Here’s The MileLion’s review of the AMEX KrisFlyer Credit Card, the entry-level rung on the Singapore Airlines cobrand card ladder.

Let’s get one thing out of the way: this has never been a good card for earning miles. Outside of its sometimes-excellent welcome bonuses (30,000 miles for S$500 spend, anyone?), the day-to-day earn rates are quite frankly embarassing for a card bearing the Singapore Airlines logo.

But, funnily enough, that also means there’s very little to nerf, and when American Express decided to “enhance” its Singapore Airlines cobrand cards in November 2024 — a move which pretty much nuked the AMEX KrisFlyer Ascend — the AMEX KrisFlyer Credit Card escaped relatively unscathed. You can’t kill that which has no life!

In fact, the AMEX KrisFlyer Credit Card has probably been the biggest beneficiary of the Ascend’s nerfing. If you want to enjoy AMEX Offers and pick up some extra miles at QR code-only merchants, but don’t want to pay an annual fee, this card becomes the natural choice- all the better if you can apply when there’s a tasty welcome offer.

|

|

| AMEX KrisFlyer Credit Card | |

| 🦁 MileLion Verdict | |

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? | |

| Its earn rates are dire, but if you want AMEX Offers and miles at QR-code only merchants, the AMEX KrisFlyer Credit Card is a fee-free solution. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: AMEX KrisFlyer Credit Card

Let’s start this review by looking at the key features of the AMEX KrisFlyer Credit Card.

|

|||

| Apply | |||

| Income Req. | N/A* | Points Validity | 3 years |

| Annual Fee | S$179.85 (FYF) |

Min. Transfer |

N/A |

| Miles with Annual Fee |

N/A | Transfer Partners |

1 |

| FCY Fee | 3.25% | Transfer Fee | N/A |

| Local Earn | 1.1 mpd | Points Pool? | Yes |

| FCY Earn | 1.1 mpd |

Lounge Access? | No |

| Special Earn | 2 mpd on SIA, Scoot, KrisShop and Grab |

Airport Limo? | No |

| Cardholder Terms and Conditions | |||

| *AMEX no longer publishes an official income requirement for this card; the last documented requirement was S$30,000 p.a. |

|||

For context, Singapore Airlines has a total of four Singapore Airlines AMEX cobrand cards.

The AMEX KrisFlyer Credit Card (sometimes referred to as the “KrisFlyer Blue”) is at the bottom of the hierarchy, with the AMEX KrisFlyer Ascend one step above it. The AMEX PPS and Solitaire PPS Credit Cards can only be held by PPS and Solitaire PPS members respectively.

| Card | Eligibility | Annual Fee |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

All | S$179.55 (FYF) |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

S$397.85 | |

AMEX PPS Credit Card AMEX PPS Credit Card |

PPS Club | S$561.35 (FYF) |

AMEX Solitaire PPS Credit Card AMEX Solitaire PPS Credit Card |

Solitaire PPS Club* | S$561.35 (FYF) |

| *Only for principal members; supplementary members do not qualify |

||

How much must I earn to qualify for an AMEX KrisFlyer Credit Card?

American Express no longer publishes minimum income requirements for any of its cards, saying instead that “card application is subjected to customers meeting the regulatory minimum income requirement and internal assessment”.

Prior to this, however, the AMEX KrisFlyer Credit Card had an income requirement of S$30,000 per year, the MAS-mandated minimum. There’s no reason to believe that has changed.

Since American Express is not a deposit-accepting bank in Singapore, there is no option to obtain a secured version of this card.

How much is the AMEX KrisFlyer Credit Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | Free | Free |

| Subsequent | S$179.85 | S$54.50 |

The AMEX KrisFlyer Credit Card has an annual fee of S$179.85 for the principal cardholder, and S$54.50 for supplementary cardholders. Annual fees are waived for the first year.

American Express does not stipulate a minimum spend requirement to qualify for a fee waiver, but based on personal experience and community reports, it’s not difficult to get.

