In a world fractured by schisms about gender, it’s comforting to know that the DBS Woman’s World Card still retains the ability to unite miles chasers, regardless of chromosomes. Contrary to what its name suggests, this card is available to both men and women, and thanks to its versatility, it’s found its way into many purses, wallets and/or manbags.

Unfortunately, 2024 got off to a bad start for the DBS Woman’s World Card, with its star attraction — 4 mpd on all online transactions — reduced from S$2,000 per month to S$1,500 per month.

That’s not ideal by any means, but in the cold light of day it still remains an essential part of my card strategy.

DBS Woman’s World Card DBS Woman’s World Card |

|

| 🦁 MileLion Verdict | |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? |

|

| Despite a cut to its monthly bonus cap, the gender-neutral DBS Woman’s World Card is still an essential card thanks to its no-questions-asked online spending bonuses. | |

| 👍 The good | 👎 The bad |

|

|

| Full List of Credit Card Reviews | |

Overview: DBS Woman’s World Card

Let’s start this review by looking at the key features of the DBS Woman’s World Card.

DBS Woman’s World Card DBS Woman’s World Card |

|||

| Apply | |||

| Income Req. | S$80,000 p.a. | Points Validity | 1 year |

| Annual Fee | S$196.20 (First Year Free) |

Min. Transfer | 5,000 DBS Points (10,000 miles) |

| FCY Fee | 3.25% | Transfer Fee | S$27.25 (per xfer) S$43.60 (per yr.) |

| Local Earn | 0.4 mpd | Points Pool? | Yes |

| FCY Earn | 1.2 mpd | Lounge Access? | No |

| Special Earn | 4 mpd on online spending | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

For avoidance of doubt, DBS has two different Woman’s cards:

- DBS Woman’s Platinum Mastercard (left)

- DBS Woman’s World Card (right)

I’ll be focusing on the DBS Woman’s World Card in this post, since there’s really no reason to get the DBS Woman’s Platinum Mastercard (even if you earn less than the income requirement; as we’ll see in the next section, that’s more serving suggestion than cardinal rule).

“I’m a guy,” you say? Good for you. Pump more iron and console yourself that applying for a lady’s card does not make you less of a man in any way shape or form. The DBS Woman’s World Card is open to both men and women; just scroll up and look at the name DBS embossed on the cardface!

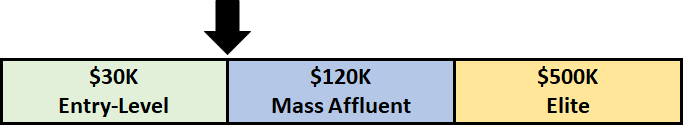

How much must I earn to qualify for a DBS Woman’s World Card?

The DBS Woman’s World Card has an S$80,000 annual income requirement, but don’t let that put you off applying. As I’ve laid out before, any income requirement above the MAS-mandated minimum of S$30,000 is essentially arbitrary.

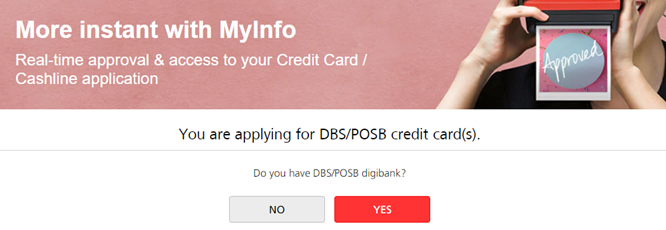

The fact of the matter is, plenty of people who earn S$30,000 per year get approved for a DBS Woman’s World Card with no drama whatsoever. It helps if you already hold an existing DBS credit card. Click through this link, then select the DBS Woman’s World Card.

Select “Yes” when asked if you already have a DBS card, and login to ibanking. You should then receive an instant decision, and from the data points I’ve seen so far, earning less than S$80,000 has never been an issue.

