It’s the most wonderful time of the year: tax season!

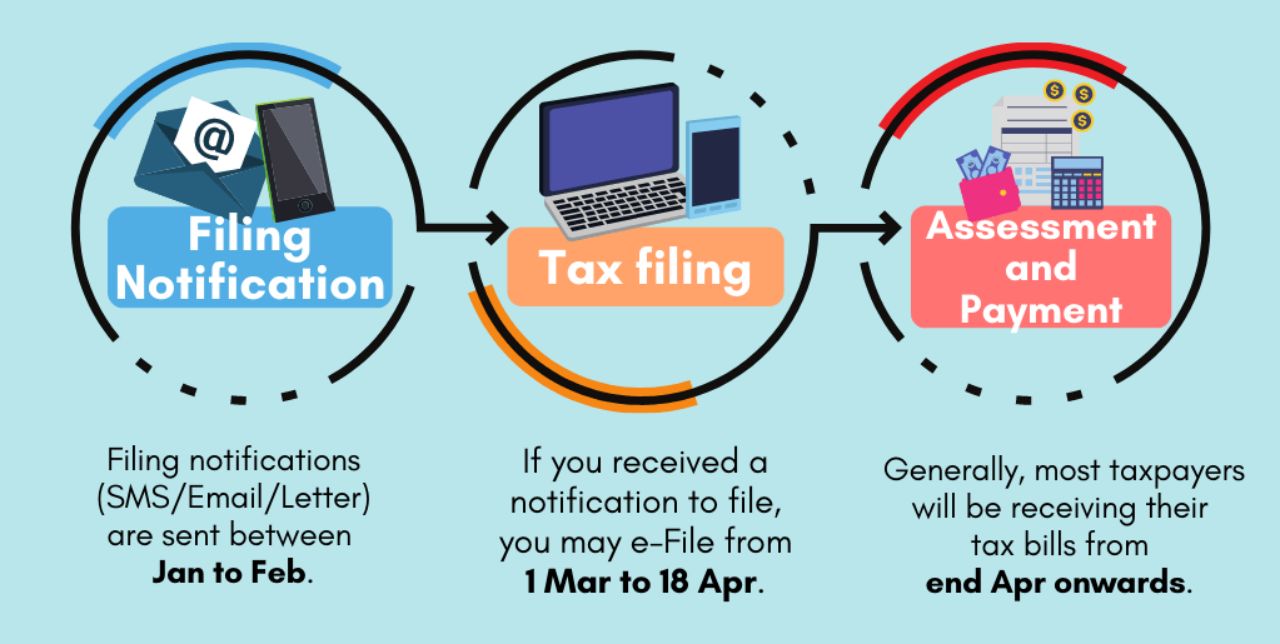

Here’s what you probably know already: Individuals with income tax obligations will need to file their taxes by 18 April 2023. They’ll subsequently receive their tax bill (NOA) from the end of April onwards.

IRAS sends NOAs in batches, so you may not receive yours at the same time as others in your household or company. Don’t take it personally; I promise they haven’t forgotten about you.

|

| Tax Season 2023 |

| 💰 The MileLion’s Income Tax Guide 2023 |

As law-abiding citizens, let us all, young and old, gather together to ensure a proper accounting of our earnings towards the sacred goal of nation-building.

Oh, and credit card rewards.

How do I pay my income tax bill with a credit card?

IRAS doesn’t accept credit card payments. In their own words:

Credit card payments are not offered by IRAS directly because of the high transaction costs charged by the credit card service providers. This is to keep the cost of collection low to preserve public funds.

