One of the most common objections I get to playing the miles game goes something like this:

If I apply for multiple cards and chop and change my card portfolio based on sign up bonuses, it’s going to have a negative impact on my credit score. Then I’m going to lose out when I apply for a housing/car/education loan

That’s certainly a legitimate concern. The difference between an high and a low credit score can will mean additional interest costs, a smaller loan amount and the potential of being rejected outright for a loan altogether.

So does playing the miles game necessarily mean taking a hit to your credit score? Is owning multiple cards a bad thing? And just how is your score calculated anyway?

I reached out to CBS for this article but didn’t get a response. Twice. But who needs them, we’ll figure it out ourselves!

What is a credit score?

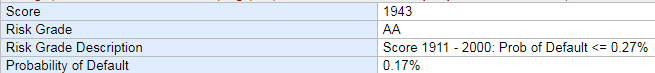

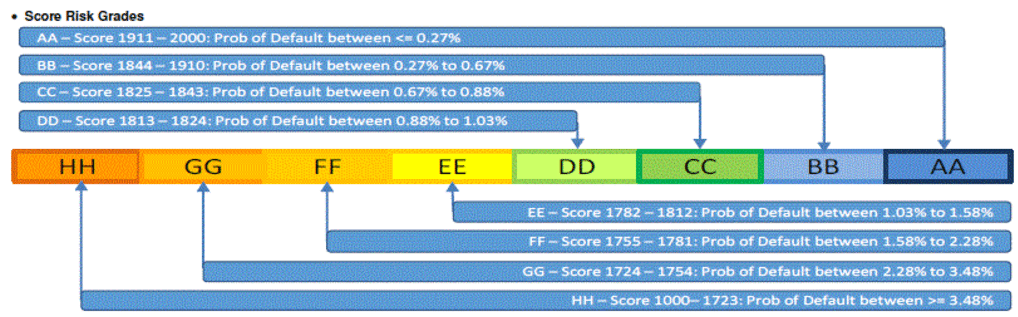

A credit score is a 4 digit number between 1000 and 2000. The higher the score, the lower your odds of defaulting. Score ranges correspond to two letter grading. For example, someone with an AA score (1911-2000) has less than a 0.27% chance of default. Someone with a HH score (1000 to 1723) has a 3.48% chance of default or higher.

It’s interesting because 3.48% doesn’t sound very high in and of itself, but it’s enough to freak banks into charging you a really high rate of interest (or declining to lend to you at all). But what do I know about credit modelling anyway.

How can I get a credit report?

You can buy a credit report from CBS for $6.42 to see your score. The good news is that if you’ve applied for a loan, overdraft or credit card recently, you’ll be able to get one for free. Consumers can get their free online report within 30 days of the date of their letter of approval or rejection. And even if you haven’t, Citibank is sponsoring 9,000 free credit reports until 13 Oct.

How is my credit score calculated?

We know that your credit score has 6 components. However, credit scoring is based on a proprietary algorithm that is not disclosed by the agency, so the exact weightage of each component is a mystery.

The 6 components that make up your score are-

(1) Credit Utilization Pattern

This is the amount of credit you’re currently using or owing on all your accounts.

(2) Recent Credit Applications

This is the number of newly-opened credit accounts that you have. All things equal, opening too many new credit facilities in a short period of time will lead to you being dinged on this dimension (but the extent to which it counts is debatable- see my example below)

My understanding is that unlike what happens in the States, average age of credit is not a factor the agencies here take into account when computing your credit score.

(3) Account Delinquency

This refers to whether or not you currently have any delinquent payments on your credit facilities

(4) Credit Account History

This sounds similar to (3), but my understanding is that this is more of a historical trend. If you frequently have (3), you’ll have a bad (4). The previous 12 months is given the highest weightage when considering this aspect.

(5) Credit limit/Available credit

This refers to the total amount of credit you have extended to you (as opposed to (1) which is how much of it you’re using)

(6) Enquiry Activity

This refers to the number of credit pulls done on your account. Each time you apply for a card, the bank asks for a credit report and a record is made. A significant number of records may indicate that a person is trying to borrow heavily.

