The Milelion is running a new series that aims to profile every credit card available in Singapore. Each week we will cover a different bank. The appendix below will be updated weekly with hyperlinks as more banks are added, allowing you to navigate between weeks seamlessly

Week 1- OCBC

Week 2- DBS

Week 3- UOB

Week 4- Citibank

Week 5- ANZ

Week 6- American Express

Week 7- HSBC

Week 8- Standard Chartered

I’ve been extremely negligent with keeping this Omnibus up to date, but a lot of people have requested that it resume. So let’s see how far I get this time round with AMEX!

American Express offers 11 different card products in Singapore. It’s a strange hodgepodge of offerings-

- The Platinum Series of AMEX cards, which are upmarket offering targeted at high income earners

- The Cobranded Series of AMEX cards, which I’ve covered extensively elsewhere so won’t go over again (spoiler alert: they’re bad)

- The Miscellaneous Series of AMEX cards, which they offer to anyone they can pull aside in the concourse of a shopping mall

Where miles and points are concerned, your AMEX cards either earn Krisflyer miles directly (if they’re the cobranded series) or Membership Rewards points otherwise (if they’re Platinum or Miscellaneous)

AMEX Membership Rewards isn’t in and of itself a bad program. They have a good suite of partners for airlines, for example. MR points transfer at a rate of 1 MR= 0.56 miles to

- Singapore Airlines

- British Airways

- China Airlines

- Malaysia Airlines

- Thai Airways

- Cathay Pacific

- Emirates

That’s a decent selection of partners, and probably second only to Citibank in Singapore for options.

AMEX does not charge a fee to convert your MR points into miles. Instead, they charge you an upfront annual fee for this. In a way it i similar to DBS’s program where you pay a flat fee for unlimited conversions throughout the year-

Enrolment into the Membership Rewards Programme is required for points to be awarded. You may choose to enrol in one of the following two options:

-

Non-Frequent Traveller Option (S$10): Earn Membership Rewards points towards redeeming dining and shopping rewards

-

Frequent Traveller Option (S$40): Earn Membership Rewards points towards redeeming dining & shopping rewards, flights and hotel stays

The issue with Membership Rewards isn’t the options but the earning. Let’s look at what they have

American Express Personal Card

- Annual Fee: $120 (no first year waiver)

- Income Req: $30,000 (Singaporeans & PRs), $60,000 (Expats)

- Marketing Spiel: 5 MR points per $1.60 spent at Starbucks. Kino, Amazon, Jasons and EpiCentre. And OMG the card is classic and green!!11one!

- The catch: It’s a crap card

AMEX relaunched its classic card in 2015 to much fanfare. I’m not sure why.

Here’s the special feature on offer- Earn 5 Membership Rewards points for every S$1.60 spent at these merchants:

- Starbucks

- Jasons Market Place

- Kinokuniya

- Amazon

- EpiCentre

Note: AMEX seems to peg its rewards earning to S$1.60 of spending. I am convinced that AMEX came into Singapore wanting to offer the same earning rate in the USA of 1 USD= 1 MR point, and at the time 1 USD= 1.60 SGD. The rate has stuck for some reason, despite the exchange rate changing.

The equivalent earn rate for spend at these merchants is S$1= 1.7 miles. Which is not too shabby, but I wonder how often you’re going to put down major spend at Starbucks, Jasons, Kino, Amazon or EpiCentre. In any case, there already exist better cards to use for Amazon (DBS Woman’s World/Citibank Rewards).

Regular spending earns 2 MR for S$1.60 spend, or S$1= 0.7 miles. This rate is easily surpassed by other minimum income credit cards on the market like the DBS Altitude.

And that’s it. Nothing else. It is very telling that the biggest selling point AMEX can make for this card is the nostalgia angle.

I feel sorry for anyone who applies for this.

Yay or Nay: Nay. If you want nostalgia go get some national flag erasers.

American Express True Cashback Card

- Annual Fee: $171.20 (first year fee waiver)

- Income Req: $30,000 (Singaporeans & PRs), $60,000 (Expats)

- Marketing Spiel: 1.5% cashback on everything, no caps or minimum spend

- The catch: Earning back your annual fee in the second year requires ~$11,000 of spend, just to be in a breakeven position

With any cashback card, it’s all about the annual fee. Once the first year fee waiver is passed, are you sure you can get at least the annual fee worth in cashback?

