Over the past few years, Citi PayAll has offered some sensational promotions during tax season, enabling cardholders to buy miles at a fraction of their usual cost. It was hoped that 2023 would be more of the same, but it appears the good times might be ending.

Citi PayAll has announced a 2.2 mpd promotion on all payments set up by 20 August 2023, but it’s also hiking the admin fee to 2.2% (from 2% previously). This means the cost per mile is now 1 cent each- still a good deal, but clearly not as good as before.

|

| Citi PayAll 2.2 mpd Promo |

This is a public offer that applies to all Citi PayAll payments: income tax, rent, insurance premiums, MCST fees, education expenses, utilities bills, miscellaneous invoices, or even friends and family for “services rendered”.

A minimum combined spend of S$8,000 and a cap of S$120,000 applies, which means you could generate up to 264,000 miles.

Earn 2.2 mpd on Citi PayAll transactions

From 20 April to 20 August 2023, Citi cardholders will earn a flat 2.2 mpd on Citi PayAll transactions, with a minimum combined spend of S$8,000 and a cap of S$120,000.

The following cards are eligible:

| Card | Earn Rate | Cost Per Mile (@ 2.2% fee) |

Citi ULTIMA Citi ULTIMA |

2.2 mpd (Base: 1.6 mpd Bonus: 0.6 mpd) |

1 cent |

Citi Prestige Citi Prestige |

2.2 mpd (Base: 1.3 mpd Bonus: 0.9 mpd) |

1 cent |

Citi PremierMiles Citi PremierMiles |

2.2 mpd (Base: 1.2 mpd Bonus: 1.0 mpd) |

1 cent |

Citi Rewards Citi Rewards |

2.2 mpd (Base: 0.4 mpd Bonus: 1.8 mpd) |

1 cent |

| ⚠️ Citi app shows regular rates! |

|

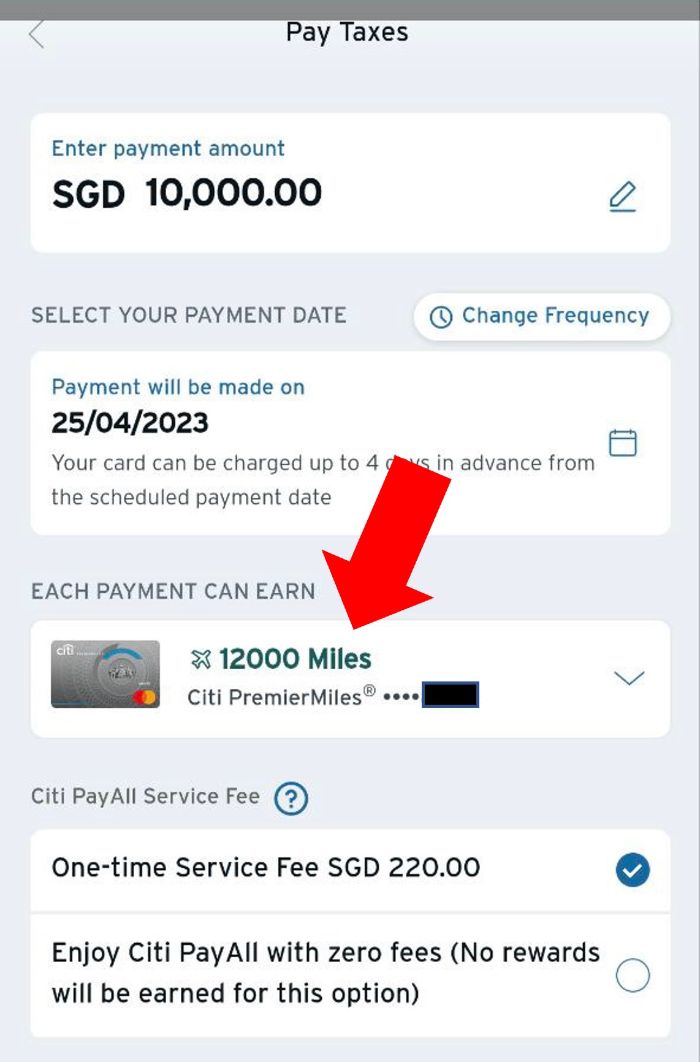

Be advised that the Citi Mobile App (where Citi PayAll payments are set up) shows the regular earn rates by default.