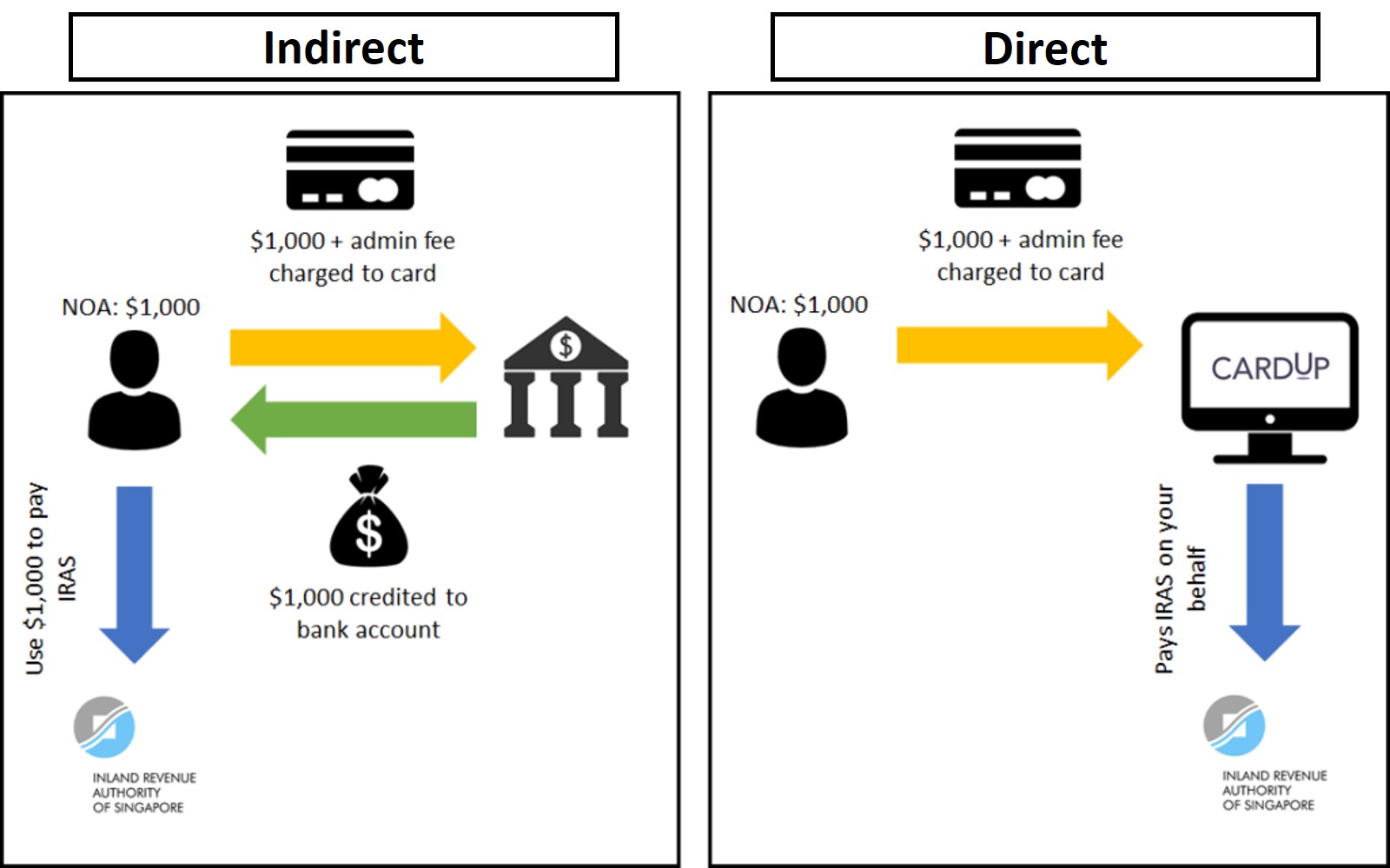

However, this doesn’t mean you can’t use your credit card to pay taxes. Banks and third party-providers offer tax payment facilities, which allow cardholders to earn rewards in exchange for a small fee. I divide these into “indirect” and “direct”.

| Indirect Payment Facilities | Direct Payment Facilities |

|  |

Both indirect and direct facilities work the same in the sense that your credit card is charged for the tax amount due plus an admin fee, earning miles in the process.

Where they differ is that:

- An indirect payment facility deposits the amount due into your designated bank account, in cash. You’re still responsible for paying IRAS

- A direct payment facility pays IRAS on your behalf

Whether it’s better to use an indirect or direct facility all boils down to the cost per mile: the admin fee, divided by the miles you earn.

What’s changed for YA2023?

