If you want to play the miles game, a very important concept to understand is how to value a mile.

The recent SQ devaluation, as well as some insights I’ve acquired from speaking to fellow miles collectors, has led to a need to revisit this topic. This article should be read in conjunction with “What you need to know before you buy miles“, because presumably the price you’d be willing to pay depends on what you value them at.

In this article we will be discussing the value of a Krisflyer mile.

Theoretical Value

It’s probably easier to start by thinking about the theoretical value of a mile.

The theoretical value of a mile is the implicit rate at which the airline is willing to substitute miles for cash

Note that I say “implicit” because SQ may price a seat at S$2,000, but it doesn’t mean the cost to them is S$2,000. That’s just how much they hope to earn from it. The explicit value of a mile should form the floor, and that’s 1 cent per mile, the rate that SQ is willing to substitute miles for cash under its (poor value) Pay with Miles scheme.

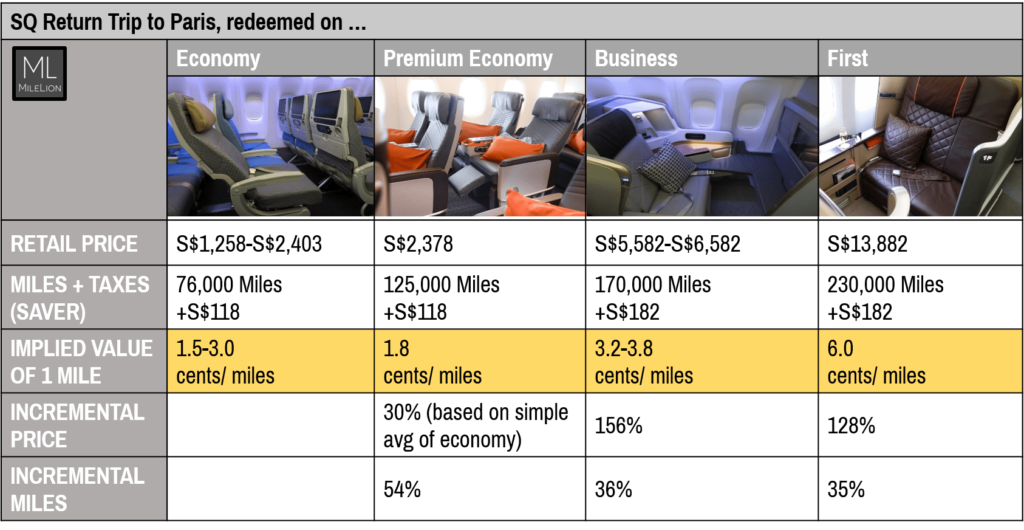

Here’s an example of the theoretical value based on a round trip ticket to Paris on SQ.

The first thing you should note is that with the exception of economy to premium economy, as you move up the cabin classes the implied value of a mile increases. For the sake of simplicity I’ve only looked at one destination, but the figures above are pretty reflective of the average cent per mile value throughout the SQ network

- Economy- 1.5-3 cents per mile

- Premium Economy- 1.5-2.5 cents per mile

- Business- 3.5-4.5 cents per mile

- First- 6-7 cents per mile

This is because the incremental price increases more significantly than the incremental miles. Business Class cost 156% more money than premium economy but only 36% more miles. First Class costs 128% more money than Business Class but only 35% more miles.

Why the exception from economy to premium economy? Because SQ’s premium economy is horribly overpriced from a miles (and many would say money) point of view. Premium economy tickets require 75% the miles of business class. And given the huge gap in comfort, you’d be hard pressed to justify redeeming premium economy.

There is a price step up from economy to premium economy, but depending on what economy fare you book the step up can be very marginal, or even negative as we see in the CDG example above.

Based on this, we can formulate a general rule that

The value of a mile depends on what cabin you redeem for. Miles are worth the most when you redeem for first class and the least when you redeem for economy

Indeed, this general rule forms the mantra of many a miles collector- if you’re going to redeem your miles for economy class travel, you may be better off with a cashback card.