How much is the DBS Woman’s World Card annual fee?

| Principal Card | Supp. Card | |

| First Year | Free | Free |

| Subsequent | S$196.20 | S$98.10 |

The DBS Woman’s World Card has an annual fee of S$196.20 for the principal cardholder, and S$98.10 for each supplementary card. This is waived for the first year, and subsequent years’ annual fees can be waived when you spend at least S$25,000 a year.

Don’t take this as a hard and fast rule. I’ve got my annual fee waived many times before, despite spending nowhere near S$25,000. It’s extremely easy to request an annual fee waiver via DBS’s online channels or hotline, so don’t be afraid to try.

How many miles do I earn?

| 🇸🇬 SGD Spending | 🌎 FCY Spending | ➕ Bonus Spending |

| 0.4 mpd | 1.2 mpd | 4 mpd on online transactions |

SGD/FCY Spending

DBS Woman’s World Cardholders earn:

- 1 DBS Point for every S$5 spent in Singapore Dollars (0.4 mpd)

- 3 DBS Points for every S$5 spent in FCY (1.2 mpd)

1 DBS Point is worth 2 airline miles, so that’s an equivalent earn rate of 0.4 mpd for local spending, and 1.2 mpd for FCY spending.

A 3.25% FCY transaction fee applies to all foreign currency transactions.

Bonus Spending

DBS Woman’s World Cardholders earn:

- 10 DBS Points for every S$5 spent online, whether in Singapore Dollars or FCY (4 mpd)

This is capped at S$1,500 per calendar month, and any spend in excess of this cap earns just 0.4 mpd.

| 📅 Transaction Date, Not Posting Date! |

| The bonus cap is enforced by transaction date, not posting date. For example, making an online transaction on 31 January at 11.59 p.m Singapore time will still be counted under January’s bonus cap, even though the posting will almost certainly happen in February |

Some (non-exhaustive) examples of online transactions include:

| Activity | Examples |

| E-commerce websites | Amazon, eBay, Lazada, Qoo10, Shopee, Taobao |

| Buying air tickets | Singapore Airlines, British Airways, Cathay Pacific, Qatar Airways |

| Booking attractions or activities | Klook or Pelago |

| Booking movie tickets | Golden Village, Cathay |

| Taxi and ride-hailing | CDG, Grab, gojek, TADA |

| Food delivery | Deliveroo, Foodpanda, GrabFood |

| Streaming subscriptions | Netflix, Spotify |

As you can see, the MCC does not matter (unless it’s on the general exclusions list like insurance or charitable donations).

All that matters is the mode of payment, and this blacklist approach (where all transactions earn bonuses unless they’re explicitly excluded in the T&Cs) makes the DBS Woman’s World Card more versatile than cards with a whitelist approach (where transactions don’t earn bonuses unless they’re explicitly included in the T&Cs) such as the HSBC Revolution or UOB Lady’s Card.

This comes in particularly handy for MCCs that aren’t excluded, yet don’t feature on the whitelist of other rewards cards. Some examples include teleconsults with DoctorAnywhere or Minmed, hospital bills paid via HealthHub and Health Buddy, and, surprisingly enough, furniture stores like IKEA.

For avoidance of doubt:

| Scenario | Earn Rate | Example |

| Transactions which are both online and in foreign currency | 4 mpd | Spending on Amazon USA website |

| In-app spend via Apple Pay or Google Pay | 4 mpd | Spending on Kris+ |

| In-store spend via Apple or Google Pay | 0.4 mpd | Dining in a restaurant and tapping your phone to pay |

When are DBS Points credited?

DBS Points earned on the DBS Woman’s World Card are not all credited at once.

Depending on the type of transaction you’re doing, some will be credited when the transaction posts, with the rest credited by the end of the calendar month following the transaction.

| Offline Local Spend | 1 DBS Point on the next working day when transaction posts |

| Online Local Spend | 1 DBS Point on the next working day when transaction posts, 9 DBS Points by the end of the next calendar month following the transaction |

| Offline FCY Spend | 3 DBS Points on the next working day when transaction posts |

| Online FCY Spend | 3 DBS Points on the next working day when transaction posts, 7 DBS Points by the end of the next calendar month following the transaction |

How are DBS Points calculated?