To be clear: there is absolutely no reason why you should be paying the annual fee for this card; if you can’t get it waived, cancel it.

What welcome offers are available?

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

|

| Apply | |

| New Customers | |

| First Spend | 5,000 |

| Spend S$1,000 (First 30 days) |

10,900 + S$50 eCapitaVoucher |

| Base Miles from S$1,000 Spend (@ 1.1 mpd) |

1,100 |

| Total Spend | S$1,000 |

| Total Miles | 17,000 + S$50 eCapitaVoucher |

New-to-AMEX cardholders who apply and receive approval for an AMEX KrisFlyer Credit Card by 2 December 2024 and spend S$1,000 in the first 30 days will receive 15,900 bonus miles + S$50 eCapitaVoucher when spend S$1,000 within 30 days of approval.

Cardholders will also earn a further 1,100 base miles (S$1,000 @ 1.1 mpd).

Do note that the calculations assume that this is your first-ever American Express Singapore Airlines cobrand card. If you have held one in the past at any time, you need to deduct 5,000 miles from the bonus component.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 1.1 mpd | 1.1 mpd |

2 mpd (SIA, Scoot, KrisShop, Grab) |

SGD/FCY Spend

AMEX KrisFlyer Credit Card members earn:

- 1.1 miles for every S$1 spent in Singapore Dollars

- 1.1 miles for every S$1 spent in foreign currency (FCY)

It used to be the case that the FCY earn rate was boosted to 2 mpd in June and December, but that feature has been discontinued effective 1 November 2024. I don’t think you should shed too many tears though, since it was always an underwhelming, highly-restricted rate that was easily bested by other cards on the market.

As I said in the introduction to this post, the AMEX KrisFlyer Credit Card’s earn rates are just painfully bad compared to the competition.

| 💳 Earn Rates for General Spending Cards (income req.: S$30K) |

||

| Cards | Local Spend | FCY Spend |

UOB PRVI Miles UOB PRVI Miles |

1.4 mpd | 2.4 mpd |

HSBC TravelOne Card HSBC TravelOne Card |

1.2 mpd | 2.4 mpd |

DBS Altitude DBS Altitude |

1.3 mpd | 2.2 mpd |

OCBC 90°N Card OCBC 90°N Card |

1.3 mpd | 2.1 mpd |

Citi PremierMiles Card Citi PremierMiles Card |

1.2 mpd | 2.2 mpd |

StanChart Journey StanChart Journey |

1.2 mpd | 2 mpd |

BOC Elite Miles BOC Elite Miles |

1 mpd | 2 mpd |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

1.2 mpd | 1.2 mpd |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

1.2 mpd | 1.2 mpd |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.1 mpd | 1.1 mpd |

When it comes to FCY transaction fees, American Express charges the same 3.25% as most of the market.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

Using your card overseas therefore means buying miles at 2.95 cents each, way too expensive to consider.

2mpd for Singapore Airlines, Scoot and KrisShop

AMEX KrisFlyer Ascend cardholders earn an uncapped 2 mpd on all transactions made on:

- Singapore Airlines website

- Singapore Airlines mobile app

- Singapore Airlines phone bookings

- KrisShop purchases onboard Singapore Airlines

- KrisShop purchases at krisshop.com

- Scoot website

- Scoot mobile app

Do note that the bonus for KrisShop transactions does not apply if you shop via the Kris+ app.

Tickets must originate from Singapore and be purchased in Singapore dollars.

For avoidance of doubt, you’ll also earn 2 mpd if you redeem an award ticket and pay for the taxes and surcharges with the AMEX KrisFlyer Credit Card. But considering how you could easily earn 3-4 mpd on these purchases by using other credit cards, there’s nothing to get excited about here.

2 mpd on Grab

AMEX KrisFlyer Credit Cardholders used to earn 3.1 mpd on Grab transactions, capped at the first S$200 spent per calendar month.