For example, it tells me a S$10,000 payment on my Citi PremierMiles Card will earn 12,000 miles (based on 1.2 mpd), when in fact it should be 22,000 miles (based on 2.2mpd). You’ll just have to take it on faith that the bonus miles will show up later. |

To illustrate how this works, someone who spends S$10,000 on the Citi PremierMiles Card (or any of the above cards for that matter) would earn 22,000 miles (S$10,000* 2.2 mpd), and pay an admin fee of S$220 (2.2% of S$10,000). The cost per mile is therefore 220/22,000= 1 cents each.

A few important points to note:

- the payment setup date must be on or before 20 August 2023, 11.59 p.m SGT

- the payment charge date must be on or before 24 August 2023, 11.59 p.m SGT (note: elsewhere in the T&Cs it seems to imply the charge date must also be by 20 August 2023, 11.59 p.m SGT, but I’ve sought clarification from a Citi spokesperson who has confirmed the 24 August date)

- the S$8,000 need not be in a single transaction; it can be combined across multiple payments on a single card that fall within the promotion period

- the aggregate bonus points or miles earned is capped at S$120,000 on only one eligible card

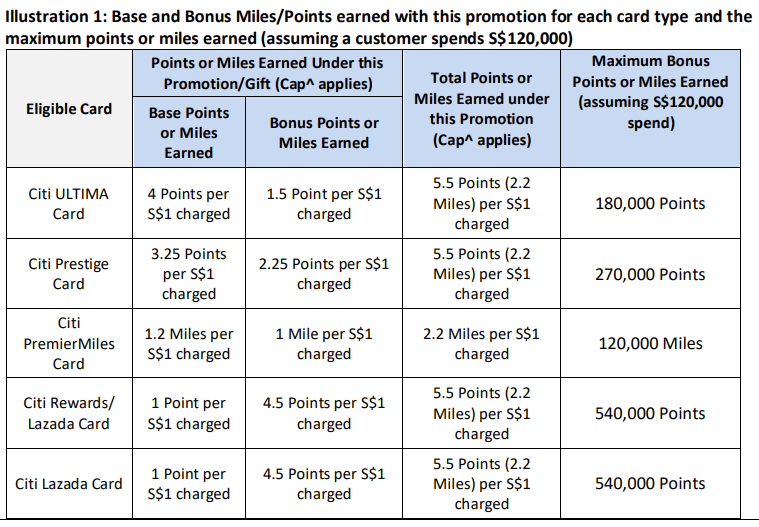

Since the base earn rate differs for each card, the maximum bonus you can earn per card differs. Don’t get confused though- the overall earn rate for all cards is the same at 2.2 mpd

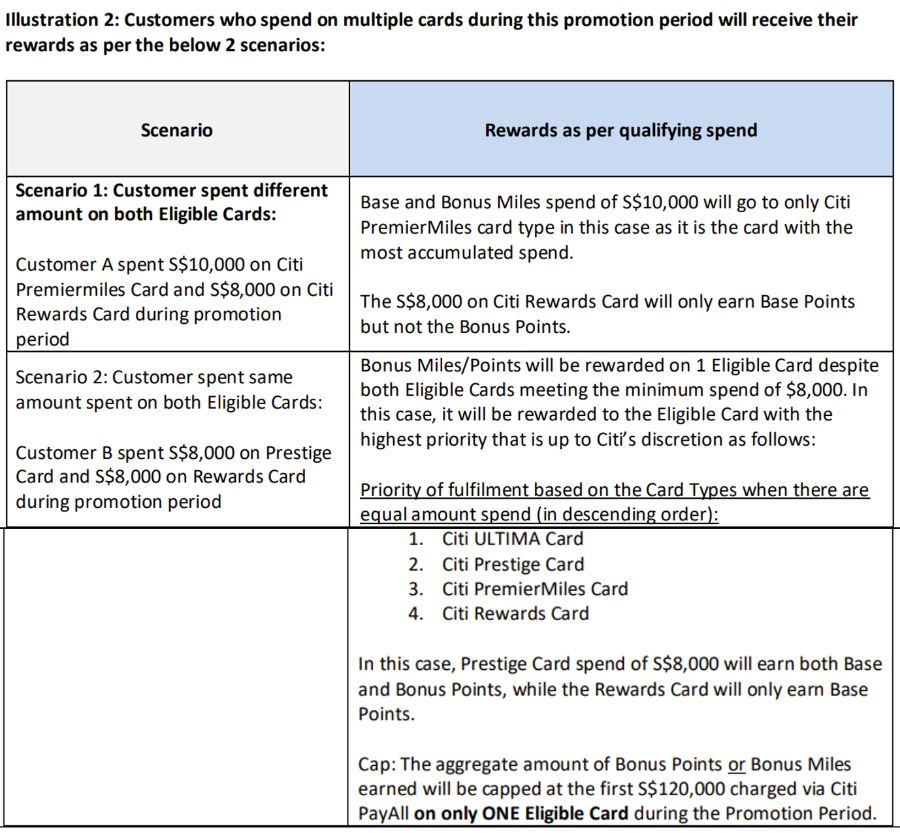

Also note that if you spend on multiple cards, only the card with the highest accumulated spend will earn bonus points. In other words: stick to a single card! No matter how many Citi cards you have, the maximum bonus you can earn is capped at S$120,000 on a single card.

