Here’s the MileLion’s review of the BOC Elite Miles Card, which is a good barometer for how long you’ve been collecting miles.

If you see this as nothing more than a punchline, then you clearly weren’t playing the game back in 2018 when, believe it or not, this was hands down the best miles card in all of Singapore.

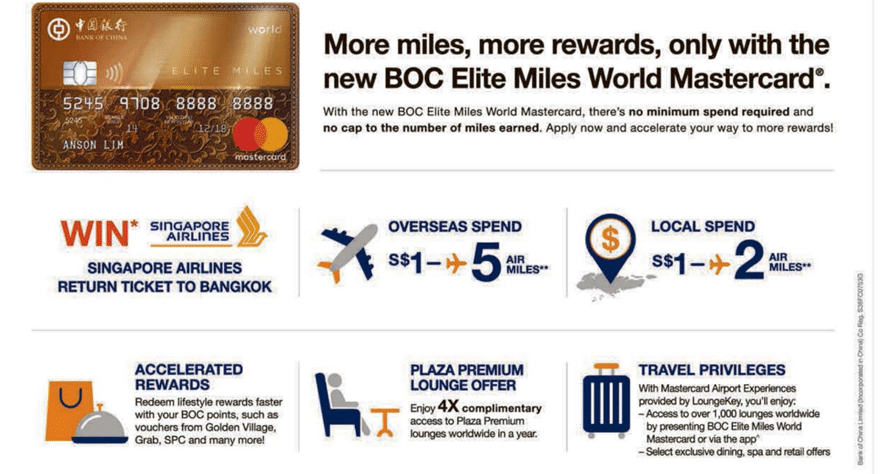

2 mpd on all local spend. 5 mpd on all foreign currency (FCY) spend. No minimum spend, no caps. Hardly any exclusions categories (not even for GrabPay and YouTrip top-ups). 4x Plaza Premium visits. My goodness, what a time to be alive.

Obviously, that couldn’t last forever, but even at its regular earn rates of 1.5 mpd (local) and 3 mpd (FCY), the BOC Elite Miles Card was a force to be reckoned with. It wasn’t perfect by any means— cardholders had to deal with a litany of untold annoyances — but the earn rates were so good such inconveniences could be forgiven.

Until one day they weren’t. In June 2020, BOC cut the earn rates to just 1 mpd (local) and 2 mpd (FCY), added numerous exclusion categories, and even devalued previously-earned BOC Points by hiking the cost of a block of miles! No surprise that cardholders cancelled en masse, and the BOC Elite Miles Card faded into irrelevance.

And then in July 2025 came another twist, as BOC revitalised the card by boosting the earn rates to 1.4 mpd (local) and 2.8 mpd (FCY). That’s a lot of figures to keep track of, but long story short, the BOC Elite Miles Card is competitive once more, and might even be the card for you — provided you’re prepared to tolerate BOC’s other nonsense.

|

|

| BOC Elite Miles Card | |

| 🦁 MileLion Verdict | |

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? | |

| With its rejuvenated earn rates, the BOC Elite Miles Card is a competitive general spending option once again— for those willing to tango with BOC. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: BOC Elite Miles World Mastercard

Let’s start this review by looking at the key features of the BOC Elite Miles Card.

|

|||

| Apply Here | |||

| Income Req. | S$30,000 p.a. | Points Validity | 12-24 months |

| Annual Fee | S$207.10 |

Min. Transfer |

50,000 pts (10,000 miles) |

| Miles with Annual Fee |

N/A | Transfer Partners |

1 |

| FCY Fee | 3% | Transfer Fee | S$30.56 |

| Local Earn | 1.4 mpd | Points Pool? | No |

| FCY Earn | 2.8 mpd | Lounge Access? | No |

| Special Earn | N/A | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

Do note that even though the card name features the word “Elite”, the BOC Elite Miles Card is a World Mastercard, and not a World Elite Mastercard.

How much must I earn to qualify for a BOC Elite Miles Card?

