UOB has launched a new payment facility called PRVI Pay that lets you use your PRVI Miles card to make any sort of payment where credit cards are not accepted. You earn 1 mile per S$1 spent with a processing fee of 2%, i.e. 2 cpm.

When someone first told me about it, I felt a bit meh. I mean, 2 cents per mile was the ceiling price I’d pay to buy miles, and I’m all for more options but this didn’t seem like a price at which I had to jump on.

Then I thought about it a bit more and changed my mind. I don’t think it’s a must grab deal still, but it’s certainly got its uses.

Let’s recap the options that exist right now for buying miles in Singapore

Options for buying miles in Singapore

I went to research the different options that are available for buying miles, the effective cost per mile, the limit you can buy each year and the implied income you need to take advantage of each option. This really deserves a separate article which I’ll get to in a bit.

For now, look at how the PRVI Pay facility stacks up against other options.

[table id=9 /]

(1) The HSBC website says that $1=0.4 miles for tax payment facility, but I have received reports that VI holders have received 1/1.25 mpd as per their relationship bonus

(2) The income requirement to get a HSBC Premier MC is $30,000, but you need $200K in deposits to open a HSBC Premier account

(3) OCBC Voyage Option 1 involves paying $488 to get 15,000 Voyage miles. These can be converted to Krisflyer miles at a 1:1 ratio but are technically more valuable than Krisflyer miles as they can also be used to pay for revenue fares at a fixed value per mile.

(4) SQ charges US$40 per 1,000 miles purchased. Price shown here is reflective of current exchange rates. The only way I could justify paying this is if I needed the miles right this minute, as SQ will credit them instantly

This table shows you that there are indeed many ways of buying miles for less than 2 cents each. However, the amount you can buy is limited. You could pay the annual fees on certain credit cards, but the amount of miles you can buy is limited because you can only pay the annual fee once per year. You could use your credit card to pay your tax bill, but the amount you can buy is capped by your actual tax bill.

When it comes to buying an unlimited quantity, only a handful of options exist. The two cheapest (and most accessible) ones are UOB PRVI Pay and iPayMy/Cardup.

But you could argue that iPayMy and Cardup aren’t truly “unlimited” in the sense that there needs to be some bona fide business transaction before you can use them. You need a tax bill, or a condo management fee, or a tuition payment etc.

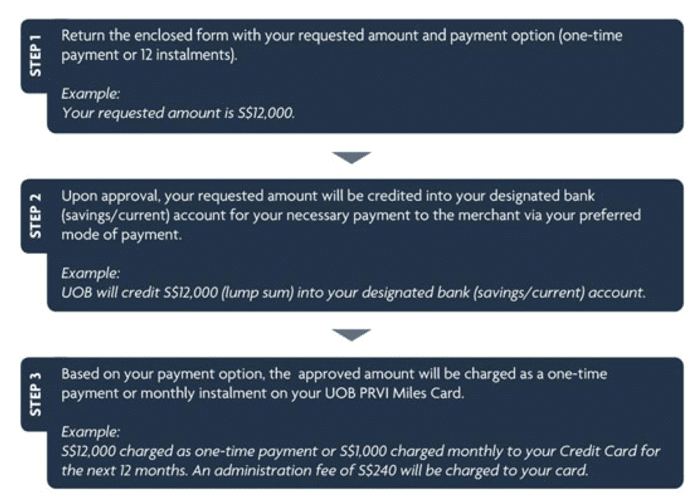

When you use UOB PRVI Pay, all you need to do is fill on the form where you want your funds credited. UOB doesn’t ask you what the money is for. UOB doesn’t care.

UOB doesn’t make the payment on your behalf to anyone- the mechanism through which this works is they credit a cash amount to your designated bank account (it could be your own), then bill your card for the amount + admin fee. Obviously you need to be within your credit limit, but this is still easier than going through iPayMy/Cardup.

It’s interesting if you think about why UOB decided to start offering this facility- they’re the only miles card on the market that does not offer renewal miles when paying the annual fee, so perhaps this was their way of throwing people a bone. I also wonder if this is the reason why UOB stopped offering 10X on Cardup payments recently.

Nothing in the T&C raises any eyebrows for me, but do note that the PRVI Pay facility will only be available until 31 Dec 2017. Presumably UOB is testing this on a trial basis and may extend it based on response. Also note that if you have a UOB PRVI Amex, this amount does not count towards your $50,000 annual spend to earn 20,000 bonus miles.