For what it’s worth, I reached out to Budget Babe who checked with some friends who work in this industry and they’re of the opinion that presence of defaults + late payments are the biggest black marks and have the highest weightage. That sounds about right to me.

Credit scores do not look at your age, salary, employment history or type of house (weird because I’d imagine your ability to repay would depend on the assets you had on hand no?). Your credit history overseas will not affect your score in Singapore because there is no cross-border exchange of data.

Does playing the miles game hurt your credit score?

Here’s my situation.

I have no outstanding loans or credit card balances, with no history of bankruptcy or defaults.

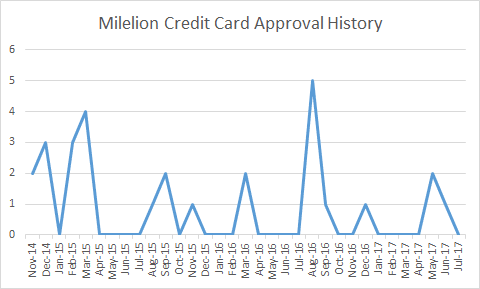

In the last 12 months, I have applied for 10 credit cards (3 still-unactivated AMEX cards just to get free Shopback money, SCB Bonus$aver card for $188 of free money, ICBC Visa and Unionpay for $200 of free money (sensing a trend yet?), Citibank Rewards MC, UOB PRVI MC, OCBC Voyage (given to me with compliments of the OCBC team for the purposes of writing this article, since cancelled, and the CIMB Visa Infinite). I have also closed 5 credit cards. I currently have 22 outstanding cards.

In graphical terms, here is my credit card application history since I moved back to Singapore in November 2014 to work.

All my cards have GIRO arrangements that pay off the full balance every month. In the past 12 months I have missed 1-2 payments on my card, due to timing differences between applying for GIRO and it getting approved. I got a call from the bank within a few days of the missed payment, paid it immediately and got the late fees and interest waived.

My credit score is 1943 with a 0.17% chance of defaulting.

So it seems that despite my big spike in credit card applications in the last year and my general habit of applying for, holding and cancelling a lot of cards, my credit score hasn’t been adversely affected.

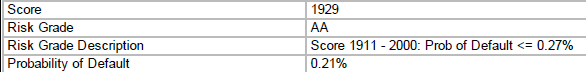

What’s even more interesting is that I applied for a separate report in November 2015 and my score was 1929 with a 0.21% chance of defaulting.

At this point I had been working in Singapore for exactly one year, and had applied for 16 credit cards in that period. I’d have thought this would be poison to my credit score, but yet it still came out ok. And as I used those cards and paid off my bills on time, my credit score improved marginally.

So based on my experience, “recent credit” and “enquiry activity” is not as important as utilization pattern or account delinquency. It seems that as long as you pay the bills regularly and don’t take on loans, you’re ok.

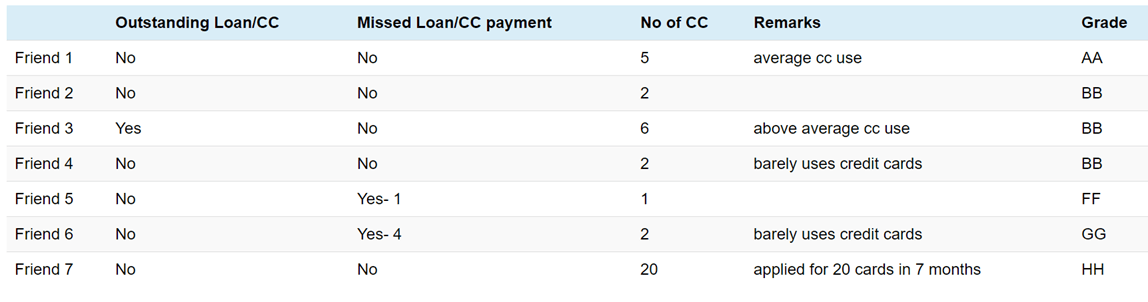

We can’t draw conclusions from just one data point, however, so I reached out to a few friends in different circumstances.