The biggest loss for YA2023 tax season has no doubt been the nerfing of GrabPay-AXS.

Back on 16 January 2023, GrabPay removed support for AXS transactions, ending an era of free miles and cashback on income tax payments (and many other bills). For the past few years, I’d been paying off my entire tax bill via the AMEX HighFlyer-GrabPay-AXS trinity, minting thousands of miles at zero cost. And even if you didn’t qualify for an AMEX HighFlyer Card, you could save 1.5% off your tax bill by using the AMEX True Cashback Card (as the icing on the cake, both will nerf GrabPay top-ups from 4 April 2023).

With the loss of GrabPay-AXS, there’s basically no way left to earn free miles on income tax payments. If you want to earn miles, you’ll need to pay- simple as that.

In addition to this, HSBC has shutdown its Income Tax Payment Programme. This was one of the lowest cost options out there, allowing HSBC Visa Infinite Cardholders to buy miles from just 1.2 cents apiece.

While not strictly speaking a tax payment facility (though it can certainly be used for paying tax), the UOB Payment Facility has also hiked its rates from 1.7-1.9% to 1.7-2.1%.

What are the fees involved?

Here’s a list of the various payment facilities and the applicable fees.

| 🧾 List of Payment Facilities | ||

| Bank | Applicable Cards | Admin Fee |

| SCB Visa Infinite | 1.6% | |

| UOB PRVI Miles, Visa Infinite Metal, Reserve | 1.7-2.1% | |

| All cards except HSBC | 1.75% (Visa) 1.8% (AMEX) 1.99% (MC) | |

| OCBC VOYAGE | 1.9% | |

Link Link | All SCB cards | 1.9% |

Link Link | All Citi cards | 2.2% |

| All DBS cards | 2.5% | |

| Key | Indirect | Direct |

| There is an additional option called ipaymy, but for reasons outlined in this post, I do not endorse nor comment on their services | ||

It may be tempting to compare options on the basis of admin fees, but that’s only half the story. You need to also consider the earn rate.

For example, the OCBC VOYAGE Payment Facility has an admin fee of 1.9%, but the earn rate is 1 mile per S$1 charged (instead of the usual 1.3 mpd). This means the cost per mile is 1.9 cents.

In contrast, Citi PayAll has a higher admin fee of 2.2%, but the Citi PremierMiles Card earns 2.2 miles per S$1 charged. This means the cost per mile is lower then VOYAGE, at 1 cent.

Do keep in mind that banks may apply different earn rates for income tax payments as opposed to regular retail spend. For example:

- the UOB PRVI Miles Card normally earns 1.4 mpd, but awards 1 mpd for UOB payment facility transactions (you’ll earn 1.4 mpd via CardUp, though)

- all DBS cards earn a flat 1.5 mpd for income tax payment plans, instead of their usual rates.

If this is too complicated for you, the next section should make everything very simple.

What are my options for paying tax with a credit card?

Here’s how much you can expect to pay for miles with various miles and points cards.

A few things to note:

- We’re bound to see additional offers added in the weeks ahead. I’ll be updating this article as and when new offers come online, so bookmark this page for future reference.

- Some of the CardUp promo codes below have limited redemptions; click on the link to read the T&Cs

| 💰 Summary of Tax Payment Options | |||

| Card | Pay Via | Fee (MPD) | CPM |

OCBC VOYAGE OCBC VOYAGE (Premier, PPC, BOS) | CardUp | 1.5% (1.6 mpd) | 0.92 |

| Use CardUp with OCBC15, valid for new users only till 3 Jan 24. Existing users use MLTAX23 for 1.75% fee (1.07 cpm) till 31 Aug 23 | |||

AMEX HighFlyer Card AMEX HighFlyer Card | CardUp | 1.8% (1.8 mpd) | 0.98 |

| Use CardUp with AMEX18, valid for new users only. Existing users use AMEX19 for 1.9% fee (1.04 cpm). Both codes valid till 22 Sep 23 | |||