The folks on HWZ aren’t too impressed, but this is something I could see going for if I needed to load up on miles and had exhausted other, cheaper options, or if my income didn’t let me access the payment facilities of higher tier cards.

i cracked at the type of transaction buying from singapore airlines lies under …

ok lah, like i said in the footnote. if you need the miles right this minute then lan lan.

Regretfully i’ve had to resort to the stupid option just the one time…

i hope they were gentle and loving with you. 5.5 cpm is no joke.

My take is that it is a good means to make up the UNI$ for block redemption of miles.

that’s a useful observation! didn’t think of that. it could help you clear out orphan points.

yea.. make it more worthwhile too.. i have 7000+ uni$ and converting them is not very useful for now

Sorry, so $1 will get how many miles?

One.

But that’s not really the point of this article.

so can i say it is like a loan with 2% interest +1miles/$ ? sounds very good compared with cash advanced interest from credit card …or do i miss something here ?

Yup, interesting way to think about it.

Yes, the EIR for the upfront 2% fee is 3.15%. So if you can use use the cash obtained from UOB Prvi Pay to generate returns of EIR 3.15%, the miles obtained are essentially free.

So effectively, I can, for example, request for $10k, earn 10000 miles, then immediately repay $10200?

Am I missing something? A hidden catch perhaps?

Nope, that’s pretty much the value prop

You can also opt for 12 month installment, the 2% added to the first installment. uni$ will be awarded for each month for the installment amount.

I hope DBS will follow with a similar scheme. Never like UOB 🙂

DBS had the scheme to pay income tax only. But charge a high administration fee of 3%. Also didn’t mention whether this will earn any miles.

Assuming it does at 1.2 miles per dollar. This will work out to be 2.5 cents per mile. Not very favourable. This means uob prvi pay is better at 2 cpm and not restricted to income tax.

https://www.dbs.com.sg/personal/cards/card-services/payment-plans

Oh… how come Milelion never show DBS income tax at 3% in the comparison table??

will add this in, thanks!

I just got famous here

don’t let it go to your head and start an instagram account.

i had one already! didn’t you follow me?

i have to pay my company’s credit card (which doesn’t earn anything) bill every month (between $1.5k to $6k). This UOB PRIVI payment facility seems like a good option to buy miles at 2cents per mile. But wait, the iPayMy/Cardup with UOB PRIVI brings the miles to 1.86cents per mile. The latter option wins.

You really don’t need a reason to use UOB Prvi Pay. 🙂 Just do it if you cannot wait for usual expenses to fetch you the miles required.

Btw, can you use Cardup to pay other credit cards?

I think Cardup cannot pay other credit card bills. What about this way: I have an outstanding $5k payment in credit card A which can be paid via AXS. If I use UOB PRIV MasterCard to pay via AXS on this $5k, will it earn 1.4mpd?

Cannot pay credit cards and loans on AXS using credit cards. Only debit cards accepted.

yeah I guessed. thanks!

If i can use HSBC VI to “buy” miles at 1.2 cents is that something i should jump at?

1.2 cpm is a good price, but will those miles sit idle or do you have a plan for them? have an article on “should i buy miles” coming out soon…

Wait! How do you access this offer!?!

Hi Aaron UOB VI can buy at 1.9c? I thought only UOB RVI?

yes, you’re right. will edit this.

Isn’t this pretty much like a Balance Transfer? Except that they give you the points

For balance transfers you can pay the minimum for every month and the lumpsum at the last month. For PRVI Pay it’s equal installments.

Also, PRVI Pay only allows for 12-month installments.

So it is an installment plan? 🙂

SC VI holder also can purchase miles at 2 cents each, 99000 miles max at one go (online), not sure about offline.

Sauce pls?

Chili, thanks : )

Just login to ibanking account -> Online Rewards -> Airmiles -> Krisflyer Visa Infinite -> Top up more points -> each 2500 points cost $20

will check it out! thanks

email me if you need a screenshot : )

Just a thought, so say i make an online purchase of 5k using my hsbc revo card, thats 5x reward points (10k miles), and if i wish to use a 12 month instalment plan, instead of the using the hsbc option (which gives no rewards), I just sign up for prvipay (12mths plan) and use that to pay off my hsbc revo card bill.

That way, i benefit from getting the miles from the revo card & prvi pay whilst on a 12mth plan for just a 2% fee. Does that make sense?

UOB Privilege banking card also have payment facility, currently is 1.9% valid until 31 june 2018.

Anyone knows if they extended this option into 2018? And if they didn’t, outside of the uob reserve card, is there another 2cents a mile unlimited out there? Many thanks