Thanks to Ms Solitaire who tipped me off about this on 2nd August, and apologies that I could only cover it 2 weeks later.

Although this does not fall within the realm of credit card deals (ok well it sort of does), it’s free money and I’m not above taking it.

Standard Chartered is running a promotion for their Bonus$aver account. From now till the end of August, if you

(1) Open a Bonus$aver current/chequing account with S$50,000 in fresh funds

(2) Apply for a Bonus$aver World Mastercard

(3) Keep said S$50,000 in funds in the Bonus$aver account until the end of the calendar month after the month you opened your Bonus$aver Account

You get S$188 cashback in your Bonus$aver World Mastercard (there’s also an option to deposit S$10,000 in fresh funds to get S$88 cashback).

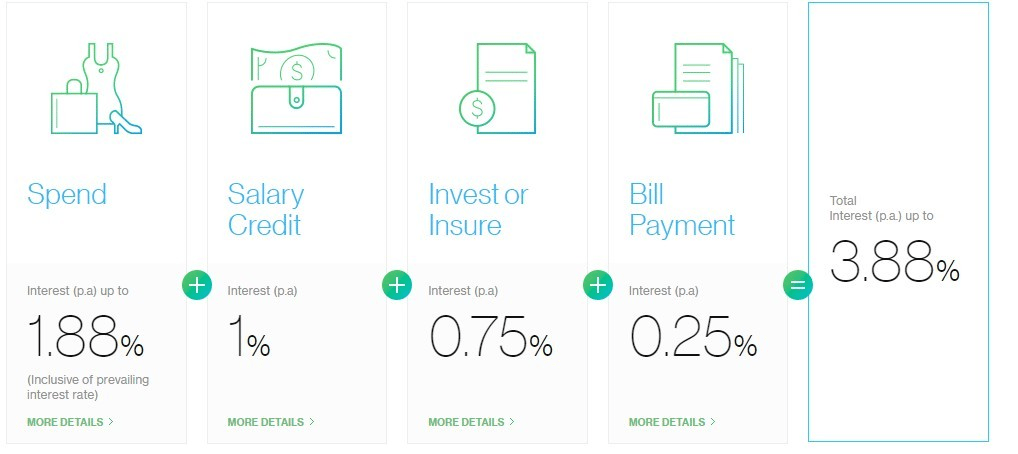

Bonus$aver must be SCB’s answer to the OCBC 360 account. They’ve got a tiered earning system where you can earn up to 3.88% p.a interest on your first S$100,000 of deposits with them, contingent on you carrying out a certain set of activities. This is not my area of specialty and I’m not familiar with what else is on the market so I’d encourage you to do your own research, but 3.88% sounds pretty sweet.

Here’s the breakdown of the bonus interest

- Earn up to 1.78% p.a. for spending at least S$2,000 in eligible transactions on your Bonus$aver Credit or Debit Card, or earn up to 0.78% p.a. for spending at least S$500 in eligible transactions on your Bonus$aver Credit or Debit Card and/or

- Earn 1% p.a. for crediting your salary of at least S$3,000 through your employer via giro and/or

- Earn 0.75% p.a. for 12 months when you purchase a new eligible unit trust investment or regular premium insurance product from SCB and/or

- Earn 0.25% p.a. for paying any 3 unique bills online or through GIRO

Unfortunately my salary does not credit as SAL (it’s MEPS for some reason) and I don’t intend to put any spending on the Bonus$aver card, so there goes 2.88% interest already. But I’m still going to jump on this for the S$188 (full T&C here, I can’t find anything that makes me unduly nervous)

Where the credit card is concerned, the only benefit I am aware of for the Bonus$aver World Mastercard is that it’s a World Mastercard and means you’re eligible for the SPG stay 1 night to Gold promotion.

I’m going to assume it’s this rather fetching 2-in-1 card and token, which is a very nifty idea I admit, even though it doesn’t earn you any points at all. Note that the credit card is free for the first 2 years, after which an annual fee of S$214 (!) applies. Well, you know what to do when that day comes…

Merits of the card aside, S$188 is S$188, and gift horse look mouth don’t.

