DBS has launched a new campaign for overseas shopping and dining, which offers cardholders an extra S$100 cashback on top of the usual credit card rewards.

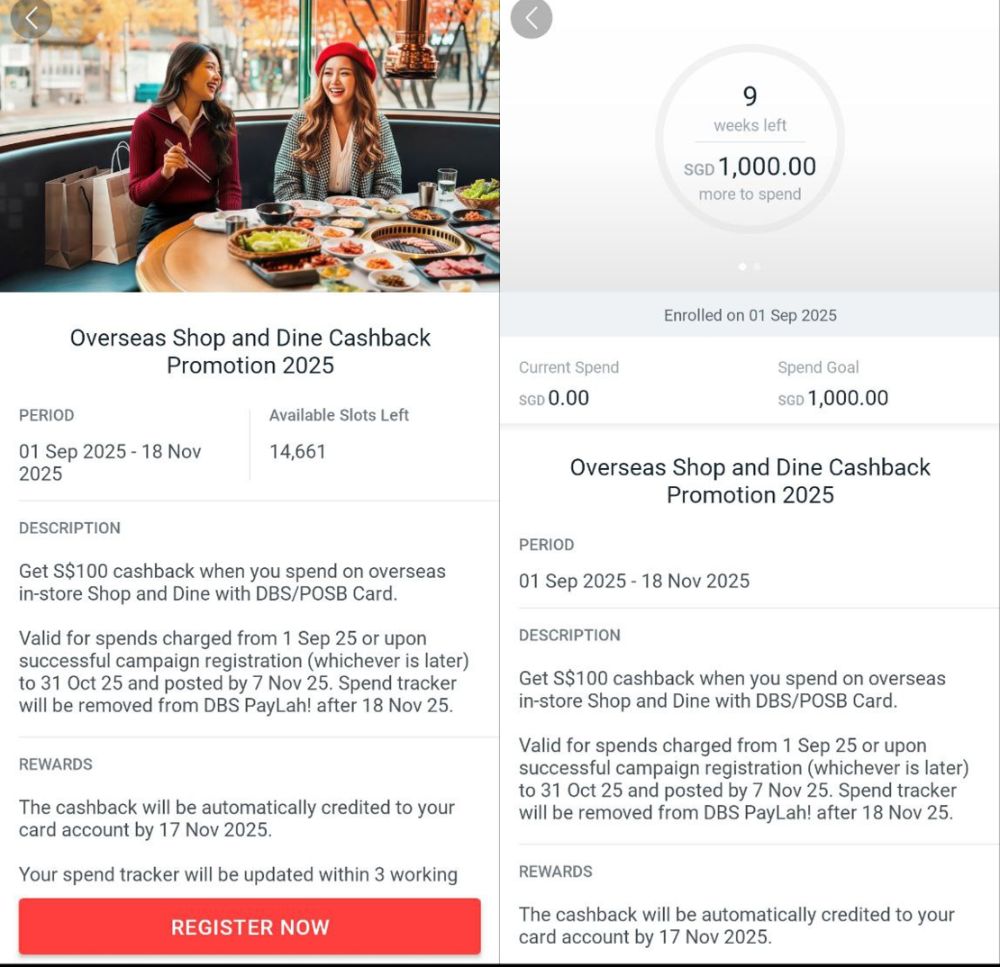

Cardholders will need to register via the DBS PayLah! app and meet their personalised spend goal (ranging from S$1,000 to S$5,000) by 31 October 2025, upon which the cashback will be automatically credited.

If you’ve been targeted for the lowest spend goal, this would be equivalent to an extra 10% rebate, and well worth gunning for.

| 🎁 DBS Gifts Promo |

|

DBS has launched a separate spend and redeem promotion that offers gifts like Apple AirPods, Apple iPads or a Nintendo Switch 2, subject to meeting a minimum qualifying spend from 1-30 September 2025. This is a targeted offer, and only includes spending on a very limited number of cashback cards. |

DBS Overseas Shop & Dine Promotion

|

| Campaign Details |

From 1 September to 31 October 2025, DBS cardholders can earn a bonus S$100 cashback upon meeting their personalised spend goal on dining, shopping and travel, on top of their usual credit card rewards.

