CardUp is launching a new promotion for income tax payments made with a Mastercard, offering a reduced fee of 1.55% for new customers, and 1.67% for existing customers.

This brings the cost per mile down to as little as 0.76 cents—currently the best deal on the market. In fact, it’s even more competitive than the 1.75% Visa card promotion introduced last month.

The catch is that redemptions are limited, and there’s a payment cap of S$3,500 for new customers, and S$5,000 for existing customers. Any amount above these thresholds will incur the standard 2.6% fee, and to maximise value, you should stay within the cap and explore other alternatives for the balance.

Do note that this promotion is scheduled to go live later today, and the codes won’t work until then. Be on the lookout for CardUp’s official eDM in your inbox.

CardUp x Mastercard income tax promotion

New customers

|

|

| Code | MCTAX25N |

| Limit | 1x redemption per user 300 redemptions overall |

| Admin Fee | 1.55% |

| Min. Spend | None |

| Cap | S$3,500 |

| Schedule By | 31 August 2025, 6 p.m. |

| Due Date By | 3 September 2025 |

| Eligible Cards | Mastercard |

| MCTAX25N T&Cs | |

| Note: T&Cs are password-protected until the promotion officially launches | |

New CardUp users (defined as those who have not completed a payment before) can use the promo code MCTAX25N to enjoy a 1.55% admin fee on income tax payments.

Here’s the key details of this promotion:

- All payments must be scheduled by 31 August 2025, 6 p.m Singapore time

- Payment due dates must be on or before 3 September 2025

- Only valid for Singapore-issued Mastercards

- No minimum payment is required

- This promotion applies to a payment of up to S$3,500; any amount above this will be subject to a 2.6% fee

This code is only valid for one-off payments.

An overall redemption cap of 300 users applies, and you’ll be able to see if the code is still valid before confirming your payment.

Existing customers

|

|

| Code | MCTAX25 |

| Limit | 1x redemption per user 1,500 redemptions overall |

| Admin Fee | 1.67% |

| Min. Spend | None |

| Cap | S$5,000 |

| Schedule By | 31 August 2025, 6 p.m |

| Due Date By | 3 September 2025 |

| Eligible Cards | Mastercard |

| MCTAX25 T&Cs | |

| Note: T&Cs are password-protected until the promotion officially launches |

|

Existing CardUp users can use the promo code MCTAX25 to enjoy a 1.67% admin fee on income tax payments.

Here’s the key details of this promotion:

- All payments must be scheduled by 31 August 2025, 6 p.m Singapore time

- Payment due dates must be on or before 3 September 2025

- Only valid for Singapore-issued Mastercards

- No minimum payment is required

- This promotion applies to a payment of up to S$5,000; any amount above this will be subject to a 2.6% fee

You can make either one-off or recurring payments with this promo code, though keep in mind that only the first S$5,000 of payments will be eligible for the discounted rate.

An overall redemption cap of 1,500 users applies, and you’ll be able to see if the code is still valid before confirming your payment.

What’s the cost per mile?

Here’s the cost per mile (CPM) with various Mastercards, given their earn rates and a 1.55% or 1.67% admin fee.

| Card | Earn Rate | CPM (1.55% fee) |

CPM (1.67% fee) |

StanChart Beyond Card StanChart Beyond Card(PB/PP) Apply |

2 mpd | 0.76¢ | 0.82¢ |

Citi ULTIMA MC Citi ULTIMA MCApply |

1.6 mpd | 0.95¢ | 1.03¢ |

StanChart Beyond Card StanChart Beyond Card(Regular) Apply |

1.5 mpd | 1.02¢ | 1.10¢ |

UOB PRVI Miles MC UOB PRVI Miles MCApply |

1.4 mpd | 1.09¢ | 1.17¢ |

OCBC 90°N MC OCBC 90°N MCApply |

1.3 mpd | 1.17¢ | 1.26¢ |

Citi Prestige Card Citi Prestige CardApply |

1.3 mpd | 1.17¢ | 1.26¢ |

Citi Premier Miles MC Citi Premier Miles MCApply |

1.2 mpd | 1.27¢ | 1.37¢ |

KrisFlyer UOB Card KrisFlyer UOB CardApply |

1.2 mpd | 1.27¢ | 1.37¢ |

BOC Elite Miles MC BOC Elite Miles MCApply |

1 mpd | 1.53¢ | 1.64¢ |

As a reminder, HSBC credit cards do not earn miles with CardUp and ipaymy.

