Well, that escalated quickly.

When the Krisflyer UOB account was first announced, I, like many other people in the miles and points game, was very excited. The 5.4 mpd figures they were throwing about were head and shoulders above anything currently offered in Singapore. The idea of a bank account that let you earn miles was something new and potentially gamechanging- if they could get it right.

But then the full details came out, and that excitement turned to disappointment. If you wanted to earn that 5.4 mpd, you’d have to park at least $350,000 in a bank account earning no interest. Your miles earning would be capped at 5% of your bank account balance, meaning that once you spent beyond a certain amount, you’d earn 0.4 mpd instead of the headline 5.4. The trumpeted benefits with Scoot and Tigerair came with so many strings attached they might as well not be used. And to top it all off, the headline rates were promotional only, with no guarantee of renewal.

I doubt I was alone in my disappointment, because the post I wrote went on to blow up in a big way- 23K+ impressions on Facebook, which is something of a record for this site. To put it another way, the Krisflyer devaluation was huge, but that only bumped about 7.5K.

And it’s not just me. The laojiaos on HWZ (who know much more about all this than I do) are also cheesed off. Coverage on other sites like The ShutterWhale has similarly been negative.

I guess that’s made UOB sit up and take notice, because it’s come out to defend its product in a Business Times article published today. (I’m quoted in the article but was not contacted directly by the journalist) Unfortunately, the article is behind a paywall, but I’ve purchased a copy that I’ll share as soon as SPH emails it to me.

The sad thing about UOB’s response is that they’ve completely missed the point. The UOB Krisflyer account is supposed to be for those people who want to earn Krisflyer miles. If that’s the case, why is it so bad at what it’s supposed to be doing?

Let’s go through the points that UOB made one by one.

“While UOB did not dispute the calculations in the post, it said that the Krisflyer UOB account combines a debit card and current account to award air miles, designed for millennials and frequent flyers on the insight it has into their lifestyle, spending and savings choices.

“Our consumer insight tells us that this account, which has an accelerated earn-rate for Krisflyer miles, will be attractive to those who would rather have free flights instead of earning interest,” said a UOB Spokeswoman

Ah, millennials. That nebulously defined group of people about whom marketers seems to know so much. I’m a millennial, and I often wonder why every single article I read about me doesn’t seem to describe me at all.

UOB said at the launch of this product that “the account provides millennials in the early stages of their career who may not be eligible for a credit card to accumulate KrisFlyer miles”

If that is an important pillar of the value proposition, we need to examine it closely. First, what exactly is a millennial? I assume in this context they’re talking about a fresh grad, young professional who just entered the workforce. What would that person look like?

The median graduate from SMU/NUS/NTU would be drawing a salary of S$3,360 a month, as per this ST article. That’s well within credit card eligibility territory. Even if you were suay enough to pick the degree that has the lowest starting pay (SIT DigiPen Bachelor of Arts in Game Design – $2,490), after your annual bonus you will almost certainly be able to hit the magic $30K mark that opens up credit cards.

Suppose you’re a Poly grad- what then? You’d still be well within the income requirement needed for a credit card. Take a look at these MOM-published starting salaries for poly folks

A post-NS poly grad would pull ~S$2.3-2.5K per month, which after a 13th month bonus would still be enough to get a card.

Therefore I can’t understand the claim that this product is somehow opening up the miles earning world to “millennials”, if we define the word that way. Sure, a new graduate would not be able to get a UOB PRVI Miles card (S$80K min income), but as we shall see in the next section there are many other good options available.