Finally, remember that if you already have an existing recurring payment in place before 20 April 2023, you will need to cancel it and set it up again to benefit from this promotion.

New customers: Get S$50 in GrabGift vouchers

If you haven’t made a Citi PayAll transaction in the 24-month period preceding 20 April 2023 (i.e. 20 April 2021 till now), you’ll receive a S$50 GrabGift voucher when you make at least S$8,000 of Citi PayAll transactions by 20 August 2023.

This can be redeemed for the following services:

- GrabTransport (except GrabHitch and GrabShuttle)

- GrabFood

- GrabMart

- GrabExpress

For avoidance of doubt, this promotion stacks with the 2.2 mpd offer mentioned above.

When will the bonuses arrive?

Cardholders will receive their regular base rewards when the Citi PayAll transaction initially posts. The bonus component will be credited within 16 weeks from the end of the promotion period, i.e. by 10 December 2023.

| Card | Base | Bonus |

Citi ULTIMA Citi ULTIMA |

1.6 mpd | 0.6 mpd |

Citi Prestige Citi Prestige |

1.3 mpd |

0.9 mpd |

Citi PremierMiles Citi PremierMiles |

1.2 mpd |

1.0 mpd |

Citi Rewards Citi Rewards |

0.4 mpd |

1.8 mpd |

The S$50 GrabGifts voucher will be credited according to the same timeline, i.e. by 10 December 2023.

Terms and Conditions

The T&Cs for this promotion can be found here.

Citi PayAll transactions count towards min. spend requirements

Citibank has confirmed that Citi PayAll transactions will count towards the minimum spend required for card-related benefits.

|

|

|

All Citi PayAll transactions can be included in the minimum spend required to qualify for card-related benefits, such as Citi Prestige’s complimentary airport limousine rides and welcome offers on other Citi cards. This includes Citi PayAll transactions, with or without service fees included. Citi PayAll transactions made with zero service fees paid, however, will not qualify for any other rewards, such as base points, bonus points or miles. In line with industry practices, we reserve the rights to review and modify the relevant terms and conditions related to Citi cards as required. -Citi spokesperson |

This means that you could use your Citi PayAll transaction to meet:

- The S$12,000 quarterly spend required to unlock 2x limo rides with the Citi Prestige

- The S$5,000 monthly spend required to trigger the 4 mpd earn rate on the Citi PremierMiles Card under the limited-time FCY spending promotion

- The S$800 minimum spend required to earn the welcome bonuses for the Citi Rewards, Citi PremierMiles and Citi Prestige

What payments does Citi PayAll support?

Here’s a reminder of the full list of payments that Citi PayAll currently supports:

| 💰 Citi PayAll: Supported Payments | |

|

|

Some categories are rather nebulously defined, which means it really isn’t difficult to find something to pay.

Just remember, however, that Citi PayAll T&Cs explicitly prohibit you from sending money to yourself, or using it as a cash advance facility. In other words, whatever payment you make must have some underlying economic substance.

|

|

10.1 When accessing and using the Service, you must comply with any prescribed verification procedures, or other procedures, directions and instructions communicated by us to you. Further, you hereby represent and warrant that you shall not, in connection with your use of the Service: (b) send money to yourself or recipients who have not provided you with goods or services (unless expressly allowed by us); (c) provide yourself or any other party a cash advance from your card (or help other parties to do so); |

Is it worth it?

It’s not as good as what we’ve seen previously, but in the cold light of day, buying miles at 1 cent each is still hard to say no to.

