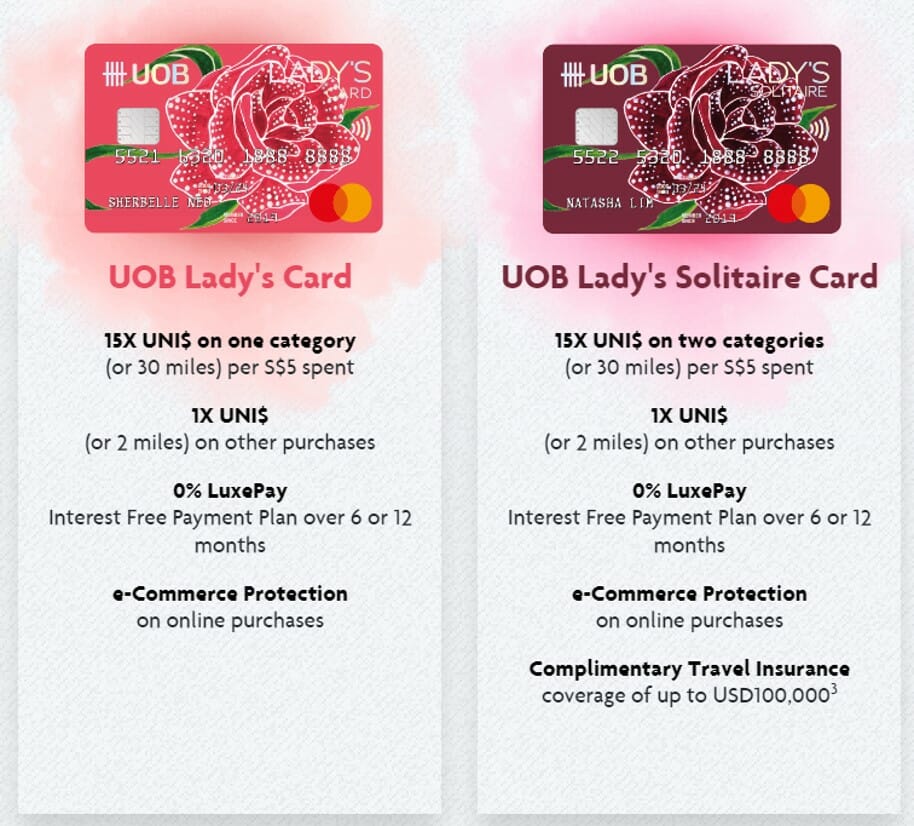

UOB has announced some big changes to the UOB Lady’s Card and UOB Lady’s Solitaire Card, and this should make any miles chaser sit up and take notice.

From 8 March 2023 to 29 February 2024, cardholders will earn 6 mpd on their choice of one (UOB Lady’s Card) or two (UOB Lady’s Solitaire & Solitaire Metal Card) bonus categories, capped at S$1,000 (UOB Lady’s Card) or S$3,000 (UOB Lady’s Solitaire & Solitaire Metal Card) per calendar month (T&Cs).

While it would certainly be better if this were an evergreen feature, I’m not going to complain about one entire year to make hay…

| 💳 One or the other |

| You can only hold the UOB Lady’s Card or the UOB Lady’s Solitaire/Solitaire Metal Card, not both. |

UOB Lady’s Card: 6 mpd on up to S$1,000 per month

UOB Lady’s Card UOB Lady’s Card |

||

| Till 7 Mar 23 | From 8 Mar 23 | |

| Earn Rate | 4 mpd | 6 mpd |

| Bonus Categories | 1 | 1 |

| Bonus Cap (Monthly Spend) |

1,800 UNI$ (S$1,000) |

2,800 UNI$ (S$1,000) |

UOB Lady’s Cardholders currently earn:

- 1 base UNI$ for every S$5 spent (0.4 mpd)

- 9 bonus UNI$ for every S$5 spent (3.6 mpd)

on their choice of one bonus category, capped at 1,800 bonus UNI$ per calendar month.