Let’s break this down into first year/second year spend. In the first year you get 3% cashback on a total of $5,000 spend over the first 6 months, or$150.

That’s poor value for money. Even if we make the big stretch assumption that all this $5,000 spending was on categories that are otherwise non-bonus for the purposes of miles earning (ie not online, not department stores, not F&B, not ait rickets), a general spend miles earning card would have netted you 7,000 miles for the same spend, worth between $140-$420 depending on what cabin you redeem them for.

In the second year, you’d need to spend an eye-watering $11,413 on this card just to break even on the annual fee. Therein lies the problem with cashback cards- you always start the second year in a net loss position.

Yes, your miles card may not waive your annual fee in the second year but if they don’t waive you get miles in return. So from one point of view, you’re no better or worse off. Suppose I need to pay the annual fee on my DBS Altitude Visa card of $192.60- I get 10,000 miles in return. And then suppose I don’t- I’ve earned whatever miles I’ve earned that year, plus no out of pocket costs for the annual fee.

A cashback card puts the onus on me to earn back my annual fee, and if I do not, I am worse off than when I started the year! This isn’t a criticism of the AMEX True Cashback card by the way, it is equally applicable to all cashback cards.

Yay or nay: Forget it.

American Express Gold Card

- Annual Fee: $180 (no first year fee waiver)

- Income Req: $55,000 (Singaporeans & PRs), $60,000 (Expats)

- Marketing Spiel: It’s gold! Look, it’s gold!

- The catch: It doesn’t actually do anything

I’ve gone over the website for the past hour trying to find some special perk of this card. After all, at a $180 annual price point and $55,000 income requirement, surely there’s got to be something good about it?

The most compelling thing I found was this

The American Express® Charter Membership is a very special designation reserved for our most valued American Express Gold Card members. Charter Membership is our way of saying thank you for your continued support. The American Express Gold Charter Card offers a collection of exclusive privileges designed to let you make the most of your lifestyle.

Charter Customer Assist

Exclusively for Gold Charter Members, our dedicated Charter Customer Assist team stands ready to assist you with any request. Whether it’s a bouquet of flowers for your loved ones, a game of golf at the nearest golf course, restaurant reservations or tickets to upcoming theatre shows, concerts, and sporting events; we are only a phone call away to help you with enquiries and bookings within the Asia Pacific region. You’ll even be able to obtain travel assistance during office hours.

Extended Warranty

We will double the original manufacturer’s warranty when you make a purchase on your American Express Gold Charter Card in Singapore – giving you up to an additional 24 months of protection and a maximum warranty period of 48 months. Quite simply, you enjoy more protection for your purchases with your American Express Gold Charter Card.

So you get a concierge service, which almost every mid-range card now has, and the option of an additional 24 months warranty when you buy appliances on this card at $1=0.7 miles ($1.60=2MR)

And that’s it. No bonus spend places. No lounge access. No limo service. You get a gold-colored piece of plastic and a feeling that you now have a credit card that would have been really cool in the 1980s.

Yay or nay: Not unless you like everything in gold.

American Express Rewards Card

- Annual Fee: $53.50

- Income Req: $30,000 (Singaporeans & PRs), $60,000 (Expats)

- Marketing Spiel: 24,000 MR bonus points after $1,500 spend in first 3 months

- The catch: No compelling reason to retain it after first 3 months

This is one AMEX card I can recommend, due to the generous sign up bonus on offer. The deal is simple- spend S$1,500 in the first 3 months of membership and 24,000 MR points (13,333 miles) are yours.

EDIT: As YC points out in the comments below, you are technically redeeming 23,850 points because of the 450 block redemption restriction. You’ll also pay a $20 conversion fee because the AMEX rewards card doesn’t have the frequent traveler/ non-frequent traveler options.

