DBS has extended its latest iteration of sign-up bonuses for the Altitude cards, which are now valid for applications received between 1 August to 30 September 2020.

New-to-bank DBS Altitude AMEX and Visa cardholders can earn up to 48,000 and 38,000 miles respectively when they spend at least S$6,000 within the first 90 days of approval. Alternatively, they can opt to get up to S$200 cashback instead.

| ❓ DBS defines new-to-bank customers as those who do not currently hold a principal DBS/POSB credit card, and have not done so in the last 12 months before application |

DBS Altitude AMEX offer

New-to-bank cardholders who apply for a DBS Altitude AMEX by 30 September 2020 can enter one of three different promo codes during application:

- 200CASH

- DBSALT

- ALTAF

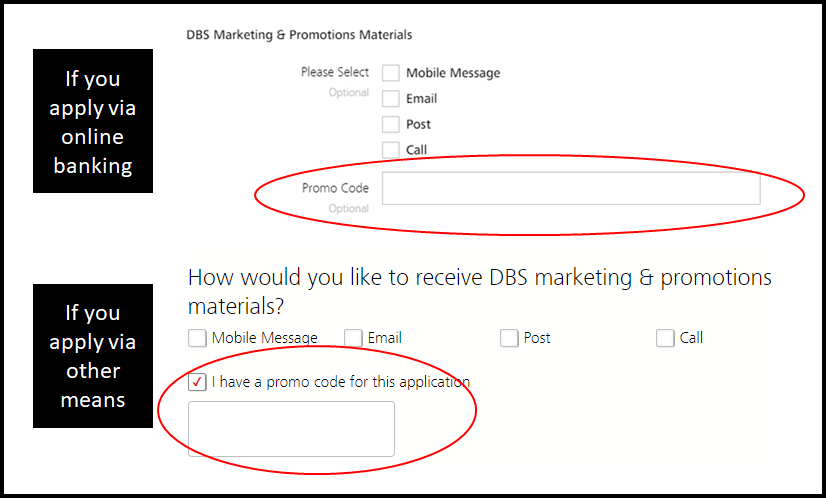

Look for this field to enter the promo code:

Depending on the promo code entered, you’ll be eligible for one of these three offers:

| 200CASH | DBSALT | ALTAF | |

| Spend | S$800 | S$6,000 | S$6,000 |

| Period | 60 days | 90 days | 90 days |

| Base Miles @ 1.2 mpd |

960 miles | 7,200 miles | 7,200 miles |

| 50% bonus miles | 480 miles | 3,600 miles | 3,600 miles |

| Bonus Gift | S$200 | 10,000 miles | 10,000 miles |

| Annual Fee Miles (S$192.60 fee) |

N/A | N/A | 10,000 miles |

| Total Miles | 1,440 miles | 20,800 miles | 30,800 miles |

| ⚠️ Typo alert |

|

On the DBS Altitude landing page, the spending requirement for cashback is listed as S$600. In the T&C document, however, it’s listed as S$800. I’m clarifying with DBS which is the correct amount, but based on past promotions it’s almost certainly S$800. |

In the table, I’ve assumed that all your spending is done on non-bonused local currency transactions (earning 1.2 mpd).

DBS quotes a bonus of “up to 48,000 miles” for the DBS Altitude AMEX. How do they get that figure? They assume the following:

- You spend all S$6,000 on online air tickets and hotels @ 3 mpd for 18,000 base miles + 10,000 bonus miles

- You max out the activation bonus of 50% bonus miles on all spending within first 90 days, capped at 10,000 miles

- You pay the annual fee of S$192.60 for 10,000 miles

DBS Altitude Visa offer

New-to-bank cardholders who apply for a DBS Altitude Visa by 30 September 2020 can enter one of three different promo codes during application:

- 150CASH

- DBSALT

- ALTAF

Look for this field to enter the promo code:

Depending on the promo code entered, you’ll be eligible for one of these three offers:

| 150CASH | DBSALT | ALTAF | |

| Spend | S$800 | S$6,000 | S$6,000 |

| Period | 60 days | 90 days | 90 days |

| Base Miles @ 1.2 mpd |

960 miles | 7,200 miles | 7,200 miles |

| Bonus Gift | S$150 | 10,000 miles | 10,000 miles |

| Annual Fee Miles (S$192.60 fee) |

N/A | N/A | 10,000 miles |

| Total Miles | 960 miles | 17,200 miles | 27,200 miles |

| ⚠️ Typo alert |

|

On the DBS Altitude landing page, the spending requirement for cashback is listed as S$600. In the T&C document, however, it’s listed as S$800. I’m clarifying with DBS which is the correct amount, but based on past promotions it’s almost certainly S$800. |

Once again, I’ve assumed that all your spending is done on non-bonused local currency transactions (earning 1.2 mpd).

