In the spirit of Christmas, here is the Milelion’s wishlist for all things miles and points related in 2016.

This list is hugely ambitious- and I’m under no impression that any of the things I’ve listed here will happen anytime soon. But hey, we can dream can’t we?

Are my wishes unrealistic? Pipe dreams? Let me know!

Wish 1: For banks to provide an itemized statement of points awarded per transaction

From a technical standpoint, there is no doubt in my mind that Banks can already do this. All it takes is to add an additional column to your already itemized monthly bill. Merchant, transaction amount and points awarded. What could be simpler?

Everything, apparently. Despite numerous requests by consumers, banks are reluctant to divulge the points awarded per transaction. The SOP is that customers have to call in and go through items line by line with the CSO.

From one point of view, this makes no sense- banks try to limit how many enquiries have to go through their CSOs because operating a call centre isn’t cheap. If people could log into their i-banking and get all this info, they’d save quite a bit. But from another point of view ,this makes perfect sense. Lack of transparency only ever benefits the banks. They’re hoping that not enough people have the motivation or time to check their statements line by line.

Why is checking points per transactions essential? Because of bonus categories. Citibank promises that you get 4 miles per $1 spent at shops whose primary line of business is “selling shoes, clothes or bags”. That’s great, but who specifically is that? UOB promises that you get 4 miles per $1 spent on dining, but does that include combination supermarkets and restaurants (eg Jones the Grocer- which doesn’t count btw), does it include gastropubs which are drinking holes first and restaurants second, does it include catering companies?

Which brings me to my next request, which might actually remove the need for Wish 1…

Wish 2: For an app that lets you check MCCs before you buy something

There is no reason why a particular shop’s MCC is privileged information. Why then are we playing what amounts to Russian Roulette with big ticket items? If you read HWZ, there are people frantically trying to confirm things like

- Will spending at Restaurant X code as hotel spend (which doesn’t earn bonus points) or restaurant (which does)

- Will buying something at Site Y code as online spend (which earns bonus points) or not?

All this hinges on the MCC.

The idea is that people have a big, likely one time spend they are going to put on their card. They’re debating whether they should risk putting in on their category spend card or play it safe and put it on their general spend card.

Why take a risk? Because of the nature of category spend cards- they’re high risk high reward. UOB Preferred Platinum AMEX gives you 4 miles per $1 on dining, but if your restaurant turns out to not be a restaurant from UOB’s point of view, too bad. 0.8 miles per $1. So if I had a $1,000 banquet spend for CNY, I could potentially get as many as 4,000 miles or as little as 400 miles. Whereas if I use a general spending card (eg UOB PRVI), I’d get 1,400 miles regardless.

How hard is it for Banks to create a portal/app that lets you enter the name of the merchant and see their MCC? Wouldn’t that work to their advantage? Suppose I’m wondering whether my purchases at the Premium Outlets in Johor will count as a bonus category for my Citibank Rewards card. If I don’t know this for sure, I might end up using my UOB PRVI, which represents lost swipe fees for Citibank.

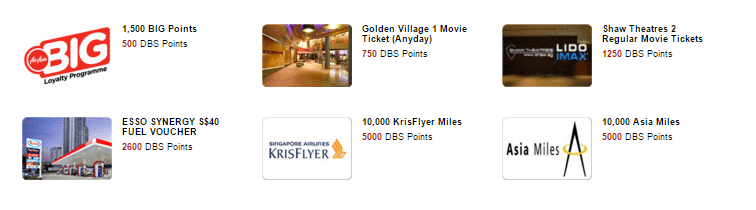

Wish 3: For DBS and UOB to introduce more Airline and Hotel partners

If you’re looking to transfer points from UOB/DBS to mileage programs, you’re pretty much stuck with SQ or CX. Citibank has a few more partners (EVA and Etihad, for example), but by and large if you’re sticking to the local banks you’re stuck with SQ or CX.

I’d love it if UOB and DBS would add on additional partners (EVA, Emirates, Ethiad, Starwood etc) for conversion of points. Adding partners isn’t difficult for Banks. The fact that American Express can partner with a wide range of transfer partners (albeit at shitty conversion rates) means that these guys are open to tie-ups.

How difficult is it, administratively, to offer more options to customers?