Friend 5 and 6 should be a warning to anyone, miles chaser or not, who uses credit cards. They missed payments because of sheer forgetfulness rather than any financial difficulty, and unlike me they only realised it on the next billing cycle, rather than a few days after the missed payment. But too bad, it’s a black mark on their scores and one that will linger for at least 6 months, possibly longer. Friend 6 missed 3 or 4 payments when overseas 2-3 years ago, and those black marks are still there.

But that’s also because Friend 6 doesn’t really use cards normally. So there’s no opportunity for her to improve her score by demonstrating responsible credit use. I suspect that’s what stopping Friend 4 from getting AA too. He has no loans, always pays bills on time, but has a grand total of 2 cards which he barely uses.

Responsible credit card use is what I think is helping Friend 3- she has a substantial housing loan on the books, but has above average credit card use, which she always pays on time and in full. That probably helps maintain her BB rating.

Friend 7 can be seen as a cautionary tale against overenthusiastic card application, but if she demonstrates a responsible use of credit over the next year I believe she’ll be AA/BB before long.

So my take is that owning multiple credit cards in a short period of time may hurt your credit score initially (although it didn’t for me, for some reason), but as you build up a track record of paying your bills in full and on time, your score will start to pick up even faster than someone who has only a couple.

Playing the miles game responsibly

I don’t think playing the miles game is mutually exclusive with the responsible use of credit. In fact, done properly, the miles game can help you build a healthy credit score.

Use the miles game to build a credit history

I know a friend who had a philosophical objection to credit cards. A family member had misused them and ended up in great debt, and the trauma of the experience led her to conclude that she would never get one for fear of ending up in a similar situation.

I sympathise, I really do. But that’s not the right solution either. You see, if you never use credit at all, your credit score will be CX. That’s not a good thing, because it means that banks have no understanding of your history, and you’re an unknown unknown to them. So come the day when you do need to take a loan (and that day will come), you’re going to run into problems.

The proper way to build a credit score is not to avoid credit cards, it is to use credit cards responsibly. It’s much better to get a couple of cards and pay off your balances on time to demonstrate to banks that you’re capable of handling credit responsibly.

From that point of view, playing the miles game may lead to a short term hit on your credit score, but as you pay off bills regularly your score can improve significantly.

Set up GIRO for all your cards

Some people tell me that if they have multiple cards they’ll end up missing payments and hurt their credit score. I then ask them, incredulously, why they haven’t heard of GIRO.

I have heard the most absurd excuses for not setting up GIRO. “Oh, it takes too much time” “Oh, I want to keep track on how much I’m spending” “Oh, the pain of paying the bill manually each month will remind me not to overspend”

Pfffffftttttt. What rubbish. GIRO isn’t as instant as I’d like it to be (I think it’s horribly antiquated that we need to fill out and mail in paper forms for cross bank payments) but it takes 5 minutes of your time and the rest is all waiting. And once it’s done you don’t need to worry about forgetting a payment.

Regarding the “I want the pain of paying the bill manually so I know how much I’m spending” argument, if you can call it that- whether or not you use GIRO, it’s your own personal responsibility to look at your consolidated bills each month to know what your P&L looks like. I don’t see why having a GIRO arrangement should stop you from doing that monthly exercise.

Missed payments are very, very bad for your score, and very, very avoidable. A responsible miles chaser will always have GIRO arrangements.

Treat credit cards as debit cards with rewards, not sources of credit

If you treat your credit card like a debit card and never use it to spend more than you have, you’ll be fine. Banks earn a surprising amount of money not from merchant fees or annual fees, but from late payment and interest. It’s an oxymoron, but you should never view credit cards as a source of credit. If you’re short on funds, there are much cheaper options to borrow money on than a credit card.

And even if it’s technically within your means, the miles game should not be an enticement to spend more than you otherwise would, in the name of collecting points. Remember: the miles game is a way of avoiding leaving money on the table, not putting extra money down.

Conclusion

One of the things that struck me while researching this piece was how few of my friends (young, educated professionals) had seen their credit score before or even knew what it was. According to Credit Bureau, >80% of Singaporeans have not seen their credit score before. That’s a staggering figure and borders on financial irresponsibility.

If nothing else, I hope this article encourages you to get a free credit report and figure out where you stand. And if you are going to play the miles game, play it right.