Citi Rewards Citi Rewards | PayAll | 2.2% (2.2 mpd) | 1.00 |

| Use Citi PayAll; min. spend of S$8K applies | |||

Citi Prestige Citi Prestige | PayAll | 2.2% (2.2 mpd) | 1.00 |

| Use Citi PayAll; min. spend of S$8K applies | |||

Citi Premier Miles Citi Premier Miles | PayAll | 2.2% (2.2 mpd) | 1.00 |

| Use Citi PayAll; min. spend of S$8K applies | |||

Citi ULTIMA Citi ULTIMA | PayAll | 2.2% (2.2 mpd) | 1.00 |

| Use Citi PayAll; min. spend of S$8K applies | |||

DBS Insignia DBS Insignia | CardUp | 1.75% (1.6 mpd) | 1.07 |

| Use CardUp with MLTAX23 till 31 Aug 23 | |||

UOB Reserve UOB Reserve | CardUp | 1.75% (1.6 mpd) | 1.07 |

| Use CardUp with MLTAX23 till 31 Aug 23 | |||

OCBC 90°N Card OCBC 90°N Card | CardUp | 1.5% (1.3 mpd) | 1.14 |

| Use CardUp with OCBC90N15, valid for new users only till 3 Jan 24. Existing users use MLTAX23 (Visa) or MCTAX23 (Mastercard) for 1.75% fee (1.32 cpm) or 1.99% fee (1.5 cpm) till 31 Aug 23 | |||

OCBC VOYAGE OCBC VOYAGE | CardUp | 1.5% (1.3 mpd) | 1.14 |

| Use CardUp with OCBC15, valid for new users only till 3 Jan 24. Existing users use MLTAX23 for 1.75% fee (1.32 cpm) till 31 Aug 23 | |||

SCB VI SCB VI | SCB | 1.6% (1.0/1.4 mpd) | 1.14 1.6 |

| Use SC Tax Payment Facility. Earn 1.4 mpd with ≥S$2K spend per statement month (includes tax payment), otherwise 1 mpd | |||

OCBC Premier VI OCBC Premier VI | CardUp | 1.5% (1.28 mpd) | 1.15 |

| Use CardUp with OCBC15, valid for new users only. Existing users use MLTAX23 for 1.75% fee (1.34 cpm) till 31 Aug 23 | |||

DBS Vantage DBS Vantage | CardUp | 1.75% (1.5 mpd) | 1.15 |

| Use CardUp with MLTAX23 till 31 Aug 23 | |||

UOB PRVI Miles Visa UOB PRVI Miles Visa | CardUp | 1.75% (1.4 mpd) | 1.23 |

| Use CardUp with MLTAX23 till 31 Aug 23 | |||

UOB VI Metal UOB VI Metal | CardUp | 1.75% (1.4 mpd) | 1.23 |

| Use CardUp with MLTAX23 till 31 Aug 23 | |||

AMEX PPS Card AMEX PPS Card | CardUp | 1.8% (1.3 mpd) | 1.36 |

| Use CardUp with AMEX18, valid for new users only. Existing users use AMEX19 for 1.9% fee (1.43 cpm). Both codes valid till 22 Sep 23 | |||

AMEX Solitaire PPS Card AMEX Solitaire PPS Card | CardUp | 1.8% (1.3 mpd) | 1.36 |

| Use CardUp with AMEX18, valid for new users only. Existing users use AMEX19 for 1.9% fee (1.43 cpm). Both codes valid till 22 Sep 23 | |||

UOB PRVI Miles MC UOB PRVI Miles MC | CardUp | 1.99% (1.4 mpd) | 1.39 |

| Use CardUp with MCTAX23 till 31 Aug 23 | |||

DBS Altitude Visa DBS Altitude Visa | CardUp | 1.75% (1.2 mpd) | 1.43 |

| Use CardUp with MLTAX23 till 31 Aug 23 | |||

SCB X Card SCB X Card | CardUp | 1.75% (1.2 mpd) | 1.43 |

| Use CardUp with MLTAX23 till 31 Aug 23 | |||

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend | CardUp | 1.8% (1.2 mpd) | 1.47 |

| Use CardUp with AMEX18, valid for new users only. Existing users use AMEX19 for 1.9% fee (1.55 cpm). Both codes valid till 22 Sep 23 | |||