Registration is required, and can be done via the DBS PayLah! app. Tap on the ‘Rewards’ tab and look for the ‘Overseas Shop and Dine Cashback 2025’ banner.

Registration is capped at 15,000 cardholders, so be sure to register sooner rather than later.

Upon registration, you’ll receive your personalised spend goal. For me, this was S$1,000. DBS doesn’t list all the possible spend goals, but other figures reported so far are as high as S$5,000.

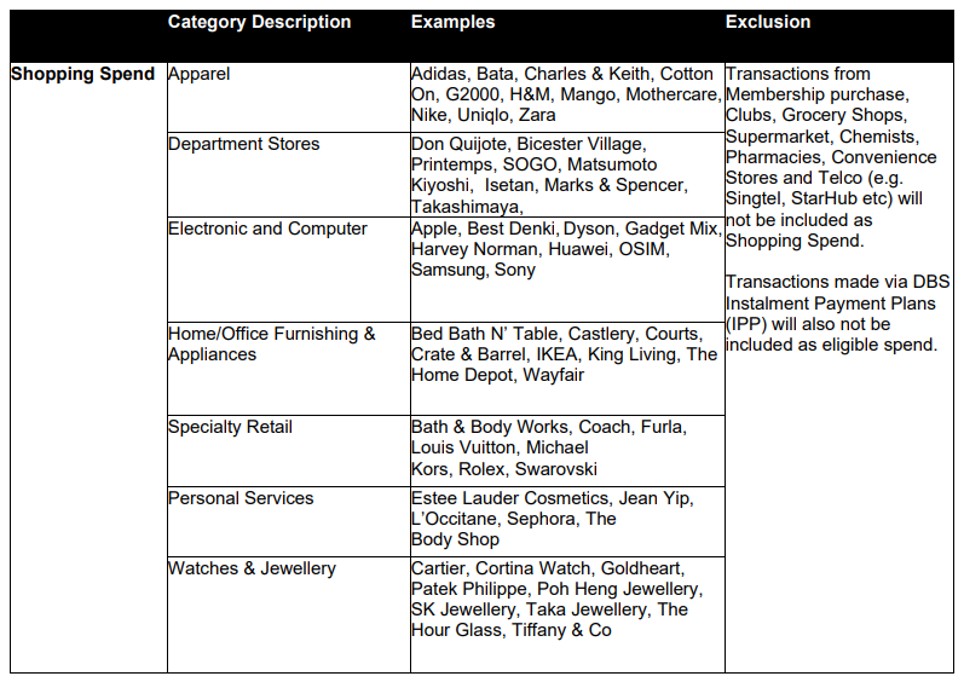

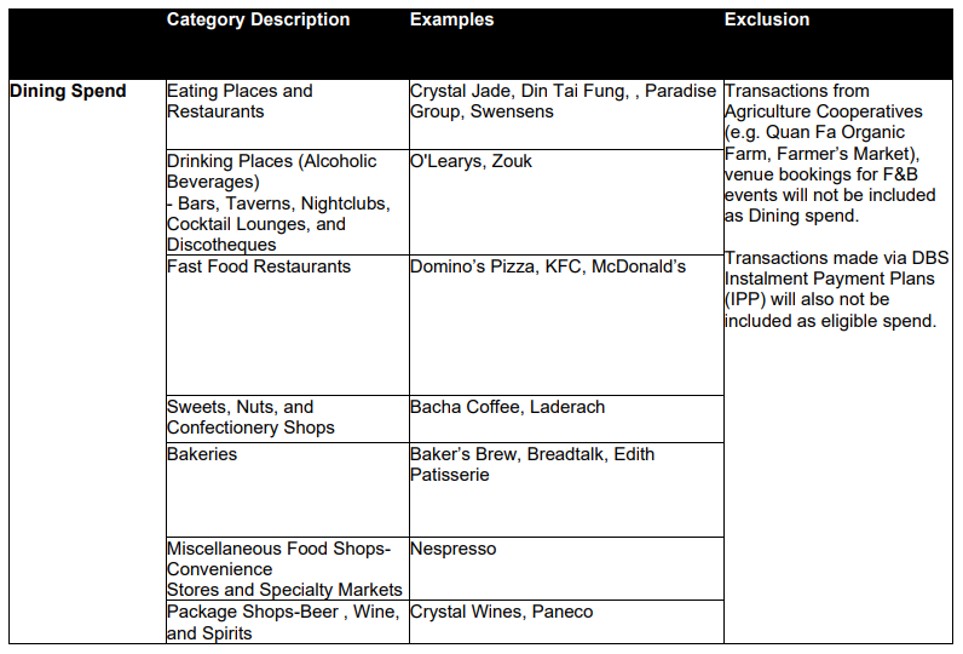

What counts as qualifying spend?

Qualifying spend consists of in-person transactions made at overseas shopping and dining merchants.

Category descriptions and examples have been provided below.

The full list of eligible MCCs can be found here.

Qualifying spend is cumulative across all DBS/POSB credit cards, so you could split your spending across multiple cards if you wish. For example, if your goal was S$1,000, spending S$500 on the DBS Altitude Card and S$500 on the DBS Vantage Card would suffice. Supplementary cardholder spending will accrue to the principal cardholder’s minimum spend.

Also note that qualifying spend is only tracked from the date of registration; any spending prior to that will be disregarded, even though it falls within the promotion period.

Qualifying spend must be charged within September or October 2025, and posted by 7 November 2025. This means that you should be able to safely spend towards the end of October as well, because seven days is more than enough time for transactions to post.

When will the cashback be credited?

Eligible cardholders will receive S$100 cashback credited to the card that was last transacted on within five working days of receiving a push notification from the DBS PayLah! app that 100% of the spend goal has been met.

Terms & Conditions/FAQs

T&Cs for this campaign can be found here.

