Citibank is running a great promotion on its Premiermiles Visa card from now till 31 Jan 2017 that lets you earn 3.5 mpd on foreign currency spending.

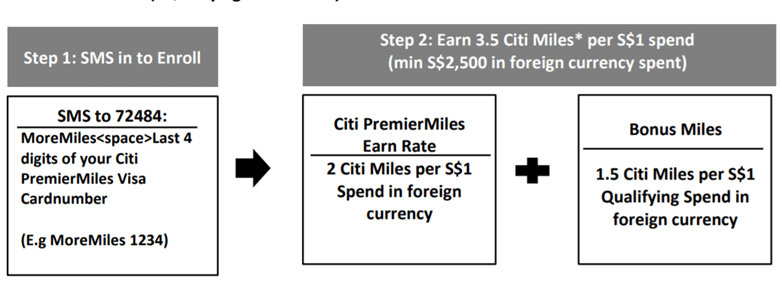

This consists of the 2.0 mpd base you normally earn on foreign currency spending plus an additional 1.5 mpd bonus (full T&C here).Registration is required. Simply SMS MOREMILES XXXX to 72484 where XXXX is the last 4 digits of your Citi Premiermiles Visa card.

In order to take advantage of this promotion you need to charge at least S$2,500 in foreign currency spend to your card. Bonus miles are capped on S$8,000 of foreign currency spend.

Obviously this isn’t as good as the 4 mpd offered by the UOB Visa Signature card but keep in mind the UOB Visa Signature has been demarketed. Furthermore, you need to remember that UOB’s definition of a foreign currency transaction is that the payment processor has to be outside of Singapore as well. For other banks including Citibank, a foreign currency transaction is simply one that is denominated in foreign currency.

Although I dislike Citibank’s policy of not pooling points across its cards (meaning you have to pay multiple conversion fees), they do have one of the widest variety of transfer partners in all of Singapore (SQ, Cathay, Qantas, Qatar, AirFrance/KLM, Etihad, Thai, BA, MAS, Garuda, EVA).

If you don’t yet own a Citibank Premiermiles card, do note that you can take advantage of a 42,000 mile sign up bonus provided you’re new to the bank.

What does “the UOB Visa Signature has been demarketed” mean? can still see it on their website…

i’ve been told that people who try to apply for it get a call telling them the card is no longer being issued

That’s what they told me (non-Singaporean) and promptly rejected my application back in October. Then my girlfriend (Singaporean) applied 3 weeks later and she got the card, no questions asked :s

I sent an application via SMS. Let’s see how it goes. Planning to use this for next year’s trips.

I applied again and got rejected again. I somehow think the nationality of the applicant is playing a part.

I wonder if you could double-dip this with Citi’s long weekend bonus miles promotion as well…

what’s the long weekend bonus miles abt? Any link?

It’s this one: https://www.citibank.com.sg/global_docs/pdf/TCs_Long_weekend_Campaign_2017_2404.pdf

I am also curious about this but would guess not as terms for the new 3.5 promotion state ’13. This Promotion is not valid with other promotions unless otherwise expressly stated.’ As I couldn’t find any reference to the weekend promotion I would guess they are not stackable. But I would be delighted if I was wrong.

does buying hilton/starwood points count as foreign ccy for this promotion?

yes

good to know, will be useful in case need to round up to $2500

And just today I got an email from OCBC Titanium:

15X OCBC$ for every S$1 spent on overseas shopping

5X OCBC$ for every S$1 spent on local and overseas dining, capped at S$500

That’s 6 miles per $1 spent overseas.

https://www.ocbc.com/assets/pdf/cards/terms-conditions-titanium-rewards-dec17.pdf

Do take note that the bonus miles are for overseas shopping – mainly clothes and shoes. I’d probably continue using mobile payments (e.g. Apple Pay) throughout for guaranteed 4mpd and hope for bonus to be awarded to qualifying transactions.

I’m really digging the Titanium Rewards, hope to get a piece up on it later this week

Does it means that by using mobile payment (apple pay) on dining, I would get 5X instead of the usual 10X (mobile payment) for dining? How will OCBC see the transaction as? Mobile payment or dining MCC?

Do you have the earn rate and other benefits of the UOB Preferred Platinum Visa card? Since it’s been demarketed, there isn’t any such info on UOB’s website naturally.

Details can still be found on the UOB website – http://www.uob.com.sg/personal/cards/credit-cards/rewards-cards/uob-preferred-platinum-visa-card.page?ms=pweb-cards-home

Anyone knows if SCB visa infinite will continue the 3 miles per $ on forex spend above $2,000 in 2018?

If I enrolled today, does the spending before today count?