Branch Gifts

If you sign up at a branch instead of online, you may win one of the following gifts. However, this is limited to the first 500 customers who sign up and I imagine they would all have been redeemed already. Doesn’t hurt to try your luck though.

| S/N | Gift Type | Number of Gifts |

| 1 | Canon EOS 1200D Kit (EFS18-55 IS II) | 20 |

| 2 | CP910 Selphy Photo Printer | 60 |

| 3 | Samsung Galaxy Tab 3 | 270 |

| 4 | American Tourister Paralite SP66 | 10 |

| 5 | Customised Blended Tea (3 types of flavours) | 40 |

| 6 | S$28 NETS Flashpay | 20 |

| 7 | $20 NTUC Voucher | 80 |

I’m not sure why they’re incentivizing you to sign up at the branches instead of online given the lower processing costs of an online application; I can only surmise this to be an opportunity to sell you more stuff in person.

TL;DR, this is valid till 31 August, and I’m going down during lunchtime to apply.

EDIT: Adam on the comments pointed out 2 other things worth taking note. If you close the account within 6 months, you pay S$30, and if your daily average balance falls below S$3,000, you pay S$5 fall below fee.

I would guess to note the early account closure fee ($30 within 6 mths) and fall below fee ($5 if daily ave below $3k).

yeah, probably good to highlight this as well. have updated. thanks

Thanks for the shoutout, Aaron! 🙂

Fund the account with $50,000 until end of Sep. On 1 Oct, transfer $47,000 out (to other higher interest rate account) and keep the remaining $3k for another 5 months.

Do you know about the ICBC free $200 for getting two credit cards?

http://singapore.icbc.com.cn/ICBC/%E6%B5%B7%E5%A4%96%E5%88%86%E8%A1%8C/%E6%96%B0%E5%8A%A0%E5%9D%A1%E7%BD%91%E7%AB%99/en/CommercialBankBusiness/PersonalBanking/BankCard/ICBCUnionpayDualCurrencyCreditCard/

You need to get 6 cards in total, two for yourself 2 more (mum and dad) Then you get $200 credit free.

I’ve done it, even less hassle than this Stan Chart offer.

ooh lala. thanks for the heads up. will do that as well.

Any idea if fund transfer from other stand chart account (such as esaver) qualify for the $188 cashback?

it will not. the funds must be fresh.

Does this work if I already have a BonusSaver account? Or must I open a new one (in addition to the one I already have?)

i think it’s for new bonussaver customers only…

Does it work if i already have another accounts with them (super salary and e$saver) ?

yes this will work.

Hi Aaron,

so did you get any gift by coming directly to sign up in branch ?

Just signed up yesterday at the branch. Got a free Galaxy Tab and $28 flash pay. Wasn’t expecting it since they stated first 500 but not complaining… I guess it’s worth a try.

Shoutout to Milelion for the free $188 + $200 (hopefully my ICBC cards get activated soon)~

you got a galaxy tab? holy moley. no one has contacted me about my sign up gift. i’m annoyed. a phone call is in order

As soon as you fund the account, they’d call you to pick up the redemption letter from the branch (actually it was within the same day for me) Call ’em! And do share with us what mystery gift you got!

p.s. I just signed up for the ICBC cards too! Thanks for the tipoff!

Ms Solitaire is right. I was able to see the new account reflected on my iBanking by the time I got back to my desk (which is just upstairs).

Actually, the lady told me during account opening to come back after funding the account to get some exclusive gifts. So I went back the next morning and she handed me the redemption letters.

i emailed the guy who helped me set up my account and he said he’d send me the award redemption letter today. let’s see.

Haha do share what u get!

going to claim on mon. will update.

Did u also receive Galaxy Tab, Ms Solitaire ?

i’m really rockin’ my tea.

Correction, blended tea.

TWG tea set ?

some unknown brand. or at least unknown to me because i dont drink tea. oh well at least i’ve got 188 to spend…

Rio, yes Galaxy Tab. And it’s viewable somewhere on Carousell at the moment. 😛

Thank to Milelion and Ms Solitaire , i open the account last day on 31st Aug, fund 50 k immediately and surprisingly manage to get Galaxy Tab 3+ NFP 28$ and 188$ to spend later

rub it in, why don’t you.

How did you get two gifts? Did you open two accounts?

The tab was for the branch sign up, the NFP was for some national day promo. Lol in fact she threw in a water bottle and umbrella as well..

Wow lucky you!! Too bad I cannot enjoy as I already have BonusSaver

The promotion continue, now no more mysterious gift

for 10,000 deposit you get Plantronics headphone (worth $169)

for 50,000 you get Bose headphone (worth $569)

https://www.sc.com/sg/important-information/bonussaver-sign-up-gift/

wow these are good gifts. too bad I already have BonusSaver 🙁