The BOC Elite Miles Card is an entry-level offering with a S$30,000 income requirement, the MAS-mandated minimum.

To my knowledge, BOC does not offer the option of a secured credit card in Singapore.

How much is the BOC Elite Miles Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | Free | Free |

| Subsequent | S$207.10 | S$103.55 |

The BOC Elite Miles Card has an annual fee of S$207.10 for the principal cardholder, and S$103.55 per supplementary card. This is waived for the first year.

There is no automatic fee waiver in the second year, but as with all cards, you’re welcome to appeal for one.

Here’s where you need to be careful, because back in 2019, some cardholders were told that their fee waiver had been approved, only for BOC to quietly deduct 95,000 points (worth 31,667 miles at the time)! I shouldn’t have to spell this out, but when customers ask for a fee waiver, they typically don’t mean “can you deduct my points instead”. It’s just plain sneaky, especially since the value of the miles deducted was worth much more than the annual fee!

BOC now charges “only” 30,000 points (6,000 miles at current rates) for an annual fee waiver, so I guess that’s an improvement?

What sign-up bonus or gifts are available?

When the BOC Elite Miles Card first launched, cardholders could claim this charming “20-inch vintage-style luggage bag.” as a sign-up gift. Vintage indeed, because nothing screams “old world romance of travel” like a sturdy, machine-moulded plastic case, forged in the bowels of Tianjin Industrial City. I never got mine, and never bothered chasing it up.

(Un)fortunately, that gift is no longer available. BOC has very occasionally run welcome offers worth up to 60,000 miles, but there’s nothing available at the time of writing.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 1.4 mpd | 2.8 mpd | None |

SGD/FCY Spending

As I mentioned earlier, the BOC Elite Miles Card’s earn rates have fluctuated over the years, from 2/5 mpd > 1.5/3 mpd > 1/2 mpd > the current rates of:

But the card received a rejuvenation in July 2025, and cardholders will now earn:

- 7 BOC Points per S$1 spent in Singapore Dollars (1.4 mpd)

- 14 BOC Points per S$1 spent in FCY (2.8 mpd)

These are very competitive earn rates for a general spending card, as the table below illustrates.

| 💳 Earn Rates for General Spending Cards (income req.: S$30K) |

||

| Cards | Local Spend | FCY Spend |

UOB PRVI Miles Card UOB PRVI Miles CardApply |

1.4 mpd | 3 mpd IDR, MYR, THB, VND 2.4 mpd All Others |

BOC Elite Miles Card BOC Elite Miles CardApply |

1.4 mpd | 2.8 mpd |

HSBC TravelOne Card HSBC TravelOne CardApply |

1.2 mpd | 2.4 mpd |

DBS Altitude Card DBS Altitude CardApply |

1.3 mpd | 2.2 mpd |

OCBC 90°N Card OCBC 90°N CardApply |

1.3 mpd | 2.1 mpd |

Citi PremierMiles Card Citi PremierMiles CardApply |

1.2 mpd | 2.2 mpd |

StanChart Journey Card StanChart Journey CardApply |

1.2 mpd | 2 mpd |

AMEX KrisFlyer Ascend AMEX KrisFlyer AscendApply |

1.2 mpd | 1.2 mpd |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit CardApply |

1.1 mpd | 1.1 mpd |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit CardApply |

1.2 mpd | 1.2 mpd |

It’s especially compelling for FCY spend because BOC charges a 3% FCY transaction fee, slightly lower than the rest of the market.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

This means that using your BOC Elite Miles Card overseas represents buying miles at an attractive rate of 1.07 cents each.