Wish 4: For banks to introduce credit cards without foreign transaction fees

This isn’t as outlandish as it sounds. In the US, you can find many credit cards that come without foreign transaction fees (eg Chase Sapphire Preferred, Capital One Venture etc). The only “fee” you pay is via the Bank’s conversion of the foreign currency into your local payment currency.

In Singapore, you get hit twice- once on the conversion of the foreign currency to SGD, then again on the surcharge levied (3-4%). If you buy something in a non-USD currency you actually get hit 3 times! They will first convert the non-USD currency to USD, then to SGD.

There is a huge market opportunity for a Singapore bank to introduce and market a no foreign transaction fee card. Why not take it? You could even scale down the rewards for overseas spending and people would still be happy to take it up. As it is, it is very expensive to buy big-ticket items from overseas (3-4% might not sound like a lot but on a big base it can be painful) using a credit card.

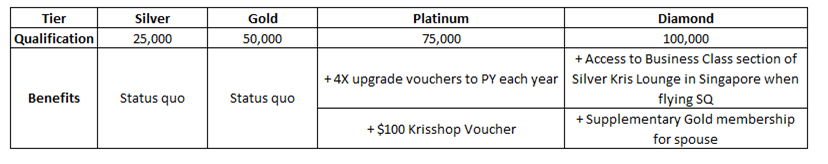

Wish 5: For Singapore Airlines to introduce more tiers within Krisflyer

Krisflyer currently has 2 tiers for non-premium cabin travellers. Travel 25K miles per year, and you’re an Elite Silver. Travel 50K miles per year and you’re an Elite Gold.

KF Elite Gold is, well, alright in terms of benefits. You get lounge access, priority baggage, extra baggage, priority boarding.

But what is the incentive to continue flying with SQ after you’re hit the 50K mark and requalified for Gold? As someone who has flown ~100K miles with SQ this year (all in economy, and believe me, I have felt those miles), I wish there’d be some additional recognition for my loyalty (not that I had a choice, but still!)

United Airlines has several tiers for their FFP program. SQ could do something simliar- a further tiered KF Elite program might look like this (if the SQ public affairs department is reading this, feel free to steal my ideas and brand them as your own. Really. Just get it done)

Does this take away value from the PPS program? Yes and no- PPS members get renewal gifts, guaranteed reservations in Economy when booking Business and more pull when trying to get the Awards department to open up saver space. But there are some small gestures here that would not go amiss for those of us flying at the back of the plane.

Again, I know this will not happen. The bean counters at SQ would freak at the idea of having to give away anything more. But it’s Christmas!

Wish 6: For online booking to be made possible for Krisflyer partner awards

Look, I know why they don’t do this. All things equal, it is cheaper from SQ’s point of view that you spend your KF miles on SQ tickets than on Star Alliance partners (because of reimbursement issues)

But it seems mean spirited of SQ to go out of their way to make this difficult to do. As if their poor value award chart (with some exceptions) wasn’t a deterrent enough, you have to call up a CSO and take their word for whether availability is there or not (think I’m paranoid? If you believe the interweb, United’s call centre agents are trained to tell people certain partner airline award space is not available when it really is)

If a company with shitty IT like Avianca can at least get an online booking portal working for partner airlines, why can’t SQ?

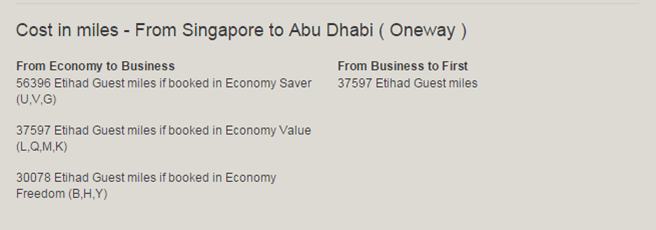

Wish 7: For all SQ Economy tickets to be upgradable, not just full fare

Hear me out on this- right now SQ’s policy is that only economy tickets purchased in the Flexi category are upgradable to business class (and even then, still subject to a miserly pool of availability)

Why can’t SQ allow those who buy Flexi Saver, Smart Deals or Super Deals tickets to upgrade too? The catch of course is that they’ll have to spend more in terms of miles. I don’t see how that’s a bad thing to SQ- internally they have their own metric that values how much those miles cost to them in terms of a balance sheet liability, so if they simply charged more miles, wouldn’t that leave them indifferent?