Actual Value

So that’s the theoretical value and although it remains a good starting point for our valuation of a mile, it cannot be the end. As this section shows you, valuing a mile is more art than science, and in some places even veers into the realm of the philosophical.

Here are some additional factors to take into account in valuing a mile.

What is the likelihood of finding saver space?

In the theoretical valuation section, I’ve used the saver award bucket when considering how many miles were required. But anyone who has spent 5 minutes trying to book an award ticket with SQ knows about the horrors of the waitlist. On popular routes like SIN-LHR or SIN-JFK, finding saver award space in premium cabins can be very tricky, if not impossible (I challenge anyone to find 2 instantly confirmable business or first saver seats on SQ25/26).

So we need to somehow factor in the probability of finding saver space. This isn’t a calculation I’m equipped to do because it depends on so many different factors like route, time of booking, number of seats etc.

I do know, however, that if you were to redeem standard awards instead of saver, your valuation would look like this (premium economy only has saver awards)

- Economy- 1-2 cents per mile

- Business-2-3 cents per mile

- First- 3-4 cents per mile

That’s about half the value of saver awards. Therefore your value of a mile is likely to be lower than what we calculated previously. I personally have never paid standard award prices (I find it too painful especially when I know what the price “should” be) but in an emergency situation I can see some people biting the bullet to do so.

Would I really have paid $10,000 for first class?

When I first started playing the miles game I’d tell people very proudly “I just got a $10,000 first class ticket for only $400 in taxes and some miles” and allow them to bask in my warm, enlightened glow (mind you, this is still how a lot of travel bloggers pitch stories to journalists because “YOU WON’T BELIEVE HOW THIS MAN GOT $20,000 OF AIR TICKETS FOR FREE” is a heck of a lot more attention-grabbing than “Man meticulously plans vacation through intelligent use of frequent flyer programs”)

I’d then lecture them about thinking twice for paying 2 cents per mile because “you can redeem them for first class and get 6-7 cents of value. It’s pure arbitrage!”

Ah, callow youth.

When Ubereats is (very often) late and gives me a $5 credit, I can safely say that I’ve saved $5 because I wouldn’t think twice on shelling out $5 of my own money on Ubereats in the future. But the only way I can take the first class ticket at face value is if I were genuinely willing to shell out that money in the first place. So I wasn’t wrong from a theoretical point of view, but implicit in what I’m saying is that I’d have been willing to pay $10,000 for a first class ticket.

And that’s the philosophy that some people take towards buying and redeeming miles. They tell themselves- I will not pay more than $2,000 for a return ticket to San Francisco, regardless of class. And then they’ll see if they’re able to buy/generate miles at a cost less than or equal to that. FYI, you’d need to buy miles at 1.1 cents each if you wanted to fly to SFO in Business Class and not pay more than $2,000.

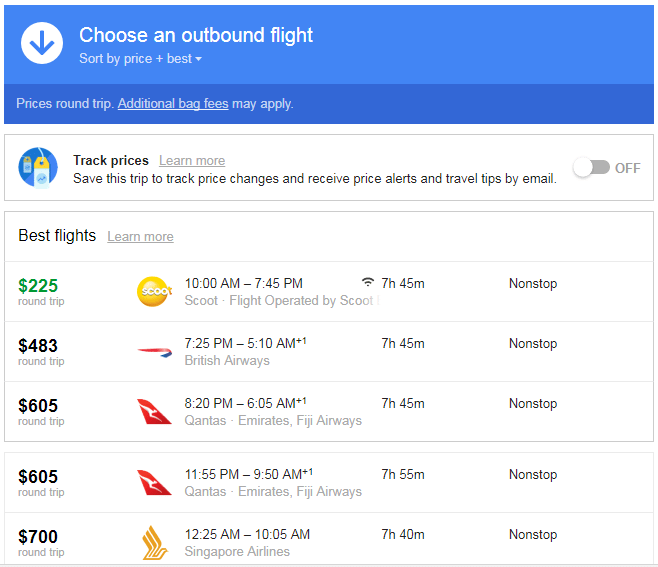

This implies that you should think about all your alternatives when redeeming miles. If I don’t get my award seat, would I still fly with SQ?

