChart Visa Infinite Card (S$10,000 tax due + S$190 admin fee @ 1.9%), for which he earns 14,000 miles (S$10,000 @ 1.4 mpd)

- S$10,000 will be deposited into his designated bank account within seven business days

- He uses the funds to pay IRAS

Step (4) is optional. Whether or not you pay IRAS with the funds credited in step (3) is your business. You’re perfectly at liberty to keep your current GIRO payment plan, or even use another bill payment platform like Citi PayAll or CardUp to buy more miles while paying IRAS.

The number of miles you can buy is only limited by the amount stated on your NOA. In our example of a taxpayer with a S$10,000 bill, the maximum miles he can buy is 14,000 (@ 1.4 mpd). Even if you’re more of a whale, a S$50,000 tax bill would yield 70,000 miles- not even enough for a one-way Business Class ticket to Europe!

For what it’s worth, you can’t pay someone else’s tax bill, but supplementary cardholders are also allowed to use the same tax payment facility.

FAQs for the tax payment facility can be found here.

Conclusion

StanChart Visa Infinite Cardholders can now enjoy a 100% rebate on the admin fee for the bank’s Income Tax Payment Facility, capped at S$300.

It could be an opportunity to earn some free miles, but the catch is that you need to be in the first 50 cardholders each month.

For the full rundown of options to pay income tax, refer to my detailed guide below.

(HT: SY Ong)

Chey. Got excited for a moment but I think no chance lah.