To illustrate how this works, suppose you’re an existing CardUp customer with a S$1,000 tax bill, and use the MCTAX25 code:

- S$1,016.70 will be charged to your credit card (S$1,000 bill + 1.67% fee)

- Assuming a 1.4 mpd card, you will earn 1,423 miles (S$1,016.70 x 1.4 mpd; ignoring rounding

- Given a S$16.70 fee, the cost per mile is 1.17 cents each (S$16.70/1,423 miles)

Remember, both the tax payment amount and the CardUp fee are eligible to earn miles.

The cost per mile with this promotion is attractively low, and even better than CardUp’s Visa promotion.

The clear winner here is the StanChart Beyond Card, especially those with Priority Banking or Priority Private status who can buy miles for as little as 0.76 cents. This is even cheaper than the Standard Chartered Tax Payment Facility, where miles cost 0.95 cents each.

Likewise, if you have a Citi ULTIMA or Citi Prestige Card, the cost per mile through CardUp is cheaper than the upcoming Citi PayAll promotion (set to launch on 18 April 2025), which offers 1.3 cents per mile at best.

In any case, all the options here (except the BOC Elite Miles Card, but who cares about that!) reduce the cost per mile to below 1.5 cents each, which is my threshold for buying.

Of course, the catch here is that there is a redemption cap, as well as a payment cap. Once either is exhausted, you’ll need to explore other alternatives.

CardUp x Visa offer

As a reminder, CardUp is also running a 1.75% promotion for Visa cards, which has the added advantage of no redemption cap nor payment cap.

| Code | MLTAX25R |

| Eligible Cards | All Singapore-issued Visa Cards |

| Type | Recurring Payments |

| Limit | 2x redemptions per user; no overall redemption cap |

| Admin Fee | 1.75% |

| Min. Spend | None |

| Cap | None |

| Schedule By | 31 August 2025, 6 p.m |

| Due Date By | 25 March 2026 |

| MLTAX25R T&Cs | |

| Code | VTAX25ONE |

| Eligible Cards | All Singapore-issued Visa Cards |

| Type | One-Off Payment |

| Limit | 2x redemptions per user; no overall redemption cap |

| Admin Fee | 1.75% |

| Min. Spend | None |

| Cap | None |

| Schedule By | 23 May 2025, 6 p.m |

| Due Date By | 26 May 2025 |

| VTAX25ONE T&Cs | |

Depending on the card you use, the cost per mile starts from 0.86 cents each. Therefore, my advice would be to utilise the Mastercard code first, then switch to the Visa code for the payment of the remainder.

For the full details of the Visa promotion, refer to my post below.

CardUp 2025 income tax promo: 1.75% fee for Visa cards; buy miles from 0.86 cents