Suppose I was going to Sydney. I could get there direct with BA, Qantas and even Scoot. So should I value my miles based on the retail price of a First Class ticket, or based on the retail price of the alternatives I’d be willing to accept? Just how much do I intrinsically value that flight to Sydney? You can see how this can quickly become a philosophical discussion more than anything.

Put it another way- if you’re the sort who would normally never pay for Tiffany jewelry, and Tiffany has a 10% sale and you buy a $10,000 ring for $9,000, you’d be stretching to say you really saved $1,000.

What is the opportunity cost of building miles?

A big part of building your miles as quickly as possible involves using the right card in the right situation. But that sometimes means forgoing discounts you could otherwise have received by using a different card.

Case in point- Citibank has a host of gourmet dining deals for its cardholders.

However, Citibank does not have a specialized dining card. The question I then face when I dine out is- do I value a 10% discount more than earning 4 mpd with my UOB PP Amex?

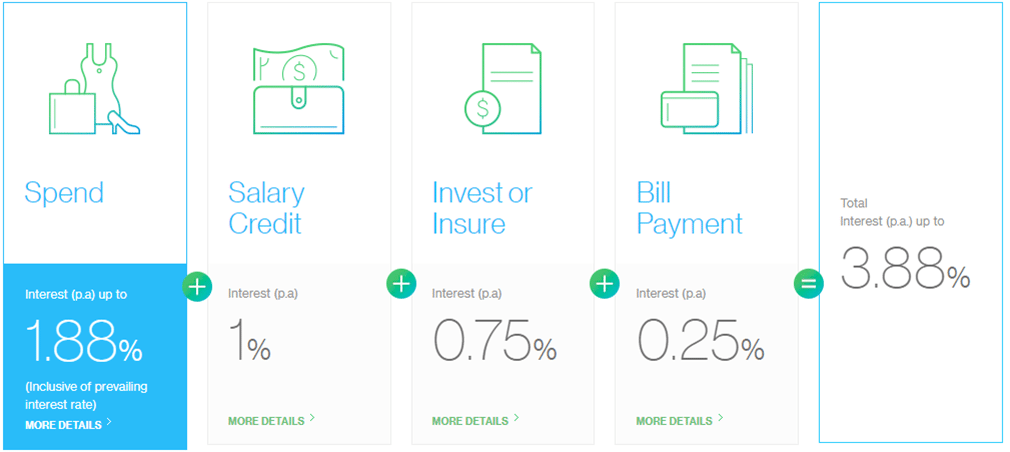

Of course if the discount is large it’s a no-brainer, but there are other situations where the opportunity cost is more subtle. Consider the Standard Charted Bonus$aver account, which awards you 1.88% bonus interest if you spend upwards of $2,000 a month on SCB credit cards.

SCB also doesn’t have a miles earning dining card. But it’s very hard for me to, on the fly, calculate the opportunity cost of not earning that 1.88% interest because of an individual transaction that may or may not cause me to fall short of the $2,000 mark. If you wanted to be completely accurate, you’d need to take this into account as well.

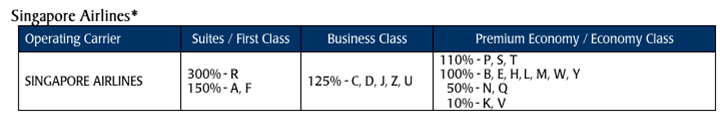

What about the miles I would have earned buying a revenue ticket?

Award tickets do not earn miles. Revenue tickets do. Therefore it’s necessary to factor the value of foregone miles into our calculations.

Business Class tickets usually earn 125% of the miles flown, so a return flight from SIN-SFO would earn 1.25*8,440= 10,550 miles, before you take into account the 25% elite tier bonus that Krisflyer Elite Silver and above gets. If you take a fairly conservative valuation of 2 cents per mile, that’s about $210 of value which you should offset from the revenue price of the ticket as a form of rebate.