From 1 November 2024, this has been cut to 2 mpd, with the cap remaining the same.

No more bonuses on telcos

AMEX KrisFlyer Credit Cardholders used to receive a one-time bonus of 500 miles on their first recurring bill payment at Singtel, Starhub, M1, Circles.Life or MyRepublic.

This perk has been removed from 1 November 2024 onwards.

How are KrisFlyer miles calculated?

Here’s how KrisFlyer miles earned on the AMEX KrisFlyer Credit Card are calculated:

| Local/FCY Spend | Multiply transaction by 1.1, then round to the nearest whole number |

Notice how the transaction is not rounded down to the nearest S$1; instead, it’s multiplied by 1.1 straight away. This means the minimum spend to earn points is S$0.46 (SGD).

This beneficial rounding policy allows the AMEX KrisFlyer Credit Card to compete favourably with ostensibly higher-earning cards like the UOB PRVI Miles (1.4 mpd), at least where smaller transactions are concerned:

AMEX KrisFlyer Card AMEX KrisFlyer Card1.1 mpd |

UOB PRVI Miles UOB PRVI Miles1.4 mpd |

|

| S$5 | 6 miles | 6 miles |

| S$9.99 | 11 miles | 6 miles |

| S$15 | 17 miles | 20 miles |

| S$19.99 | 22 miles | 20 miles |

| S$25 | 28 miles | 34 miles |

If you’re an Excel geek, here’s the formulas you need to calculate miles:

| Local/FCY Spend | =ROUND (X*1.1,0) |

| Where X= Amount Spent | |

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for KrisFlyer Miles?

The AMEX KrisFlyer Credit Card’s full exclusion list can be found below:

Exclusions

a) Charges processed and billed prior to the Enrolment Date or charges prepaid on any Card Account prior to the first billing statement for that Card Account following the Enrolment Date;

b) Cash Advance and other cash services;

c) Express Cash;

d) American Express Travellers Cheque purchases;

e) Charges for dishonoured cheques;

f) Finance charges – including Line of Credit charges and Credit Card interest charges;

g) Late Payment and collection charges;

h) Tax refunds from overseas purchases;

i) Balance Transfers;

j) Instalment plans;

k) Annual Card fees;

l) Amount billed for purchase of KrisFlyer miles to top-up your miles balance;

m) Bill payments and all transactions via SingPost (e.g. SAM kiosks, mobile app, online portal);

n) Payments to insurance companies (except payments made for insurance products purchased through American Express authorized channel);

o) Payments to Singapore Petroleum Company Limited (SPC) service stations;

p) Payments for the purpose of GrabPay top-ups;

q) Payments to utilities merchants (with effect from 12 February 2021);

r) Payments to public/restructured hospitals, polyclinics and other public/restructured healthcare institutions and facilities (with effect from 1 October 2022);

s) Transactions relating to education and other non-profit purposes (including charitable donations) (with effect from 1 October 2023);

t) Charges at merchants or establishments that are excluded by American Express at its

sole discretion and notified by American Express to you from time to time.

Historically speaking, the AMEX KrisFlyer Credit Card was very liberal with awarding miles, and merchant acceptance was a bigger issue than exclusions. However, in recent times the exclusion list has been growing (though to be fair, it’s no different from what other banks do).

Key exclusions are charitable donations, education, GrabPay top-ups, insurance premiums, SPC transactions, utilities and public hospitals. For avoidance of doubt, private hospitals, CardUp and government organisations still earn miles, where AMEX is accepted.

However, American Express imposes certain restrictions on the types of payments that can be made via CardUp, which are explained below.

What do I need to know about KrisFlyer miles?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| 3 years | N/A | None |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| N/A | 1 | Miles batched and credited once a month |

Expiry

KrisFlyer miles earned on the AMEX KrisFlyer Credit Card will expire at the end of the month, three years after they were earned. For example, KrisFlyer miles credited to an account from 1-31 July 2024 will expire at the end of the day on 31 July 2027.