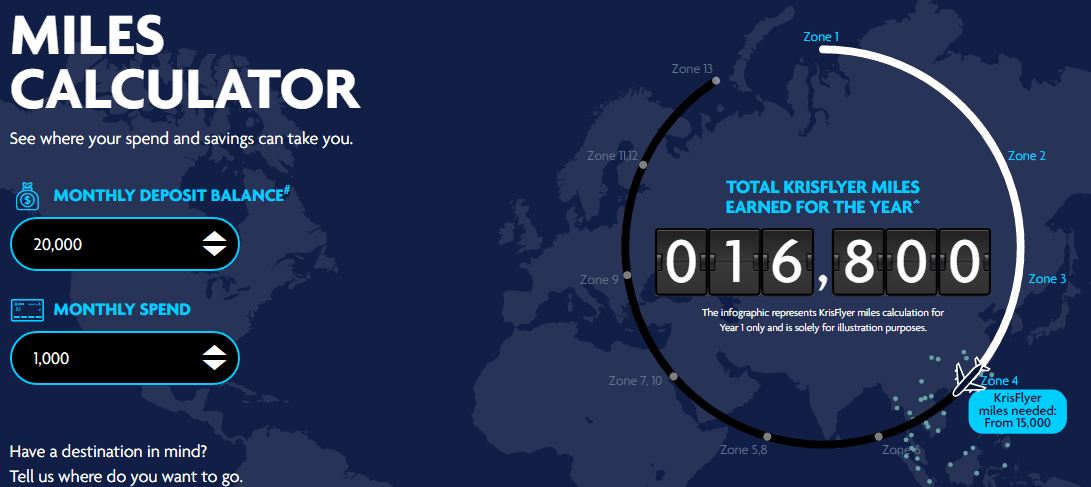

With the Krisflyer UOB account, customers with a monthly average balance of S$20,000 and a monthly spend of S$1,000 would, over one year, be able to earn the equivalent of a return trip to Bali on Singapore Airlines”

Let’s look at this hypothetical person that UOB describes, with an MAB of S$20K and monthly spending of S$1K. With UOB’s Krisflyer account, you’d earn 16,800 miles over the course of a year.

If you spent that same S$1K a month on an entry-level credit card like the DBS Altitude (min income: S$30K, 1.2 mpd on general spending), you’d be just 3K miles short of the 15K needed for a return trip to Bali on SQ.

But if you spread your S$1K monthly spending intelligently around two DBS cards (just two! I’m not going to propose my usual crazy 5 card strategies here) and spent 30% online (DBS Woman’s Card, $30K min income, 2 mpd online spending) and a weighted equivalent 10% on travel (DBS Altitude, S$30K min income, 3 mpd on travel), you’d have 19,440 miles in a year.

What I’m trying to show is that with a little bit of planning, and only 2 entry-level credit cards, you’d get that trip to Bali, plus you’d be able to put that S$20K to work for you in stocks, bonds, or any other investment that earns a non-0 interest rate. Millennials like planning, right?

Even if you do not qualify for a credit card, a secured credit card is still an option. A secured version of the DBS Altitude card can be obtained by anyone aged 21-70, with a minimum S$10K pledge to the bank.

Your S$10K would not earn interest, but

- It’s still better than not earning interest on S$20K

- You would earn 1.2 mpd on general spending (2 mpd overseas, 3 mpd on travel max $5K per month) with no limits

That, to me, is head and shoulders better than earning a maximum 1,000 bonus miles each month under the UOB arrangement (5% of $20K)

So the hypothetical person that UOB describes has much, much better options for earning both miles and interest.

“A bigger spender of S$3,000 a month for 12 months and monthly average balance of S$350,000 would earn 194,400 Krisflyer miles in 12 months which can be redeemed for one return business class ticket to New York on SIA (worth about S$6,200 on business saver)”

UOB then gives the example of a bigger spender with S$3K monthly spend and a MAB of S$350K. This guy earns 194,400 miles, enough to get a return business ticket to New York (184K miles)

Ok, big spender. First of all, I find it hard to believe anyone could, in good conscience, put S$350K in an account earning 0 interest. There surely must be some law against that. The scenario just doesn’t seem realistic to me.

But fine, in improv you’ve got to roll with the situation so let’s see what we can propose for him.

It’s clear that if you’re spending S$36K a year, even if you somehow managed to convert all that into 4 mpd spending, you’d only hit 144K miles. I know that if you intelligently use sites like Kaligo (up to 13 mpd!) you could bump that 4 mpd upwards, but, realistically speaking, you wouldn’t be able to get 184K on S$36K of spending.

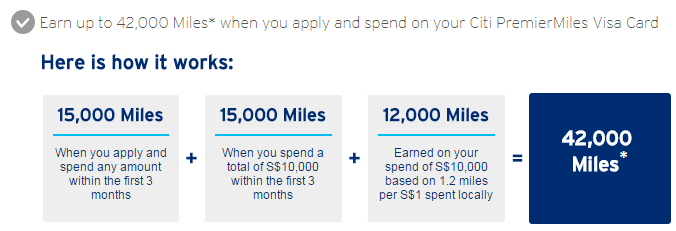

But wait! If I were to sign up for an OCBC Voyage Card and take the S$3,210 annual fee offer, I’d get 150K Krisflyer miles (never thought I’d see the day I used this card as a good example!). Then I could sign up for a Citibank Premiermiles card and, assuming I’m a new customer, get 42K miles for spending S$10K in the first 3 months and paying an annual fee of S$192.60.