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card | CardUp | 1.8% (1.1 mpd) | 1.61 |

| Use CardUp with AMEX18, valid for new users only. Existing users use AMEX19 for 1.9% fee (1.70 cpm). Both codes valid till 22 Sep 23 | |||

KrisFlyer UOB KrisFlyer UOB | CardUp | 1.99% (1.2 mpd) | 1.63 |

| Use CardUp with MCTAX23 till 31 Aug 23 | |||

DBS Altitude AMEX DBS Altitude AMEX | DBS | 2.5% (1.5 mpd) | 1.67 |

| Use DBS Payment Plans | |||

AMEX Centurion AMEX Centurion | CardUp | 1.8% (0.98 mpd) | 1.80 |

| Use CardUp with AMEX18, valid for new users only. Existing users use AMEX19 for 1.9% fee (1.90 cpm). Both codes valid till 22 Sep 23 | |||

UOB PRVI Miles AMEX UOB PRVI Miles AMEX | CardUp | 2.6% (1.4 mpd) | 1.81 |

| Use CardUp | |||

AMEX Platinum Charge AMEX Platinum Charge | CardUp | 1.8% (0.78 mpd) | 2.27 |

| Use CardUp with AMEX18, valid for new users only. Existing users use AMEX19 for 1.9% fee (2.39 cpm). Both codes valid till 22 Sep 23 | |||

AMEX Platinum Credit Card AMEX Platinum Credit Card | CardUp | 1.8% (0.69 mpd) | 2.56 |

| Use CardUp with AMEX18, valid for new users only. Existing users use AMEX19 for 1.9% fee (2.70 cpm). Both codes valid till 22 Sep 23 | |||

AMEX Platinum Reserve AMEX Platinum Reserve | CardUp | 1.8% (0.69 mpd) | 2.56 |

| Use CardUp with AMEX18, valid for new users only. Existing users use AMEX19 for 1.9% fee (2.70 cpm). Both codes valid till 22 Sep 23 | |||

| ❓How is this calculated? |

For CardUp, both the admin fee and the tax payment earn miles, so a S$1,000 payment with a 1.75% fee placed on a 1.2 mpd card earns 1,221 miles (ignoring rounding). This works out to 1.43 cents per mile. For bank facilities, only the tax payment earns miles, so a S$1,000 payment with a 1.75% fee placed on a 1.2 mpd card earns 1,200 miles. This works out to 1.46 cents per mile. |

| ❓ First CardUp payment? |

| If this is your first-ever CardUp payment, use the code MILELION to save S$30 off your first payment of any amount. You can subsequently use any other promo code for existing customers (e.g. MLTAX23) |

Other important points to note

Apply for as many facilities as you want

If you hold more than one of the cards above, there’s nothing stopping you from applying for multiple tax payment facilities in order to buy more miles (otherwise known as churning).

For example, someone with a S$10,000 tax bill could apply for both the SCB Visa Infinite tax payment facility and set up a payment arrangement with CardUp.

Take particular care if you’re applying for two direct payment facilities, however, because overpaying your tax bill will trigger a refund from IRAS, and a possible clawing back of the miles by the bank.

“Where we have determined in our discretion exercised reasonably that your Payment(s) to IRAS exceed the amount of taxes which you are required to pay to IRAS, we shall be entitled to claw back any rewards credited to your card account in connection with any amount so overpaid to IRAS using the Service. In such an event, we will refund the relevant portion of Fee in respect of such overpaid amount.” |

There’s no chance of this happening with indirect payment facilities, because the onus is on you to pay IRAS. What you do with the cash after it’s deposited into your account is your own business.

You can still use GIRO

IRAS allows taxpayers to split their payment into 12 interest-free instalments via GIRO. This is great for maximizing your cashflow, and something I opt for each year.

Setting up GIRO for income tax can be done via the following methods:

- Instant

- myTax portal (DBS/POSB and OCBC customers)

- Internet banking (DBS/POSB, OCBC and UOB customers)

- AXS stations (DBS/POSB customers)

- 3 weeks processing

- GIRO application form (all bank customers)

Once your GIRO arrangement has been approved, you can view the monthly instalment by logging to myTax Portal, selecting Account > View Payment Plan > View Plan.