Here’s how you can work out the DBS Points earned on the DBS Woman’s World Card:

| Online Local Spend | 1X: Divide transaction by 5 and multiply by 1. Round down to nearest whole number 9X: Divide transaction by 5 and multiply by 9. Round down to nearest whole number |

| Online FCY Spend |

3X: Divide transaction by 5 and multiply by 1, round down to nearest whole number, divide transaction by 5 and multiply by 2, round down to nearest whole number, add both 7X: Divide transaction by 5 and multiply by 7. Round down to nearest whole number |

If you’re an Excel geek, here’s the formulas you need to calculate:

| Online Local Spend | 1X: =ROUNDDOWN ((X/5)*1,0) 9X: =ROUNDDOWN ((X/5)*9,0) |

| Online FCY Spend |

3X: =ROUNDDOWN ((X/5)*1,0) + ROUNDDOWN ((X/5)*2,0) 7X: =ROUNDDOWN ((X/5)*7,0) |

| Where X= Amount Spent | |

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

As with all bonus-earning credit cards, it’s important to periodically check your points and make sure they’re crediting properly. Refer to the article below for more details.

What transactions aren’t eligible for DBS Points?

Per the DBS Rewards T&Cs (Point 2.6), DBS Points will not be awarded for the following transactions.

| ❌ Ineligible Transactions |

|

The DBS Woman’s World Card T&Cs have some further exclusions (Point 2) as to what counts as online spend.

| ❌ Do not count as online spend |

|

i. Bill payments and all transactions via AXS, SAM, eNETS; |

To summarise, this is not the card to use for CardUp/ipaymy, education, government transactions, insurance, charitable donations, utilities, hospitals or GrabPay top-ups. Even if these are processed online, you won’t earn 4 mpd.

Amaze transactions have also ceased to earn DBS Points, effective 1 June 2022.

What do I need to know about DBS Points?

| ❌ Expiry | ↔️ Pooling | 💰 Transfer Fee |

| 1 year | Yes | S$27.25 (per conversion) or S$43.60 (per year) |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 5,000 DBS Points (10,000 miles) |

4 | 1-3 working days (for KF) |

Expiry

While some DBS Points never expire (e.g. those earned on the DBS Altitude Card), those earned on the DBS Woman’s World Card expire after just one year.

This is a relatively short expiry period, and probably the biggest drawback of the card. You’ll want to monitor your points balance closely, and cash them out on a periodic basis.

Pooling

DBS Points earned on different cards pool for the purposes of redemption. If I have a 12,000 points on the DBS Altitude and 8,000 points on the DBS Woman’s World Card, I’ll be able to redeem 20,000 points at one shot, paying a single conversion fee.

However, DBS Points are not pooled when it comes to card cancellations. If I have a DBS Altitude and DBS Woman’s World Card and decide to cancel the latter, I’ll need to transfer my points out before cancelling or forfeit them.

Partners and Transfer Fee

DBS partners with the following frequent flyer programmes, and a minimum conversion block of 5,000 points is required (except for airasia, where the block is 500; but really, converting points to airasia is like throwing them away).

| Frequent Flyer Programme | Conversion Ratio (DBS Points: Miles) |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

|

500: 1,500 |

Transfers cost S$27.25 per programme, regardless of how many points are transferred.

For KrisFlyer miles specifically, DBS offers an alternative “auto conversion programme”. This charges a flat fee of S$43.60 per membership year, and automatically converts DBS Points to KrisFlyer miles each calendar quarter in blocks of 500 points.

How does the DBS KrisFlyer Miles Auto Conversion Programme work?

This programme is only available to DBS Insignia, DBS Black Treasures Elite, and DBS Altitude cardholders.