So all in all I’ve spent about ~S$13K and have 192K miles (vs S$36K and 194.4K with UOB). And I didn’t have to park S$350K in a 0 interest earning account.

This, of course, assumes the person in question meets the income thresholds for both cards (S$120K for the Voyage, S$50K for the Premiermiles). But come on- if you can park S$350K at 0 interest, you’re probably fairly wealthy.

“On the first day alone, hundreds of Krisflyer UOB accounts were opened and more than S$4 million deposited with us,” she said.

That’s great, and congrats to UOB and all, but that doesn’t say anything in and of itself. This is commonly known as argumentum ad populum (thanks, AS profs!), or a fallacious argument that concludes a proposition is true because many or most people believe it.

In any case, let’s examine that claim. She said “hundreds”, so let’s assume 500 accounts were opened (otherwise I’m sure they’d have played it up and said “thousands”). If S$4M was deposited, that means the average account size is S$8,000. Which means that this average guy would be earning 1.4 mpd, assuming he spends a minimum of S$500 a month on the Krisflyer UOB debit card. And the maximum bonus he could earn per month would be 400 miles (5% of $8,000). Which means that once he spends more than S$400, he’d be earning 0.4 mpd. Dude.

“For a customer who prefers to earn interest over air miles, we would recommend they deposit their money into a fixed deposit or savings account to earn interest at the prevailing market rates”

But guys, it’s not a trade off.

On the 12-month promotional period, she said that “this just means that we will review it then to make sure we have a competitive product with competitive miles earn rate for our customers. It does not mean that the bonus miles will end after next year

That’s fair enough. UOB may increase the bonus miles earning rate after a year, they may decrease it, they may do nothing. We don’t know. But that uncertainty is in itself a problem. I guess you could argue that if they change the terms later you could just take your funds out and close the account, and you’d be right, but let’s circle back to a central problem- are you really going to forgo interest altogether?

So that’s my take on UOB’s response. What UOB is missing (deliberately or otherwise) is the fact that if you want to sell this product as a miles churning machine, you cannot have a 5% cap on bonus earning. That’s a complete contradiction.

That said, I am sure the product will be a moderate success because, unfortunately, there are enough people out there who will get giddy about the 5.4 figure and not read the fine print. But to those of you who are reading this, please- there are better ways of racking up the miles. Don’t settle for less.

PS. BT- next time you need a quote call me maybe. I have lots of file photos of myself in speedos you can use too.

I have access to the article (e-newspaper) – let me know how I should send it to you.

thanks for the offer! i have a digital subscription too but the problem is I can’t post the actual article (only excerpts) until SPH sends me the copy. It’s something to do with IP restrictions. ikr.

YOU HAVE BEEN OWNED BY THE MILELION UOB.

OWNED.

PWNED.

Hear hear. Roar.

Not to mention, which low income millenial will have $20k sitting in a bank account if they can’t even get a CC? LOL! You may wanna rant about their misleading influencer advert campaigns too which gives the impression that THEIR fancy trips are made possible by the miles they collected on the account. Boo.

I have not seen your speedo photos on your instantgram.

you need a credit card to access that site. we bill discreetly.

Please send receipt in brown, unmarked envelope.

Shouldn’t DBS Women Card earn u 4 mpd? You reported it as 2 mpd for online spending.

i’m giving the example of the entry level woman’s card which is 2mpd (and $30K income requirement). because in the context of the discussion we’re talking about someone who earns towards the entry level.

DBS has got 2 types of women’s card. The 4mpd is for DBS women’s WORLD mastercard. 2mpd is for DBS women’s mastercard. Hope this helps.