In fact, this is the best uncapped FCY earn rate available with a S$30,000 card, and for that reason alone might be worth considering.

| 💳 FCY Earn Rates by Card (For cards with uncapped earn rates only, and S$30,000 min. income) |

||

| Card | Earn Rate | Remarks |

BOC Elite Miles Card BOC Elite Miles CardApply |

2.8 mpd 3% fee |

No min. spend Review |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

2.8 mpd 3.25% fee |

Min. S$800 spend per c. month Review |

UOB PRVI Miles Card UOB PRVI Miles CardApply |

2.4 mpd 3.25% fee |

No min. spend Review |

HSBC TravelOne Card HSBC TravelOne CardApply |

2.4 mpd 3.25% fee |

No min. spend Review |

| All other options earn less than 2.4 mpd | ||

However, just like UOB, BOC defines overseas spending as “transactions made at merchants with payment gateway outside of Singapore”. In other words, it’s not sufficient for the transaction to be in a currency other than SGD; the payment processing must be done outside of Singapore too.

Fortunately, there’s a way of checking this before you make a transaction, which I’ve written about in the article below (the context of the article is UOB, but it’s equally applicable to BOC).

If it’s any consolation, this will only be an issue with a small number of online transactions, and using your card while physically overseas guarantees you the FCY spending rate so long as you don’t fall victim to the DCC scam (i.e. always opt to pay in FCY and not in SGD).

When are BOC Points credited?

BOC Points are credited when your transaction posts, which generally takes 1-3 working days.

How are BOC Points calculated?

The BOC Elite Miles Card has an extremely favourable rounding policy. Forget about S$5 earning blocks; BOC awards fractional points down to the very last cent.

Therefore, you will never lose points to rounding, regardless of transaction size.

Here’s how BOC Points on your BOC Elite Miles Card are calculated:

| Local Spend | Multiply transaction by 7 |

| FCY Spend | Multiply transaction by 14 |

This means the minimum spend required to earn miles is S$0.01.

If you’re an Excel geek, here’s the formulas you need to calculate points:

| Local Spend | =X * 7 |

| FCY Spend |

=X* 14 |

| Where X= Amount Spent | |

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for BOC Points?

When the BOC Elite Miles Card first launched, rewards exclusions were non-existent. You could earn points on government transactions, utilities bills, charitable donations, even YouTrip or GrabPay top-ups.

Over time, however, BOC added exclusions that brought this card in line with others on the market.

| MCC | Description |

| 4829 | Payment of funds for money transfers and remittance services |

| 4900 | Utilities – electric, gas, water and sanitary |

| 5199 |

Non-durable goods (not elsewhere classified) |

| 5960 | Direct Marketing – Insurance Services, Insurance Sales, Underwriting and Premiums |

| 5965 |

Direct Marketing – Combination Catalog and Retail Merchants |

| 5993 |

Cigar Stores and Stands |

| 6010, 6011, 6012, 6050, 6051, 6211 | Payments to financial institutions (including banks and brokerages) for financial services |

| 6300, 6399, 6381 |

Insurance Payments |

| 6513 | Real Estate agents and managers |

| 6540, 6529, 6530, 6534 |

Payments of funds to prepaid accounts and/or merchants categorised as “payment service providers” |

| 7349 |

Cleaning, Maintenance and Janitorial Services |

| 7511 |

Quasi Cash – Truck Stop Transactions |

| 7523 |

Parking lots and garages |

| 7995 | Betting, including lottery tickets, casino gaming chips, offtrack betting and wagers at race tracks |

| 8062 | Hospitals |

| 8211, 8220, 8241, 8244, 8249, 8299 | Schools and Educational Services |

| 8398 | Charitable and Social Service Organisations |

| 8661, 8651, 8699, 8999 |

Political Organisations, Religious Organisations, and Membership Organisations (not elsewhere classified) |

| 9211 | Court Costs including Alimony and Child Support |

| 9222 | Fines |

| 9223 | Bail and Bond Payments |

| 9311 | Tax Payment |

| 9399 | Government Services – not elsewhere classified |

| 9402 | Postal Services – Government Only |

| 9405 | Intra-Government Purchases – Government only |

Both CardUp and ipaymy are also excluded from earning points. BOC has provided a non-exhaustive list of excluded merchants below.