From 8 March 2023 to 29 February 2024, UOB Lady’s Cardholders will earn:

- 1 base UNI$ for every S$5 spent (0.4 mpd)

- 9 bonus UNI$ for every S$5 spent (3.6 mpd)

- An additional 5 bonus UNI$ for every S$5 spent (2 mpd)

on their choice of one bonus category. The 9 bonus UNI$ is capped at 1,800 UNI$ per calendar month, while the additional 5 bonus UNI$ is capped at 1,000 UNI$ per calendar month.

Since the change is happening mid-way through March, here’s how it works for the rest of the month.

Scenario 1: Cardholder has already hit the old UNI$ bonus cap for March

If a cardholder has already spent S$1,000 from 1-7 March 2023, she can spend a further S$1,000 from 8-31 March 2023 to max out the additional 1,000 bonus UNI$ cap.

| 1-7 Mar 2023 | 8-31 Mar 2023 | Total | |

| Spend | S$1,000 | S$1,000 | S$2,000 |

| Bonus UNI$ | 1,800 | 1,000 | 2,800 |

| Base UNI$ | 200 | 200 | 400 |

Her total return for March 2023 would be 3,200 UNI$ for S$2,000 spend, or ~3.2 mpd.

Scenario 2: Cardholder has yet to make any spend in March

If a cardholder has not spent anything from 1-7 March 2023, she can spend a further S$1,000 from 8-31 March 2023 to max out the new 2,800 bonus UNI$ cap.

| 1-7 Mar 2023 | 8-31 Mar 2023 | Total | |

| Spend | 0 | S$1,000 | S$1,000 |

| Bonus UNI$ | 0 | 2,800 | 2,800 |

| Base UNI$ | 0 | 200 | 200 |

Her total return for March 2023 would be 3,000 UNI$ for S$1,000 spend, or 6 mpd.

UOB Lady’s Solitaire & Solitaire Metal Card: 6 mpd on up to S$3,000 per month

UOB Lady’s Solitaire & Solitaire Metal Card UOB Lady’s Solitaire & Solitaire Metal Card |

||

| Till 7 Mar 23 | From 8 Mar 23 | |

| Earn Rate | 4 mpd | 6 mpd |

| Bonus Categories | 2 | 2 |

| Bonus Cap (Monthly Spend) |

5,400 UNI$ (S$3,000) |

8,400 UNI$ (S$3,000) |

UOB Lady’s Solitaire & Metal Solitaire Cardholders currently earn:

- 1 base UNI$ for every S$5 spent (0.4 mpd)

- 9 bonus UNI$ for every S$5 spent (3.6 mpd)

on their choice of two bonus categories, capped at 5,400 bonus UNI$ per calendar month.

From 8 March 2023 to 29 February 2024, UOB Lady’s Solitaire & Metal Solitaire Cardholders will earn:

- 1 base UNI$ for every S$5 spent (0.4 mpd)

- 9 bonus UNI$ for every S$5 spent (3.6 mpd)

- An additional 5 bonus UNI$ for every S$5 spent (2 mpd)

on their choice of two bonus categories. The 9 bonus UNI$ is capped at 5,400 UNI$ per calendar month, while the additional 5 bonus UNI$ is capped at 3,000 UNI$ per calendar month.

Since the change is happening mid-way through March, here’s how it works for the rest of the month.

Scenario 1: Cardholder has already hit the old UNI$ bonus cap for March

If a cardholder has already spent S$3,000 from 1-7 March 2023, she can spend a further S$3,000 from 8-31 March 2023 to max out the additional 3,000 bonus UNI$ cap.

| 1-7 Mar 2023 | 8-31 Mar 2023 | Total | |

| Spend | S$3,000 | S$3,000 | S$6,000 |

| Bonus UNI$ | 5,400 | 3,000 | 8,400 |

| Base UNI$ | 600 | 600 | 1,200 |

Her total return for March 2023 would be 9,600 UNI$ for S$6,000 spend, or ~3.2 mpd.

