The golden rule about collecting miles is that no one should be using a general spending card as a matter of course.

While general spending cards have their uses (e.g. sign-up bonuses and lounge access), the bulk of your day-to-day spend should go on specialised spending cards, because the 1.1-1.6 mpd of the former is never going to compete with the 4 mpd of the latter.

But the higher earn rates come with a catch. Obviously, banks can’t afford to award 4 mpd without caps (well, there was this one time…), so they set limits on the bonuses that can be earned. And that creates another problem, because outside these caps, specialised spending cards earn a miserable 0.4 mpd– much less than a general spending card!

In an ideal world, you’d be allowed to split transactions over multiple cards, so as to optimise each payment. You might be able to ask the cashier to do that in a store, but it’s usually not possible online.

So in this post, I’m going to share two methods I’ve found of circumventing this problem.

Specialised spending cards and caps

Thankfully, there’s no shortage of specialised spending cards in Singapore. I can think of at least half a dozen that I use on a regular basis, even more if you include obscure ones like the Maybank World Mastercard, or slightly lower-earning ones like the StanChart Journey or KrisFlyer UOB Credit Card.

| 💳 4 mpd Cards in Singapore |

||

| Card | Earn Rate | Cap |

Citi Rewards Card Citi Rewards CardApply |

4 mpd1 | S$1K per s. month Review |

DBS WWMC DBS WWMCApply |

4 mpd2 | S$1.5K per c. month Review |

HSBC Revolution HSBC RevolutionApply |

4 mpd3 | S$1K per c. month Review |

OCBC Titanium Rewards OCBC Titanium RewardsApply |

4 mpd4 | S$1.1K per c. month Review |

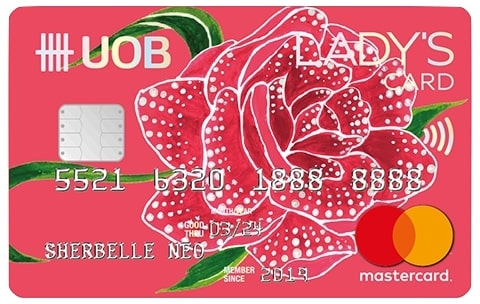

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd5 | S$1K per c. month Review |

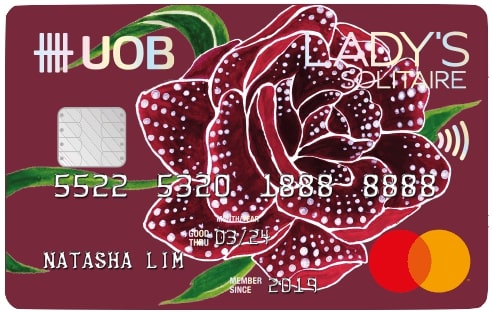

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd6 | S$2K per c. month Review |

UOB Pref. Plat. Visa UOB Pref. Plat. VisaApply |

4 mpd7 | S$1.1K per c. month Review |

UOB Visa Signature UOB Visa Signature Apply |

4 mpd8 | S$2K per s. month Review |

| 1. All online transactions except in-app mobile wallet and travel (airlines, hotels, rental cars, tour agency, cruises etc.) (T&Cs) 2. All online transactions (T&Cs) 3. Contactless and online transactions for travel, shopping, supermarkets, dining, transportation (T&Cs) 4. Electronics, clothes, bags, shoes and shopping (T&Cs) 5. Pick 1: Beauty & wellness, dining, entertainment, family, fashion, transport, travel (T&Cs) 6. Pick 2: Beauty & wellness, dining, entertainment, family, fashion, transport, travel (T&Cs) 7. For in-person mobile contactless spending, plus online shopping & entertainment (T&Cs) 8. For in-person contactless spending, plus foreign currency transactions and petrol. Min spend of S$1K per s. month applies (T&Cs) |

||

The earn rates are all good; the problem are the caps.

All of these cards cap your bonus miles by calendar or statement month, with a limit of S$1,000 to S$2,000 per month.

I hope you see the problem here. Suppose you want to buy a S$1,500 laptop on Qoo10. You have both the Citi Rewards and HSBC Revolution, but regardless of which one you choose, you’d be busting your bonus cap:

- The first S$1,000 would earn 4 mpd

- The remaining S$500 would earn 0.4 mpd

- You would earn 1,000*4 + 500* 0.4 = 4,200 miles, a weighted average of 2.8 mpd

That’s far from ideal, but using a general spending card like the UOB PRVI Miles isn’t the solution either: S$1,500 @ 1.4 mpd gives a mere 2,100 miles!

Here’s what I do in these situations.

Buying gift cards

Buying gift cards effectively allows you to “break up” a transaction into two different modes of payment.