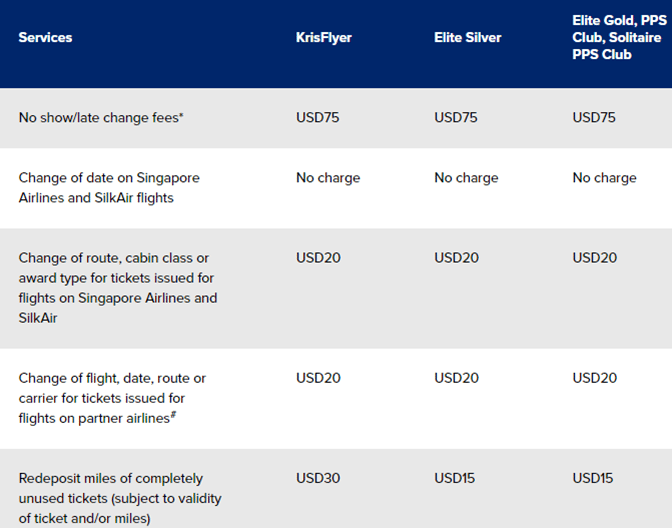

How much do I value flexibility?

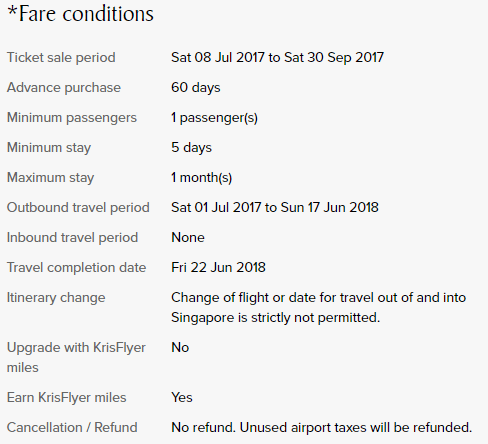

Award tickets have a great deal of flexibility. You can change the date for free, you can change your route/cabin class or award type for US$20 or cancel an award for US$15-30, depending on your status (and I know from experience that if you ask them nicely for a one-time exception they’re not above bending the rule)

This is more of an issue in economy, where tickets can range from fully flexible to highly restricted (although it should also be noted that the cancellation fee for a revenue business class ticket is US$150-300 versus US$15 for an award ticket) . So it’s not fair to compare the cheapest bucket of economy to an economy award ticket. An SQ super deals ticket to San Francisco may cost $1,408, but good luck if you need to make any changes to it.

Valuing a mile

And now we come down to the final question- how much should I value a mile?

My (very cop out) answer is that it depends on you.

- I personally value miles at 2 cents each.

- Ben over at OMAAT and TPG value miles at 1.5 US cents (or 2.05 SG cents) each.

- PointsHacks values them at 2.1 Australian (2.28 SG cents) each.

How you value miles is inherently linked to the kind of traveller you are. People who believe in saving money above everything else will value them lower, because miles are “free” (assuming you don’t pay explicitly for them). That’s why they’re willing to trade them for economy class tickets. People who believe in accessing experiences they couldn’t otherwise have afforded will value them slightly higher, because they’ll invariably redeem them for business or first. And people who buy first and business class as a matter of practice anyway will value them the highest, because to them it’s simply a replacement mode of payment.

So that’s my take on the valuation of a mile!

A very well written article.

While I do not spend my miles on economy, I do calculate its valuation based on Y-class (full flexi) prices. I do not think that the cheapest fare, nor the average fare should be used as it’s just not an apple-to-apple comparison. Well, I know, it never is.

I like your point on how the mile should valued against what you are prepared to spend on in the first place. Very good point 🙂

glad you find it useful! i can understand why you’d use full fare Y as the price to calculate for economy, insofar as you’re looking at equal flexibility for an award ticket and a full fare Y, but can we agree that the closer you get to your departure the more the value of an economy class ticket approximates a super saver one? that is- when you’re 99% sure your travel plans won’t change, you’d be better off getting a cheaper economy fare than redeeming miles (assuming you dont run into advance purchase restrictions etc)