Agree, I hold 13 CC at the moment, with high CC usage on a few cards. AA score. And then I subsequently applied for personal loan, housing loan, and car loan. DBS even wrote me to threaten they would suspend my CC facilities because of my high unsecured balances ratio. Even after all that, my credit score is still AA. I think timely repayment and sufficiently long history is ultimately key for the score. I’ve missed a few that were waived (no marks on the report).

However CCs might affect your TDSR and affect the loan quantum that you can receive from the bank. That’s what I heard, correct me if I’m wrong.

Yes correct. But that’s only if you carry a balance no?

that’s only if you carry a balance on your ccright?

Yes, when applying for my housing loan, the bank was only concerned with my unpaid balances. My banker advised me to pay everything I owe off before that month’s statement was generated.

Is the solution to this to not have a high credit limit on your cards?

Thats exactly wrong! One of the factors in credit score is your credit utilization: credit used/credit limit. The lower the better. So you should max your credit limit. I got a home loan recently too and it is the carry (unpaid credit) on the cards which matters not your credit limit. This , assuming you are going to base your spending on your income and not credit limit!

I found your comment “Remember: the miles game is a way of avoiding leaving money on the table, not putting extra money down” interesting.

Read in the context of your previous (very relevant) articles on valuing miles, it could seem to suggest against one buying miles. Just one way of looking at it.

My take on that is: if you were gonna travel anyway, look at whether buying miles can help you save money instead of paying revenue prices. don’t travel more just because miles are available for cheap

Do supplementary card holders get their own credit rating or are they assigned the rating of the primary holder?

they are not assigned the rating of the primary card holder – their rating remains their rating. any form of delinquency by the supplementary card holder is borne by the primary card holder. i.e. if a supplementary card holder defaults, then the primary card holder’s credit rating takes the hit.

aye, that’s right. ergo, be careful who you give a supp card to!

Since the primary holder is responsible for payment of bills regardless of how much the supp holder spends (or doesn’t), it seems only logical that only the primary holder’s rating is affected.

I had this exact concern and was also curious to find out about my credit score. So I applied for 1. Lo and behold, I actually have a perfect credit score of 2000 with a probability of default of 0.08%. It’s pure speculation but I believe that the fact I’m chasing miles helped me to get the score. And my theory is it’s due to my credit card payment strategy. This is my (simplified) strategy:- Let’s say I worked out my monthly expenses to be $1000- a) $500 for bills (household, handphone, etc) b) $500 for other expenses (groceries, entertainment,… Read more »

In Australia our bank manager requested we get rid of one of our credit cards when applying for mortgage last year. He wanted our overall credit limit reduced as even though we pay all balances in full every month, the bank had to assume we may max out our credit lines in the future, and the minimum monthly repayments in that scenario were deducted from our potential disposable income when they were calculating how much they’d lend to us. Unsure if similar policies apply elsewhere in the world.

Different in Australia. My understanding is that Aust banks look at the minimum payment required should you max out your credit limit, and how this may affect your ability to service your debt. Reducing the credit limit will impact this. Part of the problem in Australia was that until March 2014 or 2015, there was only negative credit reporting due to the inflexibility of the Privacy Act. Essentially all your credit report would say was any late/defaults on your file, and how many times your an enquiry was made against your credit file. Things like where you got approved or… Read more »

I don’t like GIRO for credit card bills to avoid auto paying the annual fee. Anyway around this? Not sure if the banks are more willing to waive if they see that the balance isn’t paid by GIRO.

I GIRO my bills. Have never had issues waiving. Only possible problem is that the sum sometimes gets auto-deducted from your account anyway, so if you don’t use the card much you might end up with extra credit locked up in the account for some time. Could be annoying.

Mother of all credit score is your payment conduct and not bring over credit, other than that, it will only tickle your creditability.

Would like to clarify if there’s a difference between late payments and missed payments

1) Late payments, but waive interest charges + pay back immediately within a few days

2) Late payments but pay only after next billing cycle

Whilst its understandable that the second scenario would deserve a black mark, does frequently being in scenario 1 affect the credit score, anyone?