FAQs are available here.

Which card should you use to spend?

As a reminder, all qualifying transactions must be made in-person, and in foreign currency. The following DBS cards could therefore be good options.

| Card | FCY Earn Rate |

DBS Treasures Black Elite DBS Treasures Black EliteApply |

2.4 mpd |

DBS Altitude AMEX DBS Altitude AMEXApply |

2.2 mpd |

DBS Altitude Visa DBS Altitude VisaApply |

2.2 mpd |

DBS Vantage Card DBS Vantage CardApply |

2.2 mpd |

DBS Woman’s World Card DBS Woman’s World CardApply |

1.2 mpd |

It may surprise you to see the DBS Woman’s World Card here, given that spending must be done in-person. But the DBS Woman’s World Card actually earns an uncapped 1.2 mpd on offline FCY spending, and if this is the only DBS card you have, getting an extra 10% rebate on top of that might still be worthwhile (assuming you were targeted for a S$1,000 personalised spend goal).

All FCY transactions are subject to a 3.25% fee, with the exception of the DBS Altitude AMEX and DBS Treasures Black Elite, where the fee is 3%.

Conclusion

DBS/POSB cardholders can now register to earn an extra S$100 cashback on top of their usual credit card rewards, by meeting their personalised spend goal by 31 October 2025.

My personal spend goal is S$1,000, so you can bet I’ll be trying to hit it. If your spend goal isn’t so favourable, then you need to do the sums and see whether the incremental rebate is worth giving up alternative 4 mpd options.

What other spend goals have you been targeted for?

The ‘Overseas Shop and Dine Cashback 2025’ banner is not appearing in my PayLah app. Is it because it is a targetted campaign? Can’t be.

Don’t see this offer as well. Guess it is targetted

My spend goal is 5000, guess I’ll be giving this a miss

Not appearing in mine also.

Does payment using Apple wallet ( link to DBS card) count? I am overseas now but did not bring my physical card.