Scenario 2: Cardholder has yet to make any spend in March

If a cardholder has not spent anything from 1-7 March 2023, she can spend a further S$3,000 from 8-31 March 2023 to max out the new 8,400 bonus UNI$ cap.

| 1-7 Mar 2023 | 8-31 Mar 2023 | Total | |

| Spend | 0 | S$3,000 | S$3,000 |

| Bonus UNI$ | 0 | 8,400 | 8,400 |

| Base UNI$ | 0 | 600 | 600 |

Her total return for March 2023 would be 9,000 UNI$ for S$3,000 spend, or 6 mpd.

What are the bonus categories?

UOB Lady’s Cardholders and UOB Lady’s Solitaire & Metal Solitaire Cardholders get to choose one and two bonus categories respectively, and change them every calendar quarter if they wish.

| Category | MCCs | Description |

| (1) Beauty & Wellness | 5912, 5977, 7230, 7231, 7298, 7297 | Discount, Mass and Drug Stores, Cosmetics Stores, Barber and Beauty Shops, Health and Beauty Spa, Massage Parlours |

| (2) Dining | 5811, 5812, 5814, 5499 | Caterers, Eating places and Restaurants, Fast food restaurants and food deliveries |

| (3) Entertainment | 5813, 7832, 7922 | Bars, Taverns, Lounges and Nightclubs, Motion Picture Theatres, Theatrical Producers and Ticket Agencies |

| (4) Family | 5411, 5641 | Grocery stores, Children and Infants wear store |

| (5) Fashion | 5311, 5611, 5621, 5631, 5651, 5655, 5661, 5691, 5699, 5948 | Department Stores, Men’s and Boy’s Clothing and Accessories Store, Women’s Ready-to-wear Stores, Women’s Access and Specialty, Family Clothing Stores, Sports and Riding Apparel Stores, Shoes Stores, Men’s and Women’s Clothing Stores, Miscellaneous Apparel and Accessories Shops, Luggage and Leather Stores |

| (6) Transport | 4111, 4121, 4789, 5541, 5542 | Local Commuter Transport, Taxi, Cabs, Limousines and Travel Service, Service Stations and Automatic Gas Dispensers |

| (7) Travel | Credit card retail transactions made at major airlines and/or hotels with their main business activity classified as flights and/or hotels only | |

The ability to change your bonus category every quarter means the card can be different things to you at different times.

If this quarter you’re taking an overseas trip, switch your bonus category to travel to earn 6 mpd on your airline and hotel bookings. If this quarter you’re dining out a lot, switch your bonus category to dining to earn 6 mpd on restaurants, caterers and fast food. If this quarter you’re buying an expensive massage package, switch your bonus category to beauty & wellness.

This is an excellent change

No two ways about it: this is an excellent change, and makes the UOB Lady’s Card practically essential for anyone who qualifies.

With the changes, a UOB Lady’s Cardholder who spends S$1,000 per month would earn 72,000 miles per year, enough for a round-trip Business Class flight to Taiwan. A UOB Lady’s Solitaire Cardholder who spends S$3,000 per month would earn 216,000 miles per year, enough for a round-trip Business Class ticket to Europe or the USA, or to fly a family of four to Japan or South Korea and back in Economy Class.

No other card on the market offers anything beyond 4 mpd, let alone on a regular basis. In fact, I’ve often used “4 mpd cards” as a shorthand for rewards cards, on the assumption that nothing could go higher than that. I mean, I have my issues with UOB cards, but man, are they hard to ignore.