Even though DBS Woman’s World Cardholders are not eligible, the fact that DBS Points pool means that so long as you have one of the participating cards, you can use it as a conduit to cash out the DBS Points earned on the DBS Woman’s World Card!

| 💡Alternative to miles |

| While I normally would not recommend redeeming DBS Points for anything other than miles, the bank has been running some attractive redemption deals for vouchers of late. These deals have offered the equivalent of up to 2.5 cents per mile, which I think is a very compelling offer. |

Transfer Times

DBS tells customers to expect points to be credited in 1-2 weeks, but in reality it usually takes about 1-3 working days at the very most for KrisFlyer (transfer times to other programmes may be longer)

If you need your points credited instantly, you can do so via Kris+. 100 DBS Points can be instantly transferred to 170 KrisPay miles, which can then be converted to KrisFlyer miles at a 1:1 ratio with no fees.

|

| S$5 for new Kris+ Users |

| Get S$5 (in the form of 750 KrisPay miles) when you sign-up with code W644363 and make your first transaction |

However, those 100 DBS Points would normally have earned you 200 KrisFlyer miles, so you effectively take a 15% haircut. Therefore I wouldn’t recommend taking this option, unless you need a small top-up to redeem a flight, or have an orphan DBS Points balance (<5,000 points).

If you choose to do so nonetheless, do remember that it’s a two-step process:

- Transfer DBS Points to KrisPay miles

- Transfer KrisPay miles to KrisFlyer miles

Do not forget the second step! If you wait more than seven days, or spend any of the converted KrisPay miles via Kris+, the entire balance will be stuck in the Kris+ app. KrisPay miles expire after six months, and can only be spent at a poor ratio of 150 miles = S$1.

Other card perks

There’s no lounge or airport limo benefits with the DBS Woman’s World Card, but by virtue of its World Mastercard tier, it’s eligible for certain generic Mastercard benefits. These include:

- GHA DISCOVERY Platinum status

- I Prefer Titanium status

- Swiss-Belexecutive Gold Influencer status

- Wyndham Rewards Platinum status

- HoteLux Elite membership

Otherwise, you’ll have access to the usual generic DBS benefits, which can be found here.

Terms and Conditions

Summary Review: DBS Woman’s World Card

DBS Woman’s World Card DBS Woman’s World Card |

| Apply |

Given the sheer number of online transactions the average person performs on a daily basis, you absolutely need to have a dedicated online spending card.

With the DBS Woman’s World Card, you’re guaranteed 4 mpd, so long as it doesn’t run afoul of the general exclusions. That’s an easy 72,000 miles per year, with very little effort on your part.

The main drawback here is that this card isn’t nearly as good as it was before, thanks to the nerf of its bonus cap from S$2,000 to S$1,500 per calendar month. Also, the one-year points expiry can be annoying, though paying an extra conversion fee once a year is far from a deal-breaker.

I pump iron, you know.

| 🦁 MileLion Verdict | |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

Aaron I like you

you’re cute too.

Expired points can be clawed back to redeem for gifts but not miles. I was told the miles conversion fee is for per transfer transaction. I was also told that there’s no longer an annual version of that fee.

you mean this doesn’t work?

https://www.dbs.com.sg/Contact/dbs/cards/dbs-rewards/default.page

it’s not for WWMC, mind.

ok got it – annual fee is only for auto conversion and not applicable for WWMC

Ladies and gents, this is one of the must-have cards!

Hi Aaron,

Will top up Shopee wallet considered as online transaction?

no data points on this, sorry

I did this in Jun and Aug and got points. However YMMV

got points but not 10X point. I only got 20 points for 100 dollar top up which equals 0.4 mpd.

How do you deal with the 1 year expiry (on a quarterly basis)? Do you redeem on a yearly basis (to reduce the admin fee for the conversion) or on quarterly basis (to maximise the validity of the miles)?

i’d redeem on a yearly basis. wouldn’t that also maximize the validity of the miles? if you redeem each quarter, you start the clock sooner on each batch

I meant the quarter in which the miles would expire, but yearly is probably a good way to go about it.