There are no issues using GIRO if you opt for an indirect payment facility, as the bank simply credits the cash to your account, and how you go about paying IRAS after that is up to you.

It’s also possible to use GIRO when you’re paying via a direct payment facilities, though you’ll want to make manual payments well in advance of each month’s scheduled deduction (on the 6th of each month) to avoid double payment.

To illustrate, suppose your tax bill is S$12,000 and you opt for GIRO. IRAS will split your tax bill such that S$1,000 comes due each month.

| Month | Manual Payment | GIRO | Total Paid |

| May 2023 | – | S$1,000 | S$1,000 |

| Jun 20223 | – | S$1,000 | S$2,000 |

| Jul 2023 | S$400 | S$600 | S$3,000 |

| Aug 2023 | – | S$1,000 | S$4,000 |

| Sep 2023 | S$1,500 | – | S$5,500 |

| Oct 2023 | – | S$500 | S$6,000 |

| Nov 2023 | – | S$1,000 | S$7,000 |

| Dec 2023 | – | S$1,000 | S$8,000 |

| Jan 2024 | – | S$1,000 | S$9,000 |

| Feb 2024 | – | S$1,000 | S$10,000 |

| Mar 2024 | – | S$1,000 | S$11,000 |

| Apr 2024 | – | S$1,000 | S$12,000 |

Suppose you make a manual payment of S$400 in July 2023. According to your payment schedule, you were supposed to pay S$1,000 in July, so GIRO will automatically adjust to deduct S$600 instead of S$1,000 for that month.

Then suppose you make a manual payment of S$1,500 in September 2023. According to your payment schedule, you only needed to pay S$1,000 in September, so GIRO won’t take any deduction for this month.

When October 2023 comes round, assuming you make no further manual payment, GIRO will deduct S$500 to put you “back on schedule” with S$6,000 paid off by the end of October 2022.

Now, it’s important to keep in mind that IRAS GIRO deductions take place on the 6th of the month the tax is due (or the next working day if that happens to be a weekend or public holiday). If your manual payment is made close to this date, it’s possible the regular GIRO deduction will still take place.

Based on data points shared in the Telegram Group, the cut off is the last day of the month before, so if you make a manual payment on 1 April, the reduction will be in effect for May’s taxes. In any case, the CardUp system won’t let you schedule payments during the last few and first few days of each month.

For more instructions on how to setup a recurring income tax payment series with CardUp, refer to this link.

Other factors to consider

When evaluating two cards with similar cost per mile figures, it’s helpful to think of qualitative factors as well

- Do points expire?

- Do points pool?

- How many transfer partners are available?

- Is there a fee for transferring points?

For example, Citi Miles would be superior to DBS Points or UOB UNI$, thanks to the sheer number of transfer partners available. Likewise, non-expiring Citi Miles and 90°N Miles would be more useful than expiring UNI$ or HSBC Rewards Points.

Conclusion

Income Tax Season 2023 is now underway, and while no one enjoys paying taxes, a glass-half-full person might see this as a good opportunity to buy miles at a reasonable price.

I will be updating this article as new tax payment promotions are announced, so be sure to bookmark it for future reference.

Hi Aaron, it is stated all dbs cards earn 1.5 miles for tax payment but altitude visa shows up as 1.2 mile in the table.

that is because the best course of action is to pay via cardup which earns 1.2 mpd. if you pay via dbs tax payment plan, you earn 1.5 mpd for 2.5% fee which is 1.67 cents. Cardup is cheaper

deleted

I pay tax via SCB infinite last year, no other 2K spending. Tax payment is clasified as 1.0 mile not 1.4mile

Yup, it is not a miles reward but a points reward. They will issue 360 Reward points for tax payment at 2.5 points per $1 of taxes paid.

no citi payall promo 🙁

Also waiting for Citi Payall to come up with the promotion. Last year it started on 8 April.

Is it possible to pre-pay income tax? Say I have a minimum spend to hit in April on a certain card but no NOA yet

How abt using Citi Rewards with Card Up? Will the mpd be 4 instead of 0.4?