Don’t forget that in addition to KrisFlyer, Citi Miles and ThankYou points can be converted to 10 other frequent flyer programmes and one hotel programme, with a S$27 conversion fee.

| Frequent Flyer Programme |

Conversion Ratio (Citi: Partner) |

|

| Citi Miles | TY Points | |

|

10,000:10,000 | 25,000:10,000 |

| 10,000:10,000 | 25,000:10,000 | |

| 10,000:10,000 | 25,000:10,000 | |

| 10,000:10,000 | 25,000:10,000 | |

|

10,000:10,000 | 25,000:10,000 |

| 10,000:10,000 | 25,000:10,000 | |

| 10,000:10,000 | 25,000:10,000 | |

| 10,000:10,000 | 25,000:10,000 | |

| 10,000:10,000 | 25,000:10,000 | |

| 10,000:10,000 | 25,000:10,000 | |

|

10,000:10,000 | 25,000:10,000 |

| 10,000:10,000 | 25,000:10,000 | |

This is the most extensive list of any bank in Singapore, and features some unique partners not offered anywhere else like Turkish Miles&Smiles (great for Europe redemptions).

Income Tax Guide 2023

I recently compiled The MileLion’s Income Tax Guide for 2023, which features a running list of promotions and the cheapest ways of earning miles when paying tax with different credit cards.

Be sure to bookmark the post for further updates (I’ll be updating it with the Citi promotion later today).

Conclusion

Citibank has launched a new Citi PayAll promotion just in time for income tax season, with a 2.2 mpd earn rate offered in exchange for an increased 2.2% admin fee.

There’s a minimum spend of S$8,000 required this year (versus S$5,000 in 2022 and none in 2021), but assuming that’s not an issue then buying miles at 1 cent apiece is still a good deal for most.

If you haven’t made a Citi PayAll transaction in the past 24 months, then you can sweeten the deal further with a S$50 GrabGifts voucher as well.

Very hard for CardUp to compete with this even with their current promo rates (except for the new user one).

very hard for *anyone* to compete with Citi, really! it says a lot that even though they’ve dialled back the generosity by hiking the fee, this is still the best deal by far.

Unless using ocbc18 for cardup for 1.8% for Voyage?

I’m still holding the Citi PM Visa card. Does it qualify as well?

I have CitiPM Visa too. Read T&Cs for this Promo & general PayAll where they just state CitiPM qualifies, doesn’t specify whether MC or Visa. But I saved copy of T&Cs in case of dispute but have setup using CitiPM Visa.

Also to note I’ve used CitiPM Visa for prior PayAll promos too. They’ve always credited points previously.

No issue with pm visa

Actually it is better than buying miles at 1c. A big difference now, compared to the earlier days of these Citi promotions, is interest rates. It is easy to earn 3.8% on your funds. There are ways to earn more, but let’s use 3.8%. So, now you time your purchase, so you get the maximum “use” of the money. Up to around 50 days if you transact at the start of your card cycle. So, using the $10k example, above you have to deduct from the $220 fee, $52 (10,000*.038/365*50). So actually, you are not paying $220 to earn 22,000… Read more »

But you are also missing the $27 conversion fee.

It seems that if you set citi payall to make a payment by installements for your income tax, you need to set it to 6 months repayment tenor to enjoy the 2.2% service fee? If its 12months, it goes to 2.75%, and so on so forth.

How does this work? Citi deposits the amount in a monthly basis into a bank account of your choice OR they pay IRAS directly in full then you pay Citi monthly? Thanks for sharing

Basically, to get full advantage of it, you should make payment of up to $120,000 in taxes by 20 Aug 2023. Practically, to maximise it, you use Citi Payll to pay the monthly instalment amounts in May, June and July. Then before 20 August, you use it to pay the entire balance of your annual tax bill still outstanding. It doesn’t matter that you have a 12-month instalment plan. Each month, IRAS will not deduct for that month if you have already paid in advance.Do note that it takes about 3-4 days for the payment to happen after you give… Read more »

I see, so use cit pay all to supersede the giro payment that’s already in place. And to maximize the promo I should ensure that the tax bill is paid within the promo period of May to Aug. Thanks this helps.

Right. Of course, if you are in the fortunate minority to pay more than $120,000 in taxes, you can just pay up to that total amount by 20 August, then let the monthly instalments GIRO kick in again automatically after that in due time.

Wonder will people in the category of personal income tax exceeding $100K even bother to use citi Payall ??

Hi Tiak

Instead of setting the instalment option, can we just use multiple single payment options via Payall until 20 Aug 2023?

Another question on the use of the instalment option (and the current earliest payment date is 27 April 2023)

-> What I do not understand is that if we were to set e.g. a 6 months re-payment period (e.g. 27 Apr,May,June,July,Aug,Sept), then won’t the payments on 27 Aug and 27 Sept 23 be excluded from the bonus miles reward?