As you said Aaron, no one in their right mind that has $350k lying around will throw it in a 0% yielding account just for higher miles earn rate. This $350k @ 3-4% for a “safe” bond investment will already yield $10k-$14k in cash interest. Also, if I am a millennial who does not qualify for a credit card, why in the would would I even want to fly a full service SQ and not earn cash interest, vs. flying a budget carrier and earning a return on my cash. This account makes 0 sense to both ends of the… Read more »

the $10k that you pledge towards a DBS secured card actually earns you interest at prevailing the prevailing public board rates for FD; although the rates are pathetic low, but at least its low and not zero.. haha

interesting. cso told me 0.

For SCB, secured deposit also earns board rates, not zero.

MileLion: 2

UOB: 0

Round 3, fight!

Maybe just maybe.

UOB looked at its privilege banking customers and saw X amt of customers holding cash balances in their account > 350k and these people didnt have credit cards.

Tho the only one i can think of is Trust fund kids that have no income?

My colleague pointed out to me that with 350k you could open a treasures account or any other entry level privilege banking relationship. It really is quite a sizable chunk of cash…

Yup, you could also get SCB Priority Banking which gives unlimited Priority Passes.

Good rebuttal! I was fuming as I was reading your previous take on the UOB account and was shocked at just how bad it was (the product). Internally within a bank, launching a new product is quite a complex undertaking and requires jumping through numerous hoops (read departments) to get a proposal / business case approved. And if the product is innovative / first to market.. Anyway. For all we know, it may have started off as a great idea until everyone just kept watering it down until we got what we got. On a side note, welcome to the… Read more »

you may be on to something. I think anyone who’s worked in a large company will know the pain of ideas starting off great but then dying a slow death as they go through various departments. Who knows- perhaps at one point the idea was no cap, or a higher cap. And then they ran the numbers and realised it wouldn’t work for them. I mean, look, I don’t begrudge them offering what it is that they offer. They have every right to offer it just as we have every right not to take it up. What strikes me as… Read more »

Seeing the amount of marketing ballyhoo that’s gone into the launch and reading the article on BT, seems to me like UOB really *really* believed that it had a good product in hand. They seem to have designed the product with regular “consumers” in mind and then congratulated themselves on a job well done. They weren’t looking at moving the needle; they were merely offering people a choice. “If you have $350,000 to park, we have a 13 month FD if you are looking at earning interest, and now we have a fancy new account if you’re looking to earn… Read more »

aaronwong

APRIL 21, 2017 AT 3:23 PM

“…..To put the 5.4 mpd in big bold letters, then hide the 5% cap deep in the fine print isn’t the right way of doing business.“

Shame on UOB for this unethical business practice.

Oh BTW, thanks to all the noise, I’ve been seeing a banner ad for UOB Krisflyer Account on Milelion since morning 😀 😀

hahaha man….screenshot pls. I’d like to state for the record I have no control about what google ads serves up.

lol, of course you don’t 😛

Here you go!

I want to refute this whole millenial thing but.. it’s devoid of logic. Disengage and disarm!

Great publicity Aaron, compliments from BT.

It is time our ultra-conservative banks wake up their ideas pushing inferior miles earning cards to the market. Haiz…compared to our US counterparts our bonus miles sucks big time. *envy*

I’m still stunned at how UOB claimed they are expecting $1.5 BILLION in deposits for this account. REALLY??

Well, they can claim anything under the sun. Just like hundreds of acct openings and 4m deposits in…who can verify or refute such claims? *chucks*

Would agree that UOB has missed the point. Any well informed millennial would recognise that any trade-off is a no-no.

Not sure what UOB stats is based on, but they need to change that analyst(s). It has gotten to the point that it’s embrassing.

The final nail in the coffin would be a rival bank offering a slightly better product in this air miles accumulation programme.

Hi Aaron,

Love your posts and your sense of humour. =)

Seems UOB doesn’t like proper scrutiny too much…their hapless reaction remind me of a certain US airline who sent airport police to whack a passenger on a flight to kick him out and then blamed the passenger for getting whacked.

I used to see that SCB offer FD that pay miles instead of cash as interest.

UOB is just desperate to have something to make noise and we all fell for it. Negative publicity is still publicity and it feeds online chatter. Best was to gain online presence without losing too much. In all honest with such low margins it’s not going to possible to come up with new products the shine brighter so maybe a reverse product might make their other products sell? My biggest question is what is SIA take on this. Not a mention on their website unlike their Amex co brand cards. To have the krisflyer logo on the card I’m sure… Read more »

Sq was the one who put the initial press release out on their website on Tuesday. Uob didn’t have anything on their website until Wednesday. So I would say sq were supportive of the idea. Although I’d be interested to find out whether they knew how hobbled the end product actually was.