It’s like what happens with Etihad- see how the number of miles needed to upgrade scales with the original ticket class you bought-

Is SQ so protective of their premium cabins that you can only upgrade to them if you pay full fare? Is the type of person who buys a superdeals ticket a bit less savory than someone paying full fare? Come on.

Wish 8: For a proper functioning SQ site that, you know, lets you do useful stuff

And also, world peace!

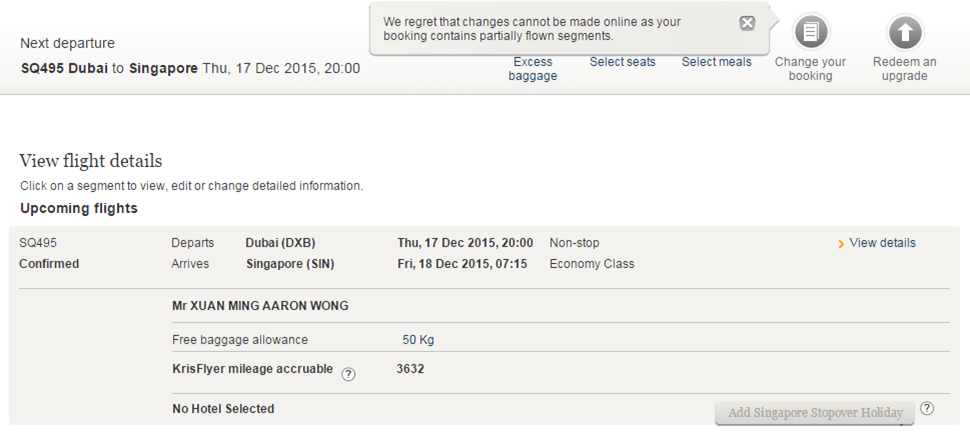

SQ’s site is a joke, but it’s an old joke that has been told so many times that everyone cringes when it’s told again. It is 2015 and it is still not possible to, via the SQ site

- Change the date of the return leg of a ticket online after the first leg has been flown

- Upgrade the return leg of a ticket online after the first leg has been flown

- Waitlist for an award upgrade via the website (waitlisting is only available for full redemptions, not upgrades)

- Waitlist for revenue flights which are sold out

Other airlines let you do this. Why can’t SQ? What is so unique about SQ’s IT infrastructure that, in 2015, we have to call up their call centre to do these basic things?

Wish 9: For GlobalEntry for Singapore passport holders

So for those of you who travel to the States, what you will notice is that there are 2 queues. There is the Global Entry queue which is short, painless and automated (think the same thing as the e-gates we have at Changi Airport). There is the regular queue which is long and you’re subject to an unfriendly (and they are always unfriendly) CBP officer who looks at you with fear and loathing

At one point in time, this was on the books.

From 2011

Singapore and the United States are working on a Trusted Travel plan, whereby eligible citizens can clear immigration and Customs faster using automated kiosks in the near future in both countries.

Singapore Prime Minister Lee Hsien Loong and US President Barack Obama have instructed their respective officials to “work closely and expeditiously to achieve this goal”, according to a White House press statement last Saturday.

Yet as of today, nothing has happened. Come on guys, get it done! South Korea, Germany, the Netherlands, and Panama already enjoy Global Entry, why not Singapore?

What are your dreams for 2016?

cover photo by davejohnson

Good wish-list! If you have APEC card, you can use the global entry to avoid long non-US citizen queue, but only with the ones with staff. I just got into Guam but because no one was at the global entry counter, the US immigration staff interrogated me as if I was a potential terrorist!

ah yes apec card! forgot to mention that one. I have it but my experiences have been mixed using it in the States. To be fair it was just after the APEC tie up with the US, but I thought they’d brief their staff properly. The officer refused to believe that APEC card holders could use the special queue and accused me of trying to cut. Now they have proper signage with APEC on it at the airport so i think that issue wont happen anymore.

[…] year’s not even out and already 1 of my Christmas wishes has been […]

This wish list is SPOT ON. With great emphasis on wishes 1 to 3! And more bonuses on new cards (and new cards), please? Or at least a card that ties up with a hotel.

oh yes- co-branded cards for something other than krisflyer. unfortunately, highly unlikely. it’s my dream there’ll be an SPG card here but the market is just too small to support it