| Category | Examples |

|---|---|

| Cleaning, Maintenance, and Janitorial Services | Helpling, Sendhelper |

| Educational Institutions | Institute of Technical Education (ITE), NTU, NUS, SIM, SIT, SMU, SUSS, SUTD |

| Financial Institutions for Financial Services | AxiTrader, BANC DE BINARY, BANCDEBINARY.COM, CardUp, City Index, FOREX.COM, MONEYBOOKERS.COM, IC Markets, IG Asia, IGMarkets.com.sg, ipaymy, OANDA, Peppersone (sic), Plus500, Revolut, Saxo Capital Markets/Saxo Cap Mkts Pte Ltd, SKRSKRILL.COM, SKRxglobalmarkets.com, SKYFX.COM |

| Government Services | ACRA, CPF, HDB Season Parking, ICA, IRAS, LTA, MOM, Town Council, URA |

| Hospitals | Farrer Park Hospital, Gleneagles Hospital, KK Women’s and Children’s Hospital, Mount Alvernia Hospital, Mount Elizabeth Hospital, National University Hospital, Parkway Shenton Hospital, Singapore General Hospital, Tan Tock Seng Hospital |

| Insurance Payments | AIA Insurance, AIG, AVIVA, AXA, Great Eastern, Manulife, MSIG Insurance, NTUC Income, Prudential, QBE Insurance, Sompo Insurance, TM Life Insurance |

| Money Transfer and Remittance Services | MoneyGram, Swiss Money Transfer, Western Union, Wise, WorldRemit |

| Prepaid Accounts and Payment Service Providers | AXS, EZ Link/EZ-Link/EZLINK, eNETS, HelloPay, MatchMove Pay, NETS FlashPay, SAM, SingTel Dash, Transit/TransitLink, Youtrip, Grab wallet top-ups, ShopeePay wallet top-ups |

| Real Estate Agents and Managers | ERA Singapore, MCST, RentHero |

| Utility Bill Payments / Other Payments | AXS, SAM payments, SP Services |

What do I need to know about BOC Points?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| 12-24 months | No | S$30.56 |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 50,000 BOC Points (10,000 miles) |

1 | 2-3 weeks |

Expiry

BOC Points are valid for 12-24 months, depending on when they were earned.

| Earned | Expiry |

| 1 Jul 2024 to 30 Jun 2025 | 30 Jun 2026 |

| 1 Jul 2025 to 30 Jun 2026 | 30 Jun 2027 |

| 1 Jul 2026 to 30 Jun 2027 | 30 Jun 2028 |

Points expiry takes place on 30 June each year, which means that in a worst case scenario, points could be valid for as little as 12 months (if they were earned on 30 June). On the flip side, however, points could be valid for as much as 24 months (if they were earned on 1 July).

Pooling

BOC Points do not pool across cards, but in any case, BOC really only has one points-earning card of note.

Transfer Partners & Fees

BOC Points can be converted into KrisFlyer miles at a 5:1 ratio, with a minimum conversion block of 10,000 miles (transfers to Asia Miles were discontinued on 1 July 2025).

| Frequent Flyer Programme | Conversion Ratio (BOC Points: Miles) |

| 50,000 : 10,000 |

It’s worth noting that the conversion ratio was originally 30,000 BOC Points = 10,000 miles, but was devalued to 45,000 BOC Points = 10,000 miles on 15 June 2020, and then again to the current 50,000 BOC Points = 10,000 miles on 1 July 2025. It’s very rare to see a bank in Singapore devaluing transfer ratios, let alone twice, but BOC is not like most banks!

Each transfer costs S$30.56, and you can only transfer a maximum of 10 blocks in a single transaction, i.e. 100,000 miles.

Why? Because BOC said so. There’s absolutely no technical reason for this; it’s a pure money-grab on the part of the bank. 100,000 miles may sound like a lot, but if you’re redeeming long-haul premium cabin awards for more than one person, it really isn’t. For the record, BOC is the only bank in Singapore with such a policy.

Transfers of BOC Points must also be done via this PDF form, as the bank lacks an online rewards portal.