As for using the card after the bonus, I really don’t recommend it. The regular earning rate is 1 MR for S$1, or S$1= 0.56 miles. There is a 100% points bonus on spend in the first 3 months (S$1=1.1 miles), and you can earn 50% more MR points (S$1=0.83 miles) at your choice of 5 places in Singapore, but this is capped on S$5,000 spend

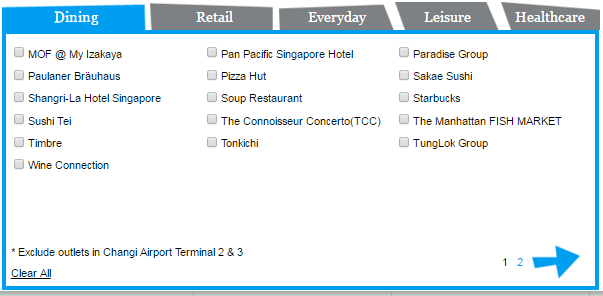

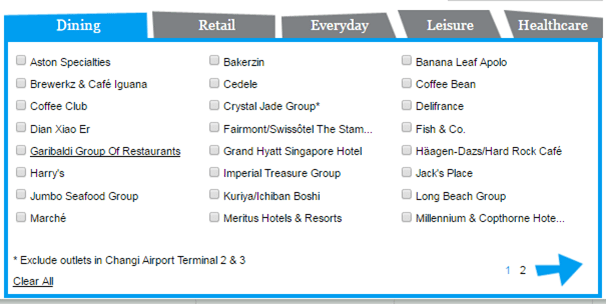

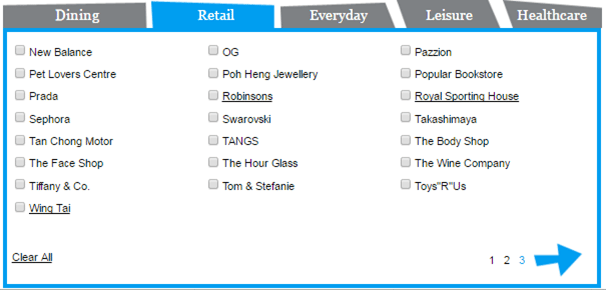

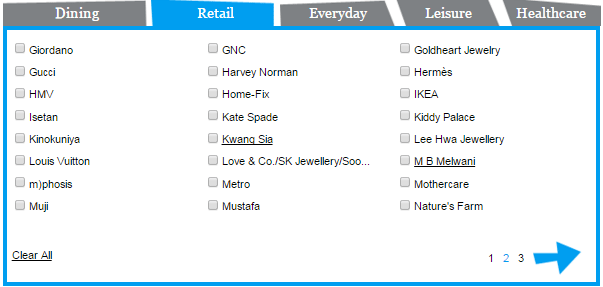

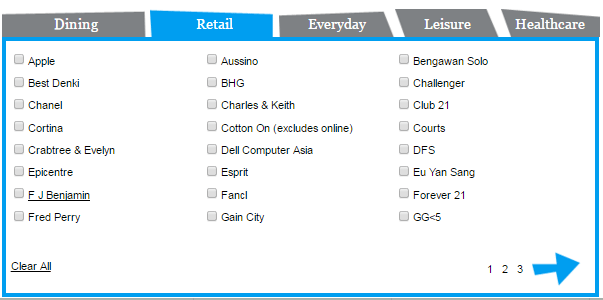

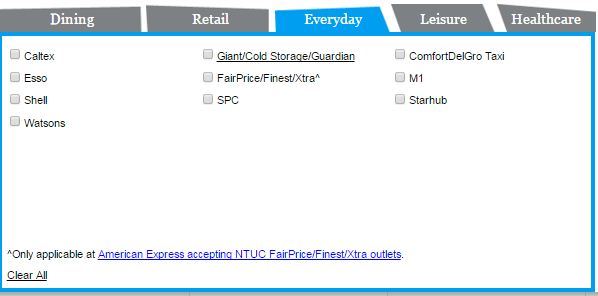

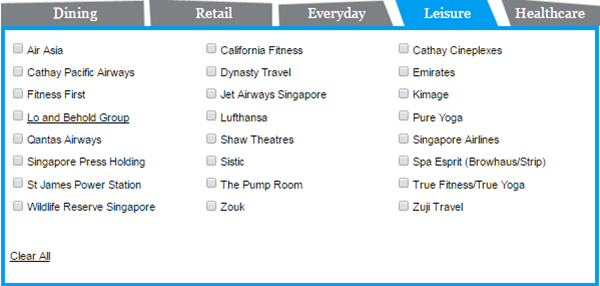

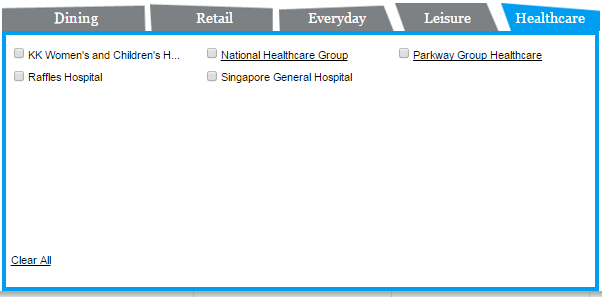

What are these 5 places? The list is surprisingly long. You have-

Dining

Retail

Everyday

Leisure

Healthcare

The list is long, but remember at the end of the day we are talking about $1=0.83 miles. That’s still way below the DBS Altitude rate.

AMEX Platinum Series

Ah, the Platinum card series. The nomenclature here is a bit confusing because the entry-level Platinum Credit Card and the invitation-only Platinum Card have basically the same name. It’s not difficult to tell them apart if you see them though…

The differences among the 3 cards are summarized below-

| American Express Platinum Credit Card | American Express Platinum Reserve Card | American Express Platinum Card | |

| Income Req. | $50,000 (locals) $60,000 (expats) | $150,000 (locals & expats) | Invitation only |

| Annual Fee. | $321 (first year waiver available) | $535 | $1700+ |

| Points Earning | $1= 0.7 miles ($1.60=2 MR)

$1=3.5 miles at selected Platinum XTRA partners |

Same as Platinum Credit Card |

$1=0.8 miles (As per Lois on the comments there is a special earning rate for the Platinum Card) |

| Perks | Palate Dining Privileges

FAR Card Platinum Golf, Platinum Wellness and Platinum Lifestyle program Boingo Free Wifi Program |

Same as Platinum Credit Card +

Sign up bonus of 27,777 miles with $5,000 spend in first 6 months Tower Club Access Staycation Vouchers 1x Complimentary night with Capri by Fraser (Platinum Reserve only) |

Same as Platinum Reserve Card +

Priority Pass Program Delta SkyClub Access AMEX Centurion Lounges (mainly in the States, see here for an example) Gold Status with SPG Gold Elite Status with Carlson Rezidor Golden Circle Jade Status with Shangri-La Fine Hotels & Resorts Program (Extra benefits when booking through AMEX eg hotel credit) Invitation-only events |