I’m not privy to what goes on behind the scenes so I can’t really say to what extent SQ is involved in this. The autoconversion feature + SQ publicity suggests it’s a closer collaboration than your usual arrangement where banks buy miles from the airline as and when cardholders convert points, and banks do their own marketing. But I doubt SQ has anything to do with the UOB krisflyer account earn rates or conditions. These are uob’s business decisions that SQ doesn’t get involved in

Well. If i had $350k and my only life ambition was to fly business class in a year. Then I’d put it in some gov bonds. At 3% I’d get $10.5k a year. More than enough for that ticket with spare change for hotels and food and activities.

Or i could buy cow class tickets and treat my whole family to a nice vacation.

Would you share which government bonds earning 3%?

https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield

look at 30 yr bonds.

From this disastrous product, it shows how the two big local companies valued and understood their customers…it is no surprise that SIA is no longer a great way to fly.

This will be a textbook case of a new service design arising from poor customer research and unclear value propositions and most importantly, it has insulted the intelligence (and numerical literacy) of its customers in coming with a product that makes no math sense.

The product’s target customer segment is so messed up – trying to target millennials who don’t qualify from CC and also want to attract High net worth individuals who want to earn miles to fly business class and yet bundling with lousy benefits from budget airlines….I am so confused..this product will be the joke of the town for some time…the whole product team needs to go back to school to retake Marketing 101.

Spot on! Shotgun approach to cast a wide net for all and sundry. Suspect they saw bunch of $350K balance accounts earning zilch and wanted to hold on to them. So might as well dream up a cockamamie 5.4mpd DEBIT (!!!) card and see if there are suckers out there.

This krisflyer account was reported, or should I say promoted on Todayonline.com as well. http://www.todayonline.com/business/uob-offers-new-bank-account-earns-krisflyer-miles I have recently been involved in a fraud dispute with UOB, and am suitably cheesed off by their practices. Hence it irritates me that they dare to launch a new card while having no interest in consumer protection whatsoever. You can read about it here, I actually posted on their facebook page detailing all my interactions with them, with proof to back my claims up. https://www.facebook.com/UOB.sg/posts/656659964544047 Their head of card risk management more or less told me that the signature on the back of your… Read more »

Clarence go straight to FIDREC as this I’d s financial issue and as financial disputes CASE can’t do any thing. Also reporting to the police is a good idea for record purpose in case you need you to go to court. As much as I hate it all banks and business these days don’t have customer first priority mindset. Similar things have happen to me and I feel your pain but now what you must do is protect yourself against these fraud charges and while we assume the banks and VISA/MASTER is there to help at the end of the… Read more »

As annoying as it is to read fawning articles in the press, what we need to realise is that the reporters who write these articles, at the end of the day, are not miles hobbyists like us. Therefore we can’t expect them to exercise the same level of discernment. At least not in a newsy type article. It would be nice, however, if one of the ST Finance columnists did some closer analysis on the account maybe in a Sunday times Finance section style format.

You have a point. But how much time does it take to get an opinion from a frequent flyer or miles collector (let alone a miles blogger)? For almost every other article, they manage to get an opinion.. “however, according to experts…”, “some users disagree though…”. Its even more important that they get guidance from someone well versed in that field, if they completely lack awareness of the miles game. Even in the “UOB defends” article, the tone is accusatory – accusing a blogger of finding something hidden, which seems to be a grave mistake to them. Its clear where… Read more »

Is UOB engaging in false advertising making untrue claims?!

“Our consumer insight tells us that this account, which has an accelerated earn-rate for KrisFlyer miles, will be attractive to those who would rather have free flights instead of earning interest,” said a UOB spokes-woman.

Thanks lady, but i prefer to have both as it already is. LMAO

Dear UOB spokeswoman, you need to get your consumer insights research team and your data analytics team changed – likely their research sample is skewed and bias or they are discarding naysayers’ data. Perhaps UOB should use the billions of deposits expected to recruit more insightful people and upgrade your data analytics software.

i never thought there would be a day where you would say the ocbc voyage card would be recommended for use!

WOW