Transfer Time

While most banks advise customers to wait up to 14 working days for conversions to be completed, that’s really more of a CYA kind of thing, and transfers are usually competed within 3-5 days at most.

In BOC’s case, it really means it. Don’t expect speedy conversions with BOC. Points conversions take 14-21 working days to be completed, little surprise since the process is highly manual.

Other card perks

BOC SmartSaver bonus interest

Spending on the BOC Elite Miles Card is eligible to earn bonus interest on the BOC SmartSaver account.

Cardholders will earn bonus interest of up to 1.25% p.a. if they spend S$2,500 or more on their card each month.

| Monthly Spend | Bonus Interest |

| S$2,500 and above | 1.25% p.a. |

| S$750 to S$2,499.99 | 0.75% p.a. |

Since the bonus interest is capped at S$100,000, this has the potential to yield an extra S$104.67 of interest each month. But this comes with an opportunity cost, because by using the BOC Elite Miles Card, you’re diverting spend away from 4 mpd cards.

The BOC SmartSaver account will be cutting its interest rates from 1 August 2025, but this affects the Wealth Bonus and Salary Crediting Bonus only.

But be warned…

Before I begin, I should caveat that I stopped using the BOC Elite Miles Card several years ago, so I can’t say for sure how many of these issues still exist.

But during my time with BOC, I found that their processing times were painfully slow. When the card first launched, it took up to 3-4 months to process applications. Far from just teething problems, these delays continued long after- when my wife lost her card in July 2019, it took 36 working days to replace.

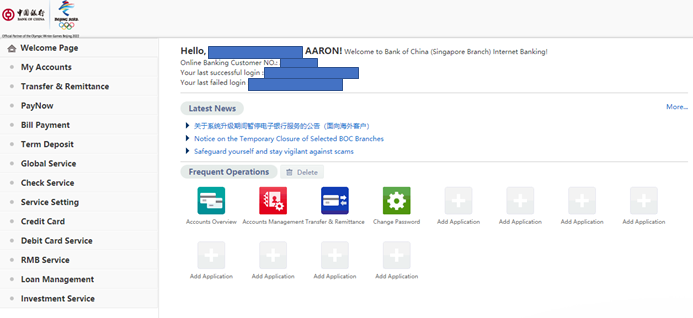

You’re also going to have to get used to an antiquated IT setup. The BOC website looks like something from the early 2000s, complete with SimSun-esque fonts and menus that were obviously machine-translated. To even access ibanking, you need to head down to a physical BOC branch to register. Then, when you get your BOC credit card, you need to go down again to link it to your account.

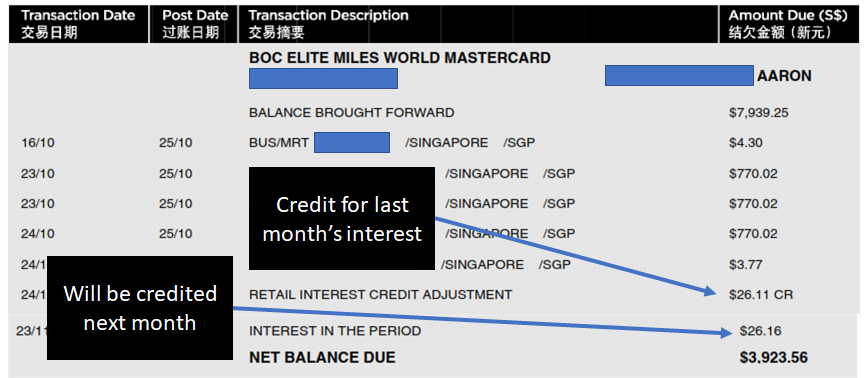

I also encountered unexpected interest charges. Suppose you make two purchases of S$50 and S$100, and receive a refund of S$30 from a previous transaction. All-in-all, you owe the bank S$120, which is duly deducted through the GIRO arrangement you set up. Next month, however, you see interest on your account. When you call up the bank, you’re told you underpaid your balance by S$30!