I’m sure there are other things to consider when assessing these cards but since you’re reading this I assume you care about the miles. And the basic miles earning rate is just flat out terrible, considering that you can get a UOB PRVI Miles card and earn twice that on local spend and more than 3 times that on overseas.

But what about the Platinum XTRA partners? Feel free to have a look here, but none of them strike me as the type of place that you’ll regularly drop heavy spend. There’s a mismash of high end restaurants, fashion, watches and electronics, but the only one that I could envision someone spending regularly at is Harvey Norman (of course, YMMV).

I do think the ancillary benefits with the highest-tier Platinum are somewhat attractive.

- The Centurion Lounges (full list here) look really nice (although you can access them with any AMEX card for a $50 fee)

- The Fine Hotels & Resorts program gives you additional benefits when you book through them like noon check in, 4pm checkout, room upgrades, daily breakfast for 2, complimentary wifi and a unique property amenity (usually a US$100 credit). Stays booked through FHR also qualify for elite stay credit and points

On the other hand

- You can get SPG Gold status with just a single stay at any Asia-Pacific SPG property with a World Mastercard)

- Delta SkyClubs aren’t a place you want to spend an extended period of time

- You could get some additional benefits at hotels by booking through the Visa Luxury Hotel collection (I think FHR is definitely better on the whole but still)

I’m aware that AMEX will organize some special invite-only events for their top-tier members, and who knows- perhaps these events make the cost of the annual fee worth it to some people. But you know I’m all about the miles, so there’s no way I’m going to get one of these anytime soon

Yay or nay: I suppose if you wanted to max out the AMEX Reserve sign up promotion (AND were offered a first year annual fee waiver) there might be some merit, but otherwise these cards aren’t designed for miles earning

AMEX SQ Cobranded Cards

Sigh.

For the Platinum Card (the low end one is actually the Platinum *Credit* Card), there is a different (better) mile conversion rate. Basic earn rate is about 0.78miles per dollar. Can take a look at http://forums.hardwarezone.com.sg/credit-cards-line-credit-facilities-243/amex-platinum-charge-card-1716728-122.html for a bit more info.