The citi rewards card is not an eligible card on cardup.

https://carduphelp.zendesk.com/hc/en-us/articles/360024526894-Will-my-spend-on-CardUp-earn-rewards-on-my-credit-card-

Hiya, I’m still a little lost even after reading the article on earning credit card miles after opting for GIRO arrangement. I am currently using the Citimiles card and had already established a GIRO arrangement between IRAS and my own bank.

Hi, how about using Citi Prestige with CardUp?

Hi Aaron, just a thought to bounce across you. If one had the UOB krisflyer account with a suitable minimum monthly balance, which awards an additional 5-6 miles per dollar spend on eligible cards (such as prvimiles) – then using cardup with privmiles would earn one at least 6.4 miles per dollar of taxes?

Sure, but you’d lose so much on interest as to offset the benefit, and don’t forget the 5% mab cap on miles

Can a relative use their credit card (with their consent) to pay my tax, or do the payer and taxee’s details have to tally?

Wondering abt this too. Anybody knows if its possible?

I have an existing GIRO to pay my income tax from another bank. I want to switch to paying using Citi PayAll. Can you please share what are all the steps I need to take? e.g. Cancel GIRO payment plan, then etc. etc.. Thank you!

You don’t need to cancel your GIRO plan. Keep it as a backup. You either pay through Payall on a monthly basis, based on your monthly GIRO deduction amount. Once IRAS receives the money for that month, they will not deduct from your bank account. Or you could just pay everything in one shot.

Omg. Thanks for your comment.

I am in the same boat as Dya. Just cancelled my giro plan and intending to use citi payall for the miles

seems like a better option is to setup giro for monthly payment AND pay before the giro deduction date which is 6th of each month (a few days early to be safe) i.e citi payall on 3rd of each month?

would that be correct?

anyways there is no benefit to pay all upfront right?

With the new Citi pay all promo there is an incentive to pay off before 25 Aug now. Anyway, Citi also just introduced installament payment for the pay all service. l guess in a way it works like giro (if you set up a recurring internet transfer to the card) but pay to citi on 6/12/18/24 monthly basis with fee.

Hey Jem, if I want to quality for promo and let’s say the total income tax can quality, there’s only May/June/July/Aug left before the promo ends on Aug, so just divide by 4 of the total income tax to pay this year right?

Wondering if divided by 4 is the best way or pay the first 4 months via citi payall and the remaining months till Mar 24, via cardup linked with ocbc premier voyage?

IRAS’ 12-month interest-free instalments actually save you around 1.8% based on NPV using discount rate of 4%. That will have to be factored in your calculation.

Thanks for the info Adrian! I asked the same question to Citibank, they asked me to cancel GIRO plan to avoid double payment, do you think should I still keep it as backup? Which day of the month do you recommend to pay to IRAS if I set up a recurring one? 1st of each month?

Yes, keep it as a backup. Once you make a payment to IRAS, your remaining monthly repayment plan and balance tax will be recalculated by IRAS. You can check using your Singpass. I would make the payment before the month end, because it’ll just rollover to the next month.

I think everyone should be very careful. There is no free lunch. The Direct Model which involves paying to Cardup and Payall seems very risky to me. a) How reliable and safe are these 2 companies ? Do they set aside the money you use your credit cards to pay to them in a separate trust / custodian account (like a housing developer is required to do for new property developments) to be used only for payment to IRAS ? b) These 2 companies will probably use the money it receives and the admin fee to try to earn higher… Read more »

Time to update this post

Will this be updated for 2024 Aaron?

Looking forward to 2024 edition!

will publish by april

Hey Aaron, some ideas for 24/25 tax updates: Include a simple box/chart comparing Visa/MC/AMEX for the same amount (e.g. 10k) and/or mpd just with different CardUp fees. An easy one is UOB Prvi since it has all three with the same mpd but different cpm outcomes, (makes for an easier comparison.) Share basic terms like mpd and cpm (with calculation or links explaining them), as we refer friends/family who are mile newbies and sometimes wish they get it faster! As basic as it sounds, stating that lowest cpm is what one should be aiming for, also geared for newbies (maybe… Read more »