DBS quotes a bonus of “up to 38,000 miles” for the DBS Altitude Visa. They get this by assuming:

- You spend all S$6,000 on online air tickets and hotels @ 3 mpd for 18,000 base miles + 10,000 bonus miles

- You pay the annual fee of S$192.60 for 10,000 miles

A better offer for cashback

If you’re after cashback, use the code DBSFLASH and apply by 6 August 2020.

You’ll receive S$200 cashback when you make at least one qualifying transaction (of any amount) within 30 days of approval. For more details, read this article.

What spending is excluded?

Do note that DBS excludes the following transactions when calculating whether the qualifying spending has been met:

| a. posted 0% Interest Instalment Payment Plan monthly transactions, b. posted My Preferred Payment Plan monthly transactions, c. interest, finance charges, cash withdrawal, balance transfer, smart cash, AXS payments, SAM online bill payments, bill payments via internet banking and all fees charged by DBS; d. payments to educational institutions; e. payments to financial institutions (including banks, online trading platforms and brokerages); f. payments to government institutions and services (court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra-government purchases and any other government services not classified here); g. payments to hospitals; h. payments to insurance companies (sales, underwriting and premiums); i. payments to non-profit organisations; j. payments to utility bill companies; k. payments to professional service providers (including but not limited to accounting, auditing, bookkeeping services advertising services, funeral service and legal services and attorneys); l. any top-ups or payment of funds to payment service providers, prepaid accounts and any prepaid accounts (e.g. EZ-Link, GrabPay, NETS FlashPay, Transit Link, Singtel Dash); m. any betting transactions (including levy payments to local casinos, lottery tickets, casino gaming chips, off-track betting and wagers); n. any transactions related to crypto currencies; and o. any other transactions determined by DBS from time to time |

Any supplementary cardholder spending will be combined with the principal cardholder’s in determining qualifying spend.

When do I get my gift/bonus miles?

For those using the DBSALT/ALTAF codes, bonus miles will be credited to your account within 180 days from the date of card approval.

For those using the 200CASH/150CASH codes, cashback will be credited to the card account within 150 days from the date of card approval.

Here’s the respective T&Cs:

| DBSALT/ALTAF | 200CASH/150CASH |

| T&C | T&C |

Recap: DBS Altitude Basics

Apply Here Apply Here |

|||

Apply Here Apply Here |

|||

| Income Req. | S$30,000 p.a | Points Validity | No Expiry |

| Annual Fee | S$192.60 (First Year Free) |

Min. Transfer |

5,000 DBS Points (10,000 miles) |

| Miles with Annual Fee |

10,000 | Transfer Partners |

•Singapore Airlines |

| FCY Fee | 3% (AMEX) 3.25% (Visa) |

Transfer Fee | S$26.75 |

| Local Earn | 1.2 mpd | Points Pool? | Yes |

| FCY Earn | 2.0 mpd | Lounge Access? | Yes (Visa) |

| Special Earn | 3 mpd on online flight and hotels, 6-10 mpd on Expedia, Agoda, Kaligo | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The DBS Altitude is a solid all-round option for a general spending card. Cardholders earn 1.2/2.0 mpd on local/foreign currency spending ,with a bonus rate of 3 mpd on online flight and hotel transactions.

The Visa version comes with two Priority Pass lounge visits, and points pool across various DBS cards.

For an extensive review of the DBS Altitude, including transfer partners and points calculations, have a read of the article below:

Conclusion

DBS continues to maintain the same offers for the Altitude cards until the end of Q3 2020 at least, although it’s also started to roll out some non-miles offers in recognition of the fact that people can’t fly right now.

This is about as good as any DBS Altitude sign-up offer we’ve seen in the past year, so it’s definitely one to consider if you’re looking for a general spending card.

Is Cardup transaction consider part of qualifying spend?