Goddamn it! Didn’t know that the income requirements can be 30k! I came across this site late and didn’t see the article about the lax income requirement! I didn’t apply this because I always thought I need to wait until my pay gets to 80k…

no man (i’m assuming you are a man), go for it. people have frequently been getting approved at the 30-40k mark

I think the WWMC online spend suffers the SAME syndrome as CRMC due to the mastercard online tagging issues. Tried both Live Fresh and WWMC, qualifies online for live fresh (visa) but does not awarded 9X WWMC bonus for Favepay payment at F&B outlets. Fortunately, DBS can be more lax in considering appeals unlike Citi who can be stuck up on this sticky issue.

agreed! for instance, i had transactions for Guardian On and Foodpanda, CRV get 9x bonus but CRMC!!! what the…

I wonder if the SC X card will take your coveted 1 star paperweight rating.

PSA:

Fave doesn’t track correctly, and they refused to reinstate points for my transactions.

Quite a few other types of transactions don’t track correctly, and the product team tries to impose a time limit of 3 months from transaction date (though this isn’t anywhere in the T&Cs and you get your bonus points only in the next cycle…).

They don’t have the legal right to do that since the 3 month deadline isn’t mentioned in the T&Cs, but it’s a pretty tiring fight.

Hi Aaron, i have been trying to find out what the best card to use for business class tickets purchase since I travel frequently for work on business on my own account. Thanks!

Hey Aaron, I have just applied for this card. Do you know if Gym membership falls under online transactions. Typically, they save our card details and charge it monthly or bi-weekly! Thank you

i dont have a gym membership (as my gut will attest) so unfortunately i can’t confirm this. you may have some luck asking in the milelion’s telegram group

Hi! Do you know if payment made through PayPal are entitled to the 10x DBS points?

Under the T&C further exclusions, what is counted as ‘advertising services’? Is Facebook ads excluded too?

Hey Aaron,

I have a couple of big ticket items that are slightly over 1k each. Right now, charging two to the card would take it up to 2200 for the current month.

Is it worth it to sacrifice the 200 surplus or risk not hitting the monthly cap this month? One item would be 1200 and I cannot find another 800 to charge this month.

Also, is the monthly cap reset every 1st of the new month or exactly one month from card approval?

Thanks!

monthly cap resets on 1st of every month. well it depends on your situation and what your alternative cards are. if you spend 2,200 on wwmc and you have another 4 mpd card, you’re giving up 200*(4-0.4) miles

if you dont have another 4 mpd card, your opportunity cost drops to 200*(1.4-0.4) [assuming uob prvi miles is your alternative card]

Does spending via Fairprice app earn the bonus reward too? 🙏🏼

I have both Altitude card & WW card, when i convert my DBS points to Krisflyer, will they convert the points at First In First out basis or on first expiring first out basis?

Dbs uses fifo

Hi Aaron! I am just recently starting my miles game. I have Altitude currently and thinking of applying for this card. I currently have over 20k DBS Points. Should I transfer all of them out before getting this card as you mentioned about the fifo transfer if I start using this card instead? (But covid …)

Thank you!

Just a heads up. DBS WWMC no longer rewarding points (Both bonus and basic points) for Shopeepay transactions as per 14 May 2021 TnC.

I just learnt of the benefits of this card, after so long! May I know if contactless payment is the same as online payment Will contactless payment also earn 4mpd?

Nope. Doesn’t count

Thanks for the reply, Aaron! What about about payment using the card in Apple Pay and Google Pay?

Doesn’t count either unless the purchase was made through your phone browser or an app.

Hi Aaron! Just wondering since u travel a lot, when you buy train tickets eg on Deutsch Bahn or TGV or Trenitalia do purchases of Train ticket count under online purchase with the DBS Woman‘A World Card/Citi Rewards/HSBC Revolution? Thanks!

Yes for DBS WWMC and HSBC Revo.

I use WWMC with no issues. don’t use citi rewards for anything vaguely travel related.