How to set up income tax payments

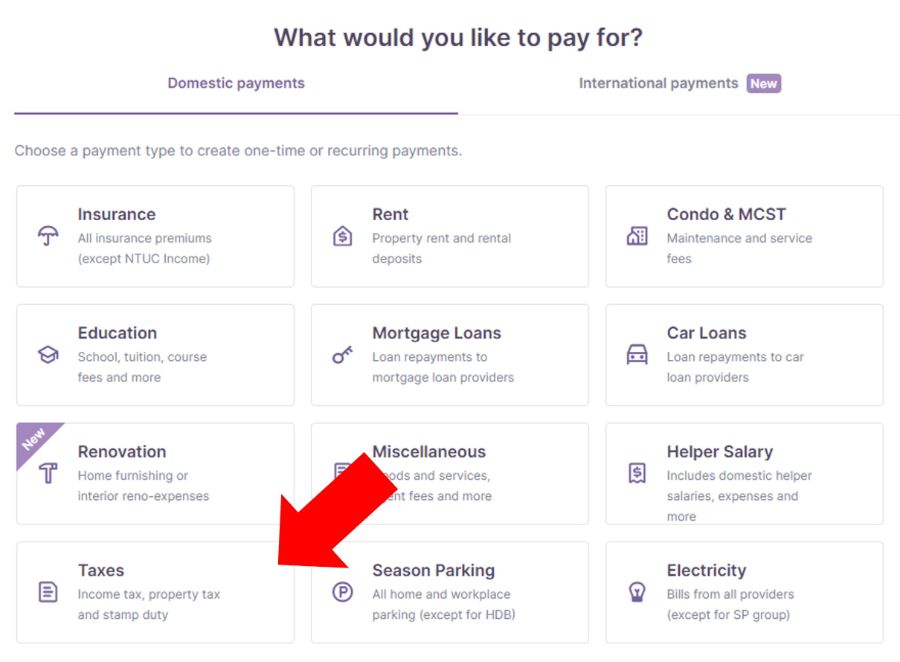

To schedule an income tax payment, log in to your CardUp account and click on Create Payment > Taxes > IRAS-Income Tax

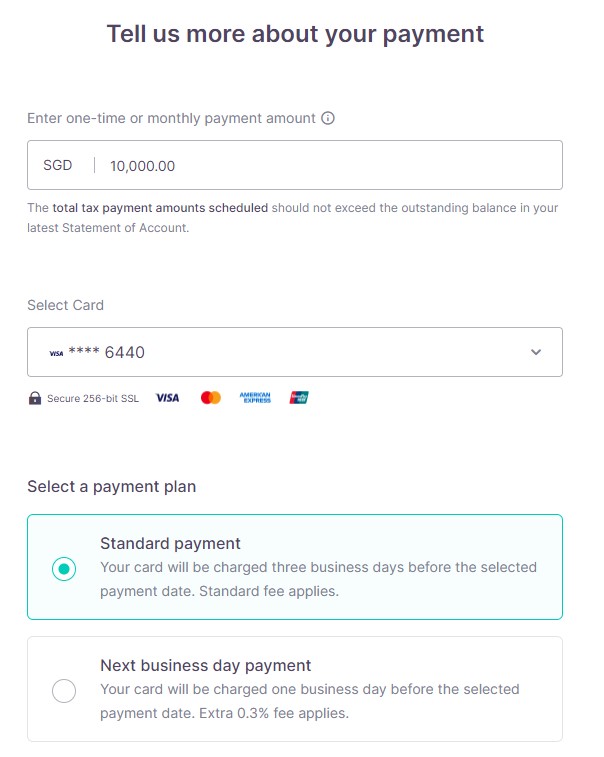

On the next screen, you’ll be prompted to enter the payment amount, choose a card (remember: Mastercard only), and a payment plan (the code is only valid for Standard payments).

Your payment reference number will be automatically filled based on the NRIC number registered to your CardUp account. This means you can’t use your CardUp account to pay someone else’s taxes, though someone else can use your credit card to pay taxes from their personal CardUp account.

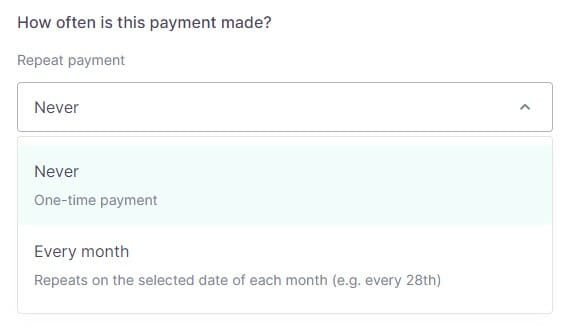

You’ll also be prompted to choose whether you want this to be a one-time payment, or a recurring payment.

One-time payment

Under this option, you can pay any amount up to the total tax due on your NOA.

In other words, if your tax bill is S$10,000, you can pay any amount up to S$10,000.

Recurring payment

Under this option, you can use CardUp to pay your monthly instalment under a GIRO plan with IRAS.