Additionally, for the Platinum Card, it earns 10+10x points at the selected merchants (about 7.8 miles per dollar) instead of just 10x.

Current annual fee is $1700+. There ARE a lot of perks associated with it, but for the average person, actual utilised benefits is unlikely to outweigh the cost.

thanks louis! will update. my understanding is that the 10X merchants are very limited though

follow up question- isn’t the earn rate closer to 0.70? $1.60= 2MR= 1.11 miles. therefore $1= 0.69=0.7 miles approx. am i missing something?

edit: and is it my imagination or does AMEX no longer have 20X merchants? it seems on the site they only talk about 10X merchants where you earn $1.60=10 membership rewards points.

Short version – for the Platinum card specifically, MR conversion to miles is done at a better rate (think it’s 1.6 MR to 1 mile). So $1 = 1.25MR = 0.78miles. Longer version – once upon a time all three cards used the 1.6MR = 1 mile rate. Sometime in (2014? I forget) there was a devaluation for the lower tier cards, but this didn’t affect the highest tier one. Since the card is invite-only it’s hard to find info in the public domain. I used to hold the card before they raised the annual fee (there was a pretty… Read more »

thanks! have updated. 0.8 miles is still pretty crappy but i’d rather be right anyway. my dad used to have this back in the day but that must have been more than 10 years ago. he said they’d never waive the annual fee and he felt it wasn’t great value so dumped it.

Lol national flag erasers…that’s true nolstagia

For the AMEX rewards card, it seems you can only redeem in 450 mile chunks, so 23,850 points. There is also a $20 redemption fee, according to the AMEX representative.

yup you’re right. that’s because for the AMEX rewards card the frequent traveller/non frequent traveller option doesnt apply, so you pay the fee every time you redeem. i’ll update that to be clear

FWIW, “The American Express® Singapore Airlines KrisFlyer Credit Card ” (blue one) has this promo:

Receive 3,000 KrisFlyer miles when you spend S$700 in the first 6 months upon Card approval

Methinks spending 700$ to get ~8500 miles is not a bad idea, so you might want to charge more than $1 on this card on signup. I also like the fact that you have 6 months to meet the spend

no that’s a fair point. i’ll add it to the article as an idea.

Hi, I was aghast when I read your article as I’ve been holding an Amex Krisflyer Gold Card for over a decade! I thought that the 50%+50% promotion was not bad though- I’d get 40,000 miles on those every year, making a total of over 140,000 miles a year for the last three years on about $100k spend. I thought the annual fee waiver, direct crediting of miles, plus tier bonuses on SQ and MI flights were good too… But are you saying that even with all these, it’s still a terrible deal?

to put things in perspective, had you used the uob prvi miles you’d have got 140,000 miles just on the 100k spend already, without any special promotions. i assume some of that 100k spend was foreign currency- in which case you’d have earned 2.4 miles with the prvi. i assume some of that was online- in which case you’d have earned 4 miles per $1 with the dbs woman’s word card. i assume some was F&B- in which case UOB PPAmex 4 miles too. even with all the things you mentioned the krisflyer gold was a terrible, terrible card because… Read more »

Hi Aaron, you are absolutely right. Maybe good back then as a first time sign-up, but definitely time to move on. Thanks again for the great articles!

Look forward to this Omnibus guide reaching the Standard Chartered series!

getting there, getting there! a lot of trip reports to clear…

Just to add on by saying that I was told by the CSO on the phone the $535 for the Platinum Reserve card is not waivable. Therefore, it is a hefty $535 to get 27,750 points, which translates into 1.9 cents per mile (if you treat it as buying miles) and this has not factored in the fact that you need to spend $5,000 to get it (5.55 miles per dollar if you dont count the fact that you still need to pay $535). Does not seem to be so good. The most bang for the buck appears to be… Read more »

How is that 1.9 cents per mile? Are you confusing points with miles?

I guess you are right. It’s actually 50k points = 28k miles which implies 1.9 cents per mile.

I just got my Ascend renewal fee waived.

more details pls? how much did you spend, did you get the vouchers stil?