Hi Aaron, I tried using the DBS Womens Master with Uber in the US and all the charges were declined – Direct or via Apple Pay. CSO said apparently it is because of the way charges are routed to MasterCard and I need to do a “travel bypass”. I have no problems using Visa cards. Is this normal? Also, Unrelated but in some online merchants, my card is picked up as Maestro and the charges don’t go through. CSO again said it’s their platform issue, not the card. She said using the physical card shouldn’t be an issue but for… Read more »

hi Aron, thanks for sharing such a useful article.

just confirm, I’m holding Woman’s World Card, so I will earn 1.2 mpd when I made any purchases on retails/offline stores with foreign currency transactions out of Singapore.

in this case, UOB PRVI Miles earns 2.4mpd which is much better than WWC.

Does payment using Kris+ considered as an online and eligible for 4mpd?

yes. I use it since last year. No problem

are Carousell purchases included for the bonus miles?

Nice write up, Aaron. Keep rocking!

Also, a gentle reminder that you are a month behind schedule on the annual $120K roundup (waiting for DBS’ new offering or just busy?). Since you don’t do a $500K roundup, this acts as a decent proxy.

It will be interesting to see how you value OCBC Voyage this time. I am seeing Voyage in a new light after 3 trips in the last month were courtesy VM while SQ Awards were wait-listed even as a TPPS. Optimising for mile earning works well till it doesn’t!

hey, you’re right. may 2021 was the previous edition.

suppose i should get cracking.

edit: actually, i think i want to wait for the dbs vantage to launch

Hi Aaron, I have been looking around but can’t find the answer.

Do recurring Apple Subscriptions count towards 4 mpd for the online transaction category?

Just tried to request for waiving annual fee of DBS women’s world card twice on 2 different days and both times get rejected.

Maybe they change their policy and will definitely charge annual fee for those didn’t spend enough, or maybe they just don’t think I am valuable customer to them.

How much did you spend in the past year on the card?

Do you know if starhub monthly subscription payment via starhub apps or website counts under online purchases?

If I use WMMC card for FairPrice app payment in any FairPrice store, will I get 10x?

anyone can help advise?

thank you.

Hi I would like to confirm whether the woman’s world card actually gets 10X rewards points via paying bills like singtel, starhub on the mobile app. Because in the woman world card terms and conditions payment to utility bill companies are excluded. I am aware Singtel and starhub are not considered utility companies but when it is reflected in my credit card transaction category as under bills,utilities & taxes

What is the mpd earn rate for physical grocery stores – Cold Storage, Fairprice etc. Do these only earn 0.4 mpd? Or does using ApplePay etc count as online and earn 4 mpd?

Hi do you know if this card can earn 4mpd using Shopback Pay (i.e. the QR code scan) at physical shops?

Hi I read the T&C and the bonus miles is only 1st $1000 and not $2000?

Elementary question: does the 4 MPD still work if I pay via ApplePay or GooglePay? Thanks!

Hi. Can this also work for the supplementary card also get the 4 mpd for online spend? So between primary and supplementary card holders the combined spend is $2000 for 4mpd?

Would I be able to get 4 mpd for PayPal using this card? If not, which card should I use for PayPal?

There is a milelion article on PayPal, do a quick search for that

Share with you guys a trick to earn free miles with DBS Woman’s Card & DBS Altitude card: Charge alternate month (Jan, March, May etc) a refundable hotel stay up to S$2,000 at agoda, expedia etc. (S$5000 for Altitude card). The booking date must be a far away date. Once the bonus 9x DBS points for DBS Woman’s card (or 4.5 DBS Points for Altitude card) is in, cancel the refundable hotel stay and keep the free points!! The basic 1x points (or 3x points for Altitude card) will be reversed once the refund is in!! 🙂

this is commonly known as fraud.

Even if the “trick” worked, it is a bit over-the-top to say it is fraud. Fraud is defined as “the crime of using dishonest methods to take something valuable from another person”. There is nothing dishonest about the above – if DBS chooses to not reverse the bonus points, that is a DBS issue – there is no dishonesty involved on the part of the customer. How is the above any different to the “trick”many were engaging in last year, topping up their Grab wallet using a cash back card, and then being able to transfer the funds back to… Read more »

I have had Agoda bookings I have cancelled in the past (for genuine reasons) and the bonus miles are reversed too – but in the following month – just like bonus miles are awarded in the following month. So, no, it does not get you free miles.