Going back to our laptop example, instead of spending the S$1,500 at one go, I could:

- Use my Citi Rewards to buy a S$500 Qoo10 gift card

- Use the S$500 gift card to offset the cost of the S$1,500 laptop

- Pay the remaining S$1,000 with my HSBC Revolution (don’t get too hung up on the order here; you could just as well use the HSBC Revolution to buy the gift card and the Citi Rewards to pay the balance)

This way, I’ll be earning 4 mpd on the entire S$1,500 transaction.

Banks exclude prepaid top-ups from earning rewards, but what they really mean is Amaze Wallet, GrabPay and YouTrip. While I can’t promise that every gift card transaction out there will earn points, I wouldn’t lose sleep buying gift cards at popular merchants like Amazon, Courts, Harvey Norman, IKEA, Klook, Lazada, MUJI, Qoo10, Shopee, TANGS, or Zalora.

Moreover, there’s other platforms where you can source gift cards for a wide variety of merchants:

- Giftano (MCC 5947: Card Shops, Gift, Novelty and Souvenir Shops)

- Mooments (MCC: 5734: Computer Software Stores)

- Wogi (MCC 5947: Card Shops, Gift, Novelty and Souvenir Shops)

- ShopBack (5311: Department Stores, 5812: Restaurants, 5814: Fast Food all reported; I wouldn’t worry too much so long as you use an MCC-agnostic option like Citi Rewards or DBS WWMC)

If want to check the MCC of any merchant before making a purchase, there’s two ways of doing so:

- DBS “block card” method (more steps, highly reliable)

- HeyMax (very simple, slightly less reliable because a given merchant may use multiple MCCs)

Using a BNPL service

If gift cards aren’t an option, another alternative you can try is a BNPL service, which splits your payment into three interest-free instalments.

Going back to our laptop example, instead of spending the S$1,500 at one go, I could opt to use Atome with my Citi Rewards or HSBC Revolution Card. I would then be charged:

- Month 1 (upfront): S$500

- Month 2: S$500

- Month 3: S$500

As each month’s instalment is less than the S$1,000 monthly cap, I’m able to earn 4 mpd on the full S$1,500.

| ⚠️ Trigger payments manually! |

|

There are reports of cardholders not earning points on the 2nd and 3rd payments with BNPL platforms. This might be because the way the platform processes subsequent instalments does not satisfy the “online” parameter required to earn bonuses with certain cards. To avoid this issue, my advice would be to trigger payments manually each month instead of letting them happen automatically. Most BNPL providers should allow for this (e.g. Atome, Hoolah, Pace). |

I’ve written a separate article about the best cards to use for BNPL platforms, which can be found below.

What’s the best credit card for Buy Now Pay Later (BNPL) platforms?

Do note that it’s been a while since I last looked at this topic, so I’d highly recommend reading the article in conjunction with the comments section, where people have reported more recent data points.

Conclusion

Specialised spending cards offer outsized rewards on your spending, provided you stay within the caps. Stray outside, and your weighted average mpd is going to fall rapidly!

If it’s not possible to split the payment over multiple cards, two workarounds include buying gift cards, or using a BNPL service. This makes it possible to optimise each transaction, maxing out the monthly cap on each specialised spending card with little to no wastage.

Any other ways you know of splitting payments?

You should also list the drawbacks. Eg buying gift cards greatly reduces your refund potential (as you’ll get the gift card or credit back, and not a refund onto your card), you may lose the ability to use chargeback protections if something goes wrong (you’ll be wholly reliant on the merchant or the marketplace to resolve your issue) and you may not get any insurances (eg travel, purchase protection) that comes with your card.

This is quite helpful since iPhone 15 is going to be released soon. Does anyone know what’s the best way to buy a new iPhone?

Atome BNPL at iStudio, that has been my go-to option for all Apple devices purchases.

How about Krisshop?

I’ve never made any purchases at Krisshop before but the critical component is your credit card pairing with Atome itself given its Atome which will bill your credit card

Thanks for sharing, Eric. Which card do you use for Atome? Read in another thread comments Citi no longer rewards 4mpd for MCC 5999(used by Atome)

@Karl – I’ve been using HSBC Revolution on Atome to reap the 4miles/dollar benefit. From an individual stand point, I’ve never had issues of missing miles dispute via using this Revolution-Atome pairing to date and my last Atome payment in June 2023. That said, we all know banking terms and conditions are so fickle, I do advocate each to check before making the purchase.

Is it possible to utilize BNPL services for flight bookings? I think you can buy flights with Atome on Klook and Trip.com, but then the drawback is… I’m not sure if you can claim frequent flyer miles for those flights then.

Hi Aaron,

Wanted to ask regarding the Citi Rewards Thankyou 10x points.

If I purchase online from iShopChangi and pay using Atome (installments), installments from Atome is paid using Citi Rewards Card, does it count towards the point accumulation?

The reason I want to Atome is because there is 10% voucher if use Atome to pay.

Thank you in advanced.