Spent just the 10k in first 3 months (including topping up the imagine card) to get the 35k sign on bonus (had to pay first year annual fee for that) apart from the usual 5k free bonus. Nothing spent in the last 9 months. Got the second year fee waived yesterday. No vouchers given. They said I can get them only if I pay annual fee. Also got my rewards card upgraded to platinum credit card for free. Nothing spent on the rewards card apart from 1.5k for the sign on bonus. Asked about the platinum reserve card – no… Read more »

I used to hold both Platinum card and Ascend card, and the annual fee for Ascend is automatically waived, CSO said that as long as i still pay 1600+7% for my platinum, there’s no 2nd annual fee charged…

anyways i canceled Ascend coz not really using it. But felt bad as i could have used the staycation voucher. lol.

Could you please share what was your spend like to get the Platinum card since its invite only? Or is it possible to request through CSO?

Also could you please share what were those “special invite only events” and maybe the few perks of the card that you feel the $1700 annual fee is worth it? Thank you so much!

I cannot really remember my spending pattern as it was a few years back… But recently I introduced a colleague to the card and the CSO only cared if he’s willing to pay the hefty annual fee. So no harm give a try and mention you know the fee and happy to pay for it… Special invite only events include those expensive ones like vip in wimbledon or kitchen tour in Noma restaurant, I’ve seen cost from 2k+ to 8k+, but never attended any. Other events including free whiskey tasting, free Shakespeare plays, free food and drinks event, etc. Some… Read more »

Hi Tanya thanks for the detailed reply! Any reason you gave up the Platinum card? and then also the Ascend card. Have you abandon AMEX completely? haha

No i still hold the platinum card. No plan to give up until the job doesn’t require both hubby and me to fly any more. lol.

The main reason for me to apply the Premium Reserve Card is for the Palate Dining Privileges and the sign up bonus. I use the card quite often when I visit those restaurants listed and enjoy at least 50% discount. I guess the money I saved has more than outweighed the annual fee i paid.

BTW, Can we really get the annual fee waived by request?

I mean “Platinum Reserve”

If you’re going for the Palate Dining as the main reason, you could consider the Platinum Credit Card instead – first year fee waiver.

Agree with Peter – the standard credit card has the same Palate benefits (and vouchers) and has a lower annual fee. Easier to get a waiver, too (YMMV).

i thought you can’t get amex annual fees waived for platinum cards but people are telling me i’m wrong. I’d defer to their thoughts on this given that i’ve never owned an amex platinum. i suppose if you visit the palate dining restaurants a lot, and i really mean a lot, you might come out on top.

the amex cards aren’t for miles earning. In fact it seems like they are more of a “prestige” thing. The dining discounts you get with amex is actually quite good, 50% for 2, 35% for 3, 2% for 4. Their restaurant list is growing quite big, with some being even recent michelan star restaurants and many 5 star hotel restaurants. I think the regular platinum credit card is well worth it for dining purposes. You dont need to be dining out every night to make value of this card. Its a perk card/luxary card rather than a miles collecting card… Read more »

Could anyone confirm whether they changed the conditions to $500 a month for the first 3 months? I’m sure when I signed up it was simply $1500 in first 3 months but I haven’t received the 24,000 point sign-up bonus and their site now says $500 a month.

Thanks

Sorry, forgot to state: on their AMEX Rewards Card

sorry i can’t be more helpful here but the best thing is just to cal them up and ask. when I signed up it was $1,500 in 3 months, with no min $500 per month. the points took 2 weeks to post if that’s helpful

Hi Aaron, do you plan to cover Maybank’s credit card series?

I am particularly looking at the Family and Friends Mastercard (which is now a World Mastercard).

It will be great if you can cover Maybank as well if you have the time.

Enjoying your articles alot!

eventually, yes! The omnibus is a heck of a lot of work but if you’ll find that useful I’ll add it to the list. Got a backlog now though, no guarantees when it will come out

I guess the Platinum Reserve card was supposed to compete against Citi prestige / the Visa infinite cards. Similar annual fee and miles / points sign on offer. But loses out badly due to the minimum spending requirement, low earn rate and zero lounge benefits.

Wont be surprised if this card is scrapped.

Amex krisflyer card has a promo now. 10,000 miles for 1st charge.

Just to clarify for ppl interested with the Rewards Card, the first three months 100% bonus points and the Favorite 5 merchants 50% bonus points do NOT stack.

So if both bonuses apply, the effective miles earned is 1.375 miles per dollar