One way to help with the mindset shift with economy tickets is to correctly label them as Discounted Ticket vs Full-Fare Ticket. Most of the people I know erroneously label the discounted price as the discounted ticket as “actual price if you buy them early” and view the full-fare as “ticket get more expensive closer to the travel date”, which is technically incorrect. This is because if I were to buy economy tickets of Y, E & B fare classes, even if I made the purchase 364 days in advance, I would still pay the same price if I had… Read more »

Juxtapose that with “aiyah why u eat at high class restaurants, in the end also it becomes sh*t”

I made this argument once when a date wanted to eat at wolfgang puck’s.

i did not hear back from her.

haha.. nice…

These type of people, not worth the time of even the first date

Am afraid not matter how simple your explanation is, one cannot stop the trolls who’ll claim they travel economy and hence everyone should travel economy. They’ll never pay for J or F, so even discussing those premium cabins is sacrilege!

I am one of those who will never paid and has no intention ever to pay _retail_ prices for J/F. As I wrote in the reply of previous article, if I can get SIN-SFO-SIN for $1900 (BTW, that was assumed USD currency there) in Business, fine, I will go and buy it. But I won’t pay $6000, $4000 or $2800 for it. That applies to all situations and conditions – I would not even pay that amount for my own honeymoon trip. But it is just me. My approach – my own rules. Others are in charge of their own… Read more »

Well written article. One thing I want to mention that cpm is very route dependent, especially with no competition on route. And if one has option to transfer points to various airline programs – citi cards in Singapore and almost all cards in US – that variation because even more. Practical examples – on UA’s miles I can fly round trip SIN-SYD-SIN for 60K miles while with SQ it requires 110K in Business Saver. If I have an equal opportunity to get miles for UA and SQ, obviously my valuation of miles is lower with UA. Opposite example – if… Read more »

Great post, very balanced.

And because the best challenges are the pointless ones: SQ 25 from new york to sgp. Monday 29 Jan 2018. Two saver seats still available in business.

Great well thought out summary – all the competing factors are in there. Other item in loss of miles consideration is status. As a Virgin Australia flyer primarily, I assign SQ flights to VA and value the SCs as they help keep me platinum and in the lounges when flying domestically in AU. Since getting into the mileage game and chasing reward flights it’s becoming harder to maintain status as the long haul flights that would have been revenue bookings are no longer there. What is the most I would pay is always a hard thing to decide – my… Read more »

You poor bugger having to fly VA haha. I like Virgin and what they are trying to do in Australia but simply put they’re not matching Qantas. And it’s not like Qantas is setting the world alight with its service and hard products…. It’s good but it’s not WOW What perks are you after as a VA Plat? I would’ve thought you could hit VA Gold and then chase Star Gold through Asiana or something to hedge yourself on your itinerary, would be interested to hear your perspective. The annoying thing from memory is that VA awards SC on most… Read more »

Good job on the updated view of your mile valuation. Of course for many people YMMV but after having tried to compare fares, checked waitlisting incidences and gauges various travel opportunities it helps to have some simplified number one can use, and I would more or less value a KF mile the same way… for now at least.

Well written article aaron.

Would like to hear your thoughts in this matter: If you value kf miles @ 2cents each and Voyage Miles @ 3cents each + amount of flexibility and other perks (free limo etc), wouldnt it make OCBC voyage card more attractive now?

when you say attractive, do you mean in terms of earning rates? if so my answer is still no. reason being- i value KF miles at 2 cents each. this is conservative. I know that KF miles CAN get me 4-7 cents of value if i redeem them for premium cabins. i know that I will not always get that value for reasons we discussed in the article (saver space, fallacy of value etc). however, i know that VMs WILL always get me 2-3 cents no matter what cabin i redeem for. this is an important distinction. it means that… Read more »

Hey aaron thanks for the detailed reply.

Keep up the good work with your blog! Many of us have benefited from your writings

[…] Many people ask me whether it’s “worth it” to use their miles card overseas. It comes down to a simple question: how do you value your miles? […]

[…] c= cashback. Each mile is approximated to have a value of 1.5 cents per the always excellent analysis performed by the Mile […]

[…] is that the value you get depends on how you spend it. For reasons which I’ll explain in a subsequent post, the value of a mile depends on what you redeem it for. All things equal, a mile applied towards a […]