Cancelling an AMEX KrisFlyer Credit Card has no impact on the miles already in your KrisFlyer account.

Pooling

All miles earned on the AMEX KrisFlyer Credit Card will be credited directly to your KrisFlyer account, where they will pool with miles earned from all other sources (be it other credit cards, flights etc.).

Transfer partners & fees

At the risk of stating the obvious, the AMEX KrisFlyer Credit Card is a cobrand card which does not give you a choice of where to credit your points. If you want to earn points that can be converted into a range of frequent flyer partners, pick a non-cobrand card instead.

All conversions to KrisFlyer are free of charge.

Transfer times

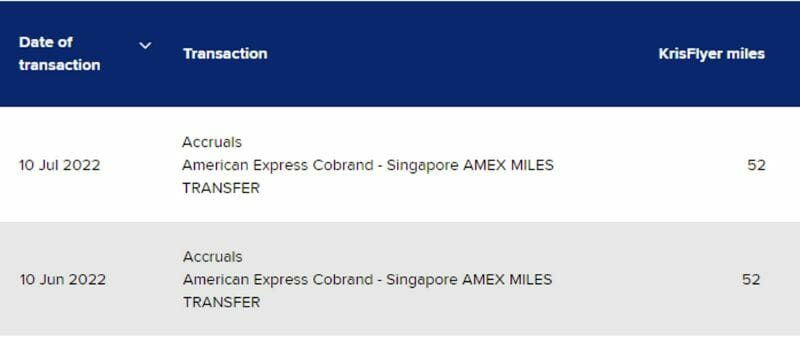

Miles earned on the AMEX KrisFlyer Credit Card are batched and credited to your KrisFlyer account once a month.

You can typically expect to see them credited around the end of your statement period.

While direct crediting avoids conversion fees, it does mean the three year expiry countdown for KrisFlyer miles starts immediately.

Contrast this with non-cobrand cards where you pay conversion fees, but enjoy “two validities”, one on the bank side, and one on the airline side. For example, if I had a UOB PRVI Miles Card:

- My UNI$ are valid for two years

- Once I convert UNI$ to KrisFlyer miles, they’re valid for three years

- In total I get five years of validity

This means there’s slightly more time pressure to use your miles, though three years should be plenty for most people.

Other card perks

AMEX Offers

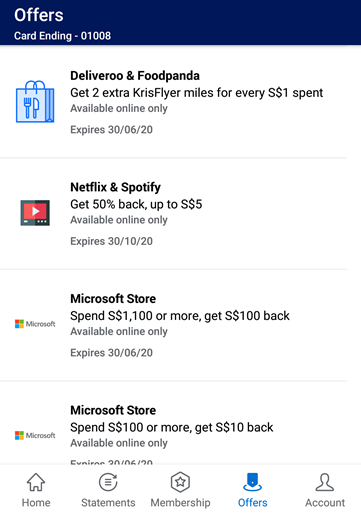

AMEX Offers are targeted deals pushed to your AMEX app, which can range from small savings like getting a few dollars back on contactless transactions, to much more substantial offers like S$790 worth of hotel credits at Four Seasons, Hilton, IHG, Marriott and other major chains. They can also take the form of bonus miles promotions, like a bonus 2 mpd on Deliveroo and foodpanda.

AMEX Offers can give excellent savings, but they’re not a unique feature of the AMEX KrisFlyer Credit Card, and could be enjoyed with any other AMEX card (not DBS/UOB issued AMEX cards though).

That said, the AMEX KrisFlyer Credit Card is the only entry-level American Express card I can think of with an easily-waivable annual fee, so if enjoying AMEX Offers is your goal, then this would be the right card to do it.

AMEX Pay

AMEX Pay is a QR-code based payment solution that allows you to pay with American Express cards at participating merchants.