| 💳 Rewards Cards |

||

| Card | Bonus Rate | Cap |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

6 mpd | S$3,000 per calendar month |

UOB Lady’s Card UOB Lady’s CardApply |

6 mpd | S$1,000 per calendar month |

OCBC Titanium Rewards OCBC Titanium RewardsApply |

4 mpd | S$13,335 per membership year |

UOB Visa Signature UOB Visa Signature Apply |

4 mpd | S$2,000 per statement month |

DBS WWMC DBS WWMCApply |

4 mpd | S$2,000 per calendar month |

UOB Pref. Plat. Visa UOB Pref. Plat. VisaApply |

4 mpd | S$1,110 per calendar month |

HSBC Revolution HSBC RevolutionApply |

4 mpd | S$1,000 per calendar month |

Citi Rewards Card Citi Rewards CardApply |

4 mpd | S$1,000 per statement month |

Of course, the catch here is that the UOB Lady’s Card is exclusively for females. My personal workaround is to add The MileLioness’ card to my phone and use Google Pay wherever possible. If nothing else, let this be a reason for all you BBFAs to start hitting the dating circuit in earnest- there’s miles to be had!

And come to think of it, if you decide to get hitched, you’ll have a wonderful wedding banquet strategy on your hands: make S$11,220 of payments per month to get 50,880 miles (make sure your spouse-to-be earns more than S$120,000/yr. so she qualifies for the UOB Lady’s Solitaire Card…does Tinder have an income filter?)

| 💒 Monthly Banquet Payments | ||

| 🤵 Him | 👰 Her | |

UOB Pref. Plat. Visa UOB Pref. Plat. VisaApply |

S$1,110 | S$1,110 |

UOB Visa Signature UOB Visa Signature Apply |

S$2,000 | S$2,000 |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

N/A | S$3,000* |

HSBC Revolution HSBC RevolutionApply |

S$1,000 | S$1,000 |

| Total Spend | S$4,110 | S$7,110 |

| Total Miles | 16,440 | 34,440 |

| *If banquet held in a hotel, select travel as your bonus category. If banquet held in a restaurant, select dining as your bonus category | ||

And when you go on your honeymoon (I’m really stretching this example), you can pair the UOB Lady’s Card with Amaze to earn 6 mpd on your overseas spend with no foreign currency transaction fees (save Amaze’s own spread). I’d personally choose travel and dining as my bonus categories, since hotels and food are likely to be my two biggest expense items on trips.

Bonus is applicable at UOB$ merchants

It’s long been thought that UOB cards should be avoided altogether at UOB$ merchants (formerly known as SMART$ merchants), such as Giant or Cold Storage, but I’ve recently confirmed that it’s not so clear cut.

While base UNI$ will not be awarded, bonus UNI$ will still be awarded for eligible transactions. This means that a UOB Lady’s Card or UOB Lady’s Solitaire Cardholder will earn 5.6 mpd at UOB$ merchants, subject to selecting the relevant bonus categories.

For the full details, refer to this post (and replace 3.6 mpd with 5.6 mpd).

Confirmed: UOB$ merchants qualify for bonus miles with UOB cards

Conclusion

UOB has given its Lady’s Cards a shot in the arm by upsizing their bonus earn rate to 6 mpd. This means you can earn up to 6,000 miles per month with the UOB Lady’s Card, and an astounding 18,000 miles per month with the UOB Lady’s Solitaire Card, without having to increase your current spending.

There’ll be much more to say about this in the days and weeks to come, but if 6 mpd is the “new normal” for rewards cards in Singapore, this might be the start of something grand.

Hi Aaron! This is excellent news! If my spouse would to hold the card, is it possible to credit the miles to my account during miles conversion?

No

Ah, that’s a bummer 😞.

What about OCBC and UOB , If my spouse would to hold the card, is it possible to credit the miles to my account during miles conversion?? Thank you.

Being a pessimist here. If 6 miles become the norm, then we can expect the cost of redemption to go up.

Airlines and credit card companies are separate

The norm has already been 15mpd with Kris+ for years. Why you think we having KF hyperinflation?

A very pleasant surprise. Not to forget that being a Mastercard, it can also be used with Amaze for foreign currency transactions. Best card for travelling.

Amaze’s foreign exchange spread is getting higher and higher. I’ve just been charged a 3.5% spread on my GBP purchase!

Hi,

I am new to the miles game.