Yeah that’s my experience too – bonus miles are reversed. I do know a couple of places where partial refunds don’t claw back the bonus miles but it’s way too troublesome to try and use this as a free mile generating scheme.

I got refunded when canceling with airline the tixs due to 2020 Covid-19 lockdown. Bonus miles credited were reversed by bank.

Doesn’t matter if this is fraud or not, if you do anything that causes the bank to lose money, things will go bad once they finds out.

There is no free miles; the bank is paying for it. And they could create more rules to counter this and those might make it harder to get miles legitimately.

But DBS rewards does not have negative balance. You redeem all the bonus points first. After that reverse the charge. Once the charge is in, you will still see 0 balance, not negative.

Hi Aaron, do you know whether Marriott hotel bookings through its website will earn 4mpd or 0.4 mpd instead? Been trying to collect bonvoy points and it’s only collectable through direct booking from Marriott, thank you in advance

There is one big annoying downside to this card. For me at least, a key source of online transactions to get the 4pmd benefit is bookings with Agoda or Airbnb. And DBS have this highly annoying charge where they add 1% to the cost, as these companies process their transactions outside of Singapore (why this makes a difference who knows, but any excuse for the bank to charge more, right?). Anyway, the 1% is not such a big deal if you get 4mpd. But where it gets unacceptable is cases where you need to cancel your booking. In this case… Read more »

Believe the 1% for SGD transactions outside SG applies for all Visa/Mastercards, except AMEX, so not really a DBS problem?

One thing to take note too about transactions. I have recently found out my transactions at Saladstop (and its sister brands) do not get any points at all, even though it was all processed/ordered online from their website/app. Managed to dispute all the Q1 transactions to earn base + bonus by calling customer service and showing proof of online receipts, but was told have to call in every single time as they were not classified as an online transactions. So I checked out the MCC via DBS digibot, and found it clocks in as “Eating Places and Restaurants” (Whatcard classifies… Read more »

Do I earn 4 mpd if I use FairPrice app (Payment method with WMMC) payment at FairPrice store?

Seems like not any more since Mar 2023… Went through a lengthy series of calls with DBS to eventually be told that it’s no longer considered online (or in-app) as it involves scanning a QR code at a counter lol

you can use Gpay linked to your WWMC to pay in FairPrice app

Hi has it been confirmed that DBS will recognize this as online spending? Thanks in advance!

Because the points are only awarded for purchases worth $5, would it make sense to use a different card for MRT/bus rides and other small transactions?

Will the x9 bonus apply if using Apple Pay to add money within revolut app?

if a transaction is both online and in foreign currency, you’ll earn 4 mpd, and not 1.2 mpd.

if the online transaction is performed online (e.g. air tickets) but settled in SGD, then it won’t be 4 mpd?

Sorry, but what’s the maximum I should be earning per month if I hit the $2,000 spend? 4000 points?

Hey Awongz, does this card give me bonus miles when buying groceries at NTUC, using the Fairprice group app?

Hi ML, you might want to check your links. not sure if it’s only me but the link-out to apply doesn’t seem to work for me.

https://apply.creatory.hyphengroup.io/click?o=36&a=13&link_id=130

this one should work! just tested it.

do i earn the bonus points for buying online such as sephora and even luxury brand websites?

Under “No 10X rewards points”, there is: “Payments made via online banking;”.

What does it mean compared to “online transaction”, which is eligible?

Also, does cruise booking through klook, etc. eligible for 10x rewards points (travel category)?

If I use the Woman’s Card to buy my new iPhone from Singtel through the Singtel App shop, is this considered an online transaction ?

for people who are unaware, payments made to CardUp, FavePay, iPaymy, SmoovPay and Fave eCard (with effect from 1 Sep 2023);

i wasnt aware that FavePay is excluded earlier so ended up with 0.4 miles for my bulk purchase using FavePay.

Hi,

can i earn DBS points if i add the card to ChangiPay or it’s on exclusion list?