Thanks

When you apply for monthly instalment, IRAS will make you set up the GIRO. So are you saying to get Citipayall to pay to IRAS before the monthly auto GIRO deduction? And once Citi payment is made, IRAS will not proceed with the GIRO for the month?

Based on this method, if i select the min 6 months repayment tenor (May to Oct) I should be able to cancel the last 3 payments on Citi PayAll so that I can pay the entire outstanding balance of my annual tax bill right?

If I have 2 cards, does it mean I can clock $120k on each?

No – its stated in article valid only for 1 card. And you need to use the same card for the all CitiPayAll setups until 20 Aug 2023 to qualify for maximum points.

What if I have 2 credit cards (say CRMC for shopping & Citi Prestige for payall transactions), questions –

1. Will I get 4mpd on my CRMC card and

2. Will I get 2.2 mpd on my Citi Prestige card for payall transactions?

Hi all, if I were to spend $100,000 under this promotion on 1 card ( Citi PM Visa), what will be the total miles (base plus bonus) that I am going to get?

Slightly confused by the illustrations are provided by Citi.

Thanks

New to filing income taxes in SG, and am greeted with this error when setting up Citi PayAll with my Prestige card: “Unable to set up Citi PayAll – Sorry. We are unable to process this setup with the payee information you provided as the account number or policy type is not valid or not supported.”. NOA has been filed early March, and there is still 1 month to go for the payment deadline. The tax reference is my FIN and the tax type is Individual Income Tax within PayAll. I had no issues using PayAll for rental in the… Read more »

After a call with CSO, we are suspecting either FINs are entirely not supported within PayAll, or PayAll hasn’t been updated to support the latest M-prefixed FINs which were introduced on 1st January 2022.

Yeah I did Citi payall with my FIN, but it’s older (not “m” prefix) and it worked fine, so I reckon there’s a fair chance that what you’ve said is indeed the issue.

Let me send this along to citi and see what they say

I have the same experience just now. FIN started with M, can’t use the City Payall

have received a response.

PayAll is being updated to enable customers with M-prefixed FIN numbers to set up payments later this year.

Nice one. Looks like it is too late for CY2022 tax payments. Guess I should have went with OCBC Voyage for CardUp instead.

The citi table illustration is wrong isn’t it? Isn’t it all 2.2miles per dollar??

Except Premier miles, for the other cards in e table, when it’s simply a total of 5.5 points per dollar how is it that the maximum points (on $120,000 spent) for the various cards be different? Points: 540k vs 270k vs 180k

It’s the “extra” points or miles earned. Since all cards get 5.5 points, the cards getting the most extra points will be the card with the worst base earn rate

If I used my Citi Rewards to do Citi PayAll for my tax, say $500 this month, does that mean I only have $500 to qualify for the 4mpd transactions?

Hi, may I ask why is it “… which means you could generate up to 264,000 miles, depending on which card you hold.” cuz for all cards the max is based on $120K?

correct, it’s the same for all cards since it’s $120k at 2.2 mpd. have removed that line.

Citi rewards card give 4mpd for transactions up to 1k per month, the promotion requires 8k min spend until aug 20. does this mean for these 4 months will have to spend 2k (1k with 4mpd , balance 1k with 0.4mpd)?

Hi, i need some clarifications. For citi payall, do I need to cancel the current GIRO arrangement first before applying the citipayall? Does payment of credit card of other banks count in the $8000 min? Thanks.

Based on illustration 2 above, how can I clock the $12K spend per quarter (for limo) AND get the 4mpd for Premiermiles on overseas spend? It seems to be a OR rather than AND because if I use PayAll on both before 20 Aug 2023, the bonus miles will only be accorded to one card and not both. Anyone?

I forgot to stick to 1 Citi card. Should have re-read this article before setting up just now.

You just set up just now? Quickly log in & cancel. Then set up with just one & same Citi credit card.

Hi Aaron, can I use the same Citibank credit card to pay for both my wife and my own taxes, to hit the min 8K requirement?

my kid’s school charges a transaction fee for payment of school fees via credit card, is Citi Payall regarded as a credit card payment?

any idea if there’s a monthly cap limit ? i.e. 30k per mth

I was looking at the promotion T&Cs and it says that eligible cardmembers must “held the Eligible Card as a main cardholder throughout the Promotion Period”. Given the promotion period starts from 20th Apr, it sounds like if I only received my Citi card in July then I would still pay the higher fee but not be eligible for the promotion and the bonus miles. Is that what it means?

I have not received the bonus miles yet , but today is Dec 11th alr….. Has everyone received the miles alr?