Can I check if i pair the UOB Lady’s card with Amaze card, what category will it be under since it is foreign currency transactions? Will it be under travel category or it will be depending on the nature of expense (e.g. buying clothes at overseas fashion store = Fashion category)?

Thank you!

Going for sex change nao

Assuming not a big spender, is it worth to jump onto this and split the miles into my wife’s krisflyer account instead due to lady card not being able to transfer to my account based on name match?

just funnel all spending over to your wife’s cards. problem solved.

I identify as a women, can I apply for the card?

Act like a transgender and apply this card lol

Hi Aaron! Given that the Additional Bonus UNI$ cap of 1000 / 3000 UNI$ is separate from the Bonus UNI$ cap of 1800 / 5400 UNI$, wouldn’t the total bonus UNI$ in Scenarios 1 & 3 also be lesser? For example in Scenario 1, since the Bonus UNI$ cap of 1800 / 5400 UNI$ was already exhausted before 8 March, any spend from 8 March should only get 1 UNI$ (base) + 5 UNI$ (Additional Bonus) per $5 spend up to the respective Additional Bonus UNI$ cap (i.e. the $360 / $1075 spend will only attract 360 / 1075 Bonus… Read more »

You might be on to something, will recheck the workings

edit: I’ve updated them- I think my mistake was assuming the 9X and 5X are one block, when in fact they each have their own separate caps. it doesn’t really matter from april, but will matter in march

Just for info, have spoken to a CSO and he confirmed that for the solitaire card, the $3k cap on bonus points applies to the whole of March – i.e. the cap doesn’t start over on 8 March.

Very sexist card.. nobody makes a big fuss because it is a lady card.. imagine if it is only for gentlemen…hell will break loose!

As a woman, I sadly agree… Wish I could apply this card for my hubby!

It is quite hilarious that cards like these still exist while women are going around shouting for equality.

Selective equality. Do not even bring up NS to these feminists.

Hi Aaron, new to MCCs here. Would 5411 (Groceries) cover both in-person and online transactions? Is there a distinction between online & in-person contactless purchases to qualify for the bonus? Thanks.

Yes, and no.

Thanks for the clarification!

Fk this stupid sexist card. Can you guys stop taking this BS treatment sitting down?

Can there be a legal challenge in court?

You go court challenge lor no one’s stopping you. Don’t be a keyboard warrior

Hi Aaron. Just to confirm, the cutover of 8 March is based on posting date? So transactions before 8 March but posted on or later than 8 March will be eligible? Thanks in advance.

Just asking, how long did you guys to get your first UOB cards approved? I tried to apply one last month, but have not received any update from UOB.

The wife (foreigner) is trying to apply online and just gets error messages. This although she very comfortably meets and exceeds the minimum income, has lived in SG for 7 years and also has payslips, etc, to support her application. AND she is an existing UOB cardholder.

Boggles the mind, UOB’s IT and customer service at its finest…

Better check if she’s a woman. Heard that’s the only reason UOB will reject applications.

Very funny

Come on Citi where is your 8mpd promotion!

If only there is a gentleman’s card equivalent

Hi Aaron! Amazing news and as always thanks for sharing 🙂

I wanted to ask when you need to select the categories for the next quarter by. Is there a cut off date? For example the next quarter starts 1 April, as long as I select the categories prior to that is that ok or would I need to do it a week or two before for example?

Seconding this question!

Also, I’m new to understanding MCCs and bonus categories. Would Grabfood (and all other Grab-related transactions) by default fall under Transport instead of Dining?

11.59 p.m on the night of the end of the calendar quarter

Grab Ride is under Transport, while Grab Food is under Dining

Such a sexist card and a sexist bank and we always talk about gender equality here.

If there was a gentlemen’s card only for man, for sure there will be a big WooHa

Hey all, question.. can I own both UOB lady solitaire and UOB lady cards? And get 6mpd $3k cap for 2 categories (i.e dining + entertainment) + $1k cap for 1 category (i.e fashion)? Thanks!

nope. one or the other.

thanks for your prompt reply!