The key use case here are hawker, wet market or other small businesses which normally don’t accept credit card payments. In these situations, having an American Express card allows you to earn some miles that you otherwise wouldn’t have been able to.

AMEX KrisFlyer Credit Cardholders will earn 1.1 mpd on AMEX Pay transactions.

S$150 cashback for Singapore Airlines

AMEX KrisFlyer Credit Cardholders who charge S$12,000 or more (on any miles-earning transaction) between 1 July and 30 June of the following year will receive S$150 cashback, valid on their next purchase of Singapore Airlines air tickets via singaporeair.com or the SingaporeAir mobile app.

To utilise the cashback, you must charge your air tickets to your AMEX KrisFlyer Credit Card. This only applies to flights originating from Singapore, and purchased in Singapore dollars.

The cashback is valid for 12 months, and will appear on your billing statement within 90 days of purchase. Ticket purchases via AMEX Pay Small do not qualify.

A S$150 rebate for S$12,000 spend works out to 1.25%, so it’s not exactly Christmas.

Complimentary travel insurance

| Coverage | Amount |

| Accidental Death | S$350,000 |

| Medical Benefits | N/A |

| Travel Inconvenience |

|

| Policy Wording | |

AMEX KrisFlyer Credit Cardholders who charge their airfares to the card will receive automatic travel insurance coverage, underwritten by Chubb. For avoidance of doubt, this applies both to cash tickets, as well as award tickets where the taxes and fees are paid for with the AMEX KrisFlyer Credit Card.

S$350,000 of coverage is provided for accidental death or permanent disability while traveling on a public conveyance. There’s also coverage for travel inconveniences like missed connections and bag delays.

However, there is no coverage for medical expenses, nor medical evacuation. This is something you can’t afford to miss, so a separate travel insurance policy is highly recommended.

Terms and Conditions

Summary Review: AMEX KrisFlyer Credit Card

|

|

| Apply Here | |

| 🦁 MileLion Verdict | |

| ☐ Take It ☑Take It Or Leave It ☐ Leave It |

The AMEX KrisFlyer Credit Card is a prime example of a “bonus and banish” card. You apply for it when there’s a good sign-up bonus, meet the minimum spend, then toss it in the sock drawer, retrieving it when there’s an attractive AMEX Offer or when AMEX Pay is the only miles-earning solution.

Unfortunately, you still see a lot of people, especially miles novices, using this as their everyday card on the assumption that “it’s a cobrand card so it must have the best earn rates”. Nothing could be further from the truth!

So that’s my review of the AMEX KrisFlyer Credit Card. What do you think?

As you rightly pointed out, this card should be called the Amex Sign Up Bonus Credit Card cos that is all it really is good for

For the SQ $150 cashback, is it applicable for taxes that I pay when I make a redemption booking?

Yes.

Between the upgrade path and separate sign-up path to the KF ascend, what are your thoughts?

Hi there, the link to sign up seems to be broken

Thanks for the valuable info!

You state that “Apart from that, anything goes”, but according to AMEX, only a very small places earn you miles. It’s not any transaction. For example, I asked rather using the card in any food court or shopping mall will earn me points, and they said no. That only very specific companies with which they work with will provide miles. Did I misunderstood?

Cancelled this card this year. CSO asked me to keep for a year. I find it no point. Just cancel and reset NTN status

Metapod used harden!

Think twice before applying the AMEX KrisFlyer Credit Card. Did the required spending on Singapore Airline websites and was told after 10 months, the same SIA transactions made online while overseas don’t count towards the Krisflyer offer even though they are all in SGD and originate from SG. Utter disappointment and canceled the card right away. Enough money and time lost 😪 Why did I bother in the first place..

If you just applied for the Amex Platinum Charge promotion where you have to spend to get the airline credits, has it made sense for people to postpone applying for UOB Krisflyer? Or is UOB Krisflyer a must have you should find a way to meet the minimum airline spend for both?

>if you can’t get it waived, cancel it.

Done and done.