This can be set up via the following methods:

- Instant

- myTax portal (DBS/POSB, OCBC, UOB, Bank of China, HSBC, Maybank)

- 3 working days

- Bank portal (DBS/POSB, OCBC, UOB)

- AXS stations (DBS/POSB)

- 3 weeks processing

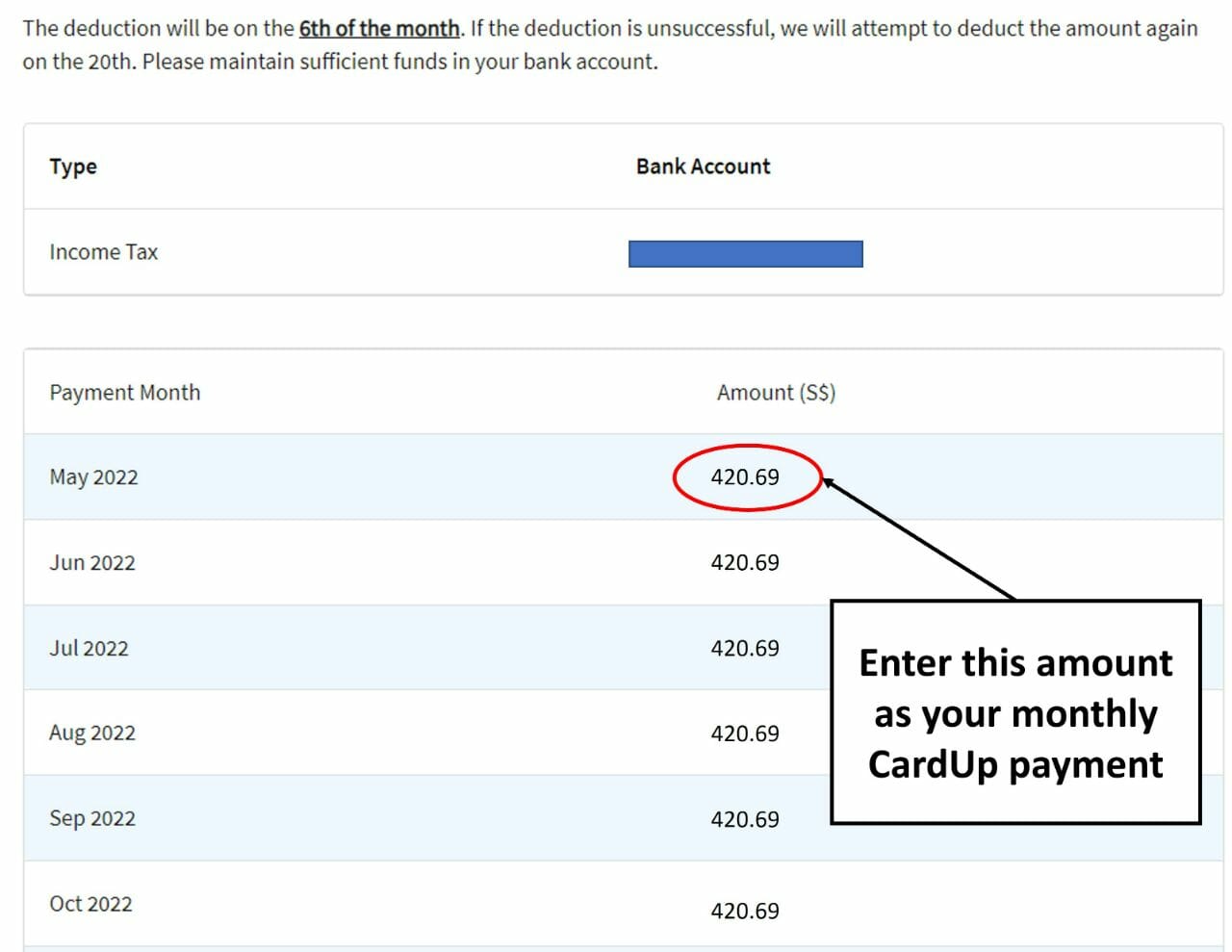

Once your GIRO arrangement has been approved, you can view the monthly instalment by logging to myTax Portal, selecting Account > View Payment Plan > View Plan.