Yes, that’s the reality of the BOC payment system, which does not see refunds as a contra to the amount due. In August 2019, I stumbled upon this practice that had presumably been going on for a while already. It was only after calling in that BOC refunded the excess interest- one wonders what would have happened if I didn’t call.

What’s crazy is that BOC didn’t actually fix the problem. Their SOP now is to still charge interest, but refund it automatically the following month. One can only hope their systems aren’t reporting this to CBS as an incomplete payment…

I’m barely scratching the surface of all the shenanigans that BOC Elite Miles Card members have encountered. I could talk about the points clawbacks, the fact you have to fill, scan, and email a form to transfer miles, or how the card didn’t get added to the BOC website for more than a year, but all this to say, this isn’t a card isn’t for the faint of heart.

Summary Review: BOC Elite Miles Card

|

|||

| Apply | |||

| 🦁 MileLion Verdict | |||

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

Let’s start with the good stuff.

With the unexpected buff to its earn rates, the BOC Elite Miles Card is a competitive general spending card once again. That’s especially so if you intend to use it for FCY spending, where it offers an uncapped 2.8 mpd with no minimum spend necessary (the lower-than-average 3% FCY fee doesn’t hurt too).

You will also never be shortchanged when it comes to earning miles, because of the fractional points system- a breath of fresh air compared to other banks and their “hey let’s round it down to the nearest S$5” policies. And BOC knows how to keep things spicy, with the occasional insane promo, albeit short-lived.

But you won’t earn miles on CardUp or ipaymy. You only have one mileage programme to choose from. You will need to pay more than one transfer fee if you’re converting anything more than 100,000 miles. Your conversion times will be measured in the weeks, not days. And, of course, you’ll have to put up with BOC’s antiquated, Kafkaesque systems which sometimes seem designed by Marquis de Sade himself.

Is it worth it? That’s for you to decide. All I can say is that I’m not particularly enthused about the prospect of getting back in bed with the BOC Elite Miles Card, though I also don’t kink shame.

I am surprised you even marked 1.5 for this trash.

I cash out all my points and cancelling it now~

just by seeing it now makes me sick~

More like 0.5 stars. But I have to give credit to the CSO who noted that after transferring the maximum points to KF, I still had enough points for a FairPrice voucher. She converted the balance points for me and I duly received the voucher. But everything else about BOC sucks big time. Not worth the energy.

1 star is the lowest rating on the scale, actually…but maybe this card warrants a new scale 🙂

The BOC Elite Miles World Mastercard scale?

I like the Harvey Dent reference thrown in

Under the Shenanigans section, you forgot to add that their transaction SMS alerts are arbitrarily set at $100 to trigger, this threshold can’t be reduced, because BOC is too cheapskate to pay for more SMS alerts triggered by lower amounts.

I am dumping both the card and SmartSaver account. What is a good alternative to credit my salary?

DBS Multiplier

True. There is alternative and no need to keep BOC account or card anymore.

When this card was launched, BOC has the best cashback card (Family Card) and general spending card (Elite Miles). Then BOC changed T&C three times a year for Family card making me cancel it and now the same thing happens to Elite Miles…0 star for BOC

Neither an “elite” nor “miles” card. No longer the same card as when it first launched despite the name

hahahaha … this is the funniest card on the market.. i am suprised you even bother to write a review on this card.. the best part is …even if any BOC staff / management reads this .. they wont change or do anything about it… if you get a chance you should really ask them what is the exact purpose of this card? who are they trying to target.. this by far is the funniest card there is… i am so curious as to the actual purpose of existence of this card .. if only they had great online earn… Read more »

🎶 if you like the way you look that much oh baby you should go and love yourself🎵

I dealt with it years ago. If you think going to the branch physically is bad enough? I would tell you no, it can be much worse. I came down to their branch to change my address and it didn’t reflect in the system. It took me another month or so to call them multiple times to get it changed until I decided enough is enough! I closed the account for good! And guess what, I think I received some letter from it eventually to my correct address saying that my account is closed. What a trash bank.

Based on the above review , why would anyone even consider BOC banking in general ?