This is the figure you need to enter as the payment amount in the CardUp portal.

You’ll need to select the date of the first and last monthly payment. Do note that first and last few dates of every month will be blocked off. That’s because IRAS does their deductions on the 6th of every month, and CardUp payments need to arrive in advance of that to avoid double deductions.

Regardless of whether you choose one-time or recurring, don’t forget to enter the relevant promo code. Don’t worry that the total fee doesn’t reflect the discount yet. That will appear on the final screen.

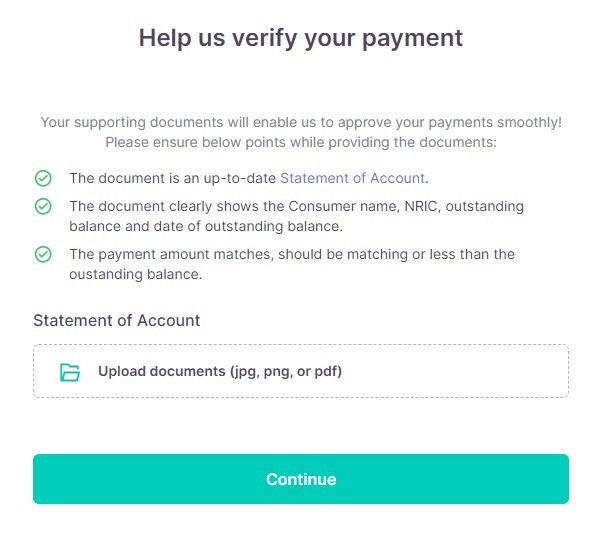

On the next screen, you’ll be prompted to upload a copy of your NOA for verification. This is to ensure you aren’t using CardUp to overpay your tax bill, which is a big no-no from IRAS.

Finally, you’ll be able to review the payment schedule before confirming it. Check that every payment in the recurring series enjoys the discounted rate.

Income tax guide 2025

In case you missed it, I’ve written a comprehensive guide to paying income taxes with a credit card, and have updated it to feature this latest Mastercard promotion.

Inside the guide you’ll also find the details of the other promotions run by Citi PayAll and Standard Chartered, among others.

2025 Edition: How to earn credit card miles on IRAS income tax

Conclusion

CardUp is launching a promotion for income tax payments with a Mastercard, which will offer a 1.55% and 1.67% fee for new and existing customers respectively.

This cuts the cost per mile significantly, though the catch is that redemptions are limited, and there’s a payment limit of S$3,500 and S$5,000 for new and existing users respectively. Once that cap is hit, you should be looking at other alternatives to limit your aggregate cost per mile.

With Citi PayAll’s upcoming offer looking to be relatively lacklustre, this could be as good as it gets for paying income taxes this year.

Argh right after I applied for a prvi visa

What about the chocolate card – shouldn’t this also work?

Chocolate Card is Visa- refer to other article

Brainfart. Apologies. Confused with Amaze.

Because the Choco card is a VISA instead of a MC?

Is the DCS Imperium Card eligible too?

UOB One Account offering 6% rebate on tax payments is better right?

Can anyone add Citi Prestige in CardUp? I’ve failed for several times.

Wow.all slots already redeemed!

Using UOB priv miles card as reference, visa is 1.23 cents per mile while the mastercard is 1.17 cents per mile. With a max cap of $5k for roughly 7000 miles, total cost difference between visa and master is only $4.2 SGD ? Did i calculate wrongly?

It’s only for a yearly $5k tax!

“Therefore, my advice would be to utilise the Mastercard code first, then switch to the Visa code for the payment of the remainder.”

How do you do this? Does Cardup allow two deductions using different credit cards in the same month?

Anyone else having issues to use the code for payment of income tax deduction due May 6, 2025? This is what I received from Cardup support team:

We appreciate you inquiring about making your income tax payment obligations through our platform. However, we regret to inform you that it is our firm policy not to facilitate any income tax payments during the month of April 2025.

As usual — PROMO has ended when I put in the code. It’s crazy that companies can put